In the age of digital, in which screens are the norm, the charm of tangible printed materials isn't diminishing. If it's to aid in education such as creative projects or simply adding personal touches to your space, Employer Did Not Withhold Social Security And Medicare Taxes have proven to be a valuable resource. In this article, we'll take a dive into the world of "Employer Did Not Withhold Social Security And Medicare Taxes," exploring the benefits of them, where they are available, and the ways that they can benefit different aspects of your life.

Get Latest Employer Did Not Withhold Social Security And Medicare Taxes Below

Employer Did Not Withhold Social Security And Medicare Taxes

Employer Did Not Withhold Social Security And Medicare Taxes -

Underwithholding The adjustment process differs if an employer fails to withhold and pay over to the government federal income taxes on the wages it paid to the employee in a

The employee usually won t have a penalty for not paying Social Security tax and Medicare tax However there will be taxes owed Fortunately there are

Employer Did Not Withhold Social Security And Medicare Taxes offer a wide range of downloadable, printable documents that can be downloaded online at no cost. They are available in numerous forms, like worksheets templates, coloring pages, and many more. The appeal of printables for free is their flexibility and accessibility.

More of Employer Did Not Withhold Social Security And Medicare Taxes

Opinion Biden s Promises On Social Security And Medicare Have No

Opinion Biden s Promises On Social Security And Medicare Have No

My employer refused to withhold federal income tax medicare or social security taxes for 2017 I paid the federal income tax using form 1040 ES How do I go

Employers are responsible for withholding the 0 9 Additional Medicare tax on an individual s wages paid in excess of 200 000 in a calendar year without regard to

Printables that are free have gained enormous popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Customization: You can tailor printed materials to meet your requirements when it comes to designing invitations and schedules, or decorating your home.

-

Education Value These Employer Did Not Withhold Social Security And Medicare Taxes offer a wide range of educational content for learners from all ages, making them a great aid for parents as well as educators.

-

It's easy: instant access a myriad of designs as well as templates will save you time and effort.

Where to Find more Employer Did Not Withhold Social Security And Medicare Taxes

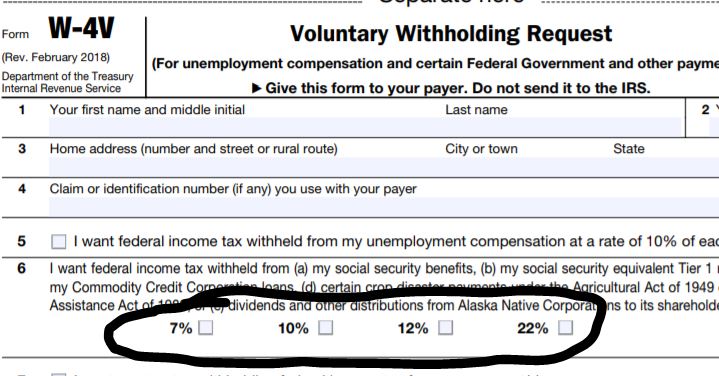

Social Security Form W4v 2023 Printable Forms Free Online

Social Security Form W4v 2023 Printable Forms Free Online

Failing to stop withholding Social Security taxes when an employee earns above the Social Security wage base can lead to excess Social Security tax withheld and FICA overpayment On the other

