In the age of digital, where screens rule our lives, the charm of tangible printed materials isn't diminishing. For educational purposes such as creative projects or simply adding an individual touch to your space, Employer Pension Contributions Tax Deductible Uk are now a vital resource. The following article is a take a dive deep into the realm of "Employer Pension Contributions Tax Deductible Uk," exploring what they are, where to locate them, and how they can be used to enhance different aspects of your life.

Get Latest Employer Pension Contributions Tax Deductible Uk Below

Employer Pension Contributions Tax Deductible Uk

Employer Pension Contributions Tax Deductible Uk -

Tax relief on employer contributions to a registered pension scheme is given by allowing contributions to be deducted as an expense in computing the profits of a trade

Provided that the contribution to a registered pension scheme meets the test of wholly and exclusively for the purposes of the trade it will be an allowable deduction for

Employer Pension Contributions Tax Deductible Uk provide a diverse selection of printable and downloadable items that are available online at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages, and much more. The benefit of Employer Pension Contributions Tax Deductible Uk is their flexibility and accessibility.

More of Employer Pension Contributions Tax Deductible Uk

Mac Financial Making Pension Contributions Before The End Of The Tax

Mac Financial Making Pension Contributions Before The End Of The Tax

You can get tax relief on private pension contributions worth up to 100 of your annual earnings You ll either get the tax relief automatically or you ll have to claim it yourself

This guidance note provides an overview of employer contributions to registered pension schemes in the UK It explains that employers receive tax relief on contributions to

Printables that are free have gained enormous popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

Modifications: We can customize printables to your specific needs for invitations, whether that's creating them as well as organizing your calendar, or even decorating your home.

-

Educational value: The free educational worksheets can be used by students from all ages, making the perfect resource for educators and parents.

-

Easy to use: Quick access to various designs and templates is time-saving and saves effort.

Where to Find more Employer Pension Contributions Tax Deductible Uk

OS Payroll Your P60 Document Explained

OS Payroll Your P60 Document Explained

Employer pension contributions count as an allowable business expense meaning you can deduct them from your taxable profits to reduce your corporation tax

Detailed guidance Key points You need to deduct contributions from your staff s salaries and pay these and your contributions over to the scheme on time and accurately After

After we've peaked your interest in printables for free We'll take a look around to see where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Employer Pension Contributions Tax Deductible Uk to suit a variety of objectives.

- Explore categories like the home, decor, organization, and crafts.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets, flashcards, and learning materials.

- Ideal for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- These blogs cover a wide variety of topics, that includes DIY projects to planning a party.

Maximizing Employer Pension Contributions Tax Deductible Uk

Here are some innovative ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Use printable worksheets for free for teaching at-home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events like weddings or birthdays.

4. Organization

- Stay organized with printable calendars or to-do lists. meal planners.

Conclusion

Employer Pension Contributions Tax Deductible Uk are an abundance of practical and imaginative resources that satisfy a wide range of requirements and needs and. Their availability and versatility make them a great addition to both professional and personal life. Explore the vast array of Employer Pension Contributions Tax Deductible Uk now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes, they are! You can download and print these free resources for no cost.

-

Can I utilize free templates for commercial use?

- It is contingent on the specific usage guidelines. Always verify the guidelines provided by the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues in Employer Pension Contributions Tax Deductible Uk?

- Some printables could have limitations regarding their use. Make sure you read the terms and conditions set forth by the designer.

-

How can I print Employer Pension Contributions Tax Deductible Uk?

- You can print them at home with either a printer at home or in the local print shops for top quality prints.

-

What program do I require to view printables at no cost?

- The majority of printables are in PDF format. They is open with no cost software, such as Adobe Reader.

