In this day and age where screens have become the dominant feature of our lives yet the appeal of tangible printed products hasn't decreased. In the case of educational materials project ideas, artistic or simply to add an element of personalization to your space, Federal Tax Credits For Home Improvements 2023 are now a useful source. We'll dive through the vast world of "Federal Tax Credits For Home Improvements 2023," exploring what they are, where they are available, and what they can do to improve different aspects of your lives.

Get Latest Federal Tax Credits For Home Improvements 2023 Below

Federal Tax Credits For Home Improvements 2023

Federal Tax Credits For Home Improvements 2023 -

10 Tax Credits You May Qualify for This Year There are limits for each kind of improvement within the 1 200 annual maximum For example the credit for eligible exterior doors is limited to 30

Home improvement tax deduction Qualifying improvements to your home that qualify for tax deductions What Home Improvements Are Tax Deductible in

Federal Tax Credits For Home Improvements 2023 include a broad range of printable, free materials available online at no cost. These resources come in many kinds, including worksheets coloring pages, templates and many more. The beauty of Federal Tax Credits For Home Improvements 2023 is their flexibility and accessibility.

More of Federal Tax Credits For Home Improvements 2023

30 Federal Tax Credits For Heat Pump Water Heaters 2023

30 Federal Tax Credits For Heat Pump Water Heaters 2023

Which home improvements qualify for the Energy Efficient Home Improvement Credit Beginning January 1 2023 the credit becomes equal to the

1 Go Renewable One of the best ways to save money on electricity is by generating your own Under the Inflation Reduction Act you can get a tax credit for 30

Federal Tax Credits For Home Improvements 2023 have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

customization It is possible to tailor the templates to meet your individual needs such as designing invitations, organizing your schedule, or decorating your home.

-

Educational value: Educational printables that can be downloaded for free are designed to appeal to students of all ages, making them an invaluable instrument for parents and teachers.

-

An easy way to access HTML0: Access to a myriad of designs as well as templates reduces time and effort.

