In this age of electronic devices, where screens rule our lives it's no wonder that the appeal of tangible printed products hasn't decreased. Be it for educational use such as creative projects or simply adding an extra personal touch to your area, Fuel Tax Credit Form are a great source. For this piece, we'll dive into the world of "Fuel Tax Credit Form," exploring the benefits of them, where you can find them, and how they can add value to various aspects of your life.

Get Latest Fuel Tax Credit Form Below

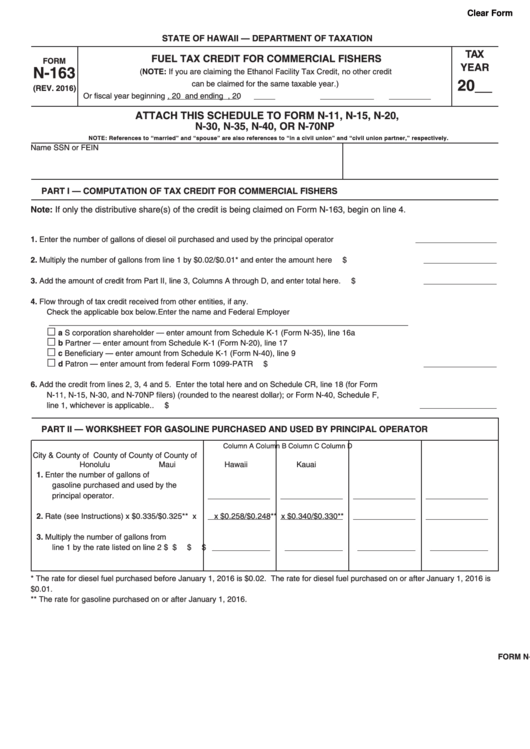

Fuel Tax Credit Form

Fuel Tax Credit Form -

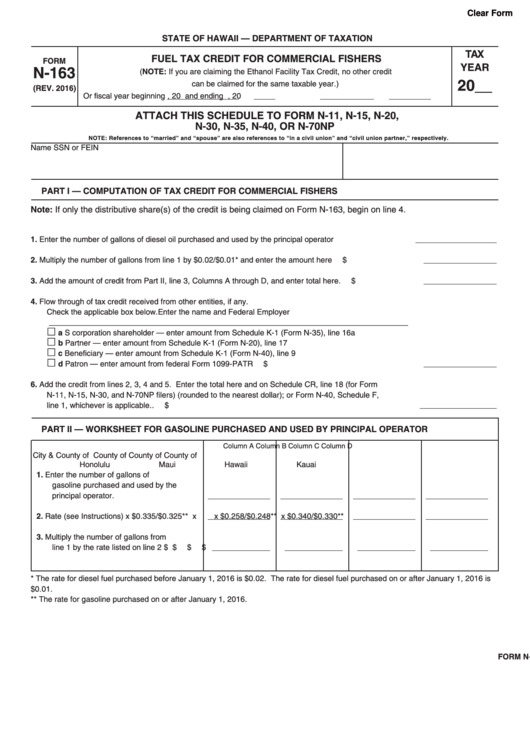

Fuel tax credits business Information about fuel tax credits for business use of fuel Last updated 5 July 2021 Print or Download Fuel tax credits provide businesses with a credit for the fuel tax excise or customs duty that s included in the price of fuel used in machinery plant equipment heavy vehicles

Step 1 Work out your eligible quantities Work out how much fuel liquid or gaseous you acquired for each business activity Step 2 Check which rate applies for the fuel Fuel tax credit rates change regularly You need to check you are using the rate that applied when you acquired the fuel including fuel used in heavy vehicles See also

Fuel Tax Credit Form offer a wide selection of printable and downloadable resources available online for download at no cost. They are available in numerous forms, like worksheets templates, coloring pages and more. The benefit of Fuel Tax Credit Form is in their versatility and accessibility.

