In a world with screens dominating our lives however, the attraction of tangible printed objects hasn't waned. No matter whether it's for educational uses and creative work, or simply adding an individual touch to the area, Elss Tax Benefit On Maturity are a great resource. For this piece, we'll take a dive into the world "Elss Tax Benefit On Maturity," exploring their purpose, where you can find them, and how they can enrich various aspects of your daily life.

Get Latest Elss Tax Benefit On Maturity Below

Elss Tax Benefit On Maturity

Elss Tax Benefit On Maturity -

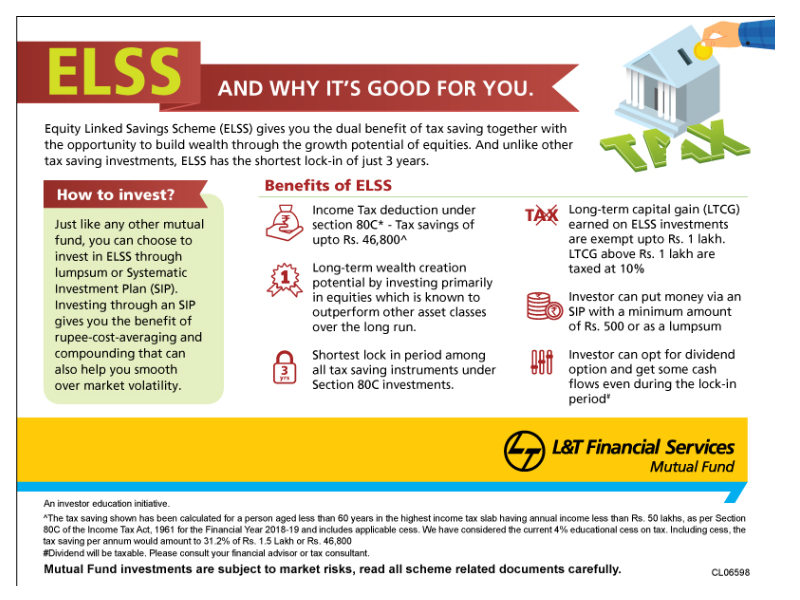

Investment Amount At Maturity 45 11 551 What is an ELSS An ELSS or equity linked savings scheme is an open ended equity mutual fund which offers tax deductions under the provisions of Section 80C of the Income Tax Act 1961

ELSS funds are the only type of funds that give investor tax benefit under Section 80C of the Indian Income Tax Act 1961 Read this article to know more about how elss funds are taxed

The Elss Tax Benefit On Maturity are a huge assortment of printable, downloadable content that can be downloaded from the internet at no cost. The resources are offered in a variety styles, from worksheets to coloring pages, templates and much more. One of the advantages of Elss Tax Benefit On Maturity is in their versatility and accessibility.

More of Elss Tax Benefit On Maturity

New To Equity Mutual Funds Start With ELSS Funds

New To Equity Mutual Funds Start With ELSS Funds

This free online ELSS calculator also helps you estimate the maturity amount from your SIP or lumpsum investments done in ELSS funds Know how ELSS funds performed Monthly SIP Lumpsum Select fund This might give you 36 74 p a returns I want to Invest Monthly Five thousand only For the period years Calculate What you get

Section 80C ELSS mutual fund Investment in ELSS mutual funds are eligible for tax benefit under Section 80C in the old tax regime However for ELSS mutual fund investment to be eligible for tax break for current financial year 2023 24 the investment must be done between April 1 2023 and March 31 2024

The Elss Tax Benefit On Maturity have gained huge popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Customization: They can make the design to meet your needs when it comes to designing invitations making your schedule, or even decorating your house.

-

Education Value Free educational printables can be used by students of all ages, making them a valuable device for teachers and parents.

-

Affordability: You have instant access many designs and templates reduces time and effort.