Funeral Expenses Tax Deductible Uk Best Reviews

Minimum Pension Contributions Will Increase In April 2019

Check more sample of Employer Pension Contributions Tax Deductible Uk below

Employer Pension Contributions Calculator Factorial

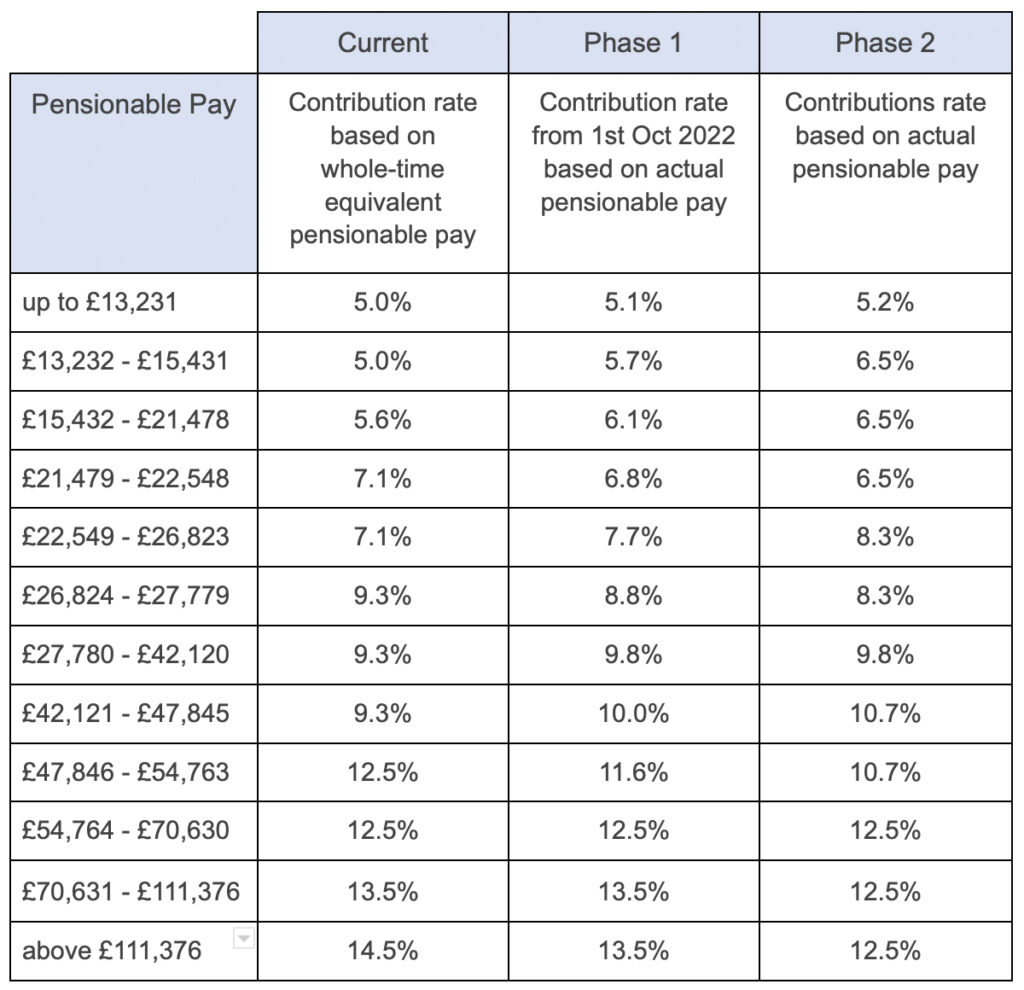

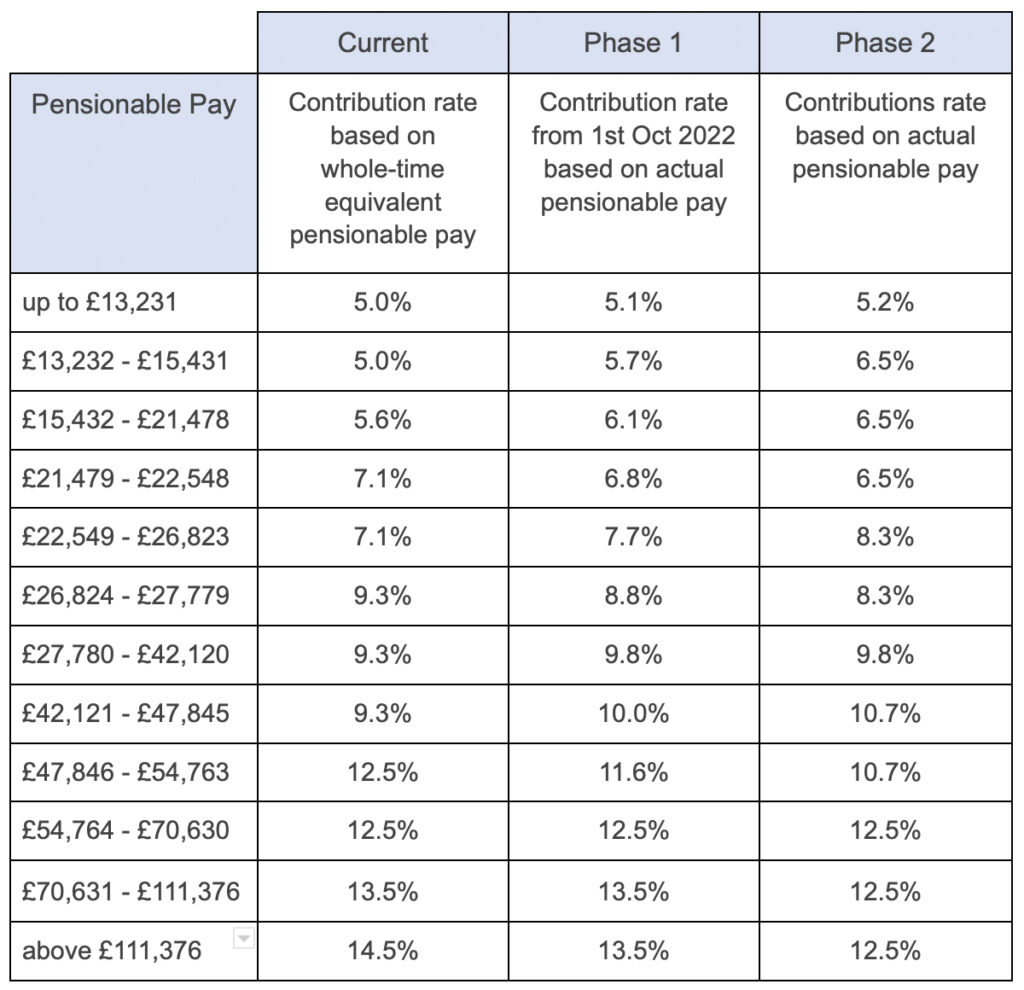

Changes In NHS Pension Contributions Are You A Winner Or Loser

National Insurance Contributions Explained IFS Taxlab

National Insurance contribution rates%2C 2021–22.png?itok=iGs8c8Ix)

