In this digital age, where screens have become the dominant feature of our lives however, the attraction of tangible printed products hasn't decreased. It doesn't matter if it's for educational reasons or creative projects, or just adding a personal touch to your area, Home Buyer Tax Credit are a great source. We'll dive deep into the realm of "Home Buyer Tax Credit," exploring what they are, how they can be found, and the ways that they can benefit different aspects of your life.

Get Latest Home Buyer Tax Credit Below

Home Buyer Tax Credit

Home Buyer Tax Credit -

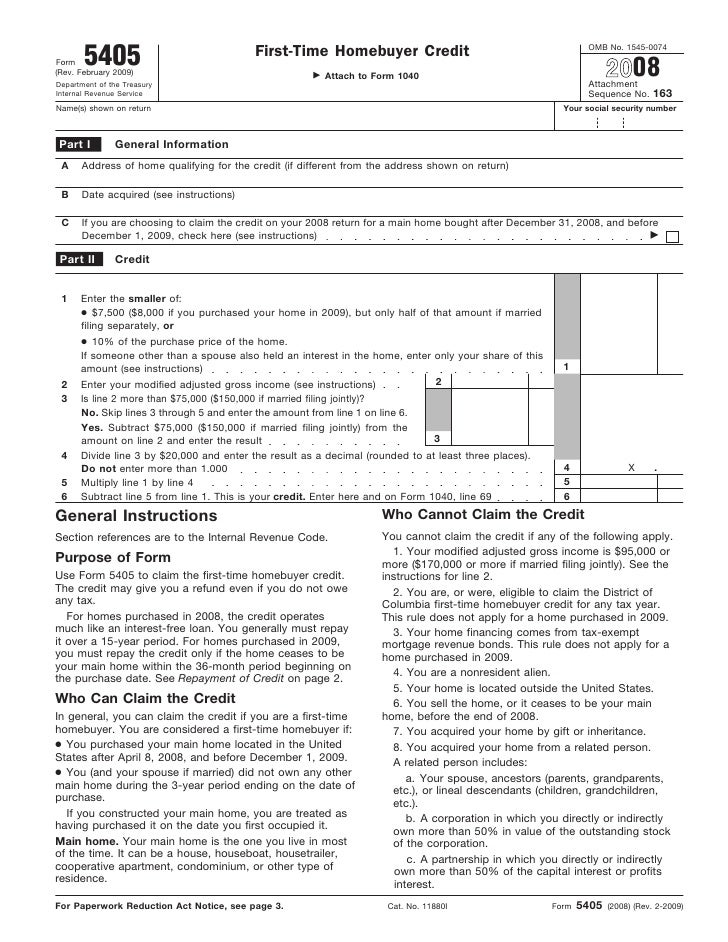

First time home buyers who acquire a qualifying home can claim a non refundable tax credit of up to 750 The value of the HBTC is calculated by multiplying 5 000 by the lowest personal income tax rate 15 in 2022

The 10 000 First Time Home Buyer Tax Credit The 10 000 First Time Home Buyer Tax Credit is a mortgage relief program to help low and middle income households stop renting and start owning The program gives eligible buyers 5 000 a year in tax credits for their first two years of homeownership

Home Buyer Tax Credit provide a diverse array of printable documents that can be downloaded online at no cost. These printables come in different formats, such as worksheets, templates, coloring pages and many more. The appealingness of Home Buyer Tax Credit is their versatility and accessibility.

More of Home Buyer Tax Credit

Home Buyer Tax Credit Can I Sell The Homestead To My Children

Home Buyer Tax Credit Can I Sell The Homestead To My Children

You received a First Time Homebuyer Credit 2 Gather Your Information Social Security number or your IRS Individual Taxpayer Identification Number Date of birth Street address ZIP Code 3 Check Your Account Go to our First Time Homebuyer Credit Account Look up to receive Balance of your First Time Homebuyer Credit

Taxpayers must file Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors and itemize their deductions to deduct home ownership expenses However taxpayers can t take the standard deduction if they itemize Non deductible payments and expenses Homeowners can t deduct any of the following

Home Buyer Tax Credit have gained immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

customization: Your HTML0 customization options allow you to customize printed materials to meet your requirements in designing invitations or arranging your schedule or decorating your home.

