In a world where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. Whether it's for educational purposes as well as creative projects or simply to add an extra personal touch to your home, printables for free have become an invaluable source. We'll dive to the depths of "Electic Vehicle Tax Rebate Status," exploring their purpose, where they are available, and the ways that they can benefit different aspects of your life.

Get Latest Electic Vehicle Tax Rebate Status Below

.png)

Electic Vehicle Tax Rebate Status

Electic Vehicle Tax Rebate Status -

Web 16 ao 251 t 2022 nbsp 0183 32 To assist consumers identifying eligible vehicles the Department of Transportation and Department of Energy published new resources today to help those interested in claiming tax credits for an electric vehicle purchased after the Inflation Reduction Act s enactment on August 16 2022

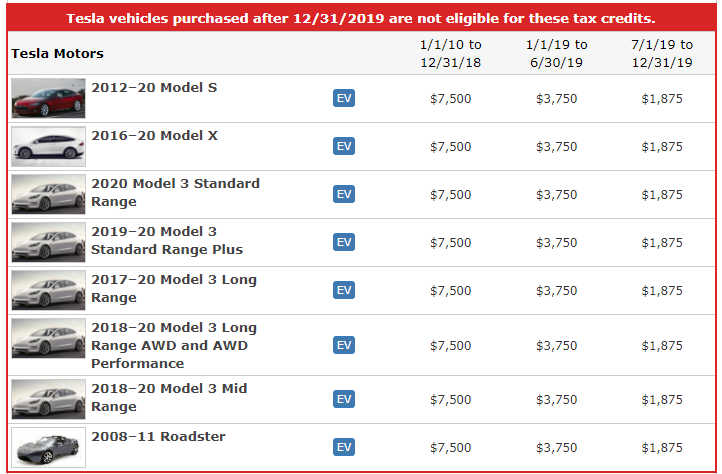

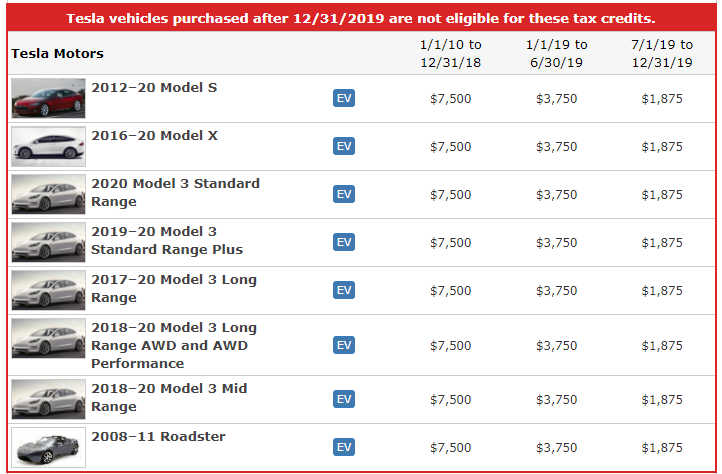

Web 27 ao 251 t 2022 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks

Electic Vehicle Tax Rebate Status encompass a wide collection of printable documents that can be downloaded online at no cost. The resources are offered in a variety types, like worksheets, coloring pages, templates and many more. The benefit of Electic Vehicle Tax Rebate Status is their flexibility and accessibility.

More of Electic Vehicle Tax Rebate Status

Do Electric Cars Still Qualify For A Tax Rebate ElectricRebate

Do Electric Cars Still Qualify For A Tax Rebate ElectricRebate

Web 7 janv 2023 nbsp 0183 32 If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit has an income cap too 150 000 for a household 75 000 for a

Web 7 mai 2022 nbsp 0183 32 1 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

customization: We can customize printing templates to your own specific requirements for invitations, whether that's creating them planning your schedule or even decorating your home.

-

Educational value: Printables for education that are free are designed to appeal to students of all ages. This makes them a vital instrument for parents and teachers.

-

The convenience of Access to a plethora of designs and templates cuts down on time and efforts.

