In this age of technology, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed materials hasn't faded away. No matter whether it's for educational uses, creative projects, or just adding the personal touch to your area, Higher Education Expenses Tax Deduction are a great source. For this piece, we'll take a dive deep into the realm of "Higher Education Expenses Tax Deduction," exploring the benefits of them, where to locate them, and the ways that they can benefit different aspects of your lives.

Get Latest Higher Education Expenses Tax Deduction Below

Higher Education Expenses Tax Deduction

Higher Education Expenses Tax Deduction -

Most tax preferential savings accounts and tax breaks will define educational expenses for the purposes of tax free withdrawals or claiming deductions and these often include room and board books supplies and other costs necessary for education

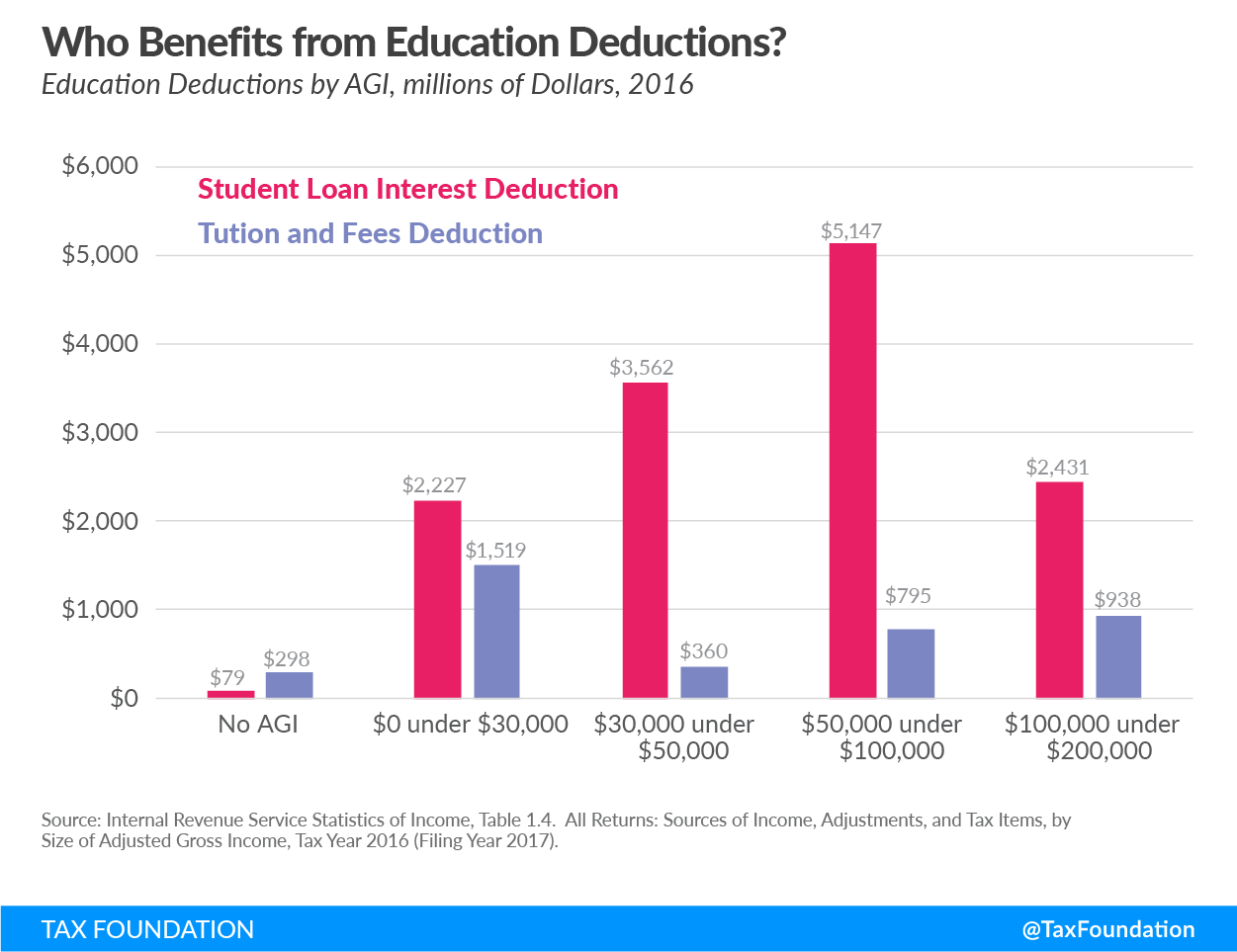

OVERVIEW The Tuition and Fees Deduction was extended through the end of 2020 It allows you to deduct up to 4 000 from your income for qualifying tuition expenses paid for you your spouse or your dependents TABLE OF CONTENTS When can I take this deduction Which expenses qualify What if I receive

