In the digital age, where screens dominate our lives yet the appeal of tangible printed objects isn't diminished. For educational purposes, creative projects, or simply to add an element of personalization to your area, Ev Tax Credit Income Limit Effective Date can be an excellent source. For this piece, we'll take a dive to the depths of "Ev Tax Credit Income Limit Effective Date," exploring what they are, where to locate them, and what they can do to improve different aspects of your lives.

Get Latest Ev Tax Credit Income Limit Effective Date Below

Ev Tax Credit Income Limit Effective Date

Ev Tax Credit Income Limit Effective Date -

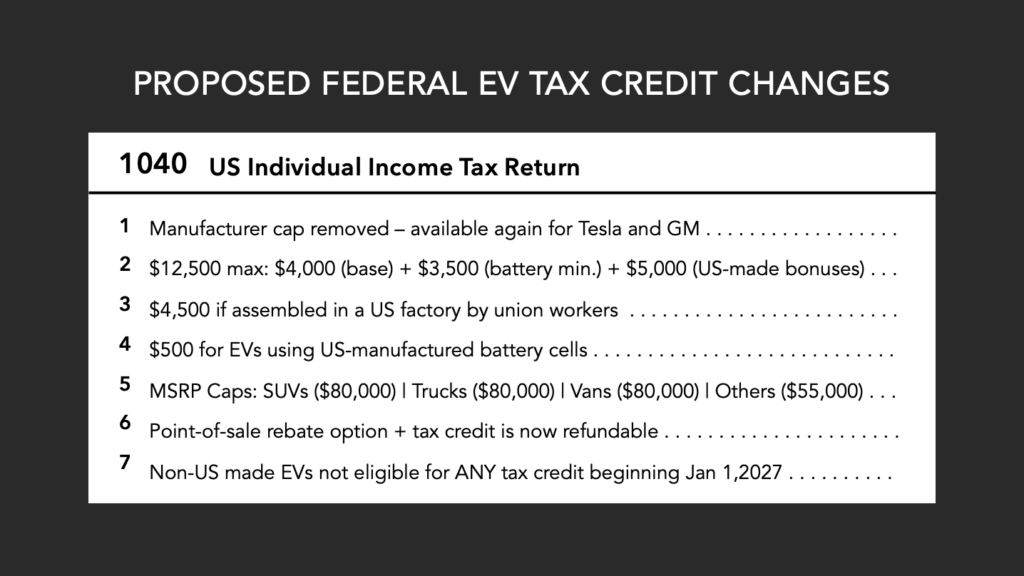

Tucked inside the massive Inflation Reduction Act of 2022 that was signed into law in August is a complex set of requirements around which EVs and other clean vehicles do and do not qualify for a

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

Ev Tax Credit Income Limit Effective Date offer a wide assortment of printable resources available online for download at no cost. These materials come in a variety of types, such as worksheets templates, coloring pages and many more. The great thing about Ev Tax Credit Income Limit Effective Date lies in their versatility as well as accessibility.

More of Ev Tax Credit Income Limit Effective Date

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Under the IRA the EV tax credit is in place for 10 years until December 2032 for electric vehicles placed into service this year 2023 The tax credit is taken in the year you take

The tax credits for purchasing electric vehicles EVs got a major overhaul on Jan 1 EV tax credits have been around for years but they were redesigned as part of President Biden s

Printables for free have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Flexible: There is the possibility of tailoring designs to suit your personal needs for invitations, whether that's creating them as well as organizing your calendar, or even decorating your house.

-

Educational Worth: Education-related printables at no charge cater to learners of all ages, which makes the perfect aid for parents as well as educators.

-

It's easy: You have instant access a plethora of designs and templates helps save time and effort.

