In this age of electronic devices, with screens dominating our lives however, the attraction of tangible printed objects hasn't waned. Whether it's for educational purposes and creative work, or simply adding some personal flair to your space, Donation For Tax Deduction are a great source. We'll dive through the vast world of "Donation For Tax Deduction," exploring their purpose, where to locate them, and ways they can help you improve many aspects of your daily life.

Get Latest Donation For Tax Deduction Below

Donation For Tax Deduction

Donation For Tax Deduction -

59 1 TurboTax Deluxe Learn More On Intuit s Website Federal Filing Fee 42 95 State Filing Fee 39 95 2 TaxSlayer Premium Learn More On TaxSlayer s Website Federal Filing Fee 0

A corporation may deduct qualified contributions of up to 25 percent of its taxable income Contributions that exceed that amount can carry over to the next tax year To qualify the contribution must be a cash contribution made to a qualifying organization made during the calendar year 2020

Donation For Tax Deduction include a broad range of printable, free materials that are accessible online for free cost. These resources come in many styles, from worksheets to templates, coloring pages and more. The appealingness of Donation For Tax Deduction is in their versatility and accessibility.

More of Donation For Tax Deduction

