In this day and age where screens dominate our lives, the charm of tangible printed items hasn't gone away. No matter whether it's for educational uses, creative projects, or simply adding a personal touch to your space, Homestead Tax Credit Vermont have become an invaluable source. We'll take a dive into the world of "Homestead Tax Credit Vermont," exploring their purpose, where to locate them, and how they can enhance various aspects of your lives.

Get Latest Homestead Tax Credit Vermont Below

Homestead Tax Credit Vermont

Homestead Tax Credit Vermont -

The credit is applied to your property tax and the town issues a bill for any balance due The 2023 property tax credit is based on 2022 household income and 2022 2023 property taxes To make a claim for property tax credit file Form HS 122 and form HI 144 with the Vermont Department of Taxes When to File File as early as

The Vermont Property Tax Credit assists many Vermont homeowners with paying their property taxes You may be eligible for a property tax credit on your property taxes if your property qualifies as a homestead and you meet the eligibility requirements The maximum property tax credit is 8 000 00

Homestead Tax Credit Vermont encompass a wide assortment of printable documents that can be downloaded online at no cost. They come in many styles, from worksheets to templates, coloring pages and more. One of the advantages of Homestead Tax Credit Vermont is in their versatility and accessibility.

More of Homestead Tax Credit Vermont

Homestead Exemption

Homestead Exemption

Vermont Homestead Declaration AND Property Tax Credit Claim DUE DATE April 15 2021 You may file up to Oct 15 2021 but the town may assess a penalty For details on late filing see the instructions

Free Tax Preparation Available Tax Credits Power of Attorney File an Extension Filing Deadlines Renter Credit Landlord Certificates Homestead Declaration Property Tax Credit File W2 1099 WHT 434 Check Return Status Pay Online or by Mail Go to myVTax Estimated Income Tax Payment Options Pay Use Tax Tax Bill Overview

The Homestead Tax Credit Vermont have gained huge popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

customization We can customize designs to suit your personal needs such as designing invitations and schedules, or even decorating your house.

-

Educational Value Free educational printables offer a wide range of educational content for learners of all ages. This makes them an invaluable tool for teachers and parents.

-

Accessibility: Fast access numerous designs and templates will save you time and effort.

