In the digital age, where screens have become the dominant feature of our lives but the value of tangible, printed materials hasn't diminished. If it's to aid in education project ideas, artistic or just adding an individual touch to the home, printables for free are now a vital resource. The following article is a take a dive to the depths of "Home Loan Rebate In Income Tax Rule," exploring what they are, how to find them and the ways that they can benefit different aspects of your life.

Get Latest Home Loan Rebate In Income Tax Rule Below

Home Loan Rebate In Income Tax Rule

Home Loan Rebate In Income Tax Rule -

Asit Manohar New income tax rules from April 2022 On new home loans sanctioned in FY23 first time home buyers won t be able to claim tax benefit under Section 80EEA as this special

Deductions Deduction for home loan interest If you have a home loan you can no longer be given tax deductions for its interest expenses The change in tax rules came into force on 1 January 2023

The Home Loan Rebate In Income Tax Rule are a huge variety of printable, downloadable materials that are accessible online for free cost. These resources come in various styles, from worksheets to coloring pages, templates and much more. The appealingness of Home Loan Rebate In Income Tax Rule is in their versatility and accessibility.

More of Home Loan Rebate In Income Tax Rule

LHDN IRB Personal Income Tax Rebate 2022

LHDN IRB Personal Income Tax Rebate 2022

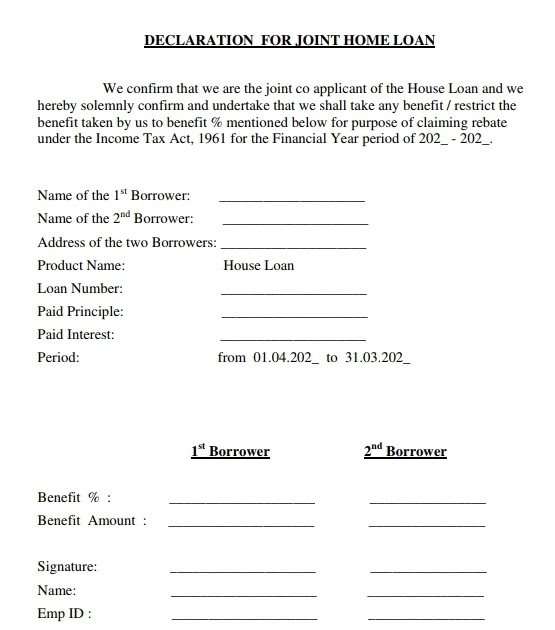

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs 1 5 lakh each in their tax returns To claim this deduction they should also be co owners of the property taken on loan

Apr 27 2023 11 28 IST Source Pixabay Apart from the deduction of up to 1 5 lakh on principal payments and up to 2 lakh on interest payments an additional deduction of

Printables for free have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

Modifications: There is the possibility of tailoring printables to fit your particular needs, whether it's designing invitations to organize your schedule or even decorating your house.

-

Educational Use: These Home Loan Rebate In Income Tax Rule cater to learners of all ages. This makes them a useful tool for teachers and parents.

-

Easy to use: You have instant access a plethora of designs and templates can save you time and energy.

Where to Find more Home Loan Rebate In Income Tax Rule

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs 1 5 lakh under Section 80C This doubles the amount of deductions available when compared to a home loan taken by a single applicant

All home loan borrowers should be informed of all income tax refunds available on home loans since doing so can drastically lower their tax payments Every home loan borrower should be aware of the following income tax rebates on home loans Cheapest home loan interest rates for amounts above Rs 75 lakh PSU banks vs private

In the event that we've stirred your interest in Home Loan Rebate In Income Tax Rule Let's see where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Home Loan Rebate In Income Tax Rule for various purposes.

- Explore categories like design, home decor, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets, flashcards, and learning tools.

- Ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their innovative designs or templates for download.

- The blogs covered cover a wide array of topics, ranging starting from DIY projects to planning a party.

Maximizing Home Loan Rebate In Income Tax Rule

Here are some new ways how you could make the most of Home Loan Rebate In Income Tax Rule:

1. Home Decor

- Print and frame gorgeous artwork, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print out free worksheets and activities to aid in learning at your home for the classroom.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars, to-do lists, and meal planners.

Conclusion

Home Loan Rebate In Income Tax Rule are a treasure trove of practical and innovative resources for a variety of needs and interests. Their access and versatility makes them an essential part of your professional and personal life. Explore the many options of Home Loan Rebate In Income Tax Rule and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually available for download?

- Yes they are! You can download and print the resources for free.

-

Can I use the free templates for commercial use?

- It's contingent upon the specific terms of use. Be sure to read the rules of the creator prior to printing printables for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Certain printables might have limitations on use. You should read the terms and conditions offered by the designer.

-

How can I print Home Loan Rebate In Income Tax Rule?

- Print them at home with an printer, or go to the local print shop for the highest quality prints.