Where to Find more Ev Tax Credit Income Limit Effective Date

The New EV Tax Credit In 2023 Everything You Need To Know Updated

The New EV Tax Credit In 2023 Everything You Need To Know Updated

The Inflation Reduction Act signed by President Joe Biden Tuesday extends the existing 7 500 tax credit for EV vehicle purchases and eliminates a barrier under the old credit that phased out incentives for any automaker once it

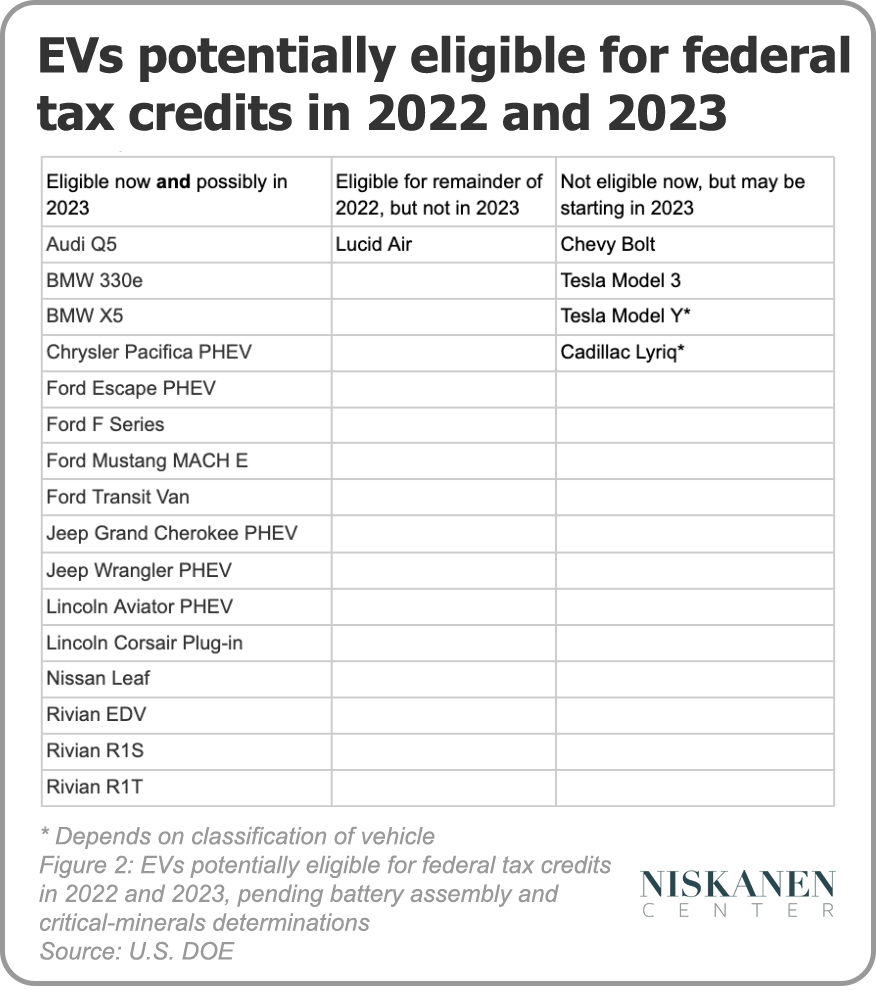

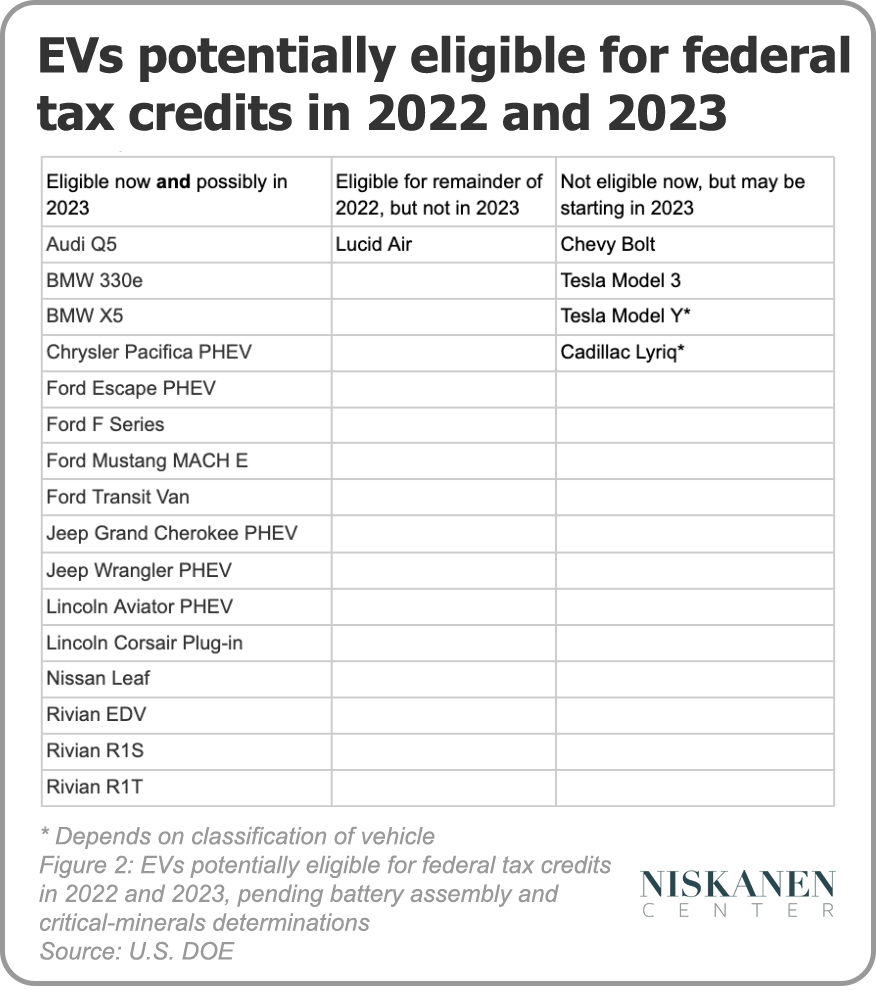

To assist consumers identifying eligible vehicles the Department of Transportation and Department of Energy published new resources today to help those interested in claiming tax credits for an electric vehicle purchased after the Inflation Reduction Act s enactment on August 16 2022

If we've already piqued your curiosity about Ev Tax Credit Income Limit Effective Date Let's see where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Ev Tax Credit Income Limit Effective Date to suit a variety of applications.

- Explore categories like furniture, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- The perfect resource for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs or templates for download.

- The blogs covered cover a wide variety of topics, ranging from DIY projects to party planning.

Maximizing Ev Tax Credit Income Limit Effective Date

Here are some creative ways that you can make use of Ev Tax Credit Income Limit Effective Date:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Utilize free printable worksheets to enhance learning at home for the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Ev Tax Credit Income Limit Effective Date are an abundance of innovative and useful resources that can meet the needs of a variety of people and desires. Their accessibility and flexibility make they a beneficial addition to both professional and personal lives. Explore the vast world of Ev Tax Credit Income Limit Effective Date right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes you can! You can print and download these tools for free.

-

Can I download free printouts for commercial usage?

