In a world where screens have become the dominant feature of our lives The appeal of tangible printed objects hasn't waned. Be it for educational use such as creative projects or simply to add an extra personal touch to your area, Home Office Deduction Tax Audit have become a valuable resource. Through this post, we'll dive through the vast world of "Home Office Deduction Tax Audit," exploring what they are, how you can find them, and how they can be used to enhance different aspects of your daily life.

Get Latest Home Office Deduction Tax Audit Below

Home Office Deduction Tax Audit

Home Office Deduction Tax Audit -

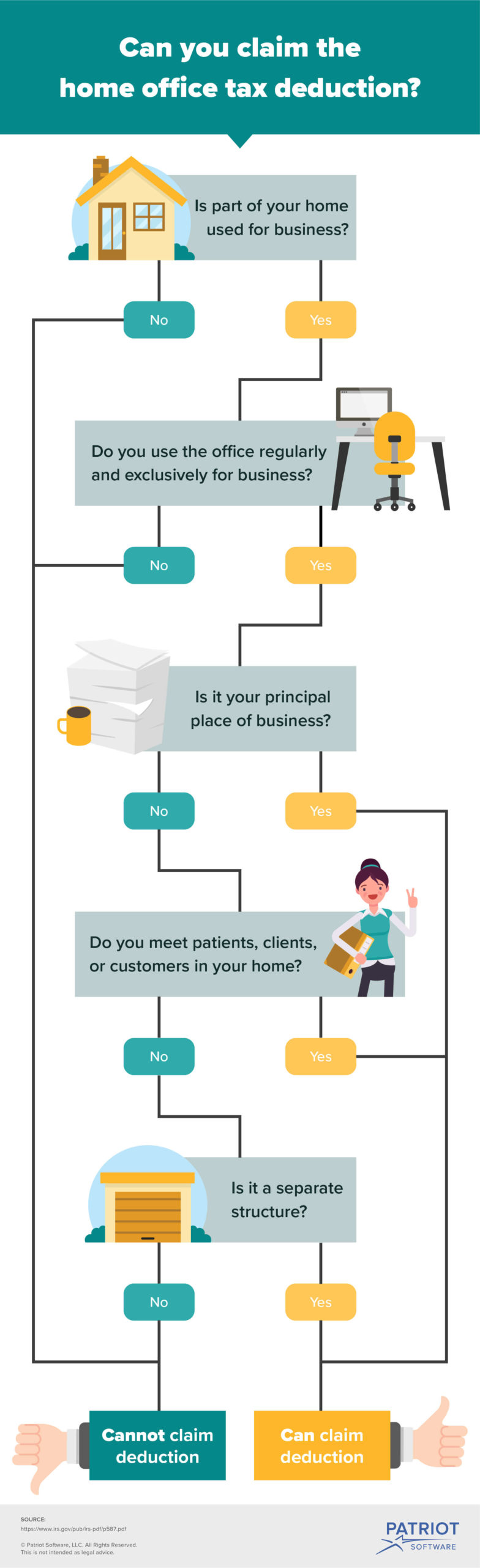

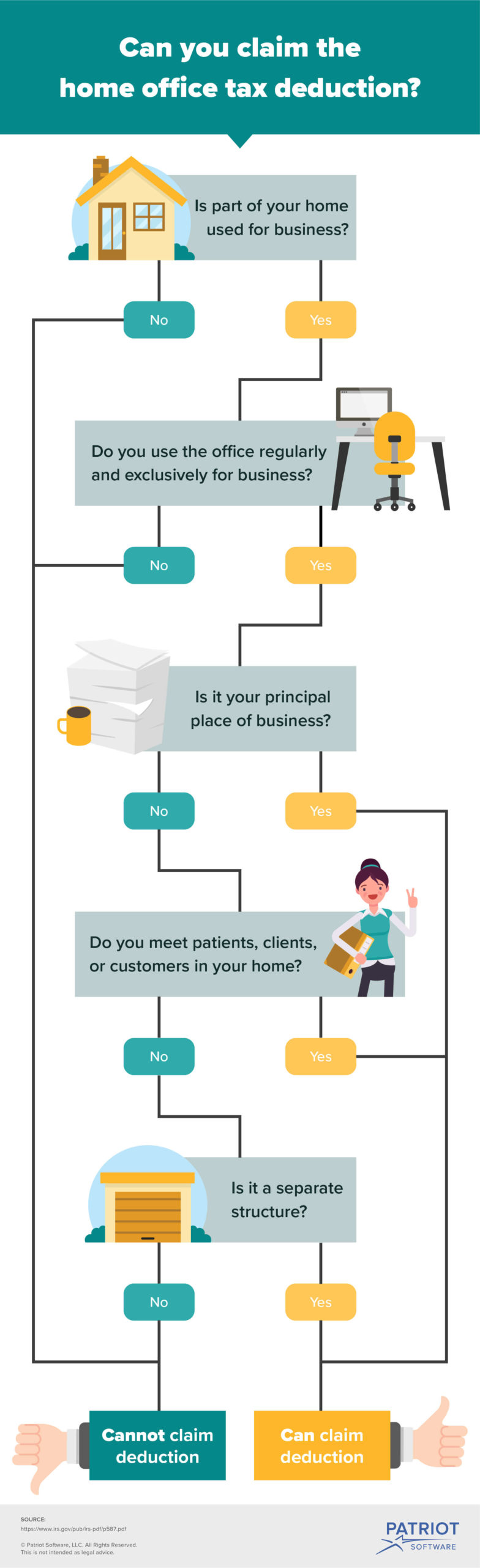

Many taxpayers worry that claiming the home office deduction will trigger an audit However in recent years the IRS has made it easier to claim the deduction by introducing the new simplified method of deducting expenses If you follow the rules below you may be able to claim a deduction for working at home

What is the home office deduction Small business owners and freelancers who regularly and exclusively use part of their home for work and business related activities may be able to write off

Printables for free include a vast array of printable documents that can be downloaded online at no cost. They are available in numerous designs, including worksheets templates, coloring pages and much more. The great thing about Home Office Deduction Tax Audit is their flexibility and accessibility.

More of Home Office Deduction Tax Audit

Simplified Home Office Deduction Blog hubcfo

Simplified Home Office Deduction Blog hubcfo

Key Takeaways The self employed are eligible for the home office tax deduction if they meet certain criteria The workspace for a home office must be used exclusively and regularly for

To claim home office deductions on your 2023 return you can choose either of the following methods Actual expense method Under this method you write off the full amount of your direct expenses and a proportionate amount of your indirect expenses based on the percentage of business use of the home

Home Office Deduction Tax Audit have gained immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

The ability to customize: This allows you to modify designs to suit your personal needs whether it's making invitations for your guests, organizing your schedule or even decorating your house.

-

Educational value: Education-related printables at no charge cater to learners of all ages, making them a vital tool for teachers and parents.

-

