In this age of technology, where screens have become the dominant feature of our lives however, the attraction of tangible printed materials hasn't faded away. No matter whether it's for educational uses as well as creative projects or just adding an individual touch to your area, Home Loan Rebate On Income Tax In India are a great source. In this article, we'll dive to the depths of "Home Loan Rebate On Income Tax In India," exploring what they are, where you can find them, and how they can add value to various aspects of your life.

Get Latest Home Loan Rebate On Income Tax In India Below

Home Loan Rebate On Income Tax In India

Home Loan Rebate On Income Tax In India - Home Loan Rebate In Income Tax India, Home Loan Deduction In Income Tax India, Home Loan Interest Rebate In Income Tax India, How To Calculate Tax Rebate On Home Loan, Maximum Tax Rebate On Home Loan, House Loan Rebate Under Section, How Much Rebate On Home Loan, Income Tax Rebate On Home Loan Rules

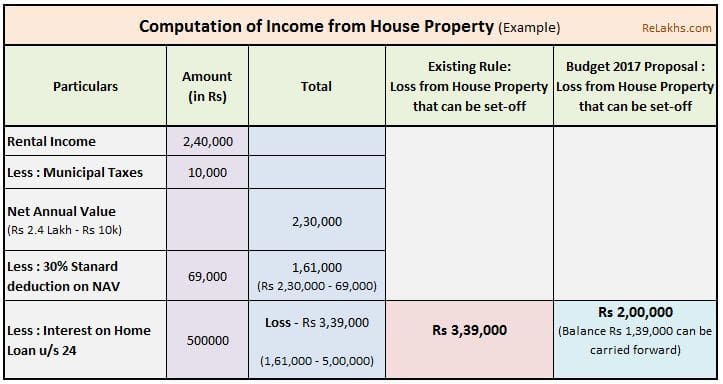

Web 7 janv 2023 nbsp 0183 32 Currently homebuyers can claim an income tax deduction on the interest paid on their home loan under Section 24 b of the Income tax Act 1961 The maximum amount of deduction that can be claimed is

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

The Home Loan Rebate On Income Tax In India are a huge range of printable, free documents that can be downloaded online at no cost. The resources are offered in a variety styles, from worksheets to coloring pages, templates and much more. The appealingness of Home Loan Rebate On Income Tax In India is their versatility and accessibility.

More of Home Loan Rebate On Income Tax In India

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

Web Joint home loan borrowers can claim individual home loan rebates in income tax up to Rs 2 lakh on interest paid and Rs 1 5 lakh on the principal amount Are there any other

Web On the interest payments for a home loan you can claim tax deductions of up to Rs 2 lakh as per Section 24 of the Income Tax Act If you are a first time homeowner additional

Printables that are free have gained enormous popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

customization You can tailor printables to your specific needs for invitations, whether that's creating them as well as organizing your calendar, or even decorating your house.

-

Educational Impact: Printables for education that are free are designed to appeal to students from all ages, making them a vital source for educators and parents.

-

Easy to use: instant access numerous designs and templates saves time and effort.

Where to Find more Home Loan Rebate On Income Tax In India

Home Loan Tax Benefits In India Important Facts

Home Loan Tax Benefits In India Important Facts

Web 27 avr 2023 nbsp 0183 32 If you can claim a total deduction of over 4 25 lakh including your home loan you may wish to continue with the old tax regime as your savings on tax may be

Web Answer An Individual can claim following tax benefits relating to home loan repayment 1 Deduction for interest on housing loan can be claimed u s 24 b under the head

Now that we've piqued your curiosity about Home Loan Rebate On Income Tax In India Let's see where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection and Home Loan Rebate On Income Tax In India for a variety applications.

- Explore categories such as the home, decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. tools.

- Perfect for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for no cost.

- The blogs are a vast selection of subjects, that range from DIY projects to planning a party.

Maximizing Home Loan Rebate On Income Tax In India

Here are some ideas in order to maximize the use of Home Loan Rebate On Income Tax In India:

1. Home Decor

- Print and frame stunning images, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use printable worksheets from the internet to enhance your learning at home as well as in the class.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners or to-do lists. meal planners.

Conclusion

Home Loan Rebate On Income Tax In India are an abundance of innovative and useful resources catering to different needs and interests. Their accessibility and versatility make them an invaluable addition to each day life. Explore the vast array that is Home Loan Rebate On Income Tax In India today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really are they free?

- Yes you can! You can download and print these resources at no cost.

-

Do I have the right to use free printables in commercial projects?

- It's based on the usage guidelines. Always review the terms of use for the creator prior to printing printables for commercial projects.

-

Are there any copyright violations with Home Loan Rebate On Income Tax In India?

- Certain printables might have limitations regarding usage. Be sure to check the terms and conditions set forth by the author.

-

How do I print printables for free?

- You can print them at home with an printer, or go to an area print shop for better quality prints.

-

What software do I need to open Home Loan Rebate On Income Tax In India?

- Many printables are offered in the format of PDF, which can be opened with free software, such as Adobe Reader.