- It's based on the usage guidelines. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables could have limitations regarding their use. Always read these terms and conditions as set out by the author.

-

How can I print printables for free?

- You can print them at home using either a printer or go to the local print shop for high-quality prints.

-

What software will I need to access Ev Tax Credit Income Limit Effective Date?

- The majority of printables are in PDF format, which can be opened using free programs like Adobe Reader.

New EV Tax Credits Taxed Right

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

Check more sample of Ev Tax Credit Income Limit Effective Date below

Earned Income Tax Credit EITC Who Qualifies

Federal EV Tax Credits Are About To Become Scarce Who Should Get Them

Proposed Federal EV Tax Credit Changes IRC 30D featured Image v3

Earned Income Tax Credit For Households With One Child 2023 Center

Child Tax Credit Income Limit 2024 Credits Zrivo

Health Insurance Income Limits For 2023 To Receive ACA Premium S

.png)

https://www.irs.gov/credits-deductions/credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

https://www.nerdwallet.com/article/taxes/ev-tax...

As of January 2024 the following fully electric and plug in hybrid vehicles may be eligible for either a full or partial tax credit if delivered on or after Jan 1 2024 The IRS urges

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

As of January 2024 the following fully electric and plug in hybrid vehicles may be eligible for either a full or partial tax credit if delivered on or after Jan 1 2024 The IRS urges

Earned Income Tax Credit For Households With One Child 2023 Center

Federal EV Tax Credits Are About To Become Scarce Who Should Get Them

Child Tax Credit Income Limit 2024 Credits Zrivo

.png)

Health Insurance Income Limits For 2023 To Receive ACA Premium S

EV Tax Credit 2024 Credits Zrivo

EV Tax Credit 2023 What s Changing With Biden s IRA The Week

EV Tax Credit 2023 What s Changing With Biden s IRA The Week

Has Federal EV Tax Credit Been Saved The Green Car Guy