More of Fuel Tax Credit Form

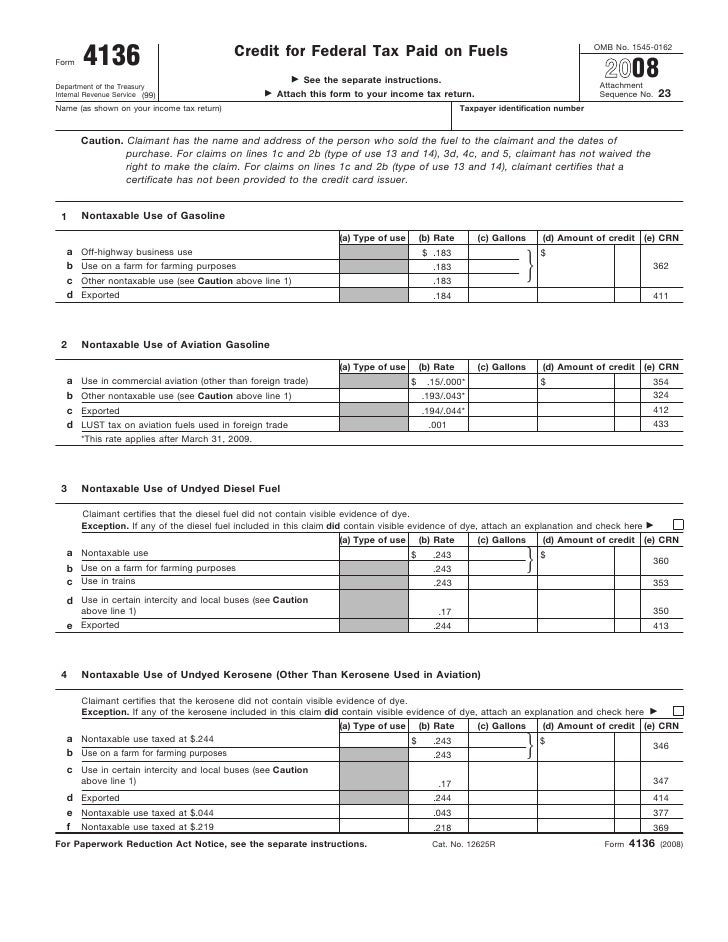

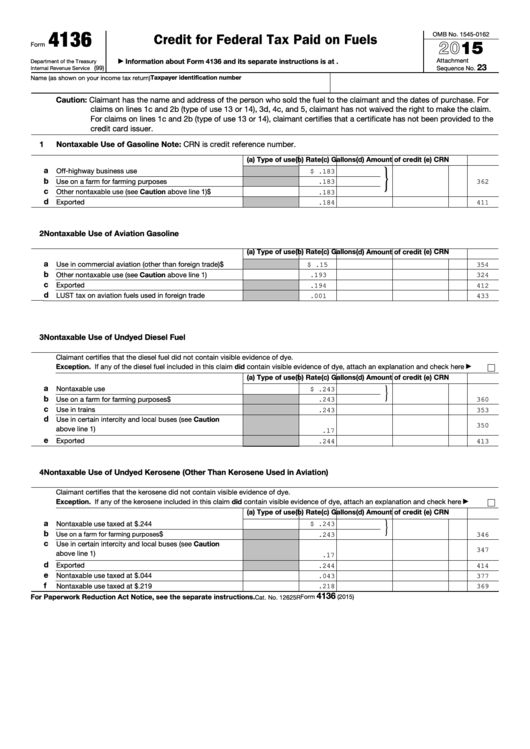

Fillable Form 4136 Printable Forms Free Online

Fillable Form 4136 Printable Forms Free Online

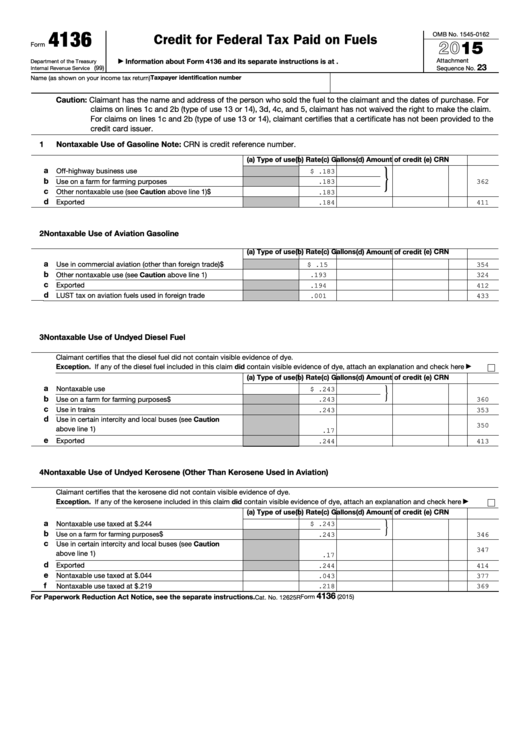

The one most familiar to taxpayers is probably the federal gas tax 18 4 cents gallon as of 2021 which pays for road projects across the country Certain uses of fuels are untaxed however and fuel users can get a credit for the taxes they ve paid by filing Form 4136

Once they determine that they re entitled to the credit companies and some individuals may apply for the Fuel Tax Credit by using Federal Tax Form 4136 Filers may also use this form to

The Fuel Tax Credit Form have gained huge popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Modifications: This allows you to modify printed materials to meet your requirements, whether it's designing invitations and schedules, or even decorating your home.

-

Educational Benefits: The free educational worksheets offer a wide range of educational content for learners of all ages, making them a valuable resource for educators and parents.

-

Accessibility: Access to a variety of designs and templates helps save time and effort.

Where to Find more Fuel Tax Credit Form

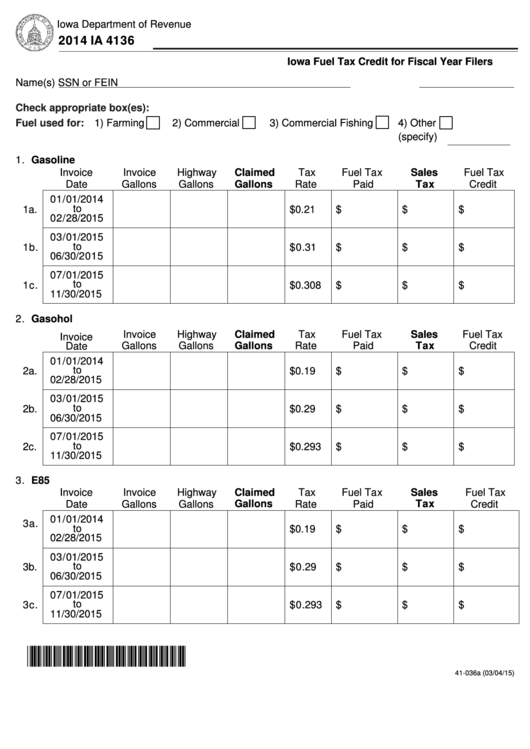

Fillable Form Ia 4136 Fuel Tax Credit For Fiscal Year Filers 2014

Fillable Form Ia 4136 Fuel Tax Credit For Fiscal Year Filers 2014

To claim fuel tax credits with Form 4136 you must Have paid federal excise taxes on fuels Have proof of tax amounts paid Have used fuels for nontaxable purposes You cannot claim a credit for fuel used for personal reasons The table below outlines common eligible and ineligible uses Eligible Uses Business vehicles driven off

Using Form 4136 businesses can claim a tax credit for federal excise taxes paid on fuel effectively reducing their overall tax liability This can be a substantial saving particularly for transportation construction or agriculture businesses where fuel consumption is high

In the event that we've stirred your interest in Fuel Tax Credit Form and other printables, let's discover where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Fuel Tax Credit Form designed for a variety motives.

- Explore categories like home decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free as well as flashcards and other learning tools.

- Ideal for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- The blogs covered cover a wide array of topics, ranging from DIY projects to party planning.

Maximizing Fuel Tax Credit Form

Here are some inventive ways that you can make use of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use printable worksheets from the internet to enhance your learning at home as well as in the class.

3. Event Planning

- Invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

Fuel Tax Credit Form are a treasure trove of practical and innovative resources that cater to various needs and desires. Their availability and versatility make them a fantastic addition to your professional and personal life. Explore the world of Fuel Tax Credit Form and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Fuel Tax Credit Form truly free?

- Yes you can! You can download and print these resources at no cost.

-

Do I have the right to use free printables for commercial purposes?

- It's dependent on the particular conditions of use. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright concerns when using Fuel Tax Credit Form?

