In this day and age where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. Whatever the reason, whether for education for creative projects, simply to add an extra personal touch to your area, How Are Personal Pension Contributions Taxed are now a vital resource. In this article, we'll dive through the vast world of "How Are Personal Pension Contributions Taxed," exploring what they are, where they are, and the ways that they can benefit different aspects of your daily life.

Get Latest How Are Personal Pension Contributions Taxed Below

How Are Personal Pension Contributions Taxed

How Are Personal Pension Contributions Taxed -

Date Updated 23 February 2024 You only pay higher rates of tax on the proportion of income that falls in each bracket For instance if you earned 90 000 you d pay nothing for the first 12 750 20 on the amount up to 50 270 and 40 on the remaining 39 730 Remember it s not just your pension that determines your tax rate

Overview Your private pension contributions are tax free up to certain limits This applies to most private pension schemes for example workplace pensions personal and stakeholder

The How Are Personal Pension Contributions Taxed are a huge collection of printable items that are available online at no cost. They come in many kinds, including worksheets coloring pages, templates and more. The appeal of printables for free is in their versatility and accessibility.

More of How Are Personal Pension Contributions Taxed

Mac Financial Making Pension Contributions Before The End Of The Tax

Mac Financial Making Pension Contributions Before The End Of The Tax

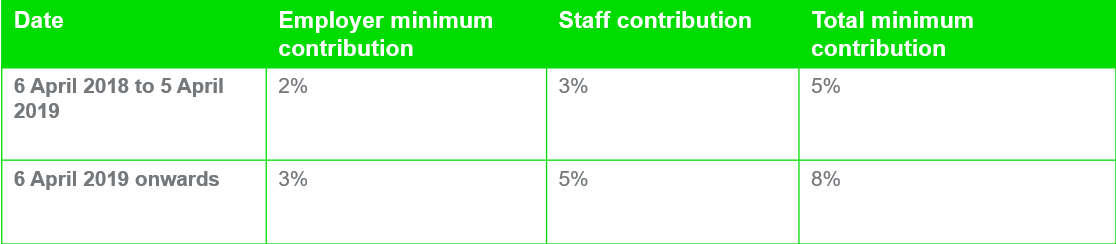

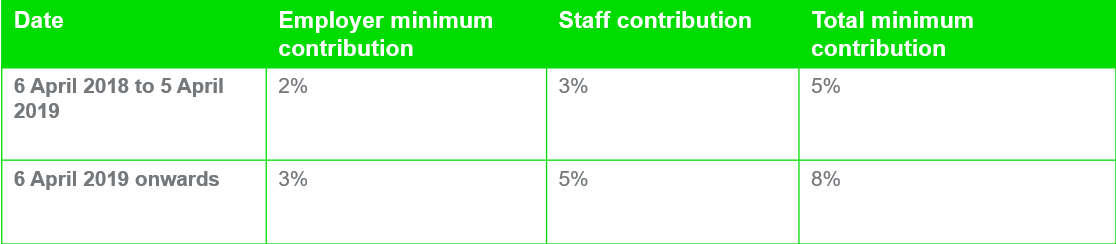

There are two ways that income tax relief on individuals pension contributions is administered a net pay arrangement where pension contributions are made out of earnings before income tax is paid so that the pension contribution is excluded from taxable income and a relief at source arrangement where individuals pension

12 February 2024 4 min read A guide to how your pension contributions and pension income are taxed This guide looks at the tax breaks available when you re building up a pension pot and what happens when you start to take money from your pension We also include a jargon buster to explain any technical terms used

Printables for free have gained immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

Modifications: Your HTML0 customization options allow you to customize print-ready templates to your specific requirements when it comes to designing invitations or arranging your schedule or decorating your home.

-

Education Value The free educational worksheets can be used by students of all ages. This makes them a useful resource for educators and parents.

-

Simple: The instant accessibility to numerous designs and templates, which saves time as well as effort.

