In this digital age, in which screens are the norm and our lives are dominated by screens, the appeal of tangible printed materials hasn't faded away. Whatever the reason, whether for education or creative projects, or simply adding some personal flair to your area, How Do I Claim My Hvac Tax Credit have become a valuable source. The following article is a take a dive into the world of "How Do I Claim My Hvac Tax Credit," exploring what they are, how to get them, as well as how they can be used to enhance different aspects of your lives.

Get Latest How Do I Claim My Hvac Tax Credit Below

How Do I Claim My Hvac Tax Credit

How Do I Claim My Hvac Tax Credit -

Q How do I know if my Home Energy Audit is eligible for a credit A Consumers can visit this IRS page on the Energy Efficient Home Improvement Credit Q What products are eligible for tax credits Home clean electricity products Solar panels for electricity from a provider in your area

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

How Do I Claim My Hvac Tax Credit cover a large range of downloadable, printable resources available online for download at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages and much more. One of the advantages of How Do I Claim My Hvac Tax Credit lies in their versatility as well as accessibility.

More of How Do I Claim My Hvac Tax Credit

When Do Div Rivals Rewards Come Fifa 22

When Do Div Rivals Rewards Come Fifa 22

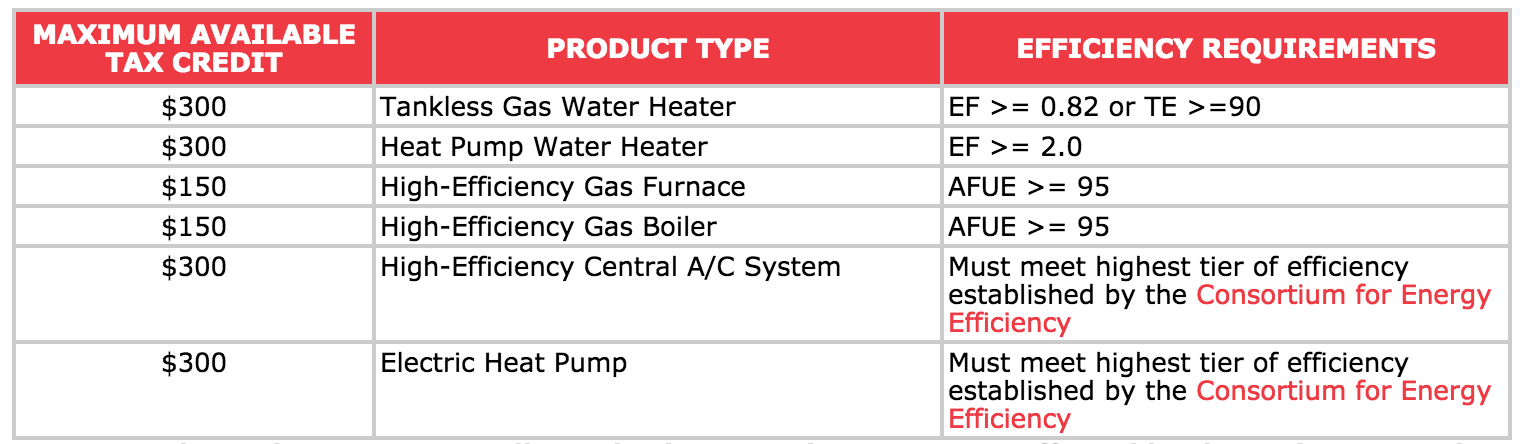

Central Air Conditioners Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695

Here s how to claim your HVAC tax credit when you file your federal income tax return Keep a copy of your installation records and your manufacturer s certification statement proving the efficiency of your system You won t qualify for the rebate program without them Download and complete IRS Form 5695 Fill out the relevant section or

How Do I Claim My Hvac Tax Credit have gained a lot of recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

The ability to customize: You can tailor printables to fit your particular needs whether it's making invitations to organize your schedule or decorating your home.

-

Educational Value Educational printables that can be downloaded for free provide for students from all ages, making them a useful instrument for parents and teachers.

-

It's easy: The instant accessibility to an array of designs and templates will save you time and effort.

Where to Find more How Do I Claim My Hvac Tax Credit

HVAC Tax Credit For 2014 Improvements

HVAC Tax Credit For 2014 Improvements

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200

For qualified HVAC improvements homeowners might be able to claim 25c tax credits equal to 10 of the install costs up to a maximum of 500 If you re unsure of how to get the tax credit you might be eligible for don t worry We ve got you covered

We've now piqued your interest in printables for free Let's look into where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of How Do I Claim My Hvac Tax Credit to suit a variety of uses.

- Explore categories like decorating your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets as well as flashcards and other learning materials.

- Great for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- The blogs are a vast array of topics, ranging ranging from DIY projects to planning a party.

Maximizing How Do I Claim My Hvac Tax Credit

Here are some ideas how you could make the most of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use these printable worksheets free of charge for teaching at-home (or in the learning environment).

3. Event Planning

- Design invitations, banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

How Do I Claim My Hvac Tax Credit are a treasure trove of creative and practical resources that can meet the needs of a variety of people and needs and. Their access and versatility makes they a beneficial addition to both professional and personal lives. Explore the wide world of How Do I Claim My Hvac Tax Credit now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are How Do I Claim My Hvac Tax Credit really gratis?

- Yes they are! You can download and print these resources at no cost.

-

Can I make use of free printables for commercial uses?

- It's determined by the specific usage guidelines. Always consult the author's guidelines prior to printing printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Certain printables may be subject to restrictions regarding usage. Be sure to review these terms and conditions as set out by the designer.

-

How can I print printables for free?

- You can print them at home with a printer or visit a print shop in your area for the highest quality prints.

-

What program must I use to open How Do I Claim My Hvac Tax Credit?

- The majority are printed in the format of PDF, which can be opened using free programs like Adobe Reader.

Pistol Pete Mack On Twitter JohnnyFoodstamp FolksFinance

HVAC Tax Credits Incentives For Energy Efficient HVACs

Check more sample of How Do I Claim My Hvac Tax Credit below

Icd 10 Data Code For Peritoneal Carcinomatosis

Marriage Allowance 1Accounts

How Do I Claim A Game On Steam TheLittleList Your Daily Dose Of

Tesla Model 3 Price Availability News And Features TechRadar

Lastkid On Twitter WhatUCookYouEat iamdagtw iamseg un

DiscordSync Minecraft Discord BuiltByBit

https://www.irs.gov/credits-deductions/home-energy-tax-credits

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

https://www.irs.gov/newsroom/irs-releases...

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

Tesla Model 3 Price Availability News And Features TechRadar

Marriage Allowance 1Accounts

Lastkid On Twitter WhatUCookYouEat iamdagtw iamseg un

DiscordSync Minecraft Discord BuiltByBit

Have You Claimed Your Digital Badge Computing Hub MKN

VAT Information Synapptic

VAT Information Synapptic

Solar Scam HVAC And Solar Tax Credit Del Sol Energy