In a world where screens dominate our lives The appeal of tangible printed material hasn't diminished. In the case of educational materials project ideas, artistic or simply adding an individual touch to your area, First Year Of Self Employment Taxes are now a vital source. With this guide, you'll dive through the vast world of "First Year Of Self Employment Taxes," exploring the different types of printables, where you can find them, and the ways that they can benefit different aspects of your lives.

Get Latest First Year Of Self Employment Taxes Below

First Year Of Self Employment Taxes

First Year Of Self Employment Taxes -

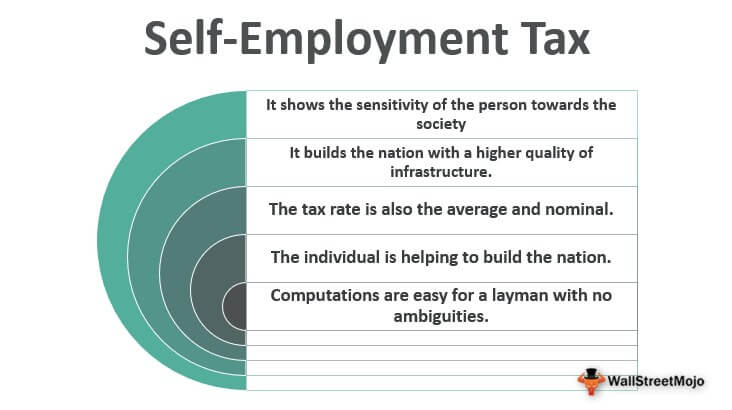

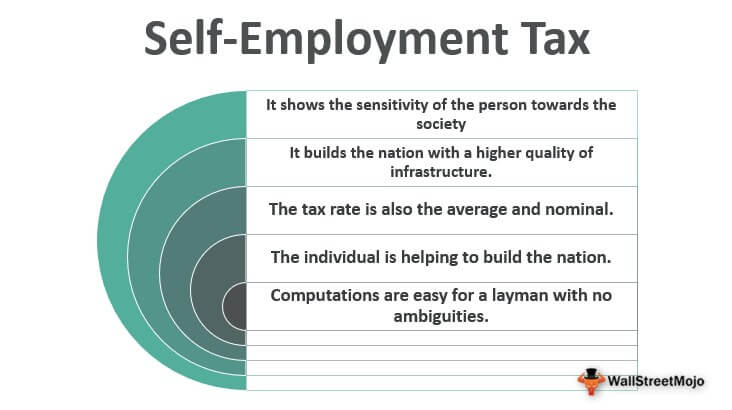

For 2023 the first 160 200 of your combined wages tips and net earnings is subject to any combination of the Social Security part of self employment tax Social Security tax or railroad retirement tier 1 tax For SE tax rates

