In this age of technology, where screens have become the dominant feature of our lives however, the attraction of tangible printed material hasn't diminished. Whether it's for educational purposes, creative projects, or just adding personal touches to your space, Federal Tax Credit Electric Vehicles 2022 have become a valuable resource. This article will take a dive deeper into "Federal Tax Credit Electric Vehicles 2022," exploring what they are, how they can be found, and how they can add value to various aspects of your lives.

Get Latest Federal Tax Credit Electric Vehicles 2022 Below

Federal Tax Credit Electric Vehicles 2022

Federal Tax Credit Electric Vehicles 2022 -

Tucked inside the massive Inflation Reduction Act of 2022 that was signed into law in August is a complex set of requirements around which EVs and other clean vehicles do and do not qualify for a

List of vehicles that are eligible for a 30D clean vehicle tax credit and the amount of the qualifying credit if purchased between 2010 and 2022 If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D

Printables for free include a vast selection of printable and downloadable materials available online at no cost. These printables come in different types, such as worksheets templates, coloring pages and more. The benefit of Federal Tax Credit Electric Vehicles 2022 lies in their versatility and accessibility.

More of Federal Tax Credit Electric Vehicles 2022

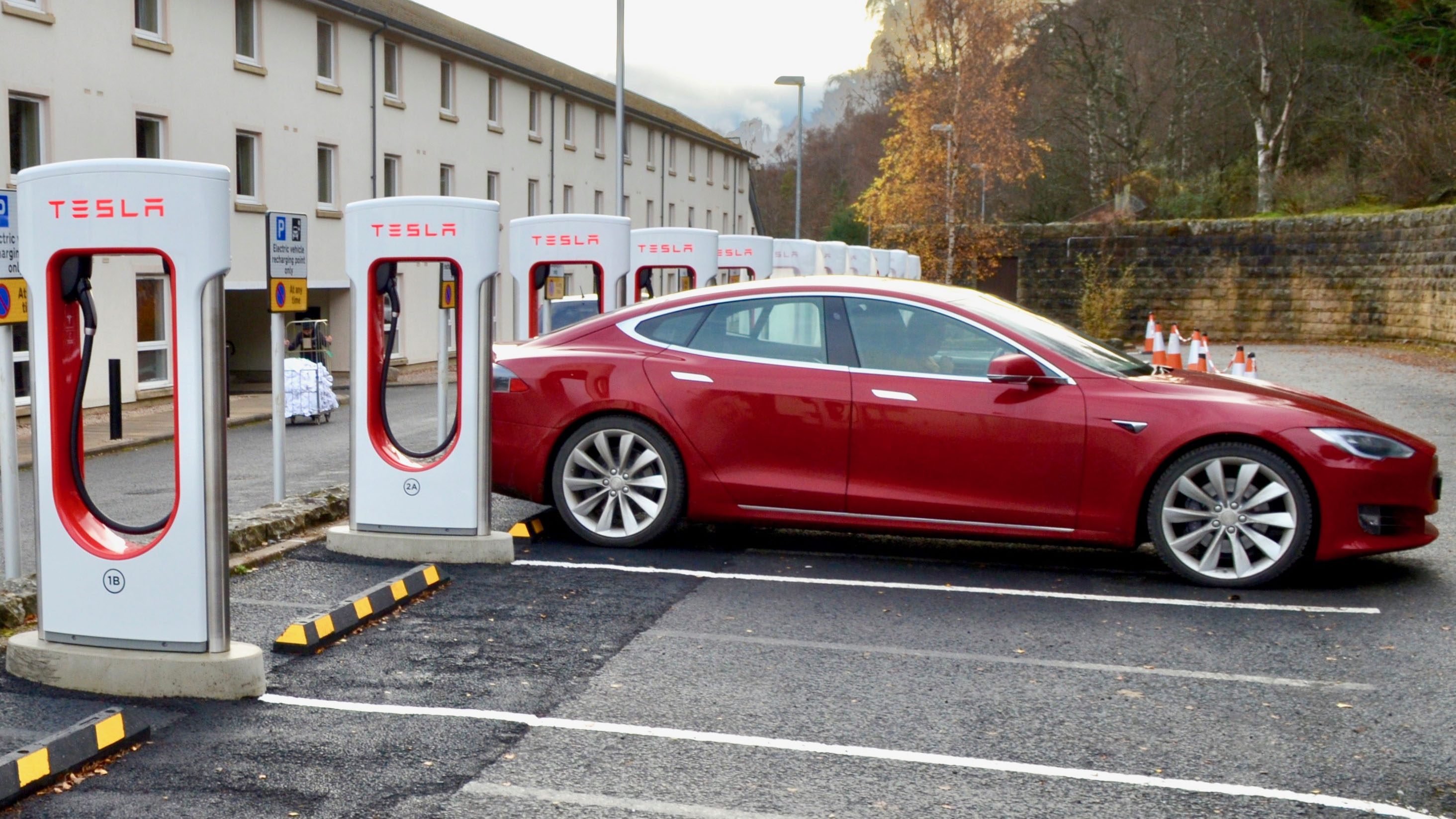

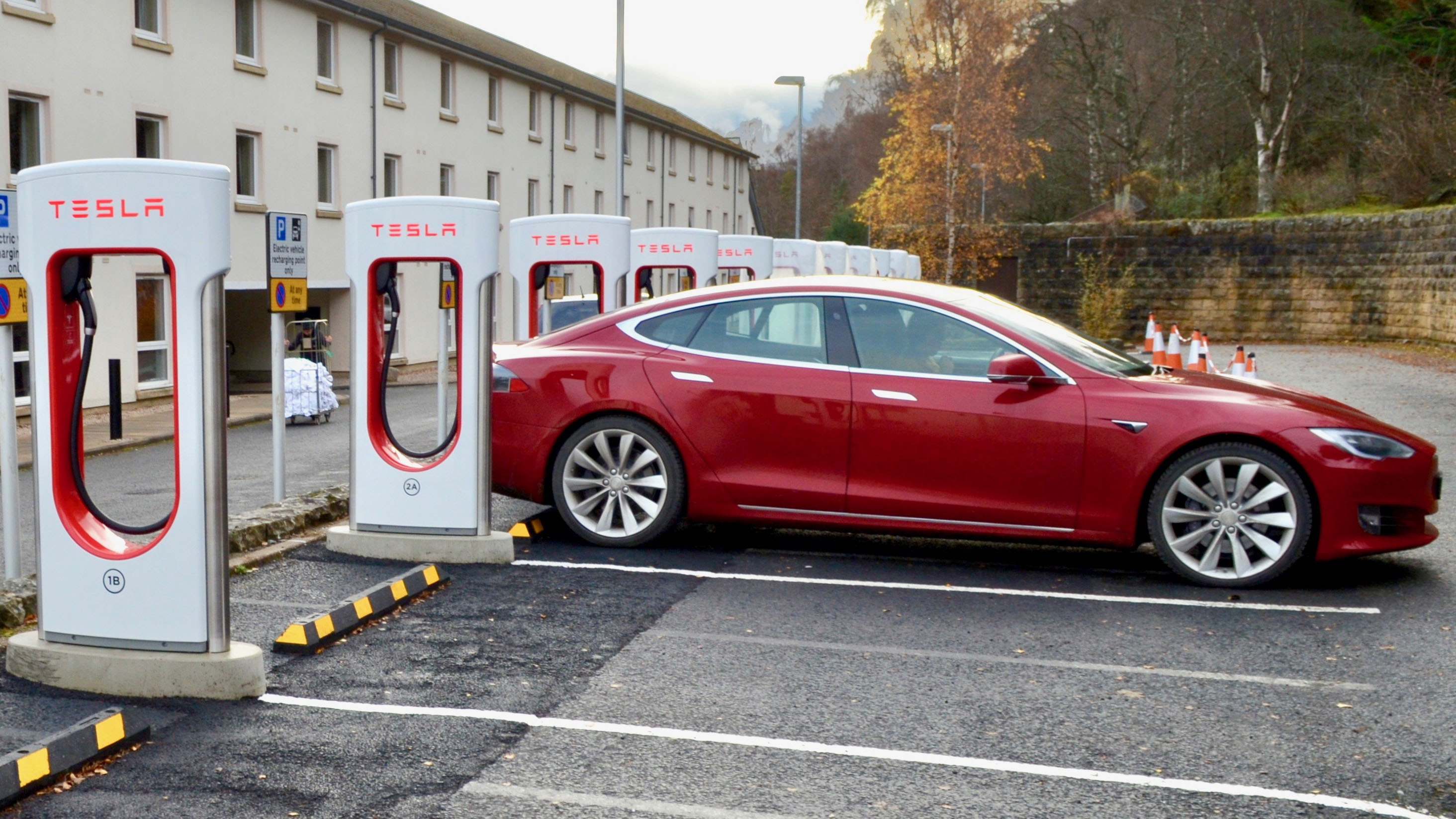

Indian Govt Lays Down Conditions To Tesla We Tell What They Are

Indian Govt Lays Down Conditions To Tesla We Tell What They Are

August 16 2022 Today s guidance marks a first step in the Biden Administration s implementation of Inflation Reduction Act tax credits to lower costs for families and make electric vehicles more affordable

Electric vehicles purchased in 2022 or before are still eligible for tax credits If you bought a new qualified plug in electric vehicle in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 Learn more Sign Up for Email Updates

Federal Tax Credit Electric Vehicles 2022 have garnered immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Customization: Your HTML0 customization options allow you to customize the design to meet your needs, whether it's designing invitations and schedules, or even decorating your house.