-

What program do I need to open printables free of charge?

- Most printables come in PDF format, which can be opened using free software like Adobe Reader.

Income Tax Rebate U s 87A For The Financial Year 2022 23

How To Get Tax Rebate In Income Tax

Check more sample of Home Loan Rebate In Income Tax Rule below

Income Tax Rebate On Home Loan 2022

Income Tax Appellate Tribunal Recruitment Https www itat gov in

Income Tax Benefits On Home Loan Loanfasttrack

Income Tax Slabs Budget 2021 No Changes In Income Tax Slabs In 2021 And

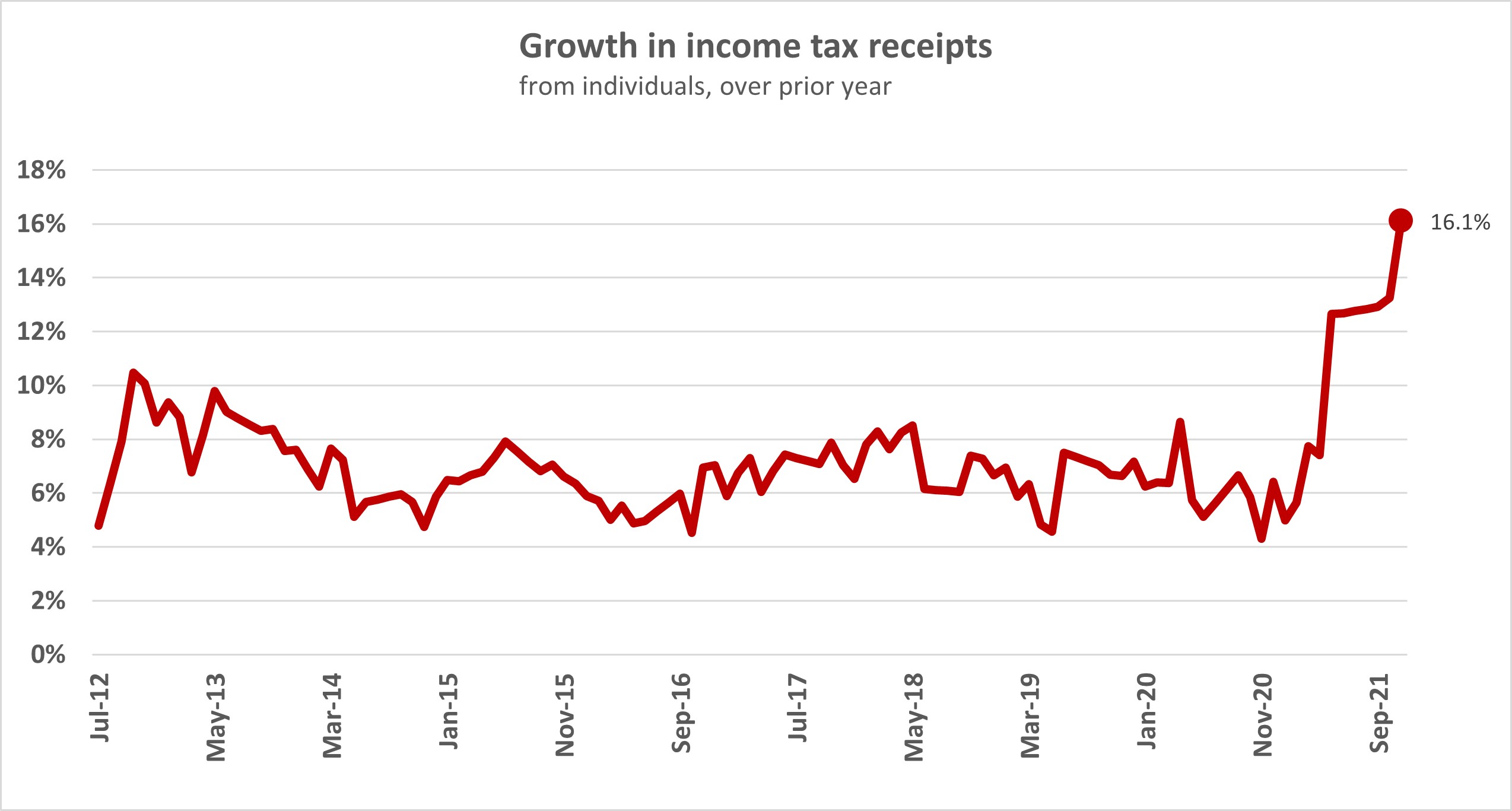

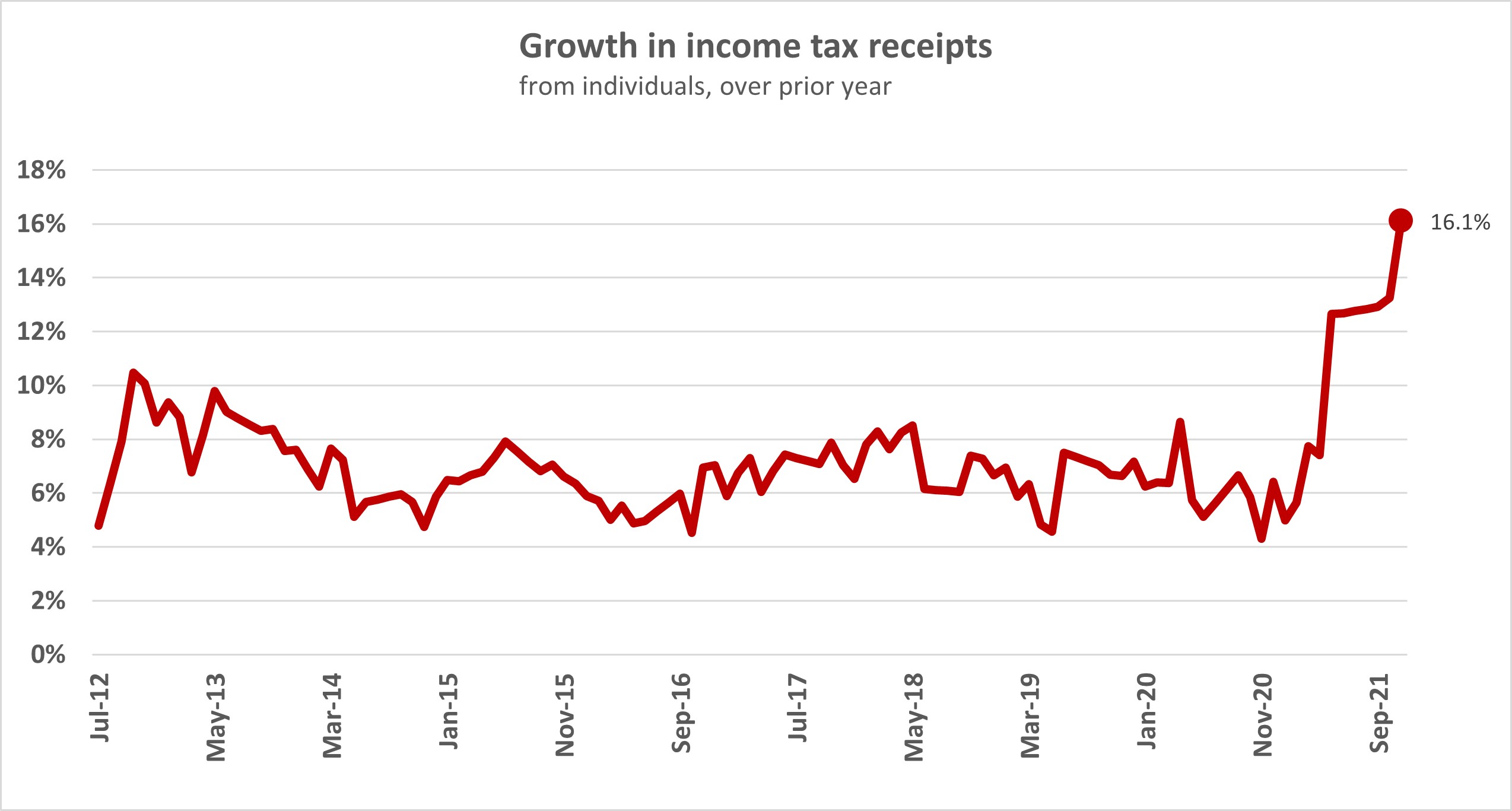

Income Taxes Paid By Individuals Eclipse Previous High Interest co nz

Income Tax Rebate Under Section 87A

https://www.vero.fi/en/individuals/tax-cards-and...

Deductions Deduction for home loan interest If you have a home loan you can no longer be given tax deductions for its interest expenses The change in tax rules came into force on 1 January 2023

https://cleartax.in/s/section-80ee-income-tax...

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution The deduction is up to Rs 50 000 per financial year Taxpayers can claim 80EE if they had serviced a home loan between 1 April 2016 to 31 March 2017

Deductions Deduction for home loan interest If you have a home loan you can no longer be given tax deductions for its interest expenses The change in tax rules came into force on 1 January 2023

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution The deduction is up to Rs 50 000 per financial year Taxpayers can claim 80EE if they had serviced a home loan between 1 April 2016 to 31 March 2017

Income Tax Slabs Budget 2021 No Changes In Income Tax Slabs In 2021 And

Income Tax Appellate Tribunal Recruitment Https www itat gov in

Income Taxes Paid By Individuals Eclipse Previous High Interest co nz

Income Tax Rebate Under Section 87A

Latest Income Tax Rebate On Home Loan 2023

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A

Breathtaking Income Tax Calculation Statement Two Types Of Financial