In this day and age when screens dominate our lives and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. If it's to aid in education as well as creative projects or just adding an element of personalization to your home, printables for free are now a vital resource. This article will take a dive into the world of "Home Loan Interest Exemption In Income Tax Under Section," exploring what they are, where they are available, and how they can improve various aspects of your daily life.

Get Latest Home Loan Interest Exemption In Income Tax Under Section Below

Home Loan Interest Exemption In Income Tax Under Section

Home Loan Interest Exemption In Income Tax Under Section -

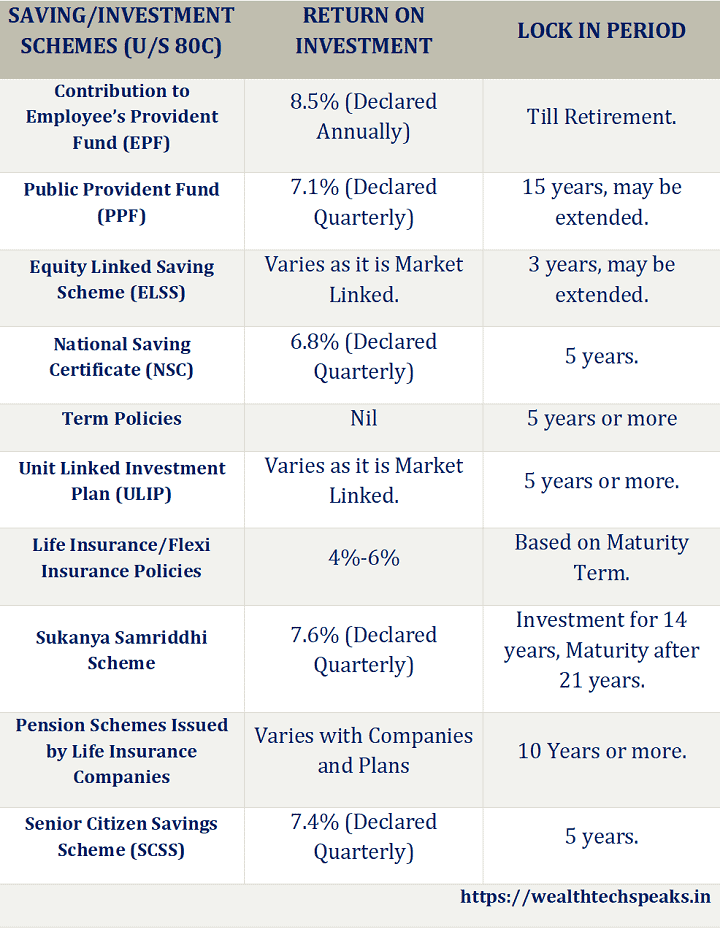

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

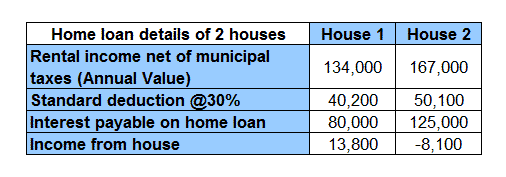

The interest that you pay on your Home Loan is allowed as a deduction under Section 24 of the Income Tax Act If you are

Printables for free include a vast range of downloadable, printable documents that can be downloaded online at no cost. The resources are offered in a variety styles, from worksheets to templates, coloring pages, and much more. The benefit of Home Loan Interest Exemption In Income Tax Under Section lies in their versatility and accessibility.

More of Home Loan Interest Exemption In Income Tax Under Section

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh can be claimed from your gross

How Do I Claim Exemption on My Home Loan Interest How Much Housing Loan Interest Can Be Exempt from Income Tax Who is Eligible for Sections

Home Loan Interest Exemption In Income Tax Under Section have gained immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

customization: The Customization feature lets you tailor the templates to meet your individual needs for invitations, whether that's creating them making your schedule, or decorating your home.

-

Educational Worth: Education-related printables at no charge provide for students of all ages. This makes them a great tool for parents and educators.

-

The convenience of Fast access various designs and templates will save you time and effort.

Where to Find more Home Loan Interest Exemption In Income Tax Under Section

List Of Benefits Available To Salaried Persons For AY 2023 24 FY 2022

List Of Benefits Available To Salaried Persons For AY 2023 24 FY 2022

Income Tax deduction under Section 80EE of the Income Tax Act 1961 can be claimed by first time home buyers for the amount they pay as interest on home loan The

Before the introduction of section 80EEA taxpayers had the option to avail a deduction u s 80EE If the loan is sanctioned during FY 16 17 deduction u s 80EE can

We've now piqued your curiosity about Home Loan Interest Exemption In Income Tax Under Section we'll explore the places the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection with Home Loan Interest Exemption In Income Tax Under Section for all reasons.

- Explore categories like interior decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets Flashcards, worksheets, and other educational tools.

- Perfect for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for free.

- These blogs cover a wide spectrum of interests, that includes DIY projects to party planning.

Maximizing Home Loan Interest Exemption In Income Tax Under Section

Here are some innovative ways of making the most of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use free printable worksheets to aid in learning at your home and in class.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Home Loan Interest Exemption In Income Tax Under Section are an abundance of practical and innovative resources catering to different needs and needs and. Their accessibility and versatility make these printables a useful addition to both professional and personal lives. Explore the many options of Home Loan Interest Exemption In Income Tax Under Section right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes you can! You can download and print these resources at no cost.

-

Do I have the right to use free printables in commercial projects?

- It depends on the specific terms of use. Always verify the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright problems with Home Loan Interest Exemption In Income Tax Under Section?

- Some printables may have restrictions on use. Make sure to read the terms and conditions offered by the designer.

-

How can I print printables for free?

- Print them at home using any printer or head to the local print shop for the highest quality prints.

-

What program must I use to open printables that are free?

- The majority of printables are in the PDF format, and can be opened using free software such as Adobe Reader.

Auto Loan Calculator Surprise You Can Claim Income Tax Exemption If

No Income Tax Exemption On Loan Interest From 2023

Check more sample of Home Loan Interest Exemption In Income Tax Under Section below

The New Section 163 j Interest Limits And The Portfolio Interest Exemption

Income Tax Exemption On Interest Of Education Loan YouTube

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Claim HRA And Home Loan Tax Exemption At The Same Time Get More From

How To Claim Tax Exemption On Home Loan Without Paying Interest In

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

https://blog.bankbazaar.com/home-loan-tax-…

The interest that you pay on your Home Loan is allowed as a deduction under Section 24 of the Income Tax Act If you are

https://m.economictimes.com/wealth/tax/tax...

To encourage citizens to invest in property the government provides a range of home loan tax exemptions and deductions under the Income Tax Act of 1961 All

The interest that you pay on your Home Loan is allowed as a deduction under Section 24 of the Income Tax Act If you are

To encourage citizens to invest in property the government provides a range of home loan tax exemptions and deductions under the Income Tax Act of 1961 All

Claim HRA And Home Loan Tax Exemption At The Same Time Get More From

Income Tax Exemption On Interest Of Education Loan YouTube

How To Claim Tax Exemption On Home Loan Without Paying Interest In

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

Site Loan Tax Exemption COOKING WITH THE PROS

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

Deduction In Income Tax Section 80ccc Section 80ccc Of Income Tax