-

Educational Use: Downloads of educational content for free can be used by students of all ages, which makes the perfect aid for parents as well as educators.

-

Affordability: Access to an array of designs and templates helps save time and effort.

Where to Find more Federal Tax Credit Electric Vehicles 2022

How To Calculate Electric Car Tax Credit OsVehicle

How To Calculate Electric Car Tax Credit OsVehicle

The Biden administration s climate and health care bill passed by Congress last week revamps a tax credit for buyers of electric cars Drew Angerer Getty Images Click here to read NPR s 2024

If you purchased a new all electric vehicle EV or plug in hybrid electric vehicle PHEV during or after 2010 you may be eligible for a federal income tax credit of up to 7 500 according to the U S Department of Energy

Now that we've ignited your curiosity about Federal Tax Credit Electric Vehicles 2022 and other printables, let's discover where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Federal Tax Credit Electric Vehicles 2022 for various needs.

- Explore categories like the home, decor, the arts, and more.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free along with flashcards, as well as other learning tools.

- Ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- These blogs cover a wide array of topics, ranging that includes DIY projects to planning a party.

Maximizing Federal Tax Credit Electric Vehicles 2022

Here are some ideas for you to get the best use of Federal Tax Credit Electric Vehicles 2022:

1. Home Decor

- Print and frame stunning art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use these printable worksheets free of charge to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations, banners, and decorations for special events like birthdays and weddings.

4. Organization

- Get organized with printable calendars or to-do lists. meal planners.

Conclusion

Federal Tax Credit Electric Vehicles 2022 are an abundance of innovative and useful resources that cater to various needs and interest. Their accessibility and versatility make them a valuable addition to every aspect of your life, both professional and personal. Explore the endless world of Federal Tax Credit Electric Vehicles 2022 now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Federal Tax Credit Electric Vehicles 2022 really completely free?

- Yes you can! You can download and print these documents for free.

-

Can I use the free printables for commercial purposes?

- It depends on the specific terms of use. Always verify the guidelines provided by the creator before using their printables for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables may have restrictions regarding usage. Check the terms and conditions provided by the creator.

-

How can I print printables for free?

- Print them at home using printing equipment or visit the local print shops for top quality prints.

-

What program do I require to view Federal Tax Credit Electric Vehicles 2022?

- The majority of PDF documents are provided in the format PDF. This can be opened using free software such as Adobe Reader.

New EV Tax Credits For 2023 Every Electric Vehicle Incentive

Income Tax Credit Electric Vehicle Update Income Tax Payments Deferred

Check more sample of Federal Tax Credit Electric Vehicles 2022 below

Tax Credits For Electric Vehicles Are Coming How Will They Work

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Volkswagen Upgrades Tech Safety Features For 2021 AutoMotoBuzz

What Is Federal Tax Credit For Electric Cars ElectricCarTalk

Federal Tax Credit Reinstated For 2018 2020 EV Purchases And Chargers

2022 Chevrolet Bolt EUV And Bolt EV Ship Out To Dealerships Early

https://www.irs.gov/credits-deductions/...

List of vehicles that are eligible for a 30D clean vehicle tax credit and the amount of the qualifying credit if purchased between 2010 and 2022 If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D

https://www.irs.gov/clean-vehicle-tax-credits

We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to buy a new clean vehicle Looking to claim a credit for a new clean vehicle you already bought Planning to buy or already bought a used clean vehicle

List of vehicles that are eligible for a 30D clean vehicle tax credit and the amount of the qualifying credit if purchased between 2010 and 2022 If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D

We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to buy a new clean vehicle Looking to claim a credit for a new clean vehicle you already bought Planning to buy or already bought a used clean vehicle

What Is Federal Tax Credit For Electric Cars ElectricCarTalk

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Federal Tax Credit Reinstated For 2018 2020 EV Purchases And Chargers

2022 Chevrolet Bolt EUV And Bolt EV Ship Out To Dealerships Early

Electric Vehicles 2022 Uk 2022 Hyundai Ioniq 5 Full Review N All

Solar Panel Cost Calculator Solar Savings With Green Ridge Solar

Solar Panel Cost Calculator Solar Savings With Green Ridge Solar

Electric Car Tax Credit Everything That You Have To Know Get