Where to Find more Federal Tax Credits For Home Improvements 2023

2023 Federal Tax Credit Only Five BEV Manufacturers Qualify

2023 Federal Tax Credit Only Five BEV Manufacturers Qualify

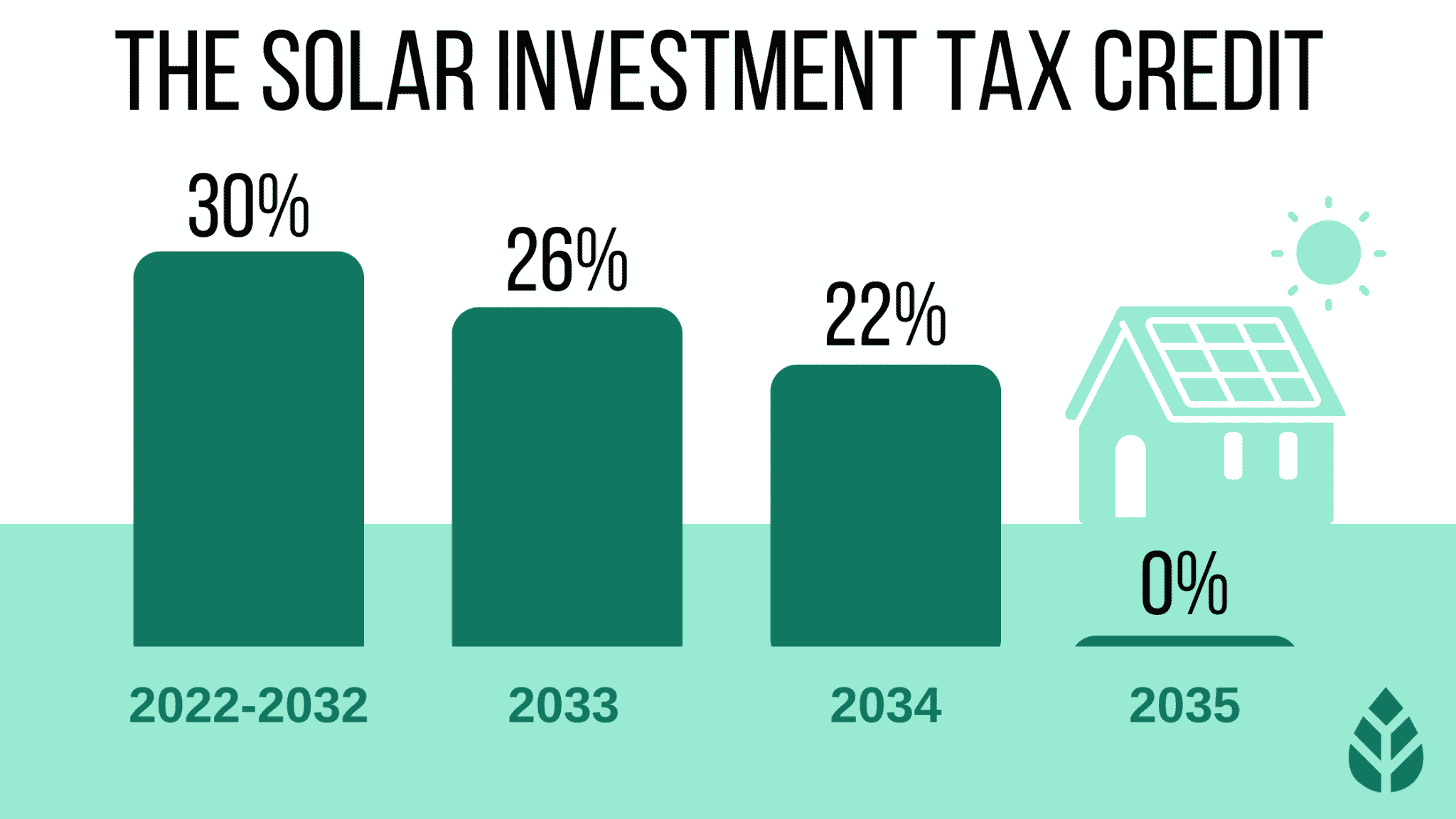

Beginning with the 2023 tax year the credit is equal to 30 of the costs for all eligible home improvements made during the year It is also expanded to cover the

Residential Energy Tax Credits Changes in 2023 November 21 2022 P L 117 169 commonly referred to as the Inflation Reduction Act of 2022 IRA expanded

We've now piqued your interest in Federal Tax Credits For Home Improvements 2023 we'll explore the places they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Federal Tax Credits For Home Improvements 2023 suitable for many uses.

- Explore categories like furniture, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets along with flashcards, as well as other learning tools.

- Ideal for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- The blogs are a vast range of interests, starting from DIY projects to planning a party.

Maximizing Federal Tax Credits For Home Improvements 2023

Here are some innovative ways that you can make use use of Federal Tax Credits For Home Improvements 2023:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Print free worksheets for teaching at-home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Federal Tax Credits For Home Improvements 2023 are a treasure trove of practical and imaginative resources that can meet the needs of a variety of people and interests. Their accessibility and versatility make them a wonderful addition to any professional or personal life. Explore the endless world of Federal Tax Credits For Home Improvements 2023 today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really completely free?

- Yes they are! You can download and print these documents for free.

-

Are there any free printouts for commercial usage?

- It's all dependent on the rules of usage. Always review the terms of use for the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues in Federal Tax Credits For Home Improvements 2023?

- Certain printables could be restricted on usage. Make sure you read the terms and conditions offered by the designer.

-

How do I print printables for free?

- You can print them at home using either a printer at home or in the local print shop for high-quality prints.

-

What software do I require to open printables free of charge?

- Most printables come in the format of PDF, which is open with no cost software such as Adobe Reader.

