In this age of electronic devices, where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed objects isn't diminished. No matter whether it's for educational uses for creative projects, simply to add the personal touch to your area, House Rent Deduction In Income Tax Section 80gg have proven to be a valuable resource. With this guide, you'll dive into the world "House Rent Deduction In Income Tax Section 80gg," exploring their purpose, where they are available, and how they can add value to various aspects of your daily life.

Get Latest House Rent Deduction In Income Tax Section 80gg Below

House Rent Deduction In Income Tax Section 80gg

House Rent Deduction In Income Tax Section 80gg -

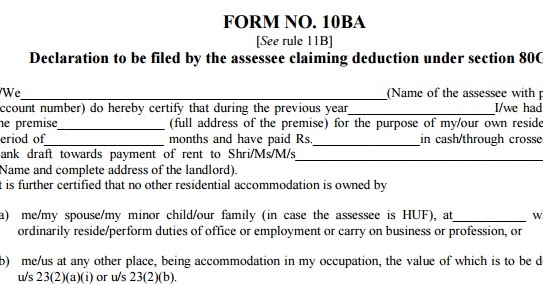

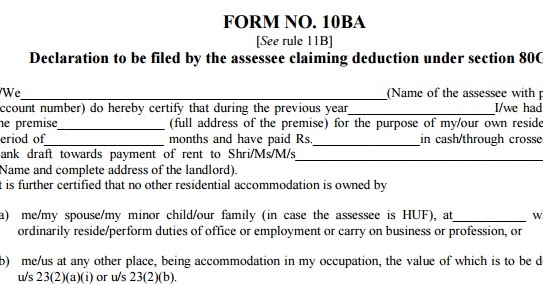

Section 80GG of Income Tax Act allows us to claim house rent amount paid in a financial year to save income tax If you receive HRA House Rent Allowance in your Salary

Deductions is respect of rents paid Under Section 80GG an Individual can claim deduction for the rent paid even if he don t get

House Rent Deduction In Income Tax Section 80gg provide a diverse collection of printable items that are available online at no cost. These printables come in different types, like worksheets, coloring pages, templates and more. The appealingness of House Rent Deduction In Income Tax Section 80gg is their versatility and accessibility.

More of House Rent Deduction In Income Tax Section 80gg

Section 80GG Of Income Tax Act II Rent Paid Deduction U s 80GG II Tax

Section 80GG Of Income Tax Act II Rent Paid Deduction U s 80GG II Tax

Section 80GG of Income Tax Act is specifically designed for those who do not receive home rent allowance from their employers If a person s salary includes HRA payment

According to Section 80GG an individual can claim deduction of expenditure incurred in respect of furnished or unfurnished accommodation occupied by such

House Rent Deduction In Income Tax Section 80gg have garnered immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Customization: This allows you to modify print-ready templates to your specific requirements whether you're designing invitations making your schedule, or even decorating your house.

-

Educational Value Printables for education that are free are designed to appeal to students of all ages, making the perfect tool for teachers and parents.

-

Easy to use: Instant access to an array of designs and templates saves time and effort.