- Some printables may come with restrictions in their usage. Always read the terms of service and conditions provided by the designer.

-

How can I print printables for free?

- You can print them at home with either a printer or go to any local print store for high-quality prints.

-

What program must I use to open printables at no cost?

- A majority of printed materials are in PDF format. These is open with no cost software, such as Adobe Reader.

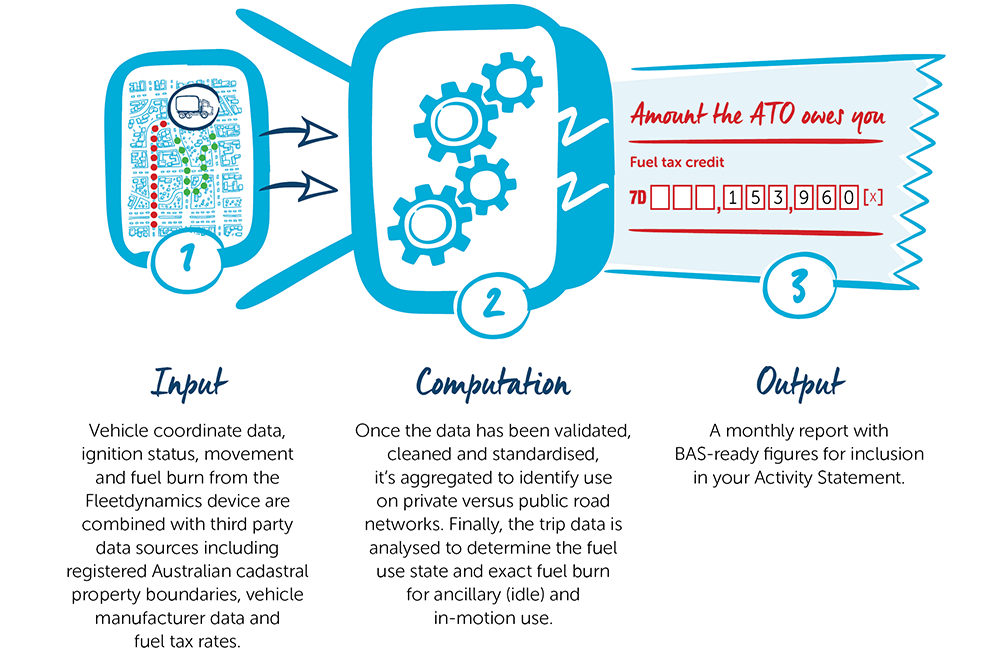

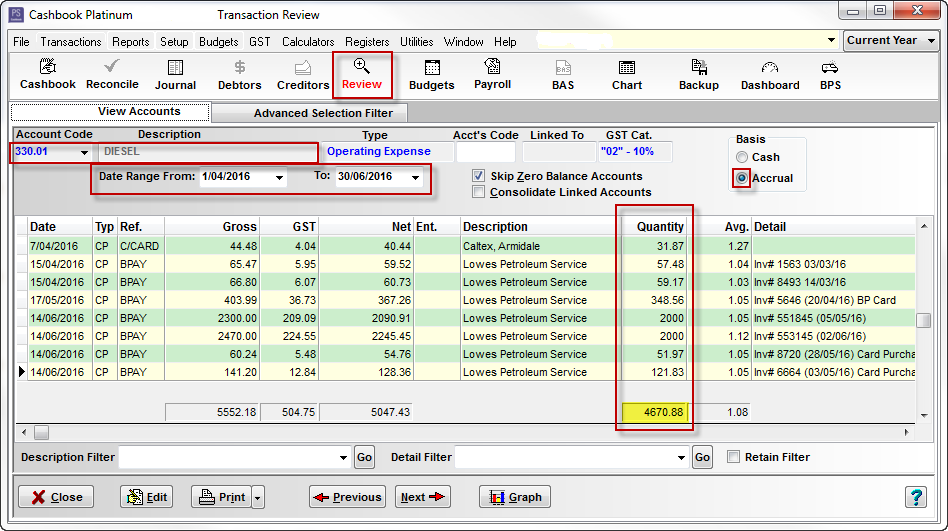

Fuel Tax Credit Computation Telematics Fleetcare