Income Tax Rebate On Home Loan Fy 2019 20 A design system

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Check more sample of Home Loan Rebate On Income Tax In India below

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Latest Income Tax Rebate On Home Loan 2023

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

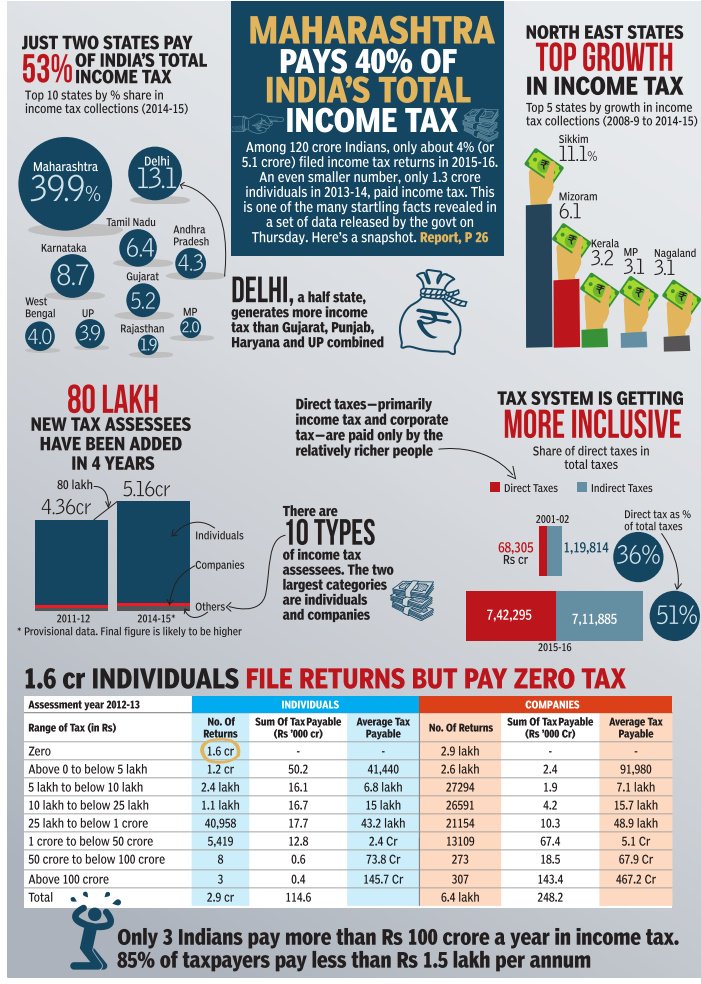

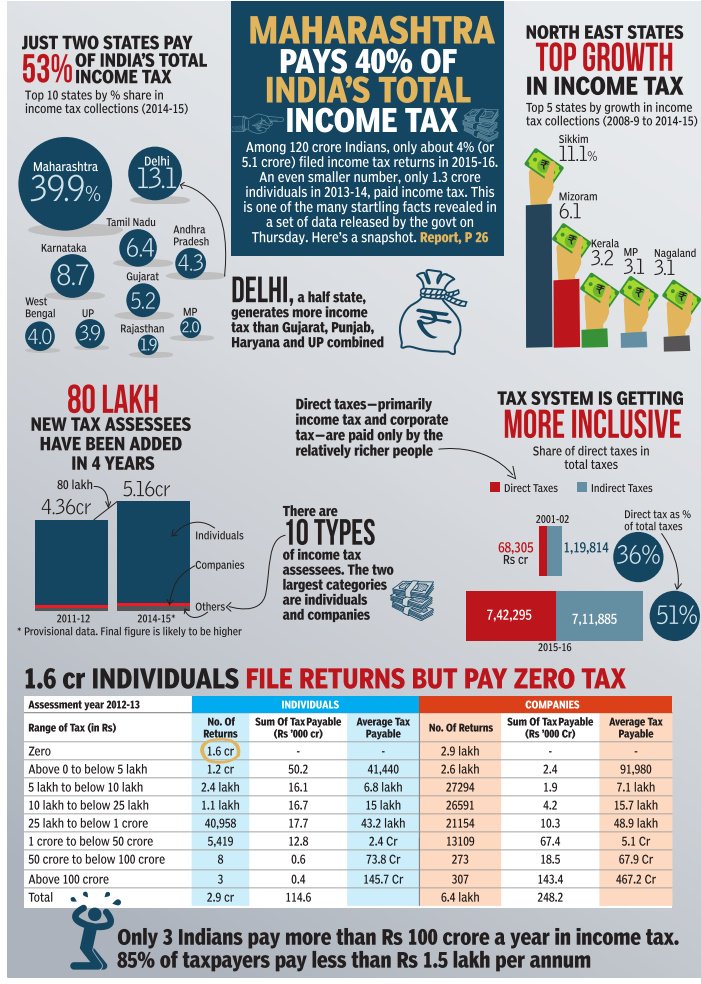

Infographic Income Tax In India Alpha Ideas

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

https://www.livemint.com/money/personal-finance/new-income-tax-rules...

Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

Latest Income Tax Rebate On Home Loan 2023

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Infographic Income Tax In India Alpha Ideas

SBI Credai Sign MoU For Home Loan Rebate For Budget Housing

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be