-

Educational Value Printables for education that are free are designed to appeal to students from all ages, making these printables a powerful resource for educators and parents.

-

Affordability: Quick access to many designs and templates is time-saving and saves effort.

Where to Find more Home Buyer Tax Credit

New York First Time Home Buyer Tax Credit Credit Walls

New York First Time Home Buyer Tax Credit Credit Walls

Despite recent attempts there is currently no first time home buyer tax credit available at the federal level However that doesn t mean there aren t options available in your state States also have the ability to issue mortgage credit certificates that can be used to lower income taxes dollar for dollar

On Mar 7 2024 in his State of the Union address President Joe Biden proposed a mortgage relief credit program which would offer tax credits to first time homebuyers and home sellers

After we've peaked your interest in printables for free Let's find out where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Home Buyer Tax Credit for various uses.

- Explore categories like decorating your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- Great for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- These blogs cover a wide variety of topics, ranging from DIY projects to party planning.

Maximizing Home Buyer Tax Credit

Here are some ideas that you can make use use of Home Buyer Tax Credit:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or festive decorations to decorate your living areas.

2. Education

- Use printable worksheets for free to enhance your learning at home or in the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars or to-do lists. meal planners.

Conclusion

Home Buyer Tax Credit are a treasure trove of innovative and useful resources which cater to a wide range of needs and passions. Their access and versatility makes them a fantastic addition to both professional and personal life. Explore the plethora of Home Buyer Tax Credit to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually for free?

- Yes you can! You can print and download these documents for free.

-

Can I download free templates for commercial use?

- It's determined by the specific usage guidelines. Always check the creator's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Some printables may have restrictions in use. Make sure to read the terms and conditions provided by the designer.

-

How do I print Home Buyer Tax Credit?

- You can print them at home with a printer or visit the local print shop for top quality prints.

-

What program do I need to open printables free of charge?

- Most printables come in the format of PDF, which can be opened using free programs like Adobe Reader.

How The Proposed 15 000 First Time Home Buyer Tax Credit Works PMR Loans

Biden 15 000 First Time Home Buyer Tax Credit New For 2023 YouTube

Check more sample of Home Buyer Tax Credit below

Biden s 25 000 First Time Home Buyer Tax Credit Downpayment Toward

First Time Home Buyer Tax Credit Ended But Help Exists Trending Home News

First Time Home Buyer Tax Credit USDA LOANS USDA Home Loan USDA

Canada s New Home Buyer Tax Credit Cornerstone

What Is The First Time Home Buyer Tax Credit In Canada Business IN Canada

The IRS Is Cracking Down On First Time Home Buyer Tax Credit Fraud

https://homebuyer.com/learn/15000-first-time-home...

The 10 000 First Time Home Buyer Tax Credit The 10 000 First Time Home Buyer Tax Credit is a mortgage relief program to help low and middle income households stop renting and start owning The program gives eligible buyers 5 000 a year in tax credits for their first two years of homeownership

https://www.cbsnews.com/news/biden-state-of-the...

To help offset the cost of buying a home Biden is proposing the following tax credits A first time homebuyer tax credit of 10 000 A one year tax credit of up to 10 000 to current homeowners

The 10 000 First Time Home Buyer Tax Credit The 10 000 First Time Home Buyer Tax Credit is a mortgage relief program to help low and middle income households stop renting and start owning The program gives eligible buyers 5 000 a year in tax credits for their first two years of homeownership

To help offset the cost of buying a home Biden is proposing the following tax credits A first time homebuyer tax credit of 10 000 A one year tax credit of up to 10 000 to current homeowners

Canada s New Home Buyer Tax Credit Cornerstone

First Time Home Buyer Tax Credit Ended But Help Exists Trending Home News

What Is The First Time Home Buyer Tax Credit In Canada Business IN Canada

The IRS Is Cracking Down On First Time Home Buyer Tax Credit Fraud

An Overview Of The First Time Home Buyers Tax Credit

First Time Home Buyer Tax Credit How To Get It From States Tax

First Time Home Buyer Tax Credit How To Get It From States Tax

First Time Home Buyer Tax Credit Ultimate Guide To Getting The Most