Where to Find more Homestead Tax Credit Vermont

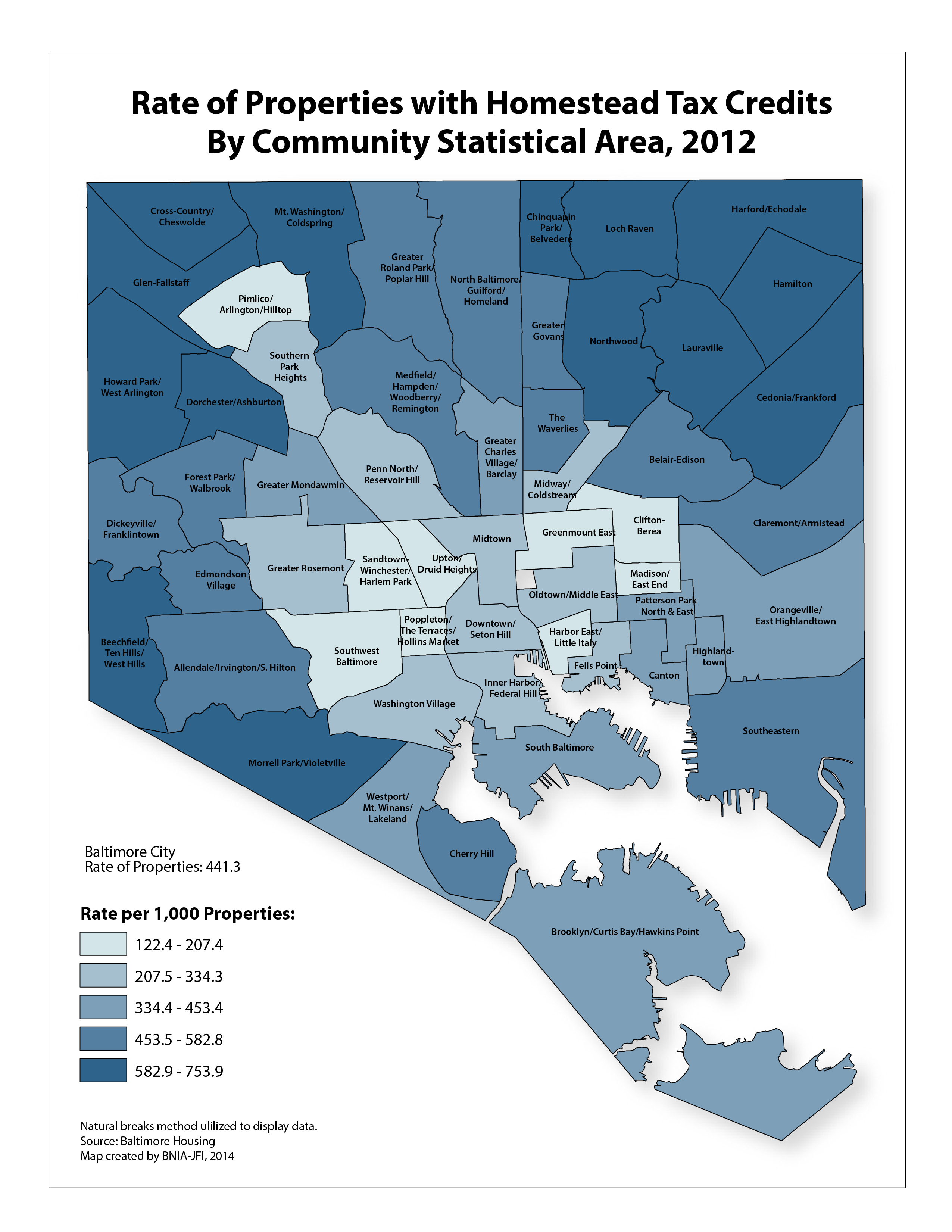

Homestead Tax Credits 2012 BNIA Baltimore Neighborhood Indicators

Homestead Tax Credits 2012 BNIA Baltimore Neighborhood Indicators

Dec 26 2023 at 10 00 AM EST By Suzanne Blake Reporter Consumer Social Trends While federal stimulus payments may have ended Vermont residents are still eligible for up to 5 600 in state

File online Visit the Vermont Department of Taxes website to file your homestead declaration and property tax credit form online Get help You can find free help to file your homestead declaration and property

In the event that we've stirred your interest in printables for free Let's see where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection and Homestead Tax Credit Vermont for a variety reasons.

- Explore categories such as home decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing including flashcards, learning materials.

- The perfect resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- The blogs covered cover a wide spectrum of interests, starting from DIY projects to planning a party.

Maximizing Homestead Tax Credit Vermont

Here are some creative ways how you could make the most use of Homestead Tax Credit Vermont:

1. Home Decor

- Print and frame beautiful images, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print worksheets that are free to reinforce learning at home for the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Be organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Homestead Tax Credit Vermont are a treasure trove of innovative and useful resources that cater to various needs and passions. Their access and versatility makes they a beneficial addition to both professional and personal life. Explore the vast collection of Homestead Tax Credit Vermont and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really gratis?

- Yes they are! You can download and print these tools for free.

-

Do I have the right to use free printables to make commercial products?

- It's contingent upon the specific usage guidelines. Always read the guidelines of the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues when you download Homestead Tax Credit Vermont?

- Some printables may have restrictions in their usage. You should read the conditions and terms of use provided by the creator.

-

How can I print Homestead Tax Credit Vermont?

- Print them at home using the printer, or go to an in-store print shop to get high-quality prints.

-

What software is required to open Homestead Tax Credit Vermont?

- The majority of PDF documents are provided with PDF formats, which can be opened with free software like Adobe Reader.