An easy way to access HTML0: instant access a variety of designs and templates is time-saving and saves effort.

Where to Find more Home Office Deduction Tax Audit

Should You Claim A Deduction For Your Home Office

Should You Claim A Deduction For Your Home Office

How to take the home office deduction without triggering an audit With less than a month before the IRS tax filing deadline readers pose their questions about credits deductions and

If your small business qualifies you for a home office tax deduction should you be concerned about triggering an audit How does a business qualify in the first place This article will delve into the most common questions about this tax deduction Do I qualify for the home office tax deduction

Now that we've ignited your curiosity about Home Office Deduction Tax Audit Let's find out where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Home Office Deduction Tax Audit to suit a variety of applications.

- Explore categories such as decoration for your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free, flashcards, and learning tools.

- This is a great resource for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- The blogs covered cover a wide array of topics, ranging starting from DIY projects to planning a party.

Maximizing Home Office Deduction Tax Audit

Here are some fresh ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or other seasonal decorations to fill your living spaces.

2. Education

- Use free printable worksheets to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Home Office Deduction Tax Audit are an abundance of creative and practical resources catering to different needs and interest. Their access and versatility makes these printables a useful addition to the professional and personal lives of both. Explore the plethora of Home Office Deduction Tax Audit today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes they are! You can print and download these materials for free.

-

Can I utilize free printables in commercial projects?

- It's all dependent on the rules of usage. Always read the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright issues with Home Office Deduction Tax Audit?

- Some printables may come with restrictions regarding their use. Always read the terms and regulations provided by the designer.

-

How do I print Home Office Deduction Tax Audit?

- Print them at home with any printer or head to an area print shop for the highest quality prints.

-

What software do I need to open printables free of charge?

- The majority of printed documents are in PDF format. They can be opened with free software like Adobe Reader.

