In a world when screens dominate our lives it's no wonder that the appeal of tangible printed products hasn't decreased. Whatever the reason, whether for education such as creative projects or simply adding a personal touch to your area, Home Energy Tax Credits 2022 have become an invaluable resource. This article will dive into the sphere of "Home Energy Tax Credits 2022," exploring the benefits of them, where to locate them, and how they can improve various aspects of your life.

Get Latest Home Energy Tax Credits 2022 Below

Home Energy Tax Credits 2022

Home Energy Tax Credits 2022 -

OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Home Energy Tax Credits 2022 cover a large variety of printable, downloadable materials online, at no cost. They are available in numerous formats, such as worksheets, templates, coloring pages and many more. The appealingness of Home Energy Tax Credits 2022 is their versatility and accessibility.

More of Home Energy Tax Credits 2022

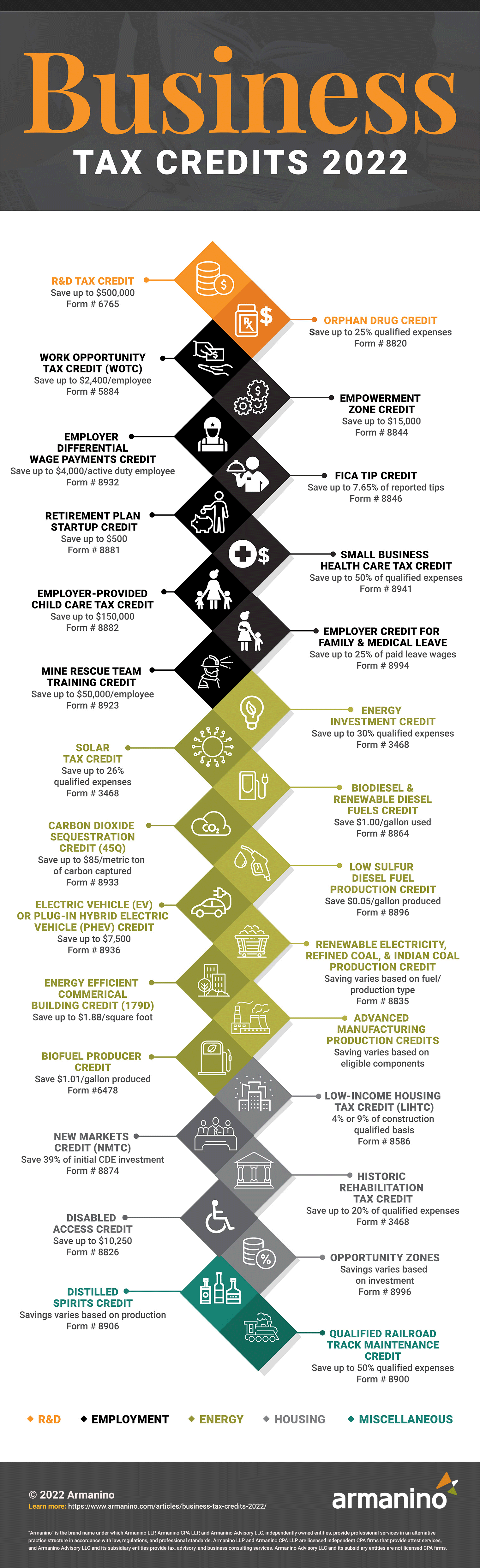

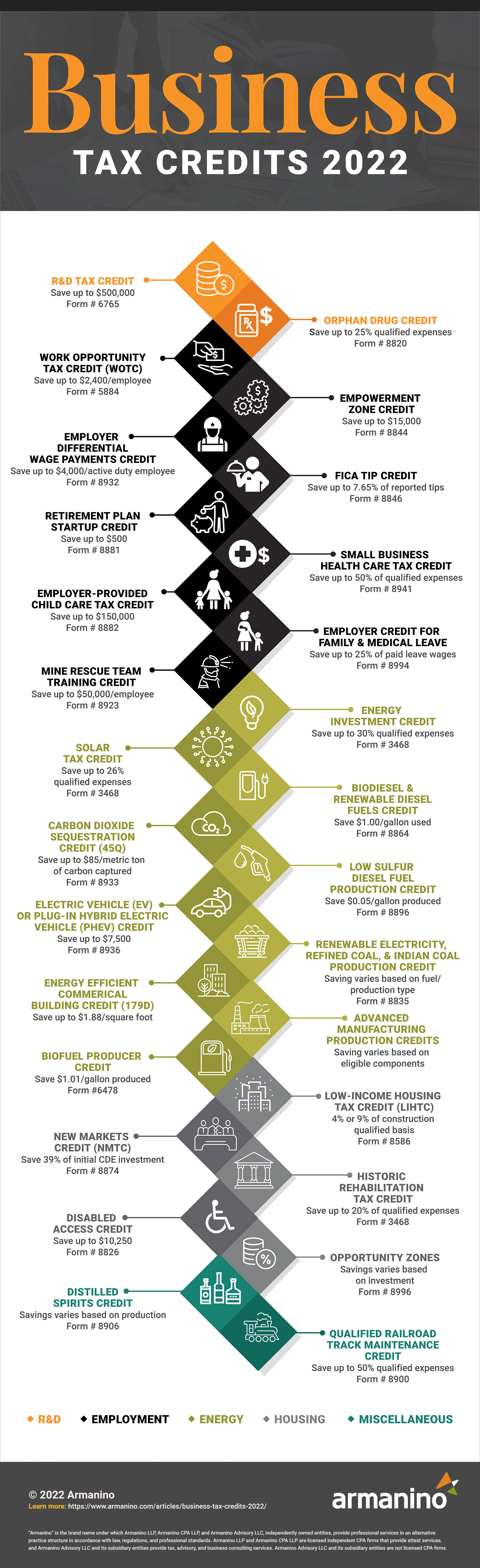

2022 Business Tax Credits Armanino

2022 Business Tax Credits Armanino

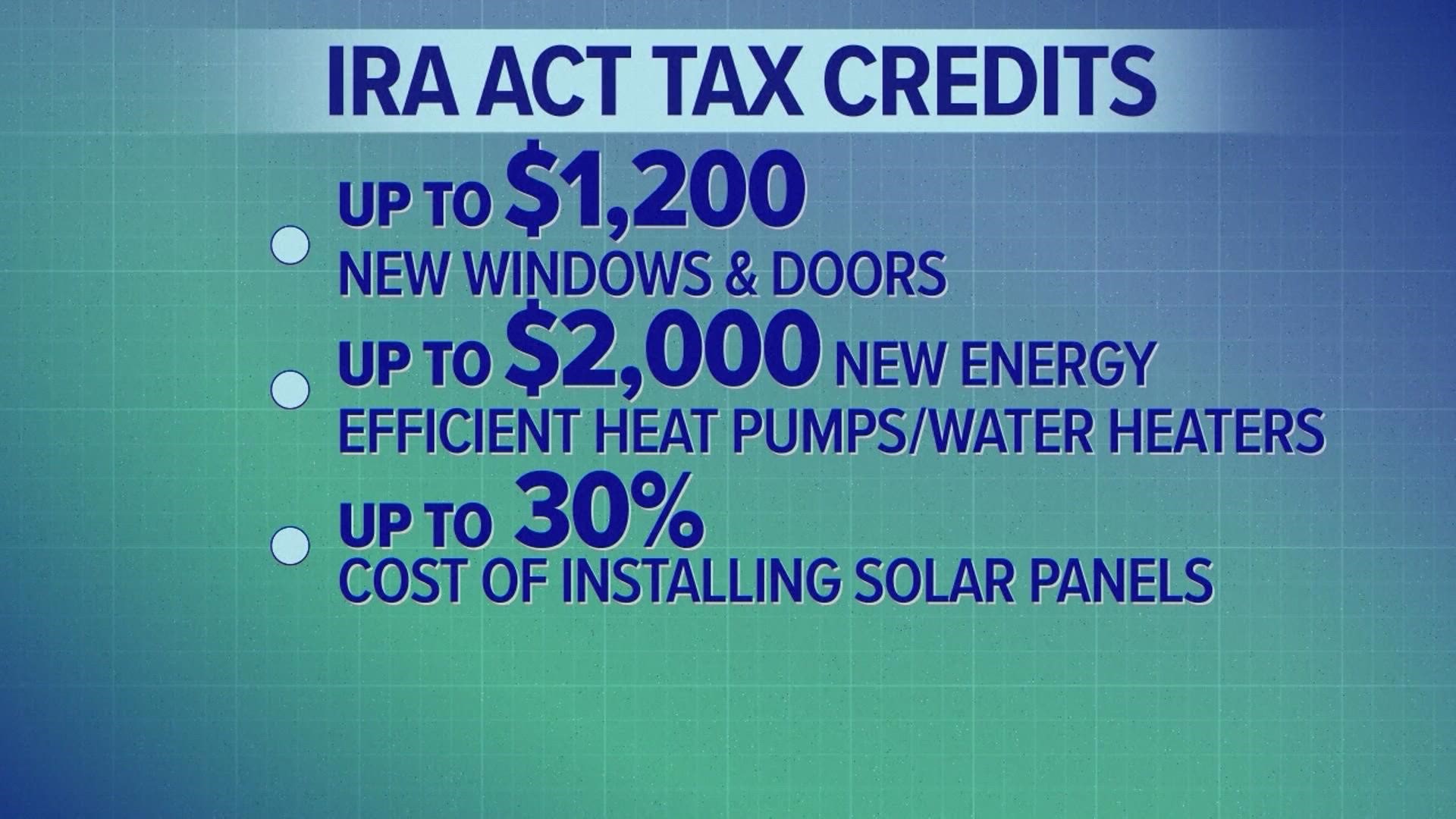

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help

Added to the taxpayer s toolkit in the mid aughts and expanded in 2022 with Biden s passage of the Inflation Reduction Act are several revamped home energy tax credits aimed at incentivizing

Print-friendly freebies have gained tremendous appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

Flexible: The Customization feature lets you tailor the templates to meet your individual needs for invitations, whether that's creating them making your schedule, or even decorating your home.

-

