In this age of technology, where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible printed material hasn't diminished. No matter whether it's for educational uses and creative work, or simply to add an individual touch to the home, printables for free can be an excellent resource. The following article is a dive in the world of "Federal Income Tax Credit For Geothermal," exploring what they are, where you can find them, and what they can do to improve different aspects of your lives.

Get Latest Federal Income Tax Credit For Geothermal Below

Federal Income Tax Credit For Geothermal

Federal Income Tax Credit For Geothermal -

The Geothermal Energy Tax Credit 2024 is a financial incentive designed to encourage the adoption of geothermal energy systems By offsetting a portion of the installation and operational costs through tax credits it aims to make geothermal energy a more attractive investment for those looking to reduce their carbon footprint and energy

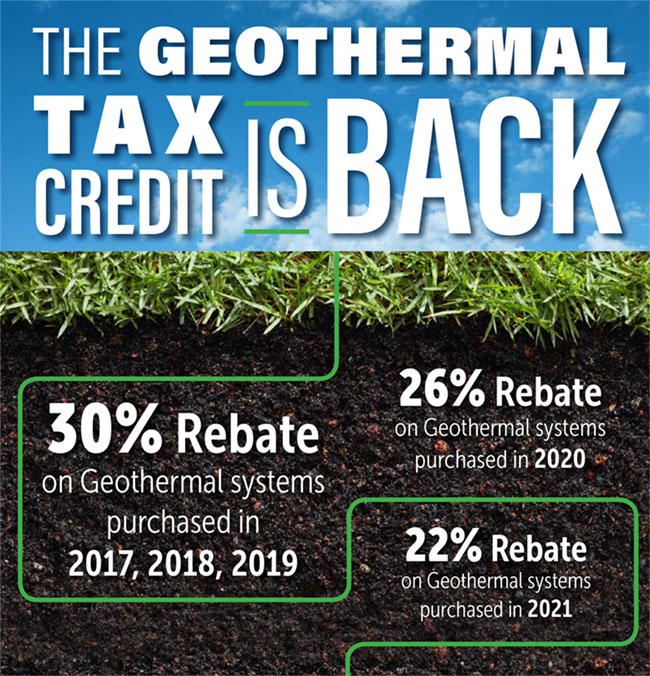

Geothermal Heat Pumps Tax Credit The following Residential Clean Energy Tax Credit amounts apply for the prescribed periods 30 for property placed in service after December 31 2016 and before January 1 2020 26 for property placed in service after December 31 2019 and before January 1 2022 30 for property placed in service after

Federal Income Tax Credit For Geothermal provide a diverse range of downloadable, printable content that can be downloaded from the internet at no cost. They come in many types, like worksheets, templates, coloring pages, and much more. The benefit of Federal Income Tax Credit For Geothermal is in their versatility and accessibility.

More of Federal Income Tax Credit For Geothermal

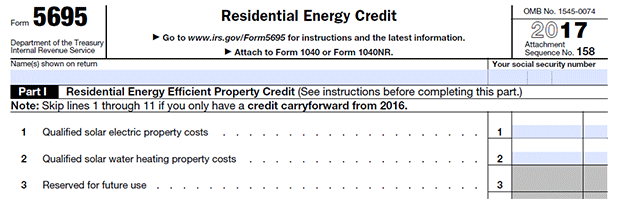

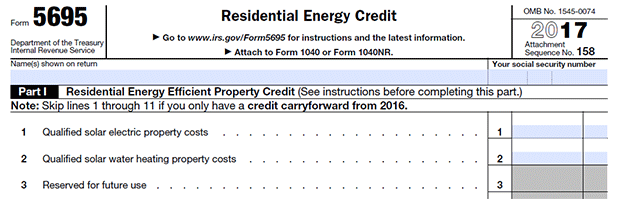

2017 Geothermal Tax Credit Instructions Are Here

2017 Geothermal Tax Credit Instructions Are Here

Not to be confused with the 26 percent residential tax credit the federal geothermal tax credit for commercial geothermal heat pumps is 10 percent This 10 percent can be applied to the total

Under the Inflation Reduction Act of 2022 IRA the federal tax credit for residential geothermal system installations was increased from 26 to 30 effective January 1 2023 The 30 tax credit runs through 2032 and then gradually reduces until expiring in 2034

Printables that are free have gained enormous popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Individualization They can make the templates to meet your individual needs when it comes to designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Worth: Printables for education that are free can be used by students of all ages. This makes them a useful tool for parents and teachers.