Homestead Tax credit Rise Aired Arkansas Governor Proposes To Reduce

Minnesota Property Tax Refunds MNbump

Check more sample of Homestead Tax Credit Vermont below

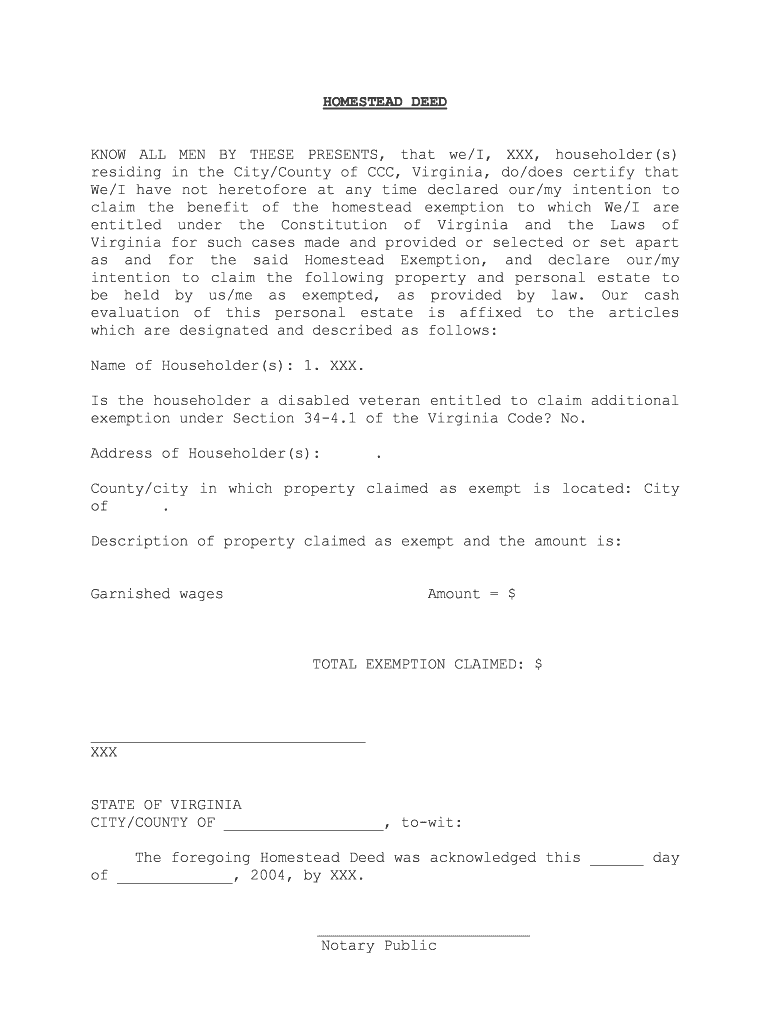

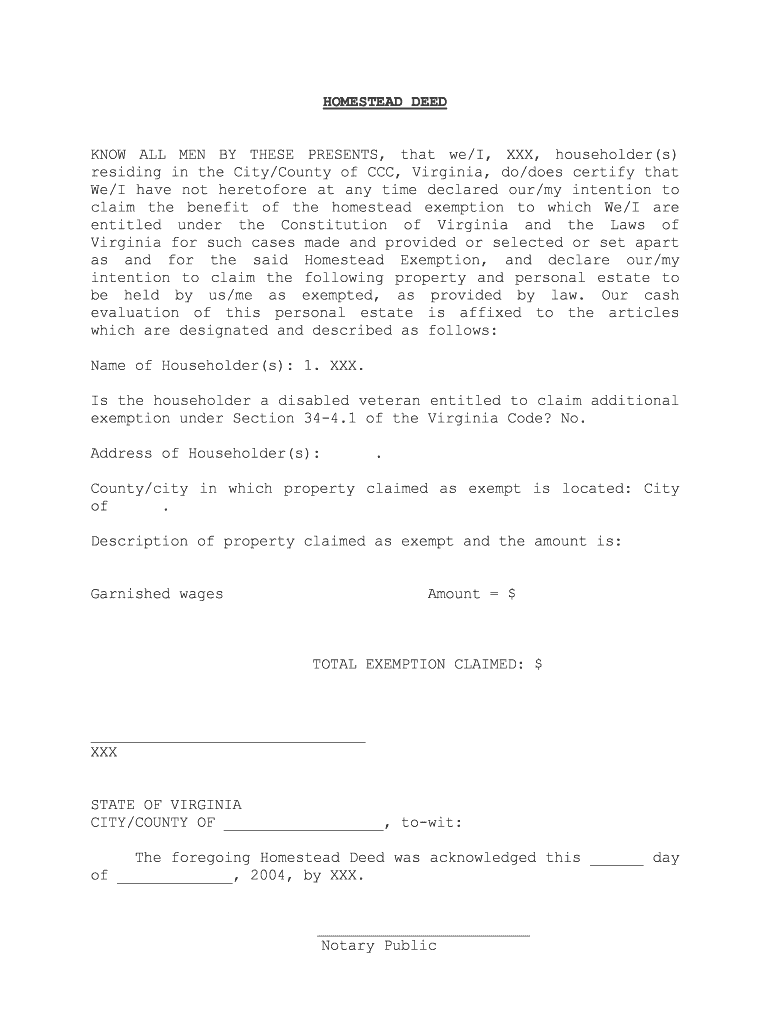

York County Sc Residential Tax Forms Homestead Exemption CountyForms

Homestead Property Tax Credit Increases KNWA YouTube

Texas Homestead Tax Exemption Guide New For 2024

Texas Homestead Tax Exemption Cedar Park Texas Living

Credit Versus Exemption In Homestead Property Tax Relief ITR Foundation

Form 2583 Choices Information Transmittal Fill Out And Sign Printable

https://tax.vermont.gov/property/property-tax-credit

The Vermont Property Tax Credit assists many Vermont homeowners with paying their property taxes You may be eligible for a property tax credit on your property taxes if your property qualifies as a homestead and you meet the eligibility requirements The maximum property tax credit is 8 000 00