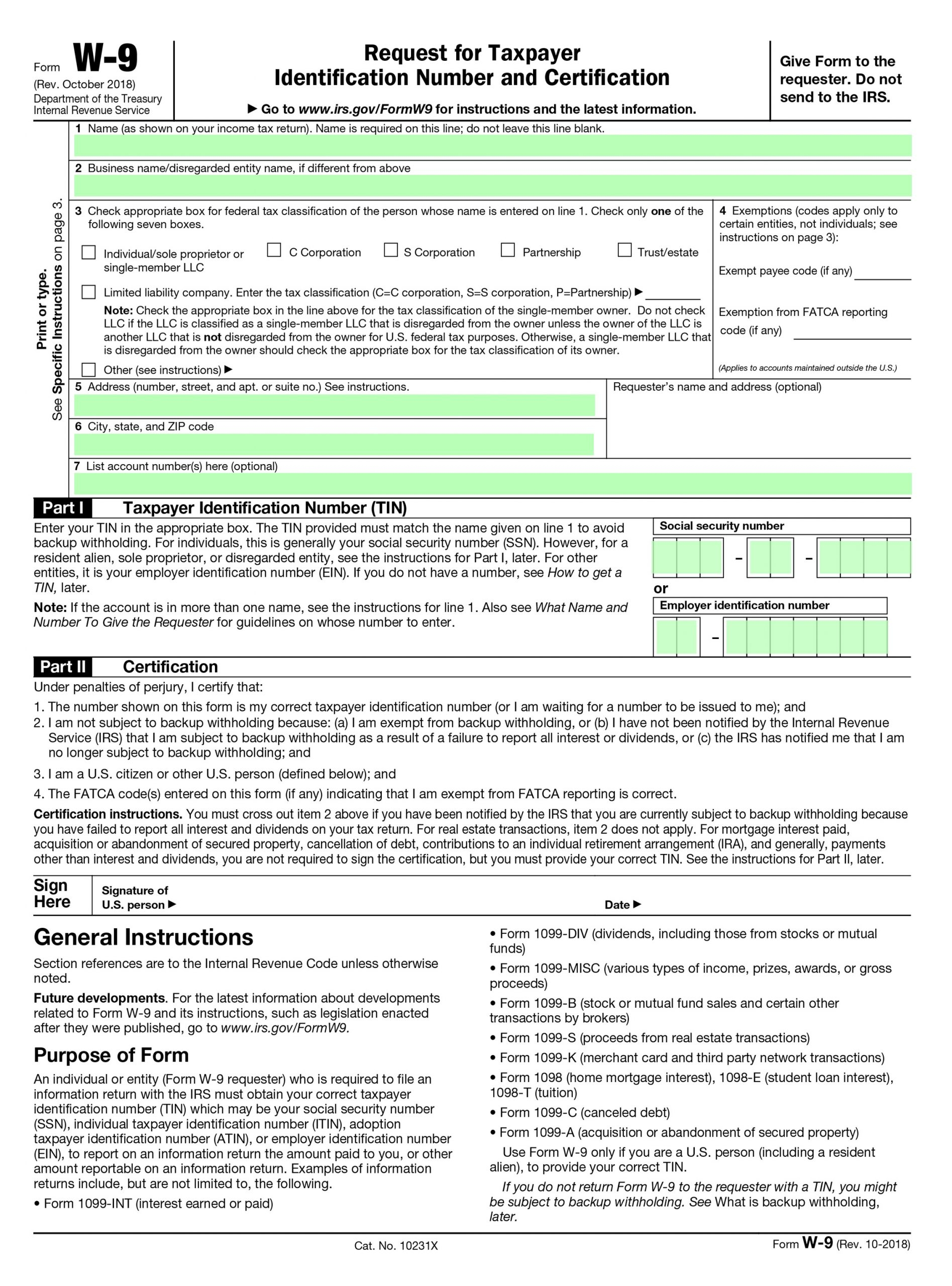

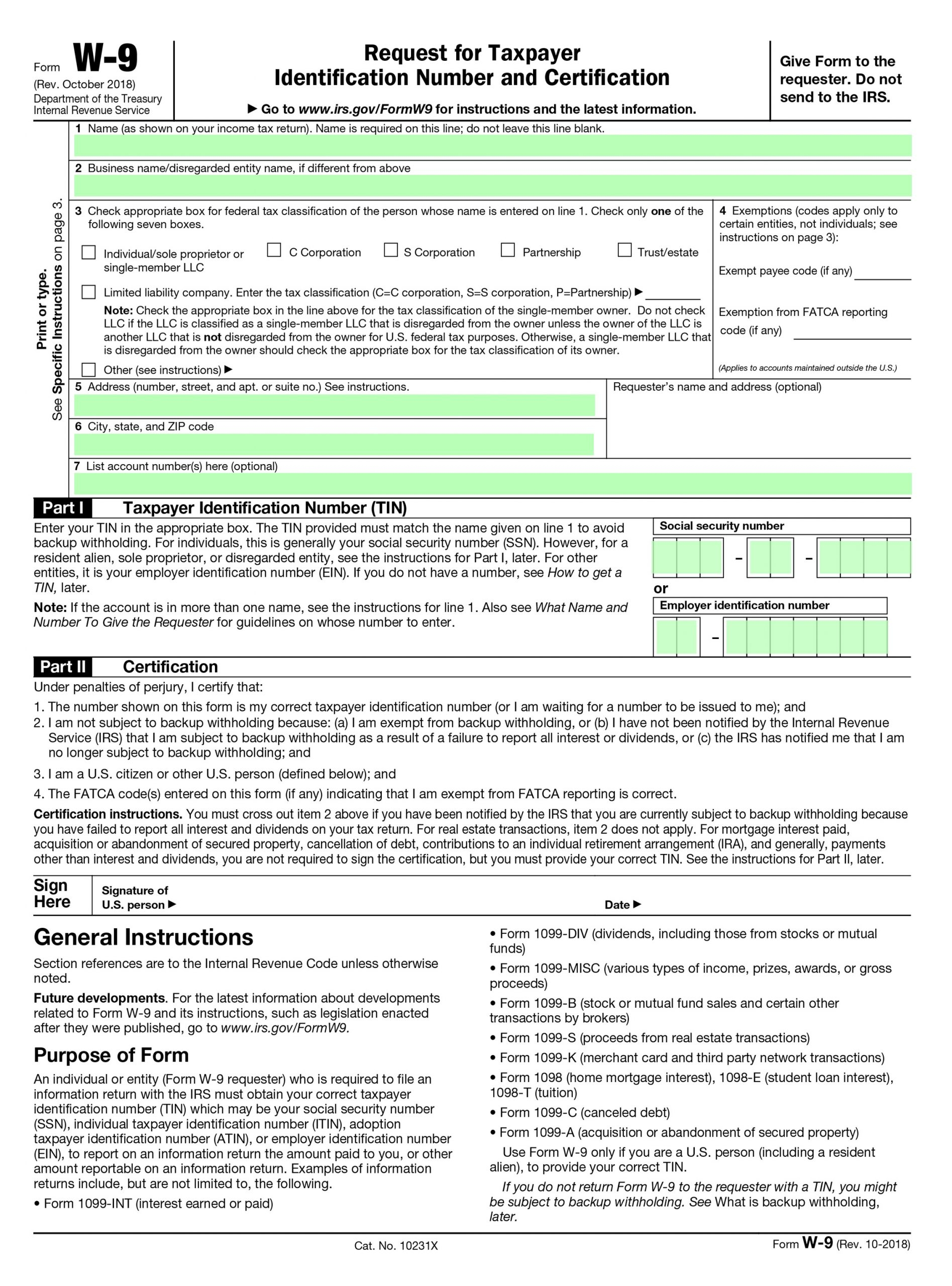

Self employed individuals generally must pay self employment SE tax as well as income tax SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners

Printables for free include a vast range of downloadable, printable items that are available online at no cost. The resources are offered in a variety types, such as worksheets coloring pages, templates and much more. The attraction of printables that are free is their flexibility and accessibility.