-

The convenience of You have instant access various designs and templates reduces time and effort.

Where to Find more Federal Income Tax Credit For Geothermal

What Is The 2021 Geothermal Tax Credit ClimateMaster Geothermal HVAC

What Is The 2021 Geothermal Tax Credit ClimateMaster Geothermal HVAC

For residential GHP projects the law currently allow individuals to claim an income tax credit under IRS Code Sec 25D that is equal to 30 of qualified expenditures for installation of an Energy Star rated GHP at their residence This tax credit also applies to second homes Extension of GHP Tax Credits Beyond 2016

There is a 26 Federal Tax Credit available for residential geothermal heat pumps and a 10 tax credit for commercial geothermal heat pumps that meet the ENERGY STAR requirements

We hope we've stimulated your interest in Federal Income Tax Credit For Geothermal and other printables, let's discover where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Federal Income Tax Credit For Geothermal to suit a variety of applications.

- Explore categories such as decorations for the home, education and organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing or flashcards as well as learning tools.

- This is a great resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- These blogs cover a broad variety of topics, starting from DIY projects to planning a party.

Maximizing Federal Income Tax Credit For Geothermal

Here are some ways that you can make use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print free worksheets to enhance your learning at home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

Federal Income Tax Credit For Geothermal are a treasure trove of creative and practical resources that meet a variety of needs and pursuits. Their accessibility and versatility make them a valuable addition to both personal and professional life. Explore the vast collection of Federal Income Tax Credit For Geothermal and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really gratis?

- Yes, they are! You can print and download these documents for free.

-

Can I utilize free printables for commercial uses?

- It's all dependent on the terms of use. Make sure you read the guidelines for the creator before utilizing their templates for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables may be subject to restrictions in their usage. Check the terms and conditions provided by the designer.

-

How do I print Federal Income Tax Credit For Geothermal?

- You can print them at home with either a printer or go to the local print shops for higher quality prints.

-

What software will I need to access Federal Income Tax Credit For Geothermal?

- The majority are printed in PDF format. These can be opened with free software such as Adobe Reader.

