In this age of electronic devices, where screens have become the dominant feature of our lives yet the appeal of tangible printed objects hasn't waned. Be it for educational use as well as creative projects or simply adding an element of personalization to your space, Entertainment Tax Deduction have proven to be a valuable source. With this guide, you'll dive through the vast world of "Entertainment Tax Deduction," exploring what they are, how they can be found, and the ways that they can benefit different aspects of your daily life.

Get Latest Entertainment Tax Deduction Below

Entertainment Tax Deduction

Entertainment Tax Deduction -

The law known as the Tax Cuts and Jobs Act TCJA P L 115 97 significantly changed Sec 274 a by eliminating any deduction of expenses considered entertainment amusement or recreation The TCJA also extended the 50 deduction limitation for expenses related to food and beverages to those provided by employers to

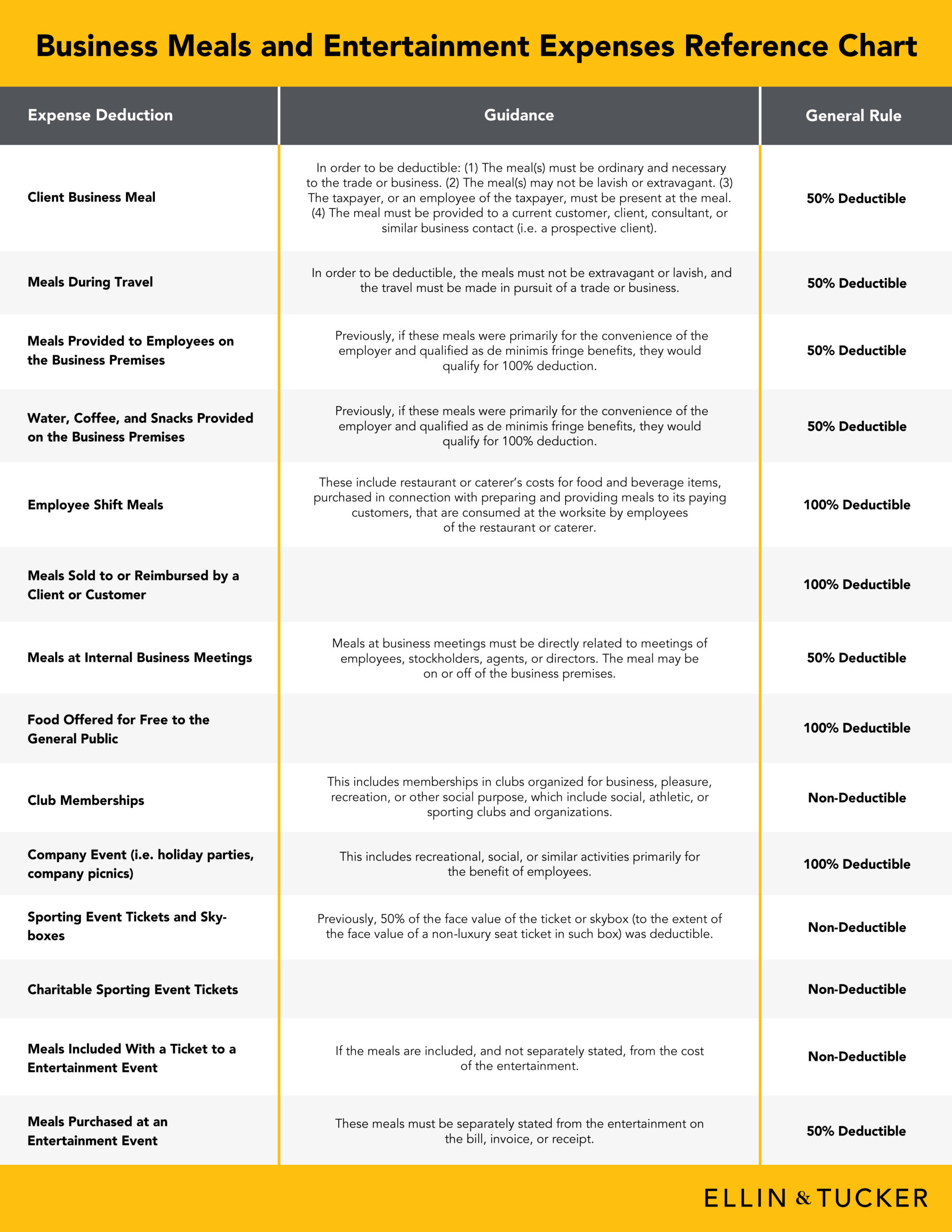

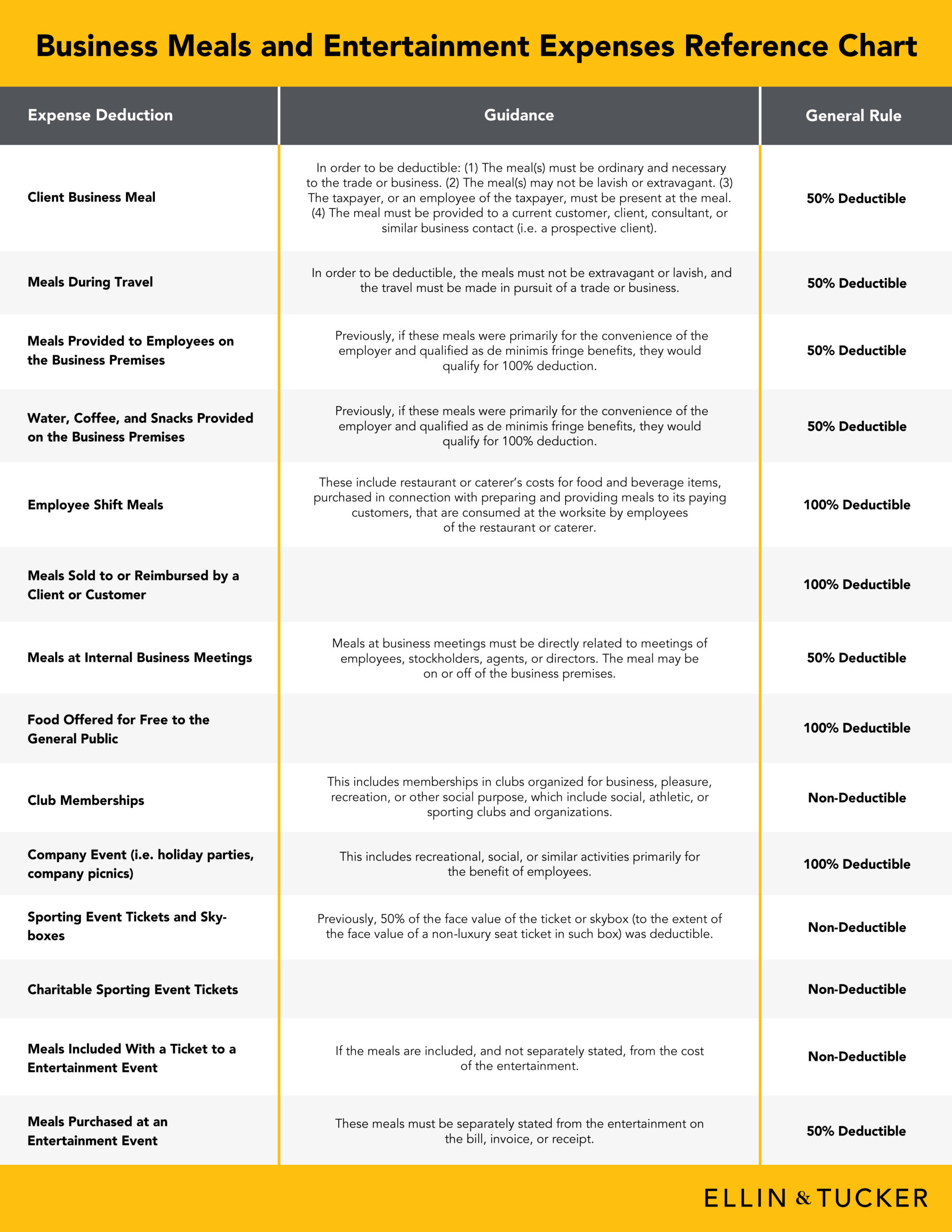

How to Deduct Meals and Entertainment in 2024 Writing off meals and entertainment for your small business can be pretty confusing Some things are 100 percent deductible some are 50 percent and a few are nondeductible It all depends on the purpose of the meal or event and who benefits from it

Entertainment Tax Deduction offer a wide variety of printable, downloadable material that is available online at no cost. The resources are offered in a variety forms, including worksheets, templates, coloring pages and much more. The great thing about Entertainment Tax Deduction is in their versatility and accessibility.