Where to Find more Electic Vehicle Tax Rebate Status

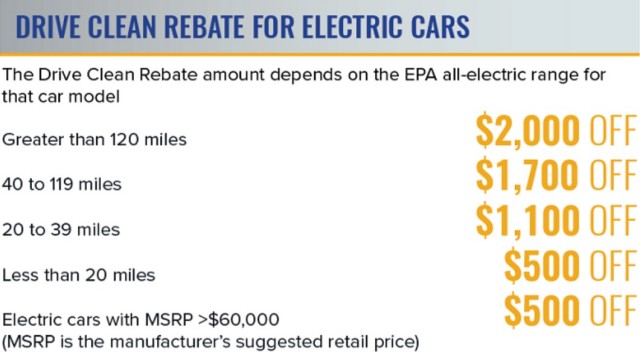

NY 2 000 Electric car Rebate Falls To 500 If It s Over 60K Sorry Tesla

NY 2 000 Electric car Rebate Falls To 500 If It s Over 60K Sorry Tesla

Web New vehicles no more than 60 000 and used vehicles no more than 40 000 purchased on or after July 7 2022 qualify with the following rules New zero emissions vehicle receives 2 500 used zero

Web 5 sept 2023 nbsp 0183 32 The short answer is that very few models currently qualify for the full 7 500 electric vehicle tax credit Others qualify for half that amount and some don t qualify at all

Since we've got your curiosity about Electic Vehicle Tax Rebate Status Let's take a look at where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection and Electic Vehicle Tax Rebate Status for a variety objectives.

- Explore categories like furniture, education, craft, and organization.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. materials.

- This is a great resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- These blogs cover a broad selection of subjects, everything from DIY projects to party planning.

Maximizing Electic Vehicle Tax Rebate Status

Here are some ways how you could make the most use of Electic Vehicle Tax Rebate Status:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living spaces.

2. Education

- Use these printable worksheets free of charge to reinforce learning at home (or in the learning environment).

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars, to-do lists, and meal planners.

Conclusion

Electic Vehicle Tax Rebate Status are a treasure trove with useful and creative ideas that meet a variety of needs and passions. Their availability and versatility make them an invaluable addition to both personal and professional life. Explore the vast world of Electic Vehicle Tax Rebate Status today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly for free?

- Yes you can! You can download and print these resources at no cost.

-

Can I utilize free printing templates for commercial purposes?

- It's contingent upon the specific terms of use. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright problems with Electic Vehicle Tax Rebate Status?

- Some printables may come with restrictions regarding their use. Make sure to read the terms and regulations provided by the designer.

-

How can I print Electic Vehicle Tax Rebate Status?

- Print them at home with any printer or head to an in-store print shop to get top quality prints.

-

What program do I need to open printables that are free?

- A majority of printed materials are in the format PDF. This is open with no cost software like Adobe Reader.

Used Electric Vehicle Rebate

Federal Tax Rebates Electric Vehicles ElectricRebate

Check more sample of Electic Vehicle Tax Rebate Status below

Federal Rebate For Electric Cars FederalProTalk

The Florida Hybrid Car Rebate Save Money And Help The Environment

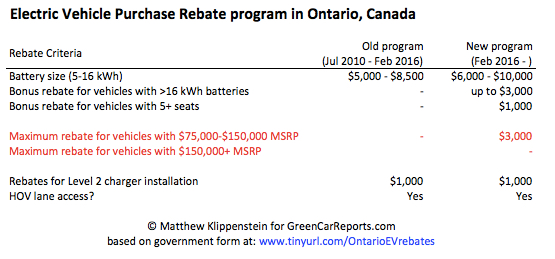

Ontario Ministry Of Transportation Electric Vehicles Rebate Transport

Federal Electric Car Rebate And Tax Withholdings 2023 Carrebate

Ev Car Tax Rebate Calculator 2022 Carrebate

The Electric Car Tax Credit What You Need To Know OsVehicle

.png?w=186)

https://www.nerdwallet.com/.../ev-tax-credit-electric-vehicle-tax-credit

Web 27 ao 251 t 2022 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks

https://www.irs.gov/credits-deductions/credits-for-new-electric...

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Web 27 ao 251 t 2022 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Federal Electric Car Rebate And Tax Withholdings 2023 Carrebate

The Florida Hybrid Car Rebate Save Money And Help The Environment

Ev Car Tax Rebate Calculator 2022 Carrebate

The Electric Car Tax Credit What You Need To Know OsVehicle

Illinois Electric Vehicle Rebate Program LLC To Get Credit Funny

EV Tax Credit Support Climate Nexus May 2019

EV Tax Credit Support Climate Nexus May 2019

Going Green States With The Best Electric Vehicle Tax Incentives The