Where to Find more How Are Personal Pension Contributions Taxed

Rebuild Your Retirement Savings

Rebuild Your Retirement Savings

Article ID 3082 Last updated 21 Mar 2024 When should I use the annual pension allowance wizard If your total pension contributions are close to exceeding your annual pension allowance and or your pension allowance is likely to be tapered you can use the wizard to Calculate excess contributions and possible pension tax charge

In the tax year 2024 25 the new State Pension is 11 502 40 a year You ll still receive your personal allowance each tax year This is the amount of income you can receive before you pay tax The standard personal allowance is higher than the State Pension which means you won t usually pay any tax if this is your only income

Since we've got your curiosity about How Are Personal Pension Contributions Taxed Let's see where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection in How Are Personal Pension Contributions Taxed for different reasons.

- Explore categories like decoration for your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free Flashcards, worksheets, and other educational tools.

- The perfect resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- These blogs cover a wide selection of subjects, including DIY projects to party planning.

Maximizing How Are Personal Pension Contributions Taxed

Here are some creative ways in order to maximize the use use of How Are Personal Pension Contributions Taxed:

1. Home Decor

- Print and frame gorgeous images, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print out free worksheets and activities to enhance your learning at home also in the classes.

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners for to-do list, lists of chores, and meal planners.

Conclusion

How Are Personal Pension Contributions Taxed are an abundance filled with creative and practical information which cater to a wide range of needs and preferences. Their accessibility and versatility make them a great addition to both professional and personal lives. Explore the wide world of How Are Personal Pension Contributions Taxed today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really available for download?

- Yes they are! You can download and print these resources at no cost.

-

Can I utilize free templates for commercial use?

- It's all dependent on the conditions of use. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues with printables that are free?

- Some printables may contain restrictions in their usage. Be sure to review the terms and condition of use as provided by the designer.

-

How can I print printables for free?

- Print them at home using your printer or visit an in-store print shop to get better quality prints.

-

What program will I need to access printables for free?

- The majority of printables are with PDF formats, which can be opened using free software, such as Adobe Reader.