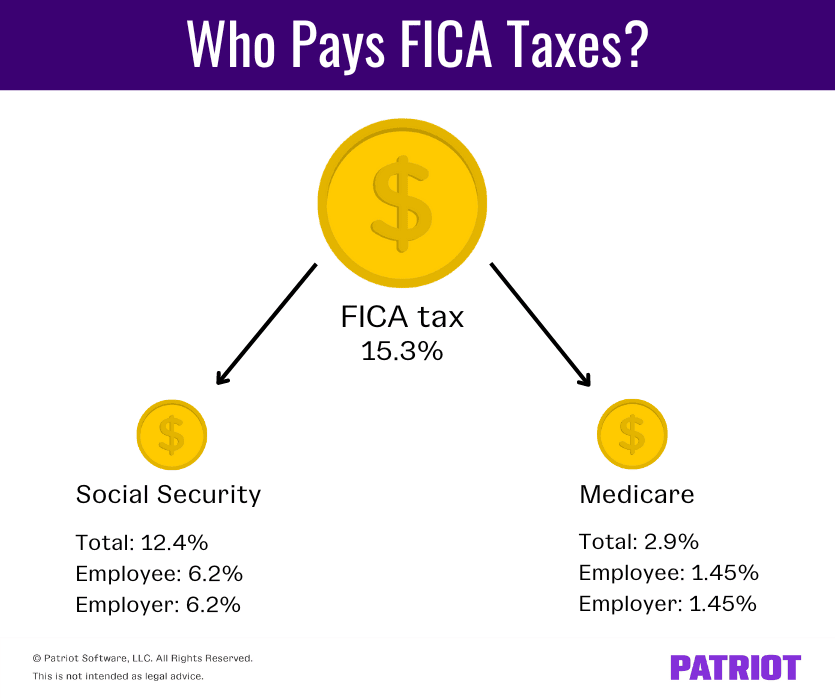

As a self employed individual you are responsible for paying 15 3 in Social Security tax and Medicare tax Half of that amount is the employer s share

After we've peaked your interest in Employer Did Not Withhold Social Security And Medicare Taxes, let's explore where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Employer Did Not Withhold Social Security And Medicare Taxes designed for a variety reasons.

- Explore categories like decoration for your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free for flashcards, lessons, and worksheets. tools.

- It is ideal for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs or templates for download.

- These blogs cover a wide array of topics, ranging that includes DIY projects to party planning.

Maximizing Employer Did Not Withhold Social Security And Medicare Taxes

Here are some unique ways to make the most use of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print out free worksheets and activities to build your knowledge at home for the classroom.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions like weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Employer Did Not Withhold Social Security And Medicare Taxes are an abundance with useful and creative ideas that meet a variety of needs and pursuits. Their availability and versatility make them an essential part of both professional and personal life. Explore the vast array of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Employer Did Not Withhold Social Security And Medicare Taxes really absolutely free?

- Yes they are! You can download and print these documents for free.

-

Are there any free printing templates for commercial purposes?

- It's all dependent on the usage guidelines. Always check the creator's guidelines prior to using the printables in commercial projects.

-

Are there any copyright issues with Employer Did Not Withhold Social Security And Medicare Taxes?

- Some printables may contain restrictions regarding their use. Be sure to read the terms and conditions offered by the creator.

-

How can I print Employer Did Not Withhold Social Security And Medicare Taxes?

- You can print them at home using printing equipment or visit the local print shops for superior prints.

-

What program must I use to open printables at no cost?

- The majority are printed in the PDF format, and can be opened with free software, such as Adobe Reader.

Can My Employer Withhold Social Security And Medicare Taxes From My

Who Pays Payroll Taxes Employer Employee Or Both Cheatsheet

Check more sample of Employer Did Not Withhold Social Security And Medicare Taxes below