https://tax.vermont.gov/sites/tax/files/documents/FS-1038.pdf

The Vermont Property Tax Credit assists many Vermont homeowners with paying their property taxes You may be eligible for a property tax credit based on your 2023 2024 property taxes if your property qualifies as a homestead and you meet the eligibility requirements described in this fact sheet

The Vermont Property Tax Credit assists many Vermont homeowners with paying their property taxes You may be eligible for a property tax credit on your property taxes if your property qualifies as a homestead and you meet the eligibility requirements The maximum property tax credit is 8 000 00

The Vermont Property Tax Credit assists many Vermont homeowners with paying their property taxes You may be eligible for a property tax credit based on your 2023 2024 property taxes if your property qualifies as a homestead and you meet the eligibility requirements described in this fact sheet

Texas Homestead Tax Exemption Cedar Park Texas Living

Homestead Property Tax Credit Increases KNWA YouTube

Credit Versus Exemption In Homestead Property Tax Relief ITR Foundation

Form 2583 Choices Information Transmittal Fill Out And Sign Printable

Homestead Credit Tax Credits For Low And Moderate Income Families

Homestead Tax Credit Johnson County Iowa Homestead Tax Credit YouTube

Homestead Tax Credit Johnson County Iowa Homestead Tax Credit YouTube

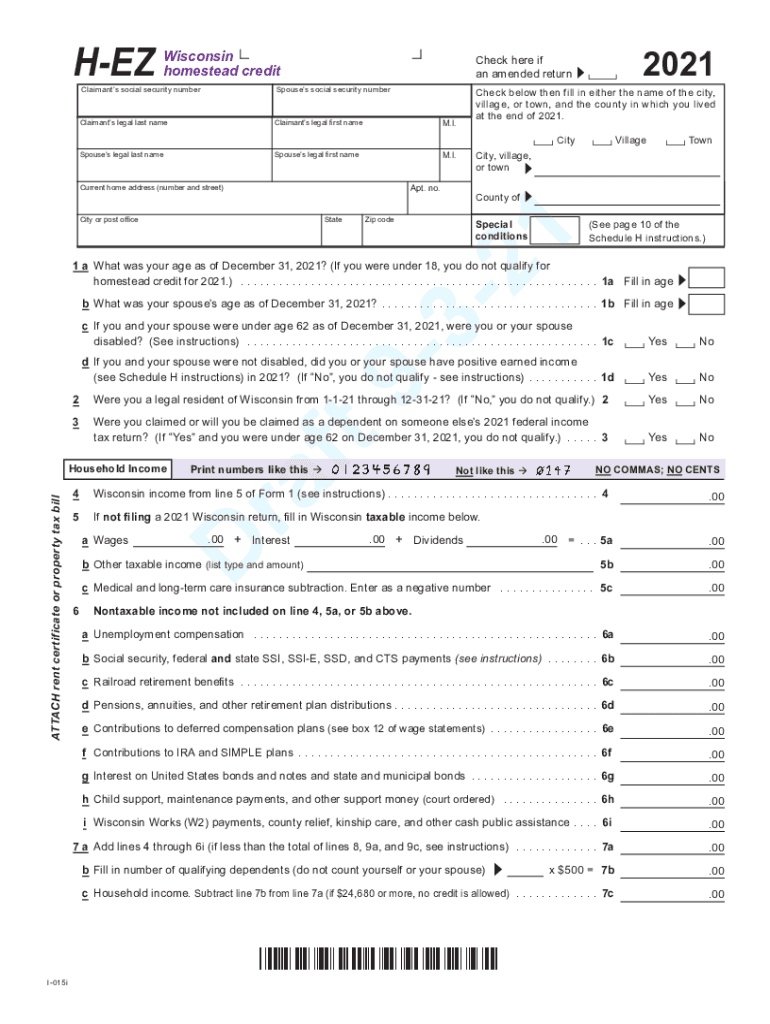

Wisconsin Homestead Credit 2021 2024 Form Fill Out And Sign Printable