The Higher Education Expenses Tax Deduction are a huge range of printable, free content that can be downloaded from the internet at no cost. These printables come in different types, like worksheets, templates, coloring pages and more. The value of Higher Education Expenses Tax Deduction is in their variety and accessibility.

More of Higher Education Expenses Tax Deduction

Federal Tax Benefits For HIgher Education

Federal Tax Benefits For HIgher Education

Such expenses must have been required for enrollment or attendance at an eligible educational institution The deduction was 100 of qualified higher education expenses with a maximum of 4 000 2 000 or 0 depending on the amount of your modified AGI and filing status

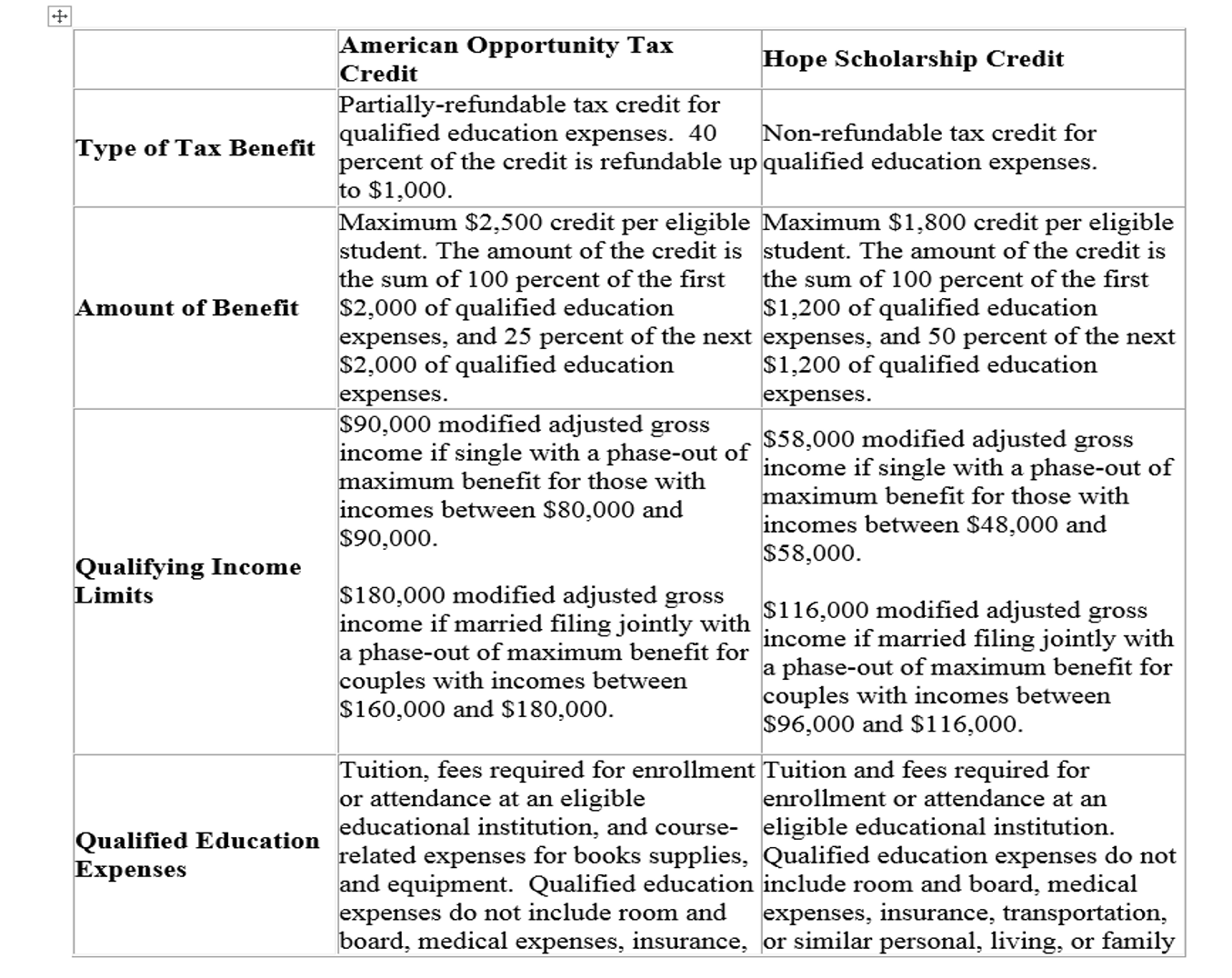

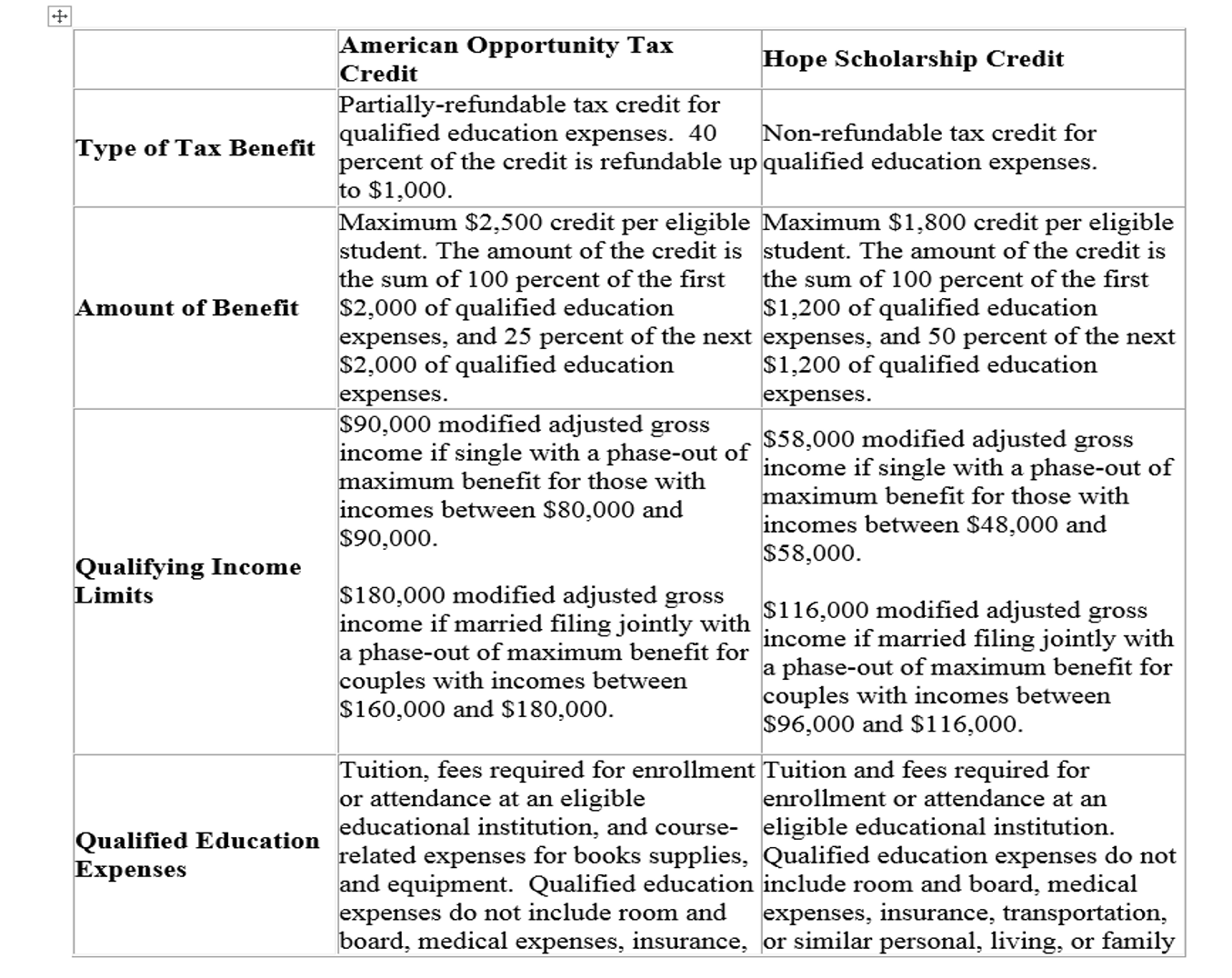

Taxpayers may claim QHEEs under the tuition and fees deduction by using Form 8917 with their completed tax return Filers may apply for the American Opportunity Tax Credit and the Lifetime

Higher Education Expenses Tax Deduction have risen to immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Flexible: There is the possibility of tailoring printing templates to your own specific requirements in designing invitations making your schedule, or even decorating your home.