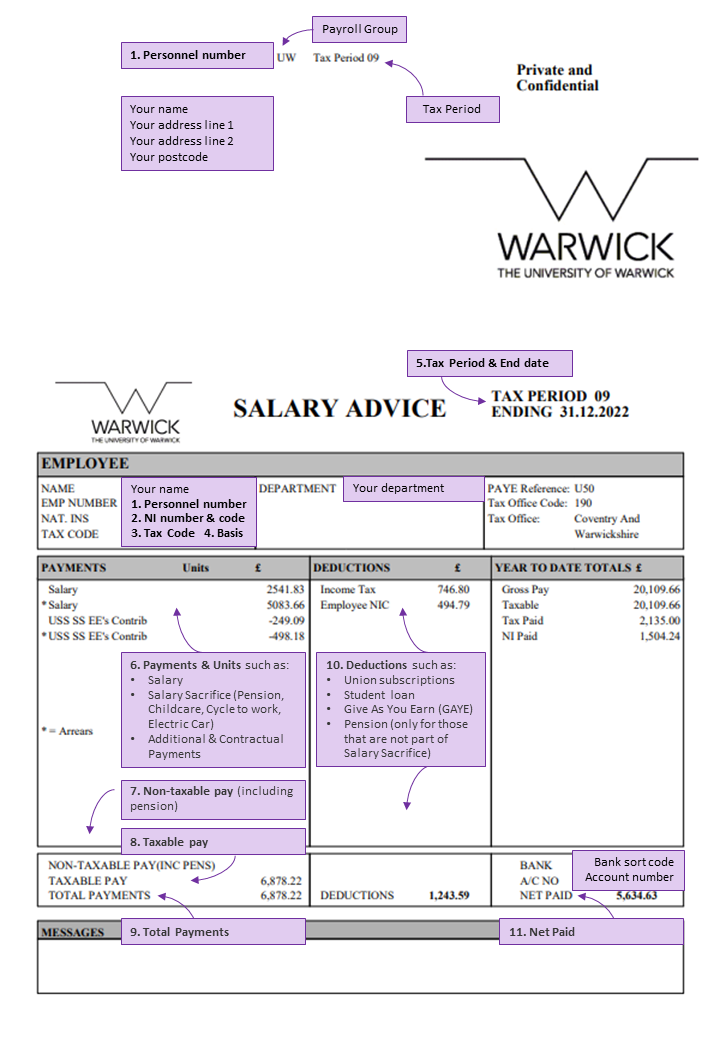

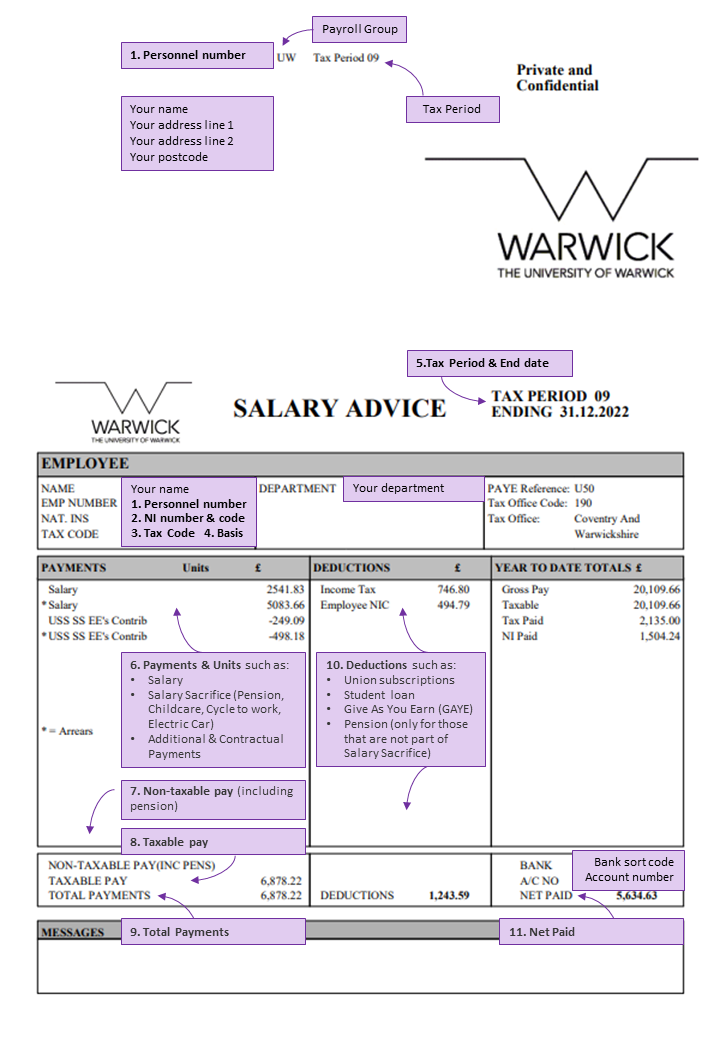

Understanding Your Payslip

Pin On Adulting

How Pension Contributions Work

https://www.accaglobal.com/uk/en/technical...

Provided that the contribution to a registered pension scheme meets the test of wholly and exclusively for the purposes of the trade it will be an allowable deduction for

https://www.hl.co.uk/pensions/contributions/employer

A basic rate taxpayer will pay income tax of 20 and National Insurance of 8 on their salary So for every 1 000 they receive 280 is deducted They can add the 720

Provided that the contribution to a registered pension scheme meets the test of wholly and exclusively for the purposes of the trade it will be an allowable deduction for

A basic rate taxpayer will pay income tax of 20 and National Insurance of 8 on their salary So for every 1 000 they receive 280 is deducted They can add the 720

Understanding Your Payslip

Changes In NHS Pension Contributions Are You A Winner Or Loser

Pin On Adulting

How Pension Contributions Work

Tax Relief On Pension Contributions FKGB Accounting

Sars 2022 Weekly Tax Tables Brokeasshome

Sars 2022 Weekly Tax Tables Brokeasshome

Hunter Gee Holroyd Changes To Pension Contributions From 6 April 2018