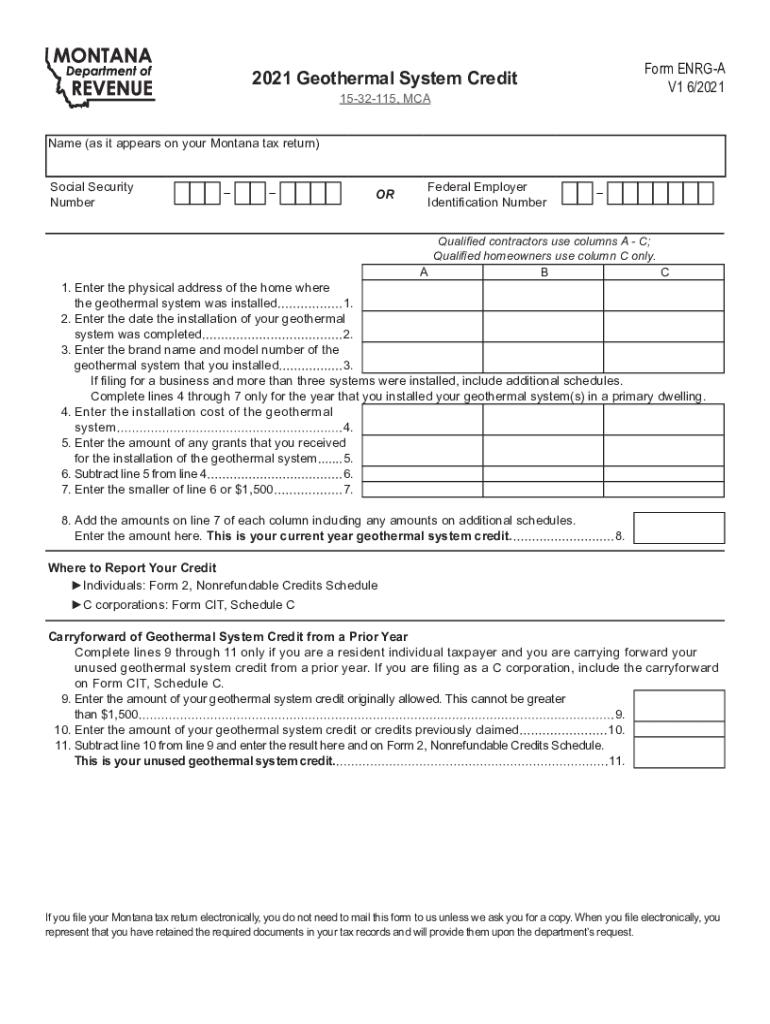

Federal Tax Incentives Increased Extended For Geothermal Heat Pumps

Fillable Online Understand The Geothermal Tax Credit Form Fill Out

Check more sample of Federal Income Tax Credit For Geothermal below

Geothermal Tax Credit Reinstated Corken Steel Products

2023 Irs Tax Chart Printable Forms Free Online

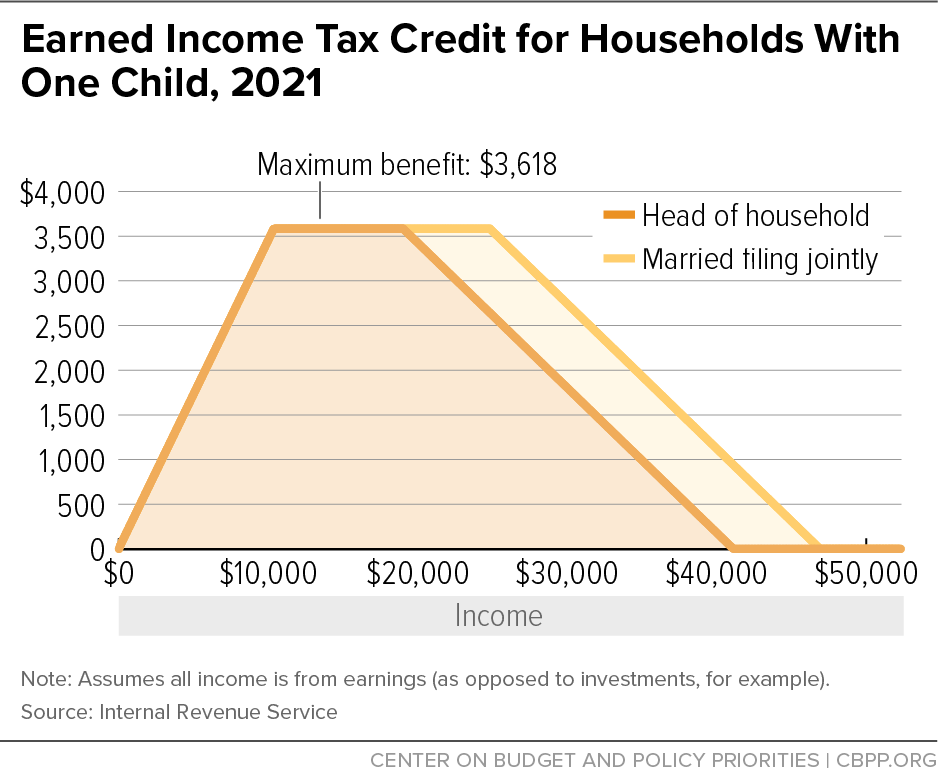

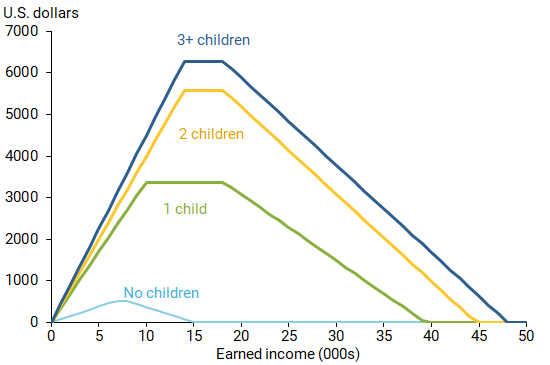

Long Run Effects Of The Earned Income Tax Credit San Francisco Fed

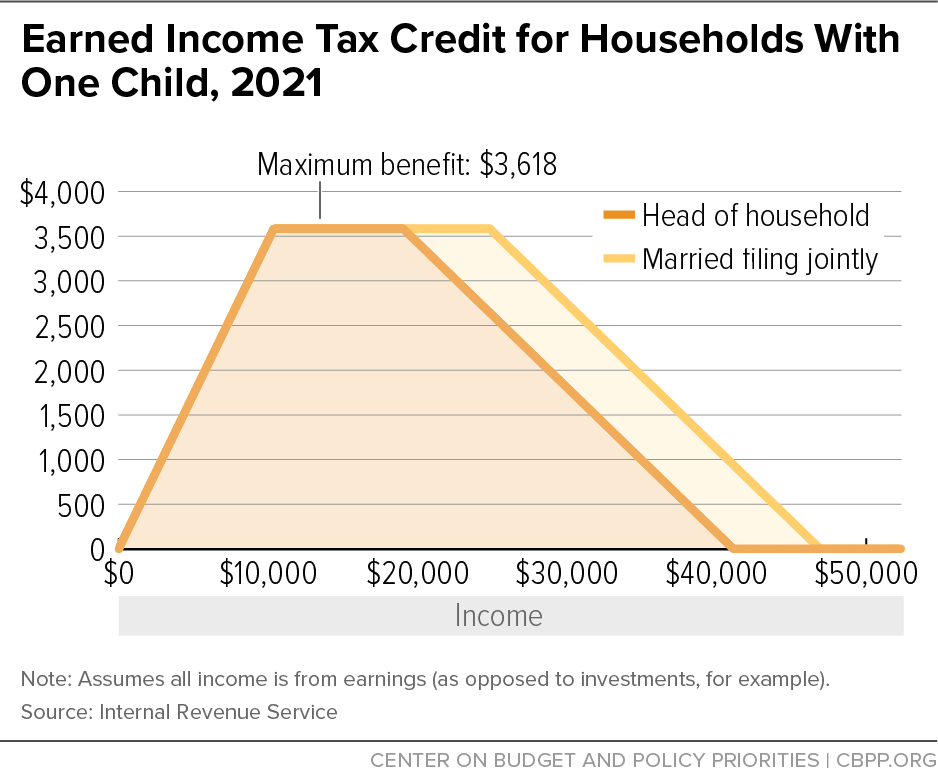

What Is Maryland Earned Income Credit Margurite Munn

Federal Tax Credits For Historic Building Preservation

Understanding The 26 Geothermal Heat Pump Tax Credit

https://www.energystar.gov/about/federal-tax...

Geothermal Heat Pumps Tax Credit The following Residential Clean Energy Tax Credit amounts apply for the prescribed periods 30 for property placed in service after December 31 2016 and before January 1 2020 26 for property placed in service after December 31 2019 and before January 1 2022 30 for property placed in service after

https://dandelionenergy.com/federal-geothermal-tax-credit