-

Educational Impact: Downloads of educational content for free can be used by students of all ages, which makes them a great instrument for parents and teachers.

-

Simple: instant access a myriad of designs as well as templates, which saves time as well as effort.

Where to Find more Higher Education Expenses Tax Deduction

Federal Tax Benefits For HIgher Education

Federal Tax Benefits For HIgher Education

The tuition and fees deduction available to all taxpayers allows you to deduct up to 4 000 The American opportunity tax credit AOTC and the lifetime learning credit LLC are tax credits that reimburse education expenses

A1 No but the Protecting Americans Against Tax Hikes PATH Act of 2015 made AOTC permanent The AOTC helps defray the cost of higher education expenses for tuition certain fees and course materials for four years To claim the AOTC or LLC use Form 8863 Education Credits American Opportunity and Lifetime

After we've peaked your curiosity about Higher Education Expenses Tax Deduction and other printables, let's discover where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection and Higher Education Expenses Tax Deduction for a variety goals.

- Explore categories such as decoration for your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets with flashcards and other teaching tools.

- The perfect resource for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- The blogs are a vast spectrum of interests, ranging from DIY projects to party planning.

Maximizing Higher Education Expenses Tax Deduction

Here are some fresh ways create the maximum value of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or festive decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge to enhance your learning at home as well as in the class.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

Higher Education Expenses Tax Deduction are an abundance of creative and practical resources catering to different needs and passions. Their accessibility and versatility make them an invaluable addition to both professional and personal lives. Explore the endless world of Higher Education Expenses Tax Deduction today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes they are! You can print and download the resources for free.

-

Can I make use of free printables in commercial projects?

- It's based on the usage guidelines. Make sure you read the guidelines for the creator before utilizing printables for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables could have limitations in their usage. Always read the terms and condition of use as provided by the designer.

-

How do I print printables for free?

- You can print them at home with either a printer or go to an area print shop for the highest quality prints.

-

What software do I require to view printables at no cost?

- A majority of printed materials are in the format PDF. This is open with no cost software like Adobe Reader.

5 Education Related Tax Credits Deductions For College Tuition

Evaluating Education Tax Provisions Tax Foundation

Check more sample of Higher Education Expenses Tax Deduction below

There Are Tax Credits For Higher Education Expenses The Law Firm Of

Maximizing The Higher Education Tax Credits Journal Of Accountancy

Tax Deduction Definition TaxEDU Tax Foundation

Education Expenses Tax Deduction Bdesignsnow

Federal Tax Benefits For HIgher Education

Qualifying Education Expenses Tax Guide College Expenses Filing Taxes

https://turbotax.intuit.com/tax-tips/college-and...

OVERVIEW The Tuition and Fees Deduction was extended through the end of 2020 It allows you to deduct up to 4 000 from your income for qualifying tuition expenses paid for you your spouse or your dependents TABLE OF CONTENTS When can I take this deduction Which expenses qualify What if I receive

https://www.irs.gov/publications/p970

Deduct higher education expenses on your income tax return as for example a business expense and also claim an American opportunity credit based on those same expenses Claim an American opportunity credit for any student and use any of that student s expenses in figuring your lifetime learning credit

OVERVIEW The Tuition and Fees Deduction was extended through the end of 2020 It allows you to deduct up to 4 000 from your income for qualifying tuition expenses paid for you your spouse or your dependents TABLE OF CONTENTS When can I take this deduction Which expenses qualify What if I receive

Deduct higher education expenses on your income tax return as for example a business expense and also claim an American opportunity credit based on those same expenses Claim an American opportunity credit for any student and use any of that student s expenses in figuring your lifetime learning credit

Education Expenses Tax Deduction Bdesignsnow

Maximizing The Higher Education Tax Credits Journal Of Accountancy

Federal Tax Benefits For HIgher Education

Qualifying Education Expenses Tax Guide College Expenses Filing Taxes

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Income Tax Deduction On Education Loan 80E CAGMC

Income Tax Deduction On Education Loan 80E CAGMC

What Is A Tax Deduction Definition Examples Calculation