In the digital age, where screens rule our lives however, the attraction of tangible printed material hasn't diminished. For educational purposes, creative projects, or just adding an element of personalization to your space, Federal Ev Tax Credit Income Limit can be an excellent source. For this piece, we'll take a dive into the sphere of "Federal Ev Tax Credit Income Limit," exploring the benefits of them, where to get them, as well as the ways that they can benefit different aspects of your lives.

Get Latest Federal Ev Tax Credit Income Limit Below

Federal Ev Tax Credit Income Limit

Federal Ev Tax Credit Income Limit -

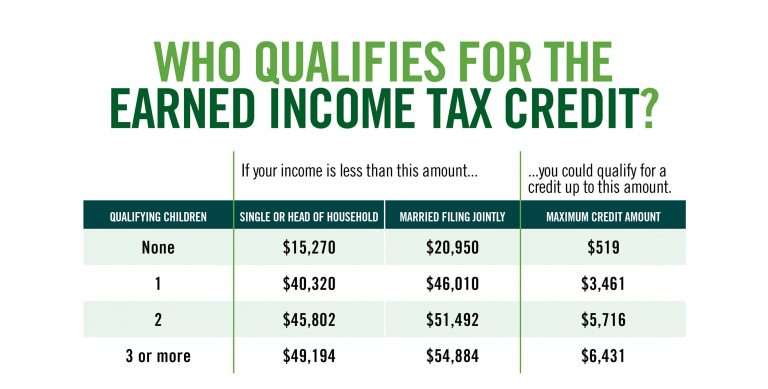

The new climate law also added income limits for the tax credit a maximum of 300 000 for a household 150 000 for an individual or 225 000 for a head of household