Where to Find more Elss Tax Benefit On Maturity

All About ELSS Its Benefits Times Of India

All About ELSS Its Benefits Times Of India

With stock markets and mutual fund houses closed over the weekend investors eyeing ELSS mutual funds must secure tax benefits under Section 80C by Thursday March 28 While banks will remain open on Saturday March 30 2024 investors may face delays in fund realisation and unit allocation navigating through KYC

ELSS mutual fund is a dynamic tax saving option in finances decoding its working could make it easier for beginners But some questions prevail How could your investment in the ELSS mutual fund help you long term How does it differ from other mutual funds These are some of the most common questions every beginner investor faces

If we've already piqued your curiosity about Elss Tax Benefit On Maturity We'll take a look around to see where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of purposes.

- Explore categories such as design, home decor, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing along with flashcards, as well as other learning materials.

- Ideal for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- The blogs are a vast array of topics, ranging starting from DIY projects to party planning.

Maximizing Elss Tax Benefit On Maturity

Here are some ways that you can make use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Use free printable worksheets to aid in learning at your home also in the classes.

3. Event Planning

- Invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Elss Tax Benefit On Maturity are a treasure trove of creative and practical resources that can meet the needs of a variety of people and passions. Their accessibility and versatility make them an essential part of both professional and personal lives. Explore the vast world of Elss Tax Benefit On Maturity today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes they are! You can download and print these resources at no cost.

-

Can I use free printables to make commercial products?

- It's dependent on the particular terms of use. Always read the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Certain printables may be subject to restrictions on use. Make sure you read the terms and conditions set forth by the designer.

-

How can I print Elss Tax Benefit On Maturity?

- Print them at home using the printer, or go to a local print shop to purchase superior prints.

-

What program do I need in order to open printables that are free?

- The majority of printables are as PDF files, which is open with no cost programs like Adobe Reader.

ELSS Mutual Fund Vs Other 80C Investments Why ELSS Is The Best Tax

ELSS Funds Offer Tax Saving As Well As Wealth Accumulation Benefits Mint

Check more sample of Elss Tax Benefit On Maturity below

Tax Planning With ELSS ELSS Tax Benefit ICICIdirectOfficial

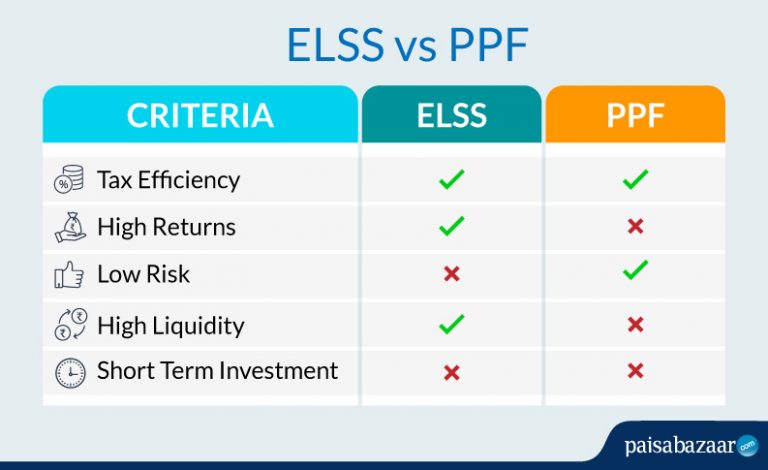

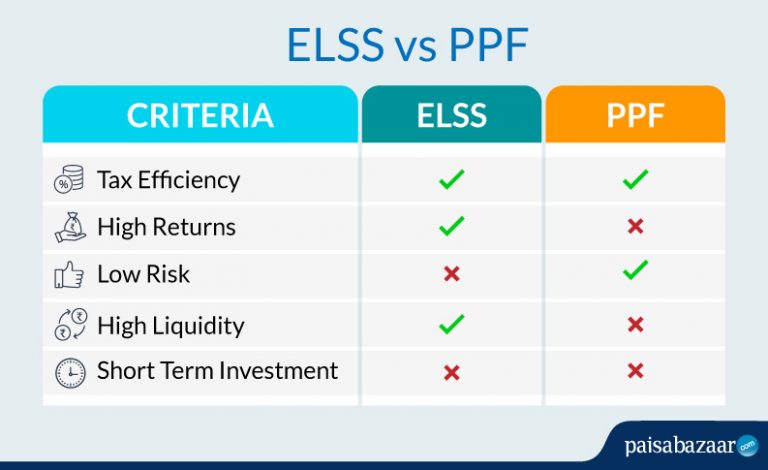

ELSS Vs PPF Comparison Returns Which Is Better

Five Reasons Why You Should Invest In An ELSS In This Financial Year

Mutualfundwala

ELSS Comparison With Other Investment Enrichwise

ELSS ELSS Tax Benefits In Hindi 2022

https://www.indiainfoline.com/knowledge-center/...