More of Entertainment Tax Deduction

Checklist Meals And Entertainment Tax Deduction In 2019

Checklist Meals And Entertainment Tax Deduction In 2019

50 deductible 100 for tax years 2021 and 2022 Food for charitable causes 100 deductible Meals for in office meetings 50 deductible Snacks for employees 50 deductible Renting out an entertainment facility 0 deductible

The cost of entertainment tickets is generally deductible However you can only deduct the face value of the ticket even if you paid a higher price for example if you pay more than face value for a ticket from a scalper ticket agency or ticket broker

Entertainment Tax Deduction have garnered immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

Customization: You can tailor designs to suit your personal needs be it designing invitations or arranging your schedule or even decorating your house.

-

Educational Impact: Education-related printables at no charge provide for students of all ages, which makes them a vital tool for parents and teachers.

-

Affordability: Quick access to numerous designs and templates, which saves time as well as effort.

Where to Find more Entertainment Tax Deduction

Is Entertainment Tax Deductible YYC Business School YYC

Is Entertainment Tax Deductible YYC Business School YYC

The entertainment and meals tax deduction has been a great way for successful business owners or self employed people to maximize their tax deductions yearly Unfortunately the Trump tax plan cut

The IRS issued final regulations T D 9925 clarifying amendments to the deductibility of certain business meals and entertainment expenses under the law known as the Tax Cuts and Jobs Act TCJA P L 115 97 enacted in December 2017 These final regulations apply to tax years beginning on or after Oct 9 2020

In the event that we've stirred your curiosity about Entertainment Tax Deduction Let's see where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of motives.

- Explore categories such as decorating your home, education, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing along with flashcards, as well as other learning tools.

- It is ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers post their original designs or templates for download.

- The blogs are a vast variety of topics, all the way from DIY projects to planning a party.

Maximizing Entertainment Tax Deduction

Here are some innovative ways that you can make use use of Entertainment Tax Deduction:

1. Home Decor

- Print and frame beautiful images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use free printable worksheets to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

Entertainment Tax Deduction are a treasure trove of useful and creative resources that satisfy a wide range of requirements and hobbies. Their accessibility and versatility make these printables a useful addition to each day life. Explore the endless world of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really for free?

- Yes you can! You can download and print these tools for free.

-

Are there any free printables in commercial projects?

- It depends on the specific usage guidelines. Make sure you read the guidelines for the creator before using their printables for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Some printables may come with restrictions on their use. Be sure to check the terms and conditions provided by the designer.

-

How can I print printables for free?

- Print them at home using either a printer or go to an area print shop for better quality prints.

-

What software do I need to open printables that are free?

- The majority of printed documents are in PDF format. These is open with no cost software, such as Adobe Reader.

Entertainment And Meal Deductibility Chart

How To Get Your Biggest Tax Deduction The Motley Fool

Check more sample of Entertainment Tax Deduction below

PIC Enhanced Tax Deduction Part 2 Tax Made Easy

5 IRS Tax Changes You ll Want To Know About In 2018

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

Types Of Taxes In Malaysia For Companies

Tax Deduction Stock Photo Photo By LendingMemo Under CC 2 Flickr

Check Please Deductions For Business Meals And Entertainment Expenses

https://www.bench.co/blog/tax-tips/deduct-meals-entertainment

How to Deduct Meals and Entertainment in 2024 Writing off meals and entertainment for your small business can be pretty confusing Some things are 100 percent deductible some are 50 percent and a few are nondeductible It all depends on the purpose of the meal or event and who benefits from it

https://www.vero.fi/en/individuals/tax-cards-and...

Individuals Tax card and tax return Deductions You may be entitled to certain deductions that reduce the total amount of taxes you must pay Some deductions have to be claimed You can claim deductions on your tax card or in your tax return You can also submit deduction details on paper forms

How to Deduct Meals and Entertainment in 2024 Writing off meals and entertainment for your small business can be pretty confusing Some things are 100 percent deductible some are 50 percent and a few are nondeductible It all depends on the purpose of the meal or event and who benefits from it

Individuals Tax card and tax return Deductions You may be entitled to certain deductions that reduce the total amount of taxes you must pay Some deductions have to be claimed You can claim deductions on your tax card or in your tax return You can also submit deduction details on paper forms

Types Of Taxes In Malaysia For Companies

5 IRS Tax Changes You ll Want To Know About In 2018

Tax Deduction Stock Photo Photo By LendingMemo Under CC 2 Flickr

Check Please Deductions For Business Meals And Entertainment Expenses

Agents A Gift Versus Entertainment Tax Deduction Tax Deductions

Maximize Travel And Entertainment Tax Deductions Blog hubcfo

Maximize Travel And Entertainment Tax Deductions Blog hubcfo

Writing Off Dining Expense And Food In 2018 Mark J Kohler