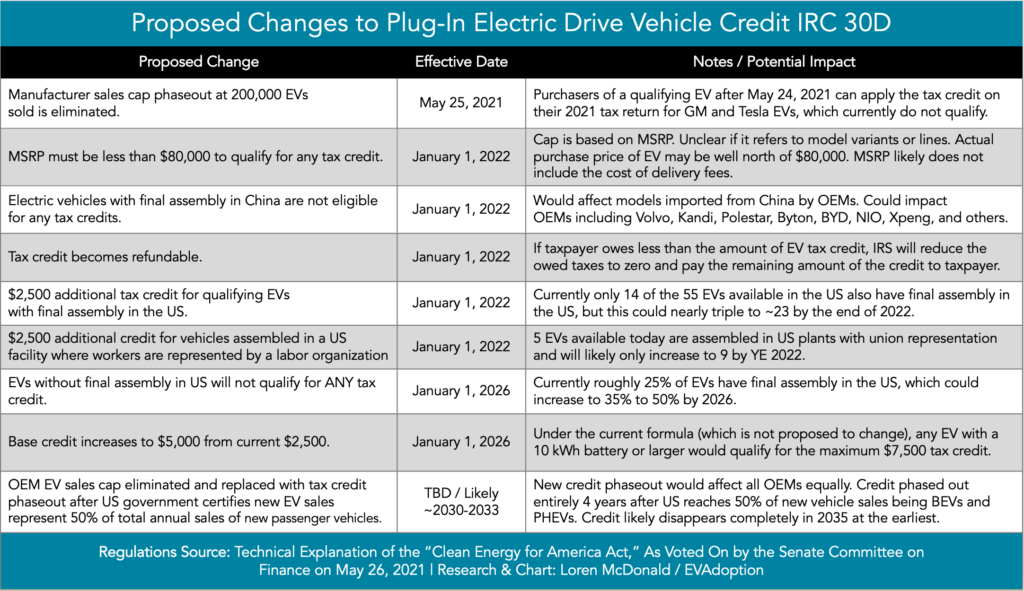

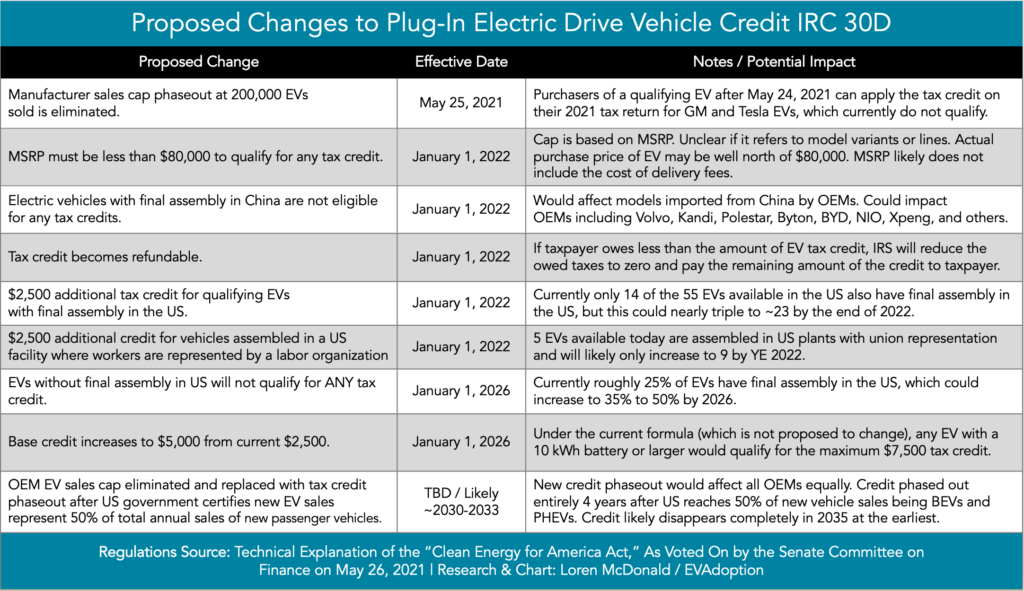

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the 30D tax credit

Printables for free include a vast array of printable resources available online for download at no cost. These resources come in many types, such as worksheets templates, coloring pages, and many more. The value of Federal Ev Tax Credit Income Limit is their versatility and accessibility.

More of Federal Ev Tax Credit Income Limit

Revamping The Federal EV Tax Credit Could Help Average Car Buyers

Revamping The Federal EV Tax Credit Could Help Average Car Buyers

The maximum credit is 7 500 It is nonrefundable so you can t get back more on the credit than you owe in taxes You can t apply any excess credit to future tax years Find information on credits for used clean vehicles and new

Treasury and the Internal Revenue Service released guidance and FAQs with information on how the North America final assembly requirement will work so consumers can determine what vehicles are eligible and claim a

Federal Ev Tax Credit Income Limit have risen to immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

Customization: We can customize designs to suit your personal needs when it comes to designing invitations or arranging your schedule or decorating your home.

-

Education Value These Federal Ev Tax Credit Income Limit can be used by students of all ages, making them a vital device for teachers and parents.

-

The convenience of Access to many designs and templates can save you time and energy.

Where to Find more Federal Ev Tax Credit Income Limit

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

You could call it a tax pre fund Starting in January you ll be able to get an electric vehicle tax credit of up to 7 500 without having to wait for the IRS to process your return Instead

Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 The availability of the credit will depend on several factors including the vehicle s MSRP its final assembly location battery component and or critical

Now that we've ignited your curiosity about Federal Ev Tax Credit Income Limit Let's take a look at where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Federal Ev Tax Credit Income Limit designed for a variety motives.

- Explore categories like decorating your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free or flashcards as well as learning materials.

- Great for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for free.

- The blogs covered cover a wide range of interests, all the way from DIY projects to planning a party.

Maximizing Federal Ev Tax Credit Income Limit

Here are some ways ensure you get the very most of Federal Ev Tax Credit Income Limit:

1. Home Decor

- Print and frame stunning artwork, quotes or other seasonal decorations to fill your living areas.

2. Education

- Print free worksheets for teaching at-home (or in the learning environment).

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars along with lists of tasks, and meal planners.

Conclusion

Federal Ev Tax Credit Income Limit are a treasure trove with useful and creative ideas for a variety of needs and interests. Their accessibility and versatility make they a beneficial addition to both professional and personal life. Explore the vast array of Federal Ev Tax Credit Income Limit to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Federal Ev Tax Credit Income Limit truly gratis?

- Yes, they are! You can download and print these files for free.

-

Do I have the right to use free templates for commercial use?

- It's all dependent on the terms of use. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Are there any copyright concerns when using Federal Ev Tax Credit Income Limit?

- Some printables could have limitations on their use. You should read the terms and conditions set forth by the creator.

-

How can I print Federal Ev Tax Credit Income Limit?

- Print them at home using printing equipment or visit a local print shop to purchase higher quality prints.

-

What program do I need in order to open printables at no cost?

- The majority are printed with PDF formats, which is open with no cost programs like Adobe Reader.

How The Federal EV Tax Credit Can Save You 7 500 On A New Plug in Vehicle

Should These EVs Qualify For The Federal EV Tax Credit EVAdoption

Check more sample of Federal Ev Tax Credit Income Limit below

Earned Income Tax Credit EITC Who Qualifies

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

Earning Income Tax Credit Table

U S Federal EV Tax Credit Update For January 2019

Federal EV Tax Credit News And Reviews InsideEVs

Earned Income Tax Credit For Households With One Child 2023 Center

https://www.irs.gov/newsroom/topic-b-frequently...

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the 30D tax credit

https://www.irs.gov/credits-deductions/credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The credit is available to individuals and their businesses

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the 30D tax credit

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The credit is available to individuals and their businesses

U S Federal EV Tax Credit Update For January 2019

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

Federal EV Tax Credit News And Reviews InsideEVs

Earned Income Tax Credit For Households With One Child 2023 Center

.png)

Health Insurance Income Limits For 2023 To Receive ACA Premium S

Impact Of Proposed Changes To The Federal EV Tax Credit Part 1

Impact Of Proposed Changes To The Federal EV Tax Credit Part 1

EV Tax Credit 2024 Credits Zrivo