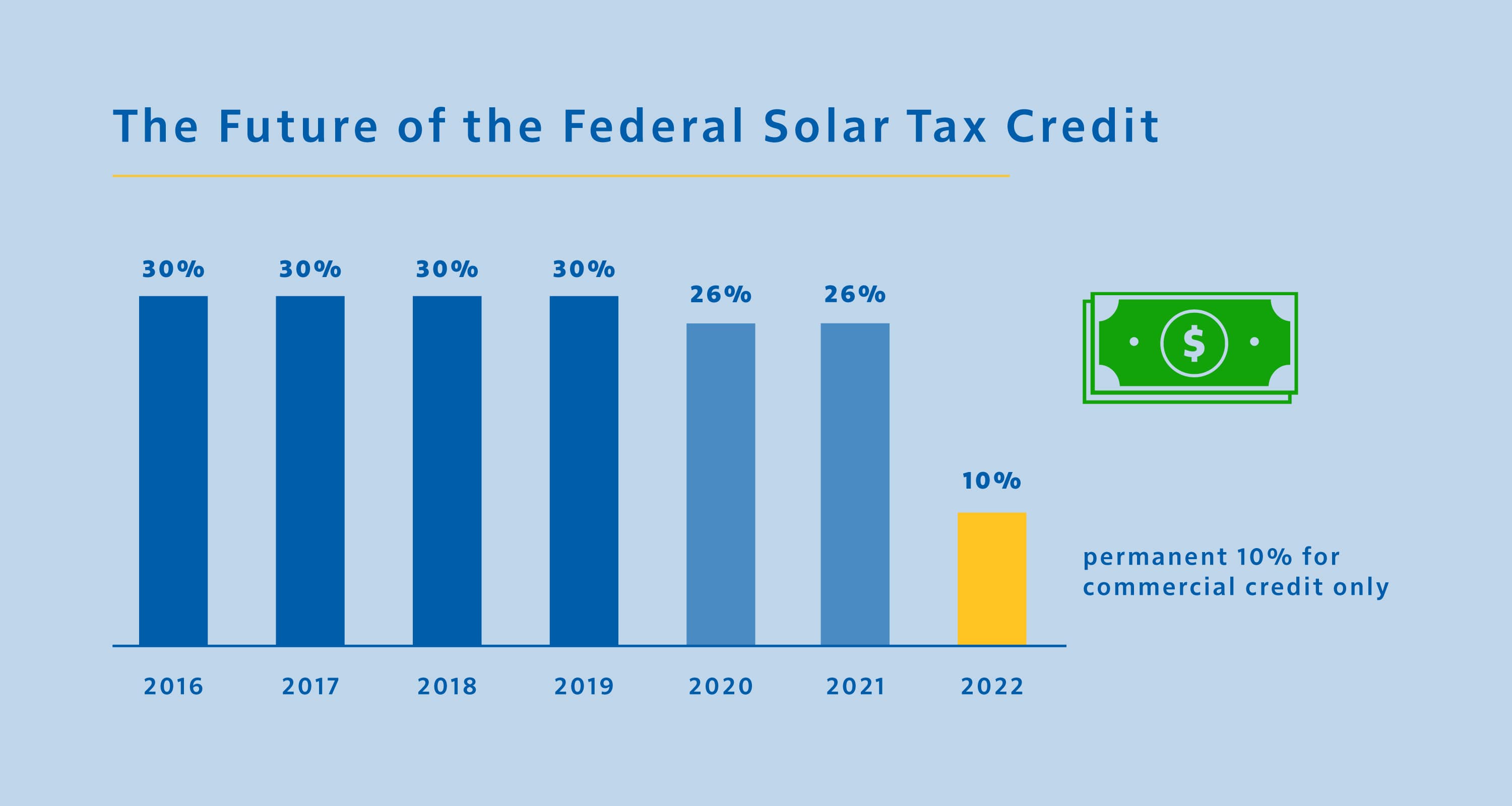

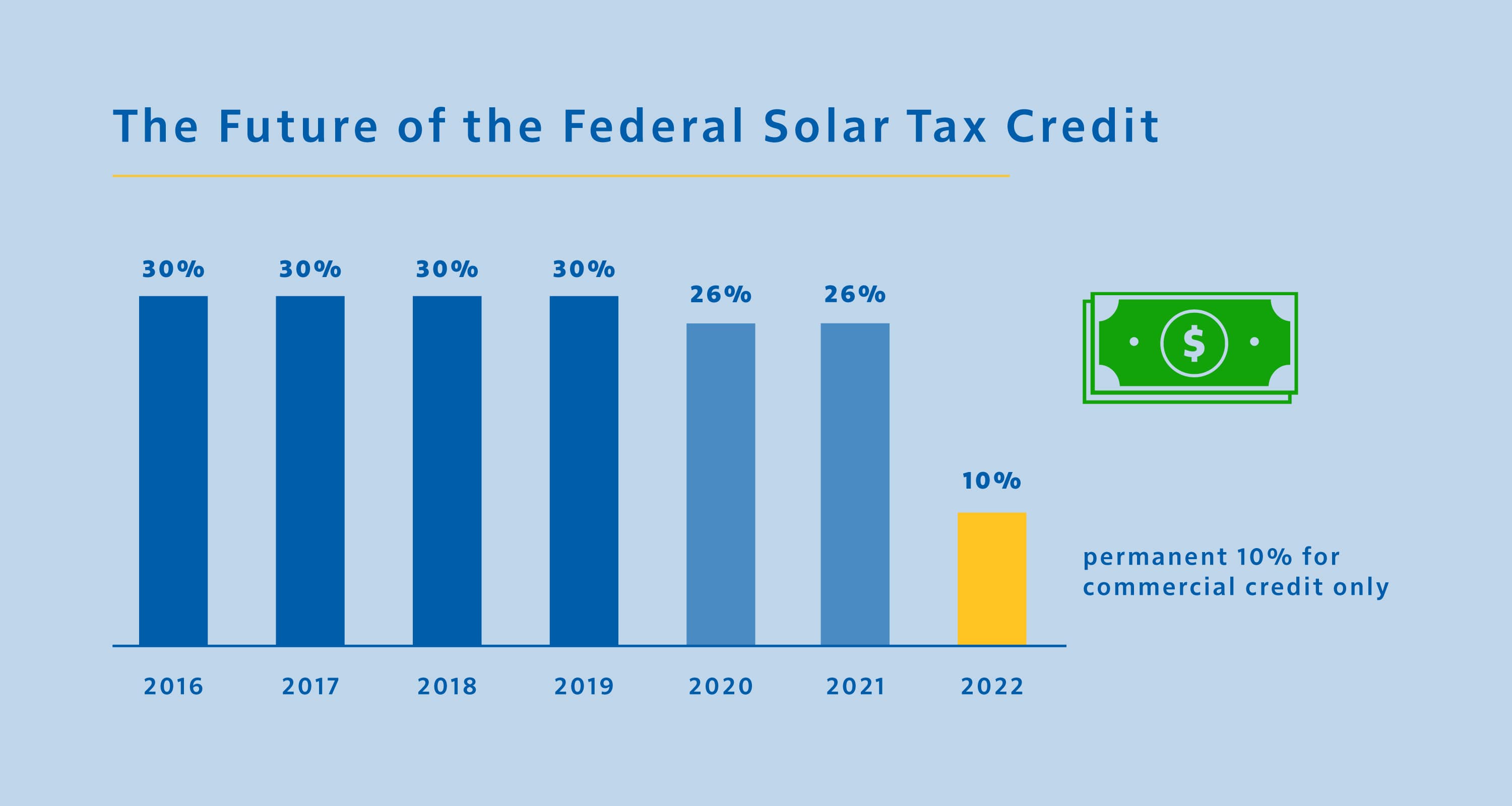

Solar Tax Credit Everything A Homeowner Needs To Know Credible

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

Check more sample of Federal Tax Credits For Home Improvements 2023 below

Tax Credits Save You More Than Deductions Here Are The Best Ones

Federal Tax Credits Sunlight Solar Energy CO OR MA CT

The Ultimate List Of Homeowner Tax Credits For 2020 Lifestyle

Energy Tax Credits For Home Improvements In 2023

Solar Tax Credits What You Should Know Before Filing

Solar Federal Tax Credit Increased To 30

https://www.familyhandyman.com/article/what-home...

Home improvement tax deduction Qualifying improvements to your home that qualify for tax deductions What Home Improvements Are Tax Deductible in

https://www.irs.gov/pub/irs-pdf/p5797.pdf

2023 through 2032 30 up to a maximum of 1 200 water heaters heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get

Home improvement tax deduction Qualifying improvements to your home that qualify for tax deductions What Home Improvements Are Tax Deductible in

2023 through 2032 30 up to a maximum of 1 200 water heaters heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get