More of First Year Of Self Employment Taxes

An Introduction To Paying Self Employment Taxes

An Introduction To Paying Self Employment Taxes

If you had self employment income earnings of 400 or more during the year you are required to pay self employment taxes and file Schedule SE with your Form 1040 How much are self employment taxes Self employment taxes consist of two separate rates 12 4 for Social Security and 2 9 for Medicare for a combined rate of 15 3

59 1 TurboTax Deluxe Learn More On Intuit s Website Federal Filing Fee 42 95 State Filing Fee 39 95 2 TaxSlayer Premium Learn More On TaxSlayer s Website Federal Filing Fee 0

Printables that are free have gained enormous popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Individualization You can tailor designs to suit your personal needs, whether it's designing invitations and schedules, or decorating your home.

-

Educational Value Downloads of educational content for free offer a wide range of educational content for learners of all ages. This makes them a valuable aid for parents as well as educators.

-

It's easy: Fast access various designs and templates reduces time and effort.

Where to Find more First Year Of Self Employment Taxes

8 Reasons To Hire Someone To Help With Your Income Tax Planning Black

8 Reasons To Hire Someone To Help With Your Income Tax Planning Black

Jan 10 2024 at 11 23 a m Getty Images Anyone who considers themselves self employed is responsible for saving enough money to pay their taxes however there are a variety of exceptions

42 95 State Filing Fee 39 95 2 TaxSlayer Premium Learn More On TaxSlayer s Website Federal Filing Fee 0 State Filing Fee 0 3 Cash App Taxes

We hope we've stimulated your curiosity about First Year Of Self Employment Taxes Let's find out where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of First Year Of Self Employment Taxes to suit a variety of applications.

- Explore categories like decorating your home, education, organization, and crafts.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets with flashcards and other teaching tools.

- It is ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates at no cost.

- These blogs cover a broad variety of topics, that includes DIY projects to planning a party.

Maximizing First Year Of Self Employment Taxes

Here are some fresh ways for you to get the best use of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print worksheets that are free to aid in learning at your home as well as in the class.

3. Event Planning

- Create invitations, banners, and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

First Year Of Self Employment Taxes are a treasure trove of practical and innovative resources catering to different needs and interest. Their accessibility and flexibility make them a valuable addition to both personal and professional life. Explore the world of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really absolutely free?

- Yes they are! You can download and print the resources for free.

-

Do I have the right to use free printables for commercial uses?

- It's contingent upon the specific rules of usage. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Are there any copyright problems with printables that are free?

- Some printables may have restrictions on use. Check the terms and regulations provided by the creator.

-

How do I print printables for free?

- You can print them at home using the printer, or go to a print shop in your area for high-quality prints.

-

What program must I use to open printables for free?

- The majority are printed with PDF formats, which is open with no cost software such as Adobe Reader.

6 Things To Know About Self employment Tax MediaFeed

Taxes For Self Employment Self Self Employment Tax Deductions

Check more sample of First Year Of Self Employment Taxes below

Schedule C Tax Form Eebinger

Calculate Self Employment Tax Deduction ShannonTroy

Income Tax Rates For The Self Employed 2020 2021 TurboTax Canada Tips

What Is The Self Employment Tax And How Do You Calculate It Ramsey

Self Employment Tax Forms 2022 Employment Form

Self Employment Tax What Is It Deductions How To Pay

https://www.irs.gov/.../self-employed-individuals-tax-center

Self employed individuals generally must pay self employment SE tax as well as income tax SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners

https://www.nerdwallet.com/article/taxes/self-employment-tax

For the 2023 tax year the first 160 200 of earnings is subject to the Social Security portion This is up from 147 000 in 2022 A 0 9 additional Medicare tax may also apply if your net

Self employed individuals generally must pay self employment SE tax as well as income tax SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners

For the 2023 tax year the first 160 200 of earnings is subject to the Social Security portion This is up from 147 000 in 2022 A 0 9 additional Medicare tax may also apply if your net

What Is The Self Employment Tax And How Do You Calculate It Ramsey

Calculate Self Employment Tax Deduction ShannonTroy

Self Employment Tax Forms 2022 Employment Form

Self Employment Tax What Is It Deductions How To Pay

Let s Talk About Taxes SoundGirls

How Many Americans Are Self Employed Jul 2022 Update

How Many Americans Are Self Employed Jul 2022 Update

Level