ELSS funds are the only type of funds that give investor tax benefit under Section 80C of the Indian Income Tax Act 1961 Read this article to know more about how elss funds are taxed

https://taxguru.in/income-tax/elss-funds-taxability.html

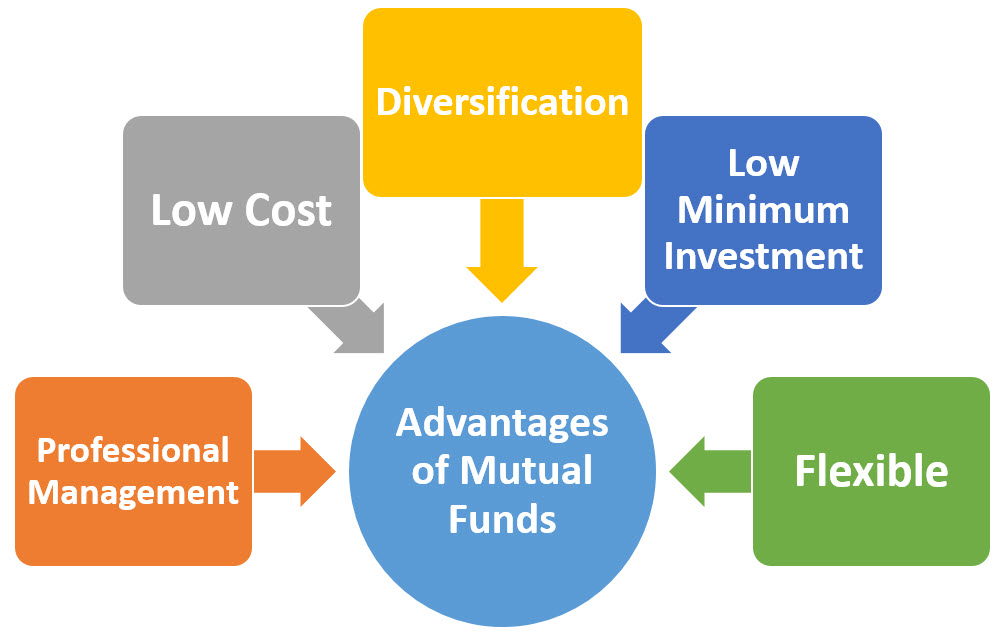

Tax benefits ELSS is known for these tax saving benefits by investing in it investors can claim deductions up to Rs 1 50 000 under section 80C of the Income tax Act Diversified Portfolio By investing in ELSS fund one can enjoy benefits of the diversified portfolio as fund houses invest in different companies with a different market

ELSS funds are the only type of funds that give investor tax benefit under Section 80C of the Indian Income Tax Act 1961 Read this article to know more about how elss funds are taxed

Tax benefits ELSS is known for these tax saving benefits by investing in it investors can claim deductions up to Rs 1 50 000 under section 80C of the Income tax Act Diversified Portfolio By investing in ELSS fund one can enjoy benefits of the diversified portfolio as fund houses invest in different companies with a different market

Mutualfundwala

ELSS Vs PPF Comparison Returns Which Is Better

ELSS Comparison With Other Investment Enrichwise

ELSS ELSS Tax Benefits In Hindi 2022

What Is ELSS Funds Tax Benefit Under 80c On Investing In SIP In Hindi

ELSS Guide All You Need To Know About Tax Saving Mutual Funds Fintrakk

ELSS Guide All You Need To Know About Tax Saving Mutual Funds Fintrakk

ELSS Fund What Is Tax Saving Mutual Fund How To Invest In ELSS