Calculating Fuel Tax Credit Manually PS Support

Check more sample of Fuel Tax Credit Form below

Fuel Tax Credit Calculator Banlaw

Bin Nicht Der Favorit Bagnaia Lobt Die Konkurrenz

Form 4136 Credit For Federal Tax Paid On Fuel

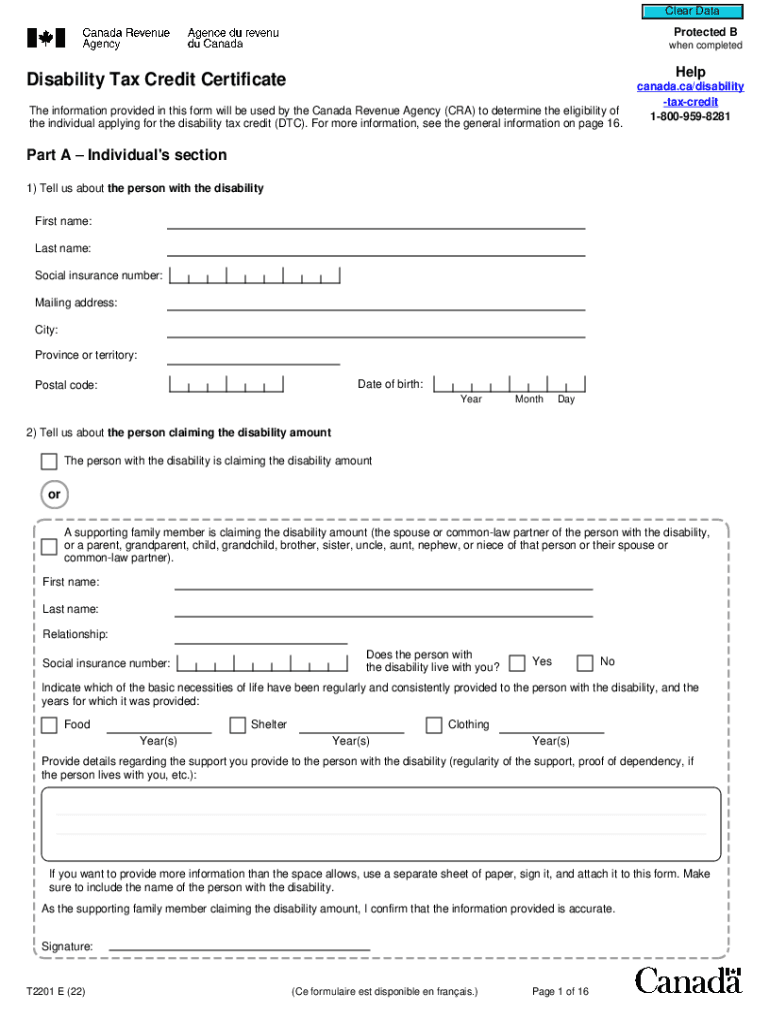

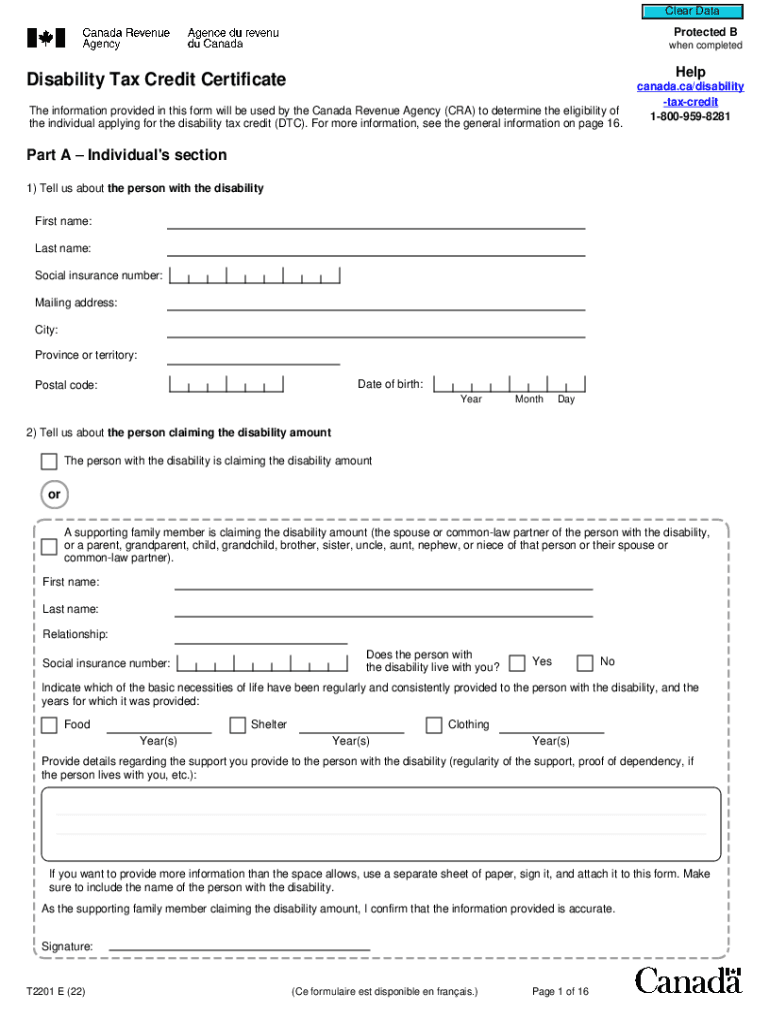

T2201 Form Disability Tax Credit Form Fill Out And Sign Printable PDF

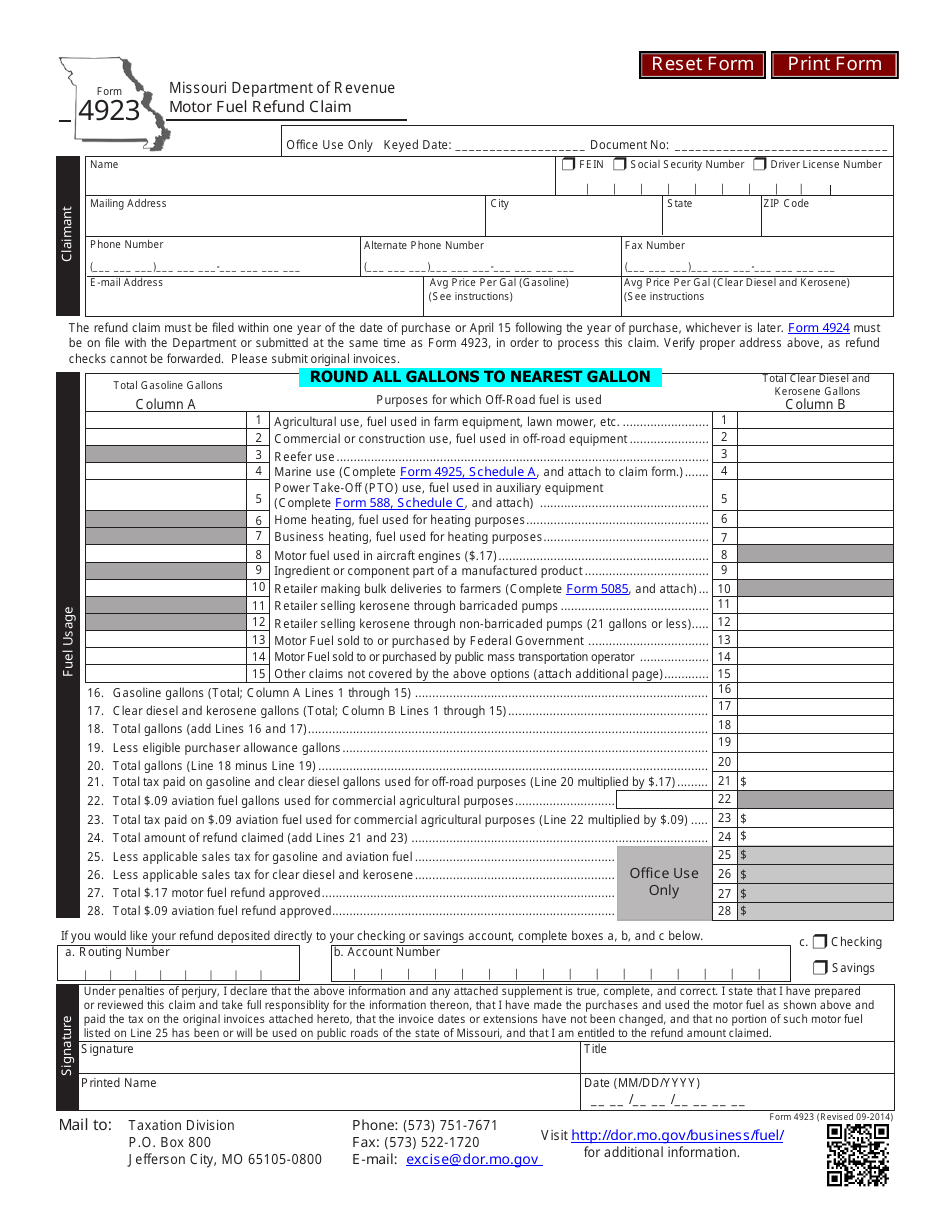

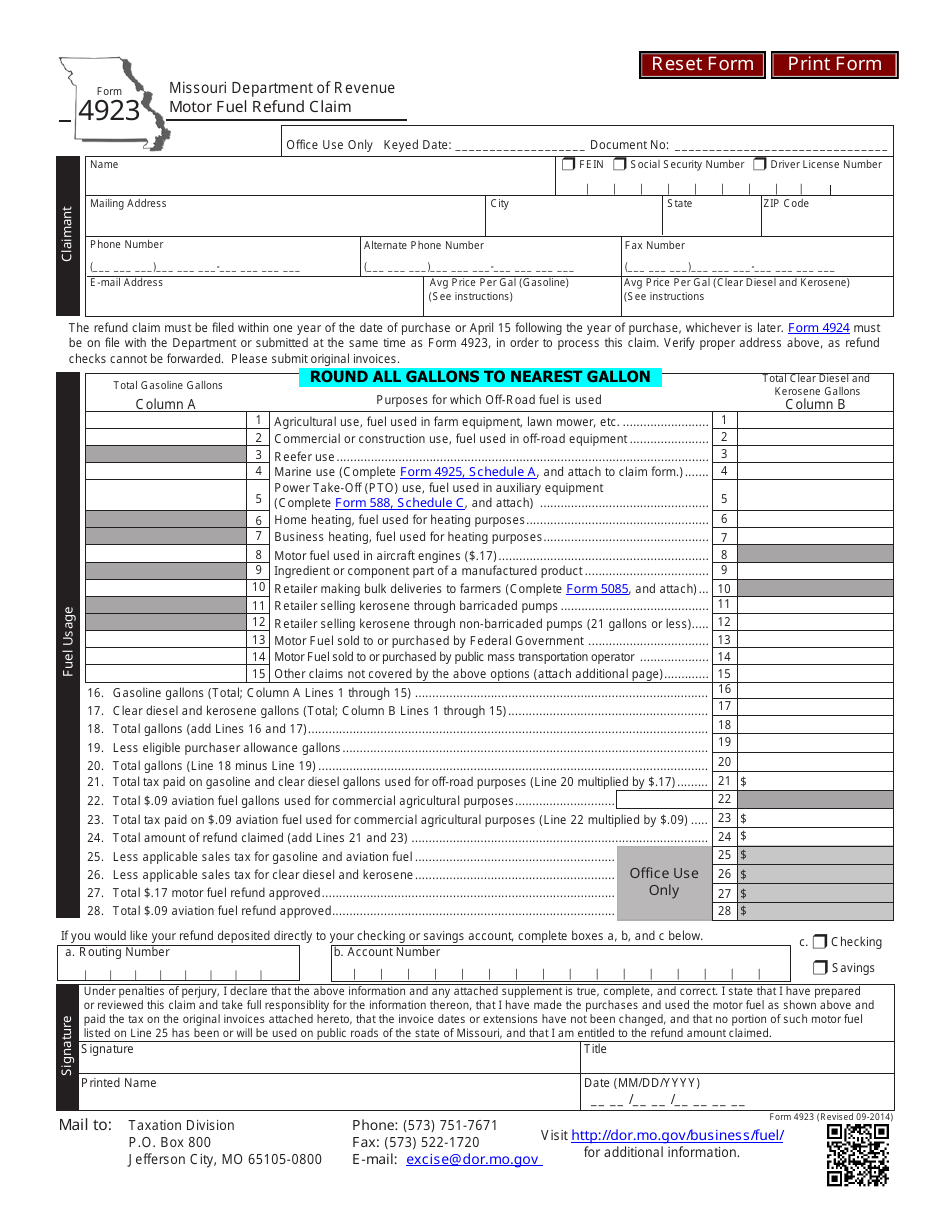

Form 4923 Fill Out Sign Online And Download Fillable PDF Missouri

Fuel Tax Credit Changes 2022 Aintree Group

https://www.ato.gov.au/forms-and-instructions/fuel...