Energy Tax Credits For Home Improvements In 2023

Federal Tax Credits Sunlight Solar Energy CO OR MA CT

Solar Tax Credits What You Should Know Before Filing

Solar Federal Tax Credit Increased To 30

The Complete List Of Tax Credits For Individuals

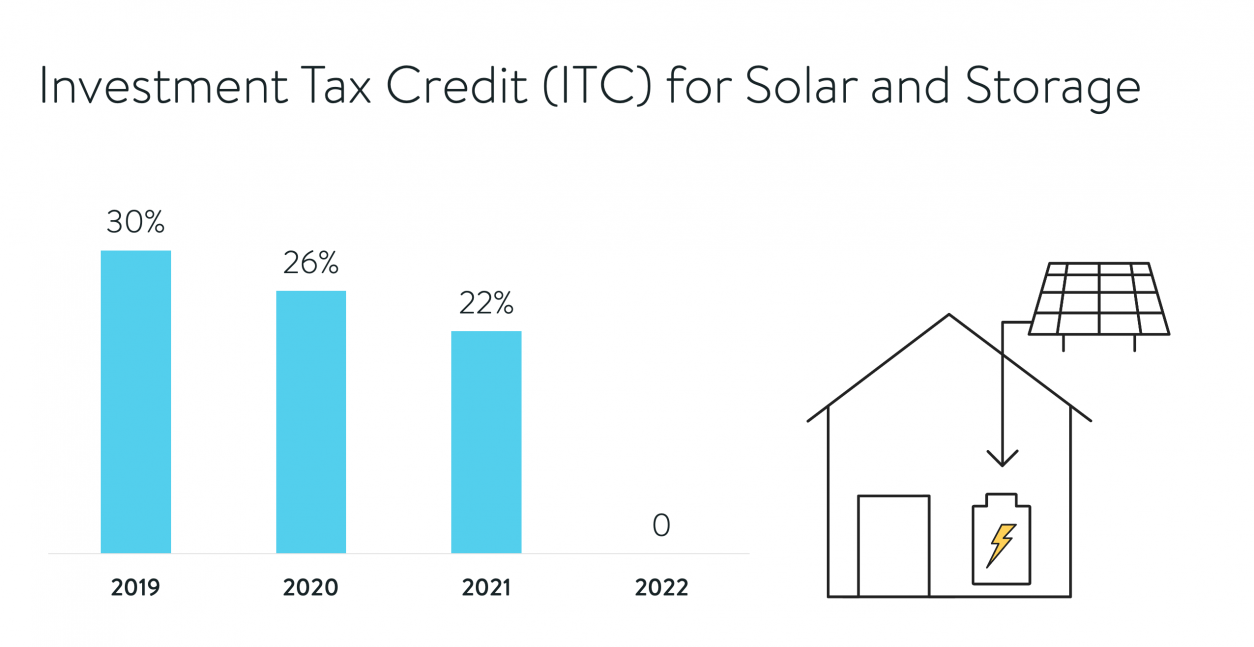

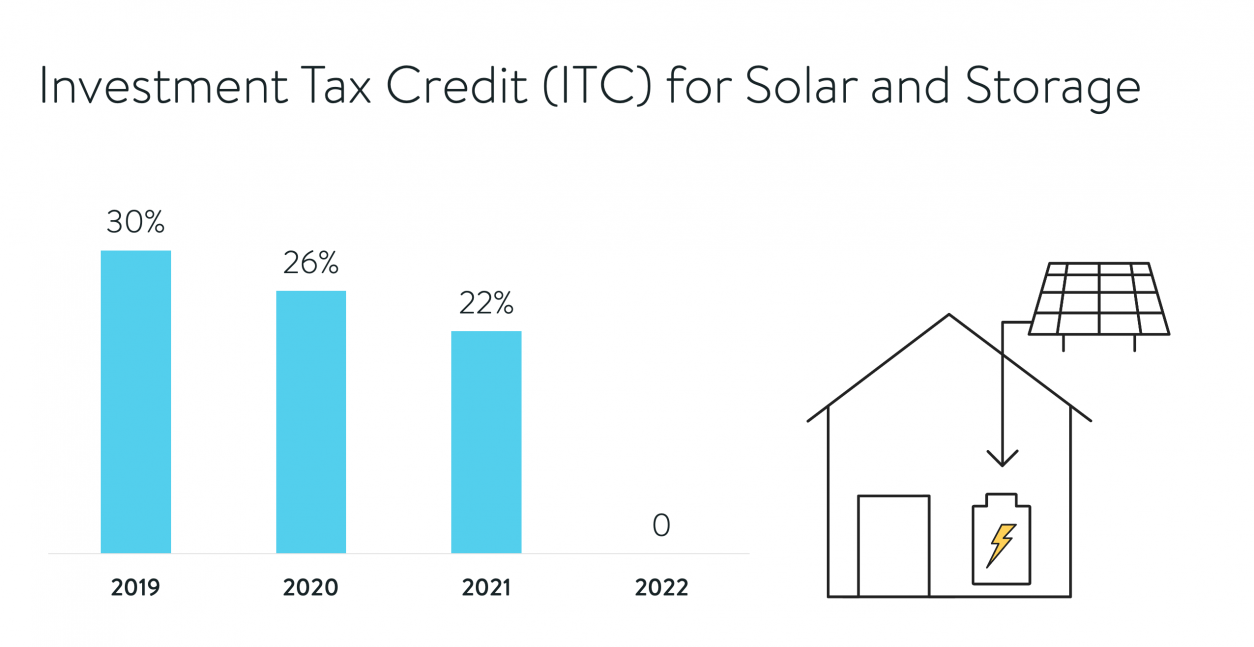

A Beginner s Guide To Federal Tax Credits For Solar And Energy Storage

A Beginner s Guide To Federal Tax Credits For Solar And Energy Storage

How To Obtain Tax Credits For Solar Roofing And Save Money Bay Area