The federal tax credit initially allowed homeowners to claim 30 percent of the amount they spent on purchasing and installing a geothermal heat pump system from their federal income taxes The tax credit currently stands at 26 percent throughout 2021 and 2022 before decreasing to 22 percent in 2023

Geothermal Heat Pumps Tax Credit The following Residential Clean Energy Tax Credit amounts apply for the prescribed periods 30 for property placed in service after December 31 2016 and before January 1 2020 26 for property placed in service after December 31 2019 and before January 1 2022 30 for property placed in service after

The federal tax credit initially allowed homeowners to claim 30 percent of the amount they spent on purchasing and installing a geothermal heat pump system from their federal income taxes The tax credit currently stands at 26 percent throughout 2021 and 2022 before decreasing to 22 percent in 2023

What Is Maryland Earned Income Credit Margurite Munn

2023 Irs Tax Chart Printable Forms Free Online

Federal Tax Credits For Historic Building Preservation

Understanding The 26 Geothermal Heat Pump Tax Credit

USA Tax Credits For Geothermal Energy Could Return In Tax Overhaul Bill

Federal Corporate Income Tax Rate For 2023 Infoupdate

Federal Corporate Income Tax Rate For 2023 Infoupdate

Summary Of Geothermal Industry s Income Tax Incentives In USA