Where to Find more House Rent Deduction In Income Tax Section 80gg

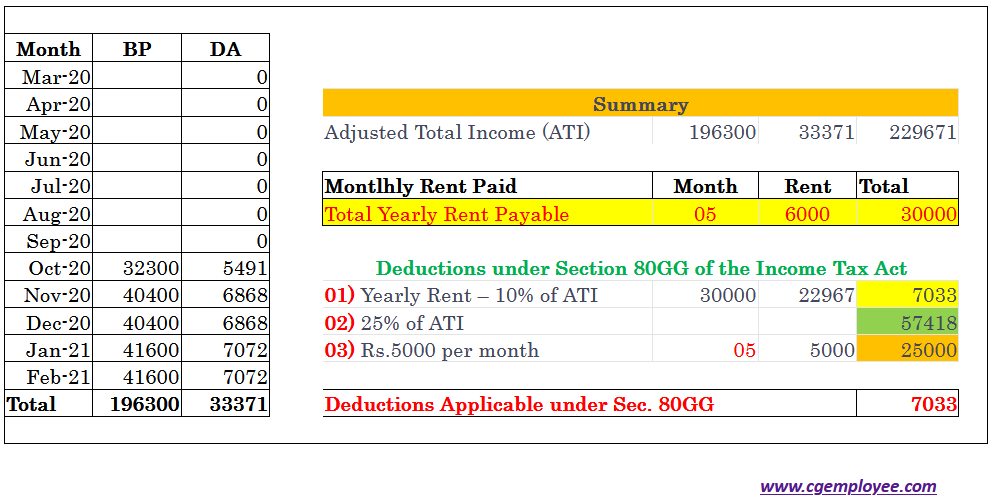

Section 80GG Tax Claim Deduction For Rent Paid CGEmployee

Section 80GG Tax Claim Deduction For Rent Paid CGEmployee

Section 80GG of the Income Tax Act is a provision that allows individual taxpayers to claim a deduction for the rent paid for a residential accommodation if they do not receive House Rent

Section 80GG is a provision in the Indian Income Tax Act that allows taxpayers to claim a deduction for rent paid when they are not receiving House Rent

In the event that we've stirred your interest in House Rent Deduction In Income Tax Section 80gg Let's find out where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of printables that are free for a variety of reasons.

- Explore categories like design, home decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing, flashcards, and learning materials.

- The perfect resource for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- These blogs cover a broad range of interests, that range from DIY projects to planning a party.

Maximizing House Rent Deduction In Income Tax Section 80gg

Here are some ways for you to get the best use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or other seasonal decorations to fill your living spaces.

2. Education

- Print worksheets that are free to reinforce learning at home (or in the learning environment).

3. Event Planning

- Design invitations and banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

House Rent Deduction In Income Tax Section 80gg are a treasure trove of fun and practical tools that satisfy a wide range of requirements and desires. Their access and versatility makes them a fantastic addition to any professional or personal life. Explore the plethora of House Rent Deduction In Income Tax Section 80gg to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly cost-free?

- Yes, they are! You can download and print these files for free.

-

Are there any free printables for commercial uses?

- It's based on the rules of usage. Always review the terms of use for the creator before using printables for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Certain printables may be subject to restrictions on usage. Check these terms and conditions as set out by the author.

-

How do I print printables for free?

- You can print them at home with a printer or visit the local print shops for top quality prints.

-

What software do I need to open House Rent Deduction In Income Tax Section 80gg?

- Many printables are offered as PDF files, which can be opened with free software, such as Adobe Reader.

Section 80gg Of Income Tax Act Deduction 80gg 80gg 2020 YouTube

What Is Standard Deduction For Ay 2021 22 Standard Deduction 2021

Check more sample of House Rent Deduction In Income Tax Section 80gg below

Section 80GG Deduction In 2022 Claim Tax Deduction For Rent Paid

Section 80GG Deduction For Rent Paid Income Tax Returns Income Tax

Section 80GG Tax Claim Deduction For Rent Paid

Deduction In Income For House Rent Paid Under 80GG YouTube

House Rent Deduction Raised From Rs 24 000 To Rs 60 000 Hindustan Times

Under Section 80GG An Individual Can Claim Deduction For The Rent Paid

https://taxguru.in/income-tax/section-8…

Deductions is respect of rents paid Under Section 80GG an Individual can claim deduction for the rent paid even if he don t get

https://taxguru.in/income-tax/section-80gg-income...

One such deduction is section 80GG where taxpayers will get a deduction of the amount of rent paid during the year This deduction is available to both Salaried

Deductions is respect of rents paid Under Section 80GG an Individual can claim deduction for the rent paid even if he don t get

One such deduction is section 80GG where taxpayers will get a deduction of the amount of rent paid during the year This deduction is available to both Salaried

Deduction In Income For House Rent Paid Under 80GG YouTube

Section 80GG Deduction For Rent Paid Income Tax Returns Income Tax

House Rent Deduction Raised From Rs 24 000 To Rs 60 000 Hindustan Times

Under Section 80GG An Individual Can Claim Deduction For The Rent Paid

Deduction Under Chapter 6A Of Income Tax Act Section 80G Donation

Section 80GG Income Tax Deduction In Respect Of Rent Paid

Section 80GG Income Tax Deduction In Respect Of Rent Paid

Tax Saving Unveiling The Benefits Of Section 80GG For Rent Deductions