Changes In NHS Pension Contributions Are You A Winner Or Loser

Why Pay Pension Contributions AccountingPreneur

Check more sample of How Are Personal Pension Contributions Taxed below

How Pension Contributions Work

Are Roth Contributions Right For Me

Workers Pension Fund Not For Borrowing NLC Warn Governors

A Guide To Pension Contributions And Types Riset

Ex servicemen Yet To Get Pension For April Defence Stories India

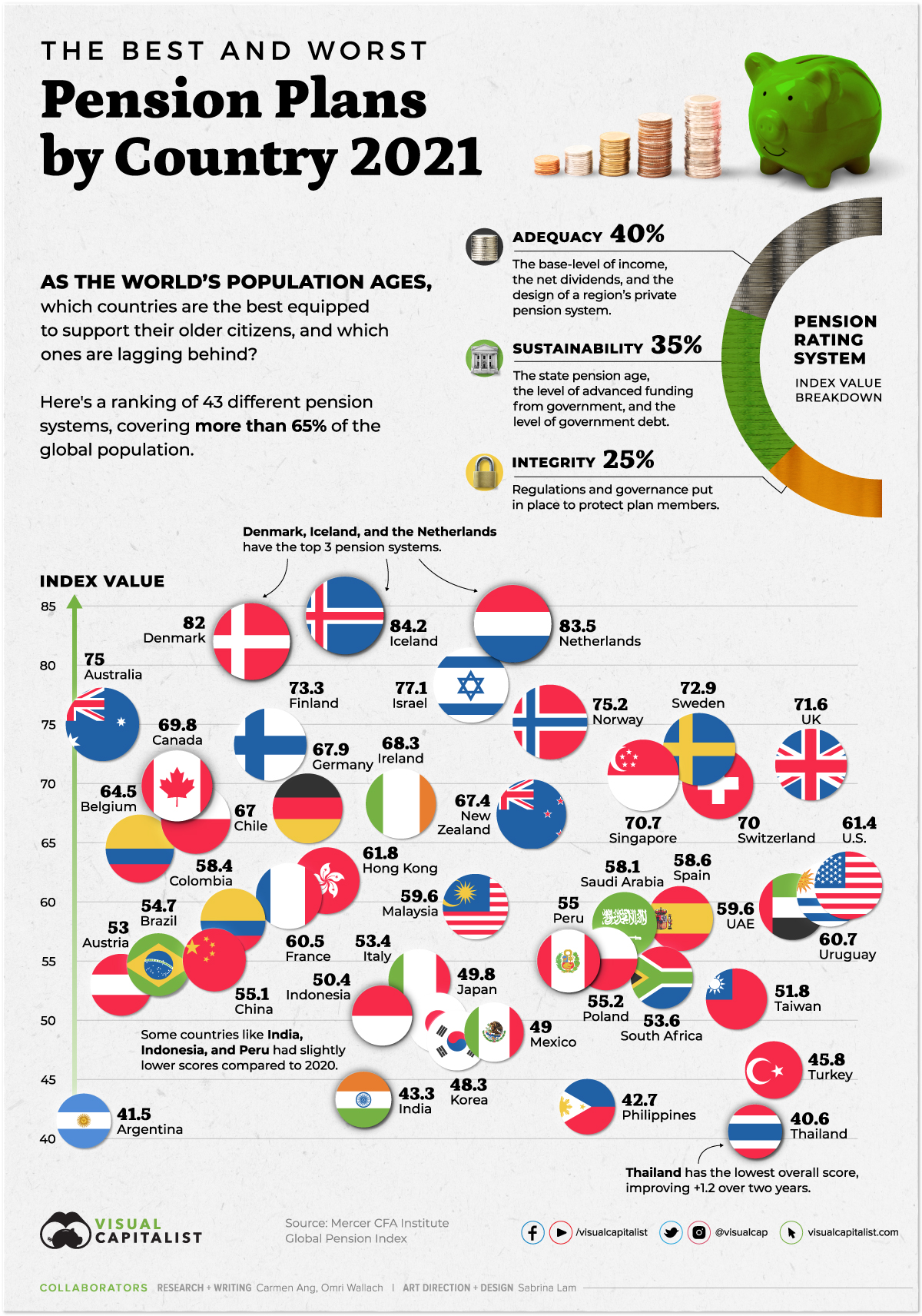

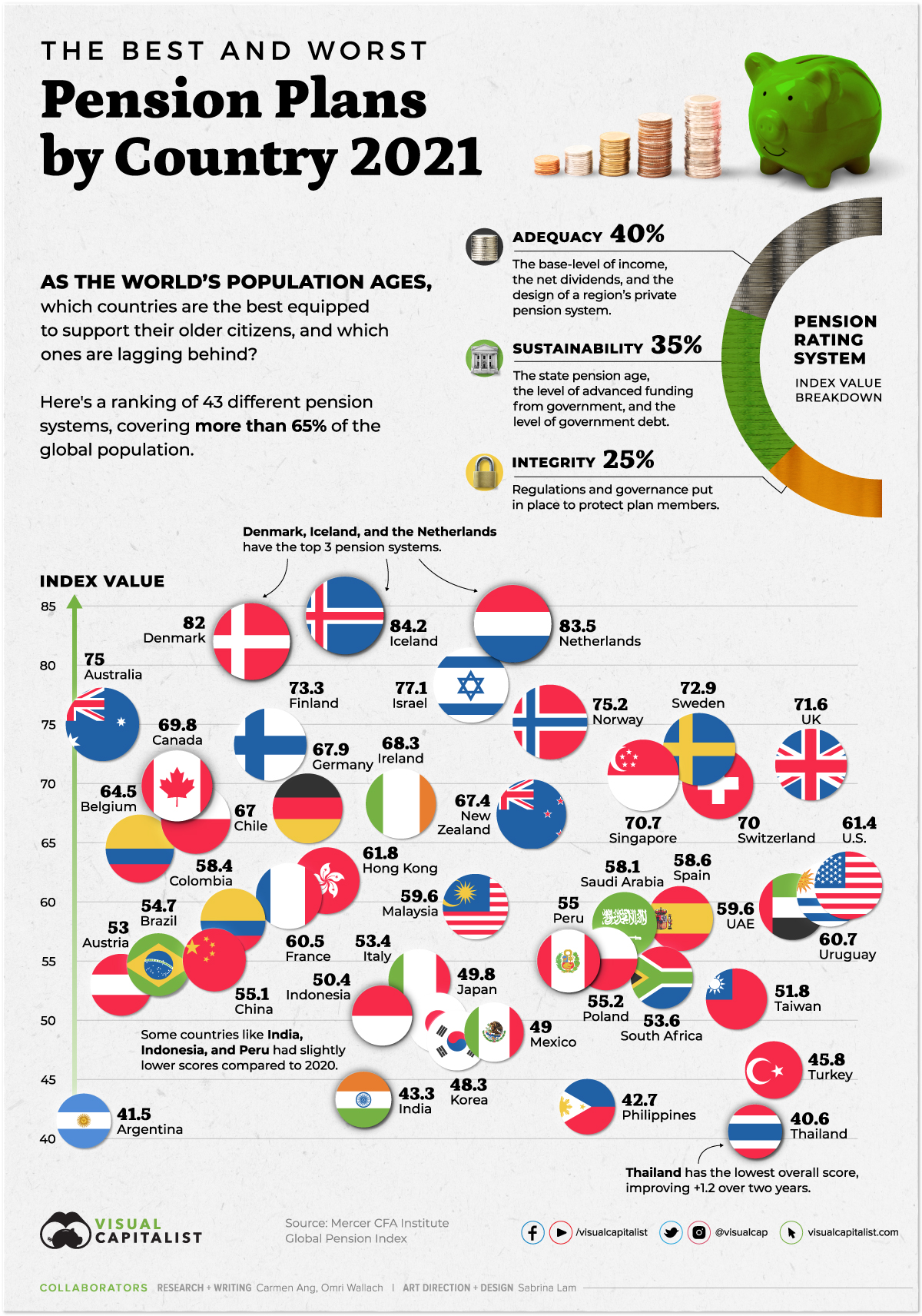

Ranked The Best And Worst Pension Plans By Country

https://www. gov.uk /tax-on-your-private-pension

Overview Your private pension contributions are tax free up to certain limits This applies to most private pension schemes for example workplace pensions personal and stakeholder

https://www. which.co.uk /money/pensions-and...

When you earn tax relief on your pension some of the money that you would have paid in tax on your earnings goes into your pension pot rather than to the government Tax relief is paid on your pension contributions at the highest rate of income tax you pay So Basic rate taxpayers get 20 pension tax relief

Overview Your private pension contributions are tax free up to certain limits This applies to most private pension schemes for example workplace pensions personal and stakeholder

When you earn tax relief on your pension some of the money that you would have paid in tax on your earnings goes into your pension pot rather than to the government Tax relief is paid on your pension contributions at the highest rate of income tax you pay So Basic rate taxpayers get 20 pension tax relief

A Guide To Pension Contributions And Types Riset

Are Roth Contributions Right For Me

Ex servicemen Yet To Get Pension For April Defence Stories India

Ranked The Best And Worst Pension Plans By Country

What Is Pension Tax Relief Moneybox Save And Invest

How Pension Contributions Work

How Pension Contributions Work

Pension Tax Relief In The United Kingdom UK Pension Help