Step 1 Work out your eligible quantities Work out how much fuel liquid or gaseous you acquired for each business activity Step 2 Check which rate applies for the fuel Fuel tax credit rates change regularly You need to check you are using the rate that applied when you acquired the fuel including fuel used in heavy vehicles See also

https://www.irs.gov/pub/irs-pdf/f4136.pdf

Department of the Treasury Internal Revenue Service Credit for Federal Tax Paid on Fuels Go to www irs gov Form4136 for instructions and the latest information OMB No 1545 0162 2023 Attachment Sequence No 79 Name as shown on your income tax return Taxpayer identification number 4136 Caution

Step 1 Work out your eligible quantities Work out how much fuel liquid or gaseous you acquired for each business activity Step 2 Check which rate applies for the fuel Fuel tax credit rates change regularly You need to check you are using the rate that applied when you acquired the fuel including fuel used in heavy vehicles See also

Department of the Treasury Internal Revenue Service Credit for Federal Tax Paid on Fuels Go to www irs gov Form4136 for instructions and the latest information OMB No 1545 0162 2023 Attachment Sequence No 79 Name as shown on your income tax return Taxpayer identification number 4136 Caution

T2201 Form Disability Tax Credit Form Fill Out And Sign Printable PDF

Bin Nicht Der Favorit Bagnaia Lobt Die Konkurrenz

Form 4923 Fill Out Sign Online And Download Fillable PDF Missouri

Fuel Tax Credit Changes 2022 Aintree Group

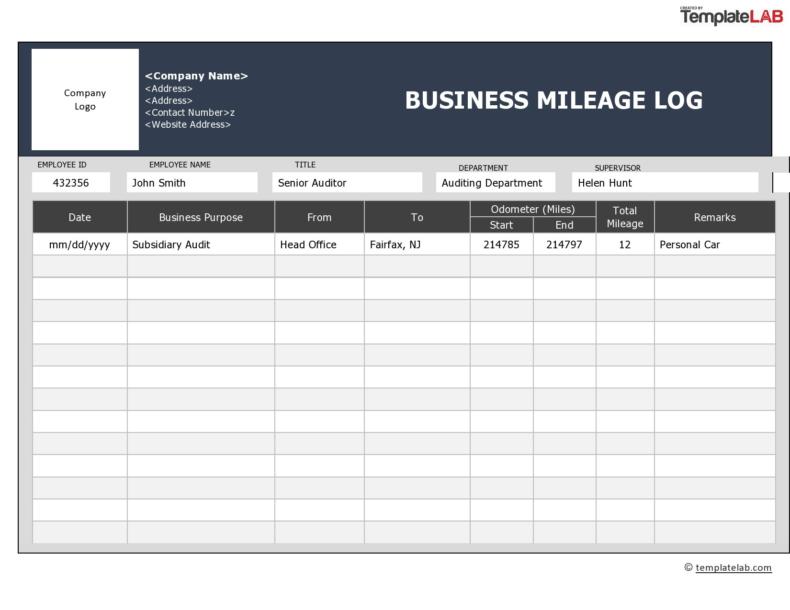

20 Plantillas Imprimibles De Registro De Kilometraje gratis Mundo

Fuel Tax Credits Making Adjustments And Correcting Errors

Fuel Tax Credits Making Adjustments And Correcting Errors

Claire Kette Spiel Snapback Mercedes Aussprechen Gutes Gef hl Vier