Educational Benefits: Educational printables that can be downloaded for free offer a wide range of educational content for learners of all ages. This makes them a great tool for parents and teachers.

-

Simple: Instant access to numerous designs and templates, which saves time as well as effort.

Where to Find more Home Energy Tax Credits 2022

Home Energy Tax Credits IR 2023 97 PA NJ MD

.jpg#keepProtocol)

Home Energy Tax Credits IR 2023 97 PA NJ MD

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to

The Inflation Reduction Act of 2022 provides federal tax credits and deductions that empower Americans to make homes and buildings more energy efficient to help

In the event that we've stirred your interest in printables for free We'll take a look around to see where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of printables that are free for a variety of needs.

- Explore categories such as design, home decor, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets with flashcards and other teaching tools.

- Great for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for no cost.

- The blogs are a vast variety of topics, starting from DIY projects to planning a party.

Maximizing Home Energy Tax Credits 2022

Here are some inventive ways to make the most use of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print worksheets that are free to enhance your learning at home (or in the learning environment).

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

Home Energy Tax Credits 2022 are an abundance of practical and innovative resources that can meet the needs of a variety of people and interests. Their accessibility and versatility make them an invaluable addition to each day life. Explore the many options of Home Energy Tax Credits 2022 to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really free?

- Yes, they are! You can print and download these files for free.

-

Do I have the right to use free printables for commercial use?

- It's based on the conditions of use. Be sure to read the rules of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues in Home Energy Tax Credits 2022?

- Some printables may have restrictions regarding usage. Be sure to read the terms and condition of use as provided by the author.

-

How do I print Home Energy Tax Credits 2022?

- Print them at home with any printer or head to the local print shops for better quality prints.

-

What program do I need in order to open printables that are free?

- Many printables are offered as PDF files, which is open with no cost software like Adobe Reader.

Joyce Announces 35 Million Allocation Of New Markets Tax Credits In

Energy Tax Credits Armanino

Check more sample of Home Energy Tax Credits 2022 below

Inflation Reduction Act Increases Home Energy Tax Credits Wfaa

4 Home Improvement Projects That Qualify For Energy Tax Credits RWC

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Do You Qualify For A Home Energy Tax Credit Benefyd

How The Inflation Reduction Act And Bipartisan Infrastructure Law Work

Home Energy Tax Credits Inflation Reduction Act Phoenix Arizona

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

https://www.irs.gov/newsroom/irs-releases...

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

Do You Qualify For A Home Energy Tax Credit Benefyd

4 Home Improvement Projects That Qualify For Energy Tax Credits RWC

How The Inflation Reduction Act And Bipartisan Infrastructure Law Work

Home Energy Tax Credits Inflation Reduction Act Phoenix Arizona

Residential Energy Tax Credits Overview And Analysis

Energy Tax Credits For 2024

Energy Tax Credits For 2024

Receive Your Tax Credits