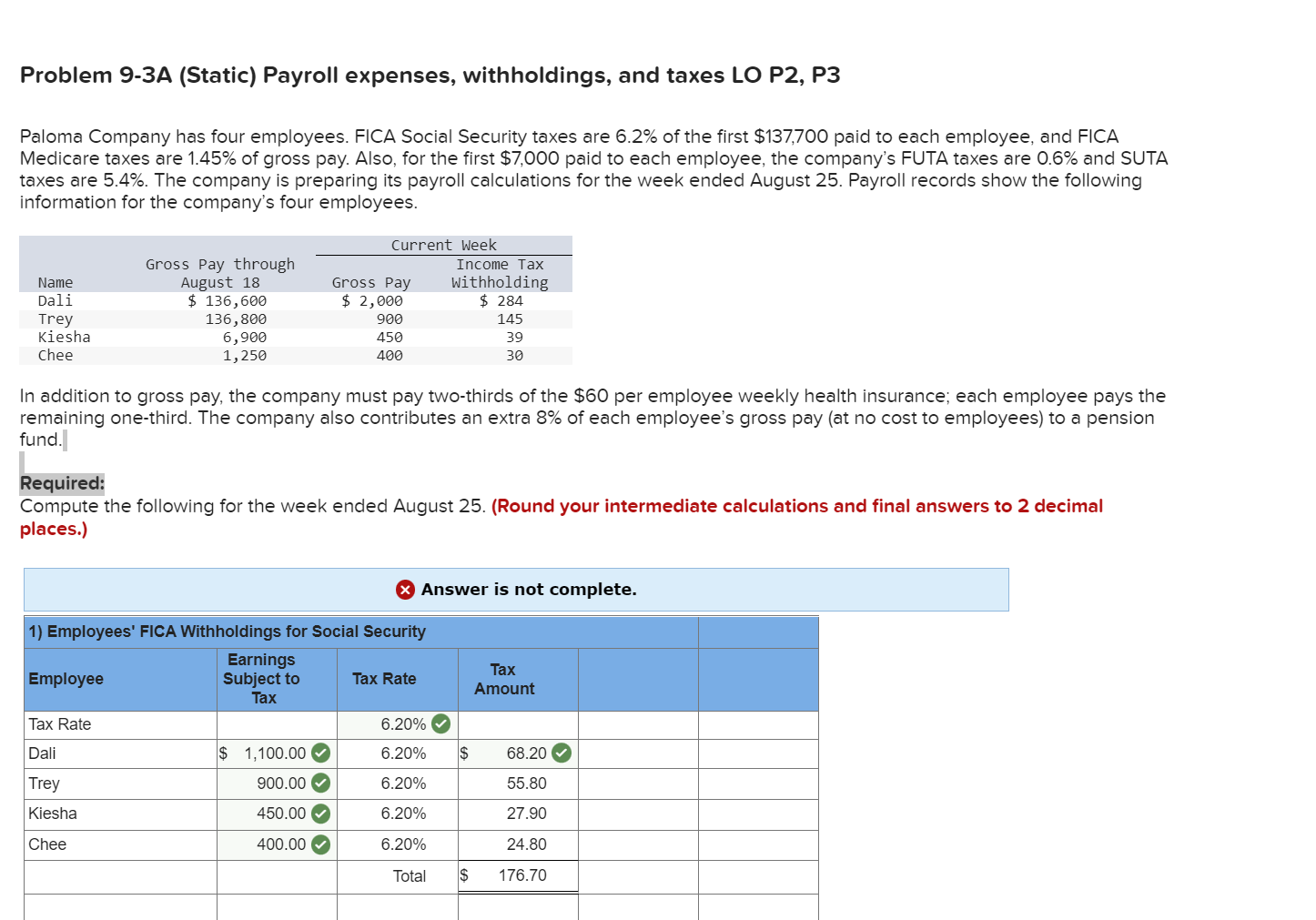

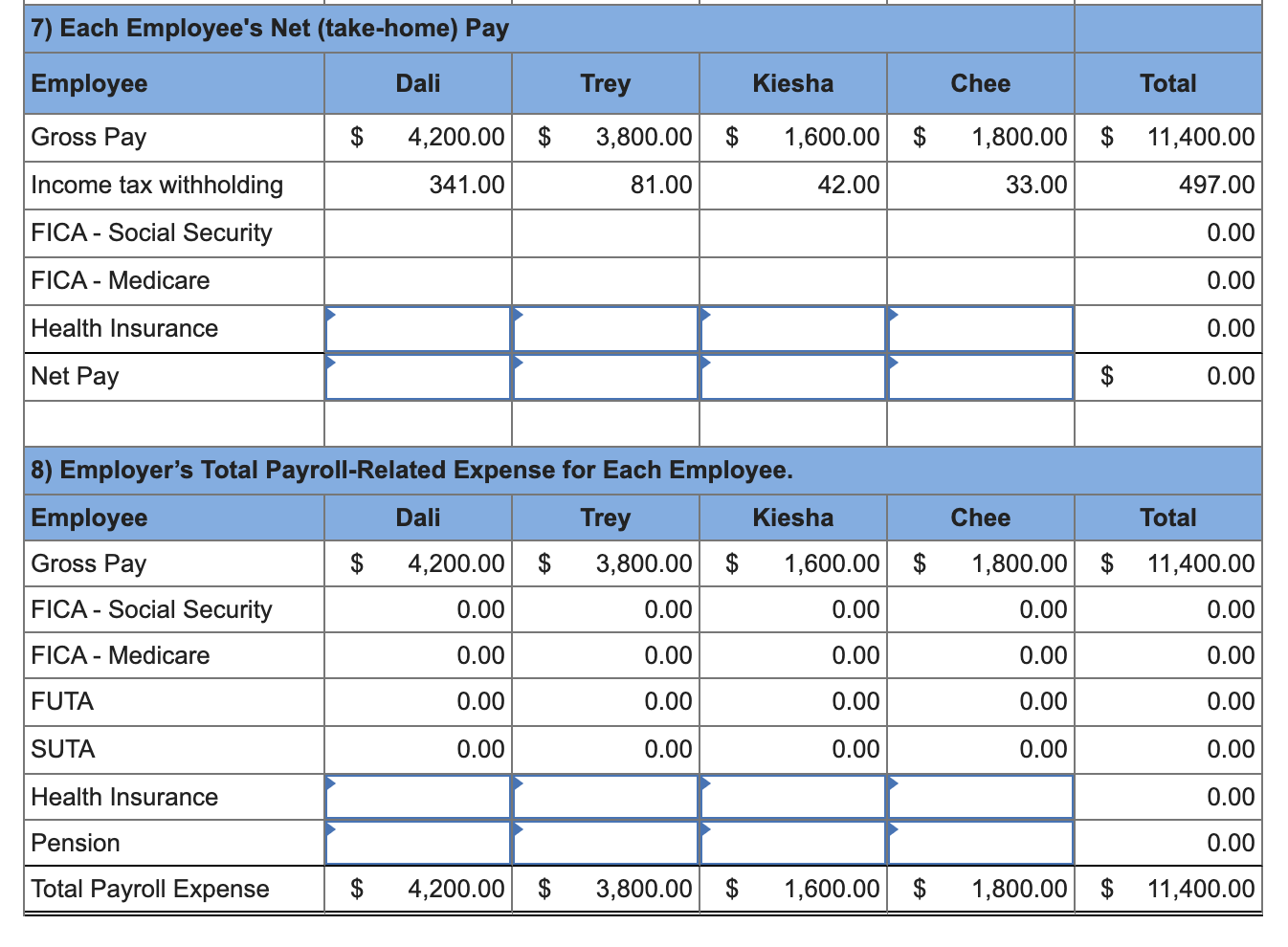

Solved Paloma Company Has Four Employees FICA Social Chegg

Pin On Lessons

Who Pays Payroll Taxes Cheatsheet

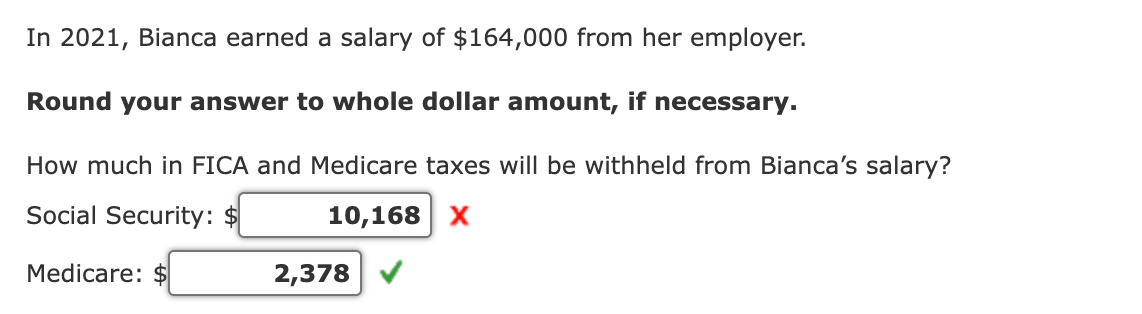

Solved In 2021 Bianca Earned A Salary Of 164 000 From Her Chegg

What Are Payroll Taxes An Employer s Guide Wrapbook

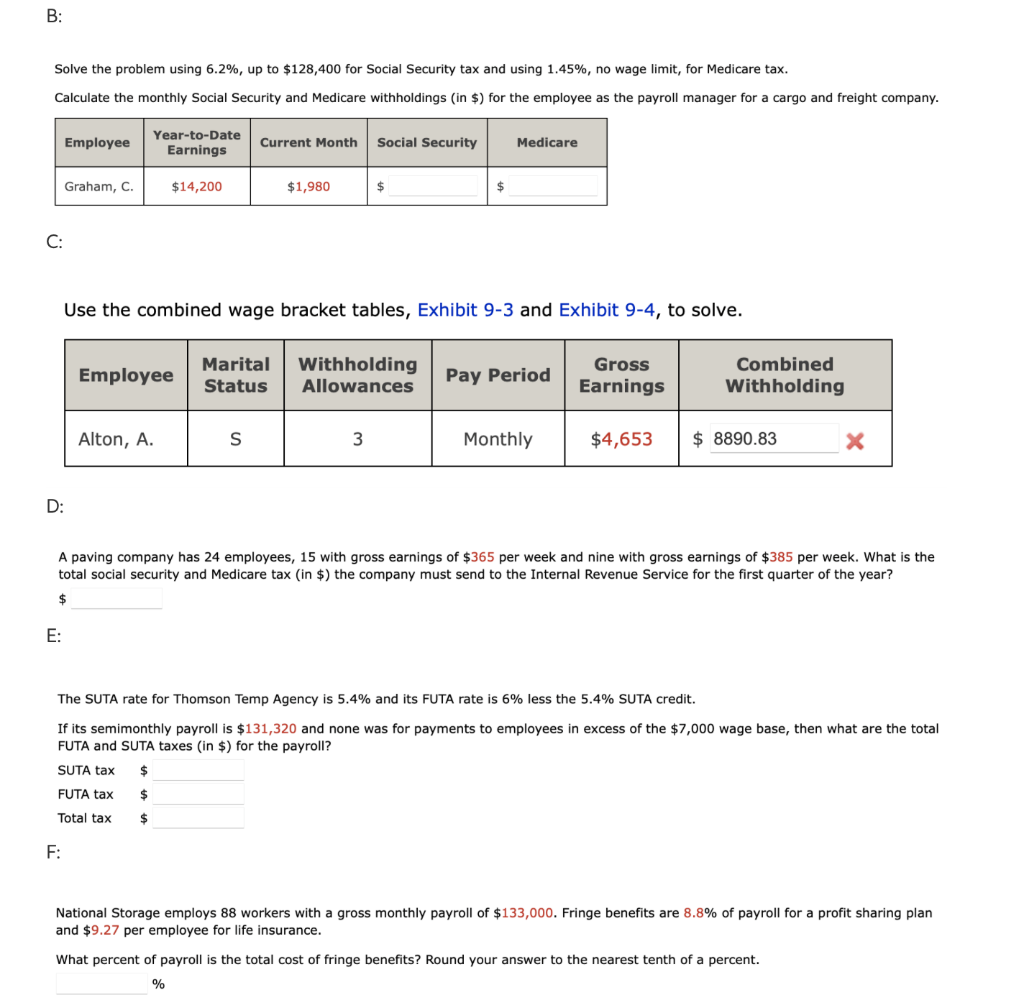

Solved B Solve The Problem Using 6 2 Up To 128 400 For Chegg

https://work.chron.com/fine-not-paying-fica-employee-11222.html

The employee usually won t have a penalty for not paying Social Security tax and Medicare tax However there will be taxes owed Fortunately there are

https://www.reddit.com/r/tax/comments/yvwx6t/...

When it comes to social security and Medicare taxes it s based on a flat percentage of your total gross income If your employer did not withhold taxes from your check to

The employee usually won t have a penalty for not paying Social Security tax and Medicare tax However there will be taxes owed Fortunately there are

When it comes to social security and Medicare taxes it s based on a flat percentage of your total gross income If your employer did not withhold taxes from your check to

Solved In 2021 Bianca Earned A Salary Of 164 000 From Her Chegg

Pin On Lessons

What Are Payroll Taxes An Employer s Guide Wrapbook

Solved B Solve The Problem Using 6 2 Up To 128 400 For Chegg

Solved Paloma Company Has Four Employees FICA Social Chegg

What Is The Employee Medicare Tax

What Is The Employee Medicare Tax

Calculating Social Security And Medicare Taxes Assume Chegg