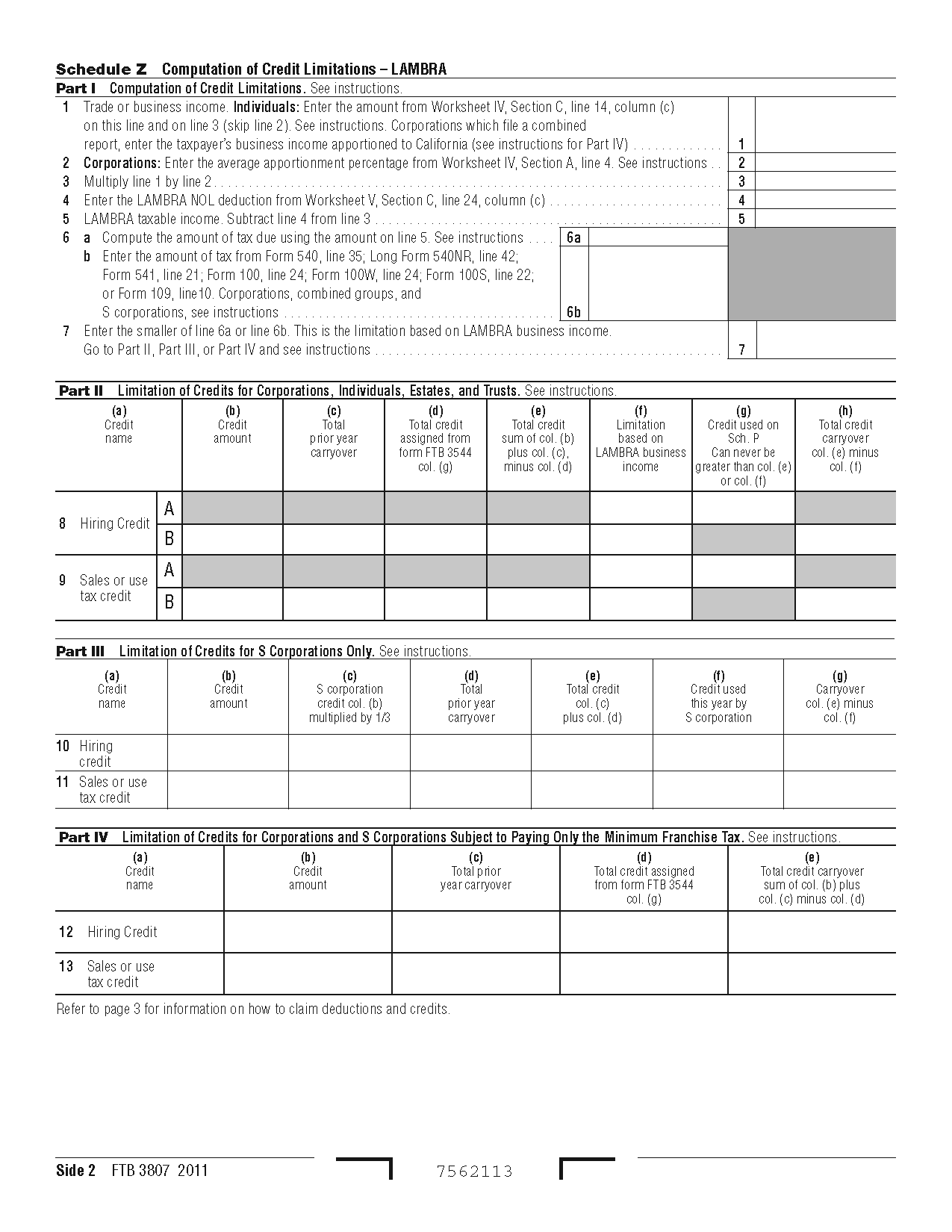

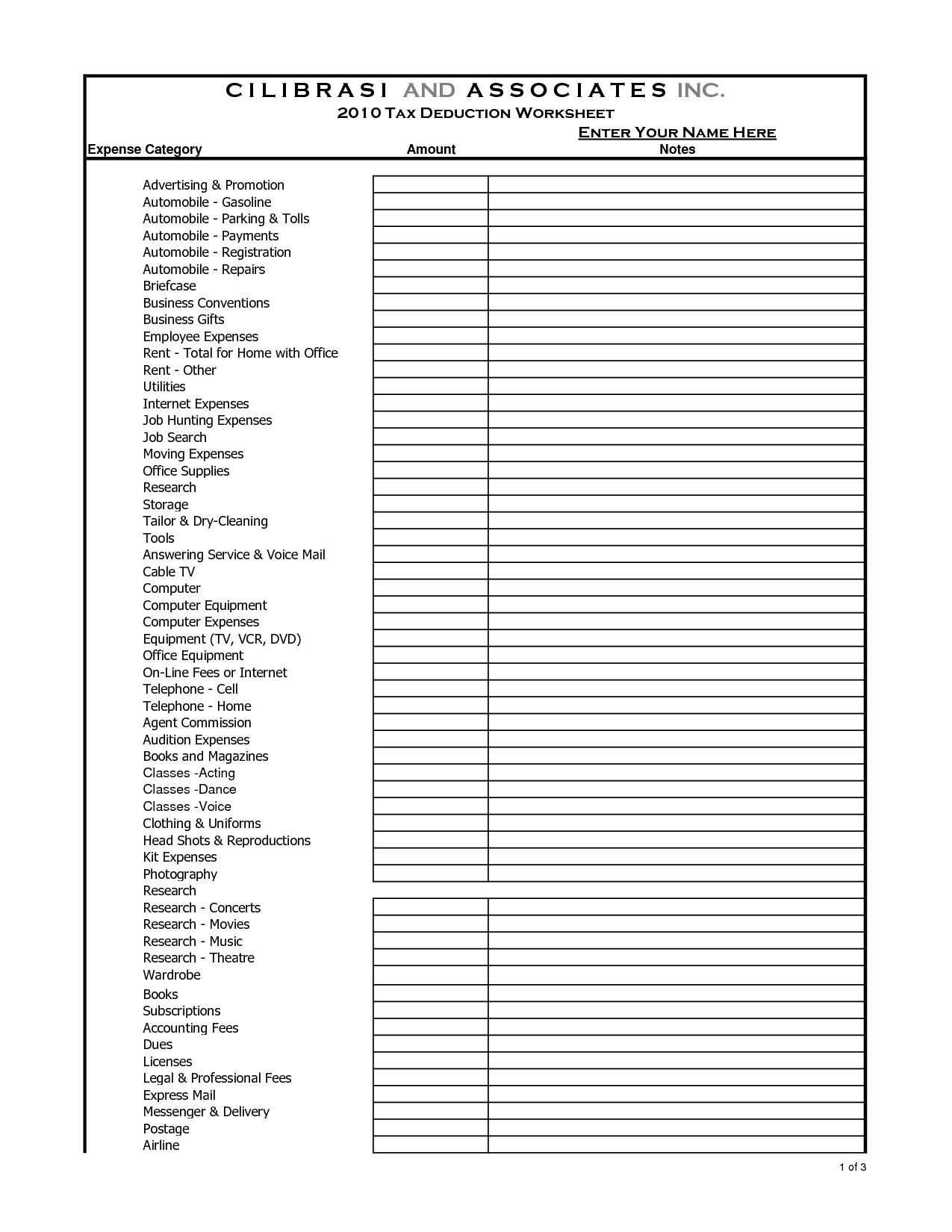

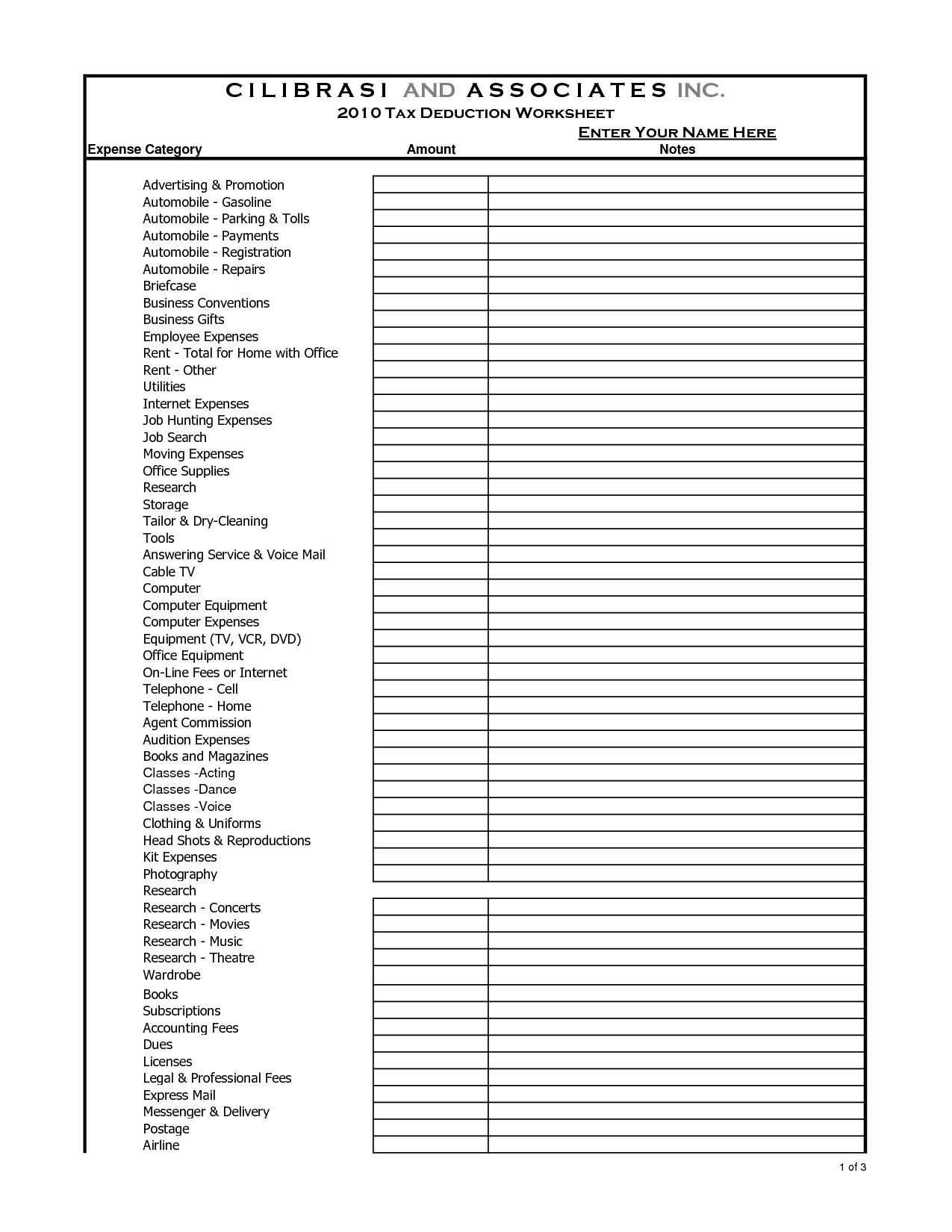

10 Home Based Business Tax Worksheet Worksheeto

Standard Home Office Deduction 2020 Standard Deduction 2021

Check more sample of Home Office Deduction Tax Audit below

Should You Claim Your Home Office Deduction TAX SECRETS YouTube

Home Office Deduction Tax Benefits Of Working From Home NBAC Corporation

Who Qualifies For The Home Office Tax Deduction During COVID 19 Tax

Home Office Tax Deduction Guide Balboa Capital

Home Office Tax Deduction What Is It And How Can It Help You

Home Office Deduction For Real Estate Investors DMLO CPAs

https://www.nerdwallet.com/article/taxes/home-office-tax-deduction

What is the home office deduction Small business owners and freelancers who regularly and exclusively use part of their home for work and business related activities may be able to write off

https://www.hellobonsai.com/blog/home-office-deduction-audit

Updated on December 12 2022 Many people defer taking the home office deduction tax write off because they are scared it will trigger an IRS audit Put simply the home office deduction audit is a myth In this article we ll go over how this is a common misconception for people who work from home

What is the home office deduction Small business owners and freelancers who regularly and exclusively use part of their home for work and business related activities may be able to write off

Updated on December 12 2022 Many people defer taking the home office deduction tax write off because they are scared it will trigger an IRS audit Put simply the home office deduction audit is a myth In this article we ll go over how this is a common misconception for people who work from home

Home Office Tax Deduction Guide Balboa Capital

Home Office Deduction Tax Benefits Of Working From Home NBAC Corporation

Home Office Tax Deduction What Is It And How Can It Help You

Home Office Deduction For Real Estate Investors DMLO CPAs

Home Office Tax Deduction For Landlords American Landlord

10 Home Based Business Tax Worksheet Worksheeto

10 Home Based Business Tax Worksheet Worksheeto

Home Office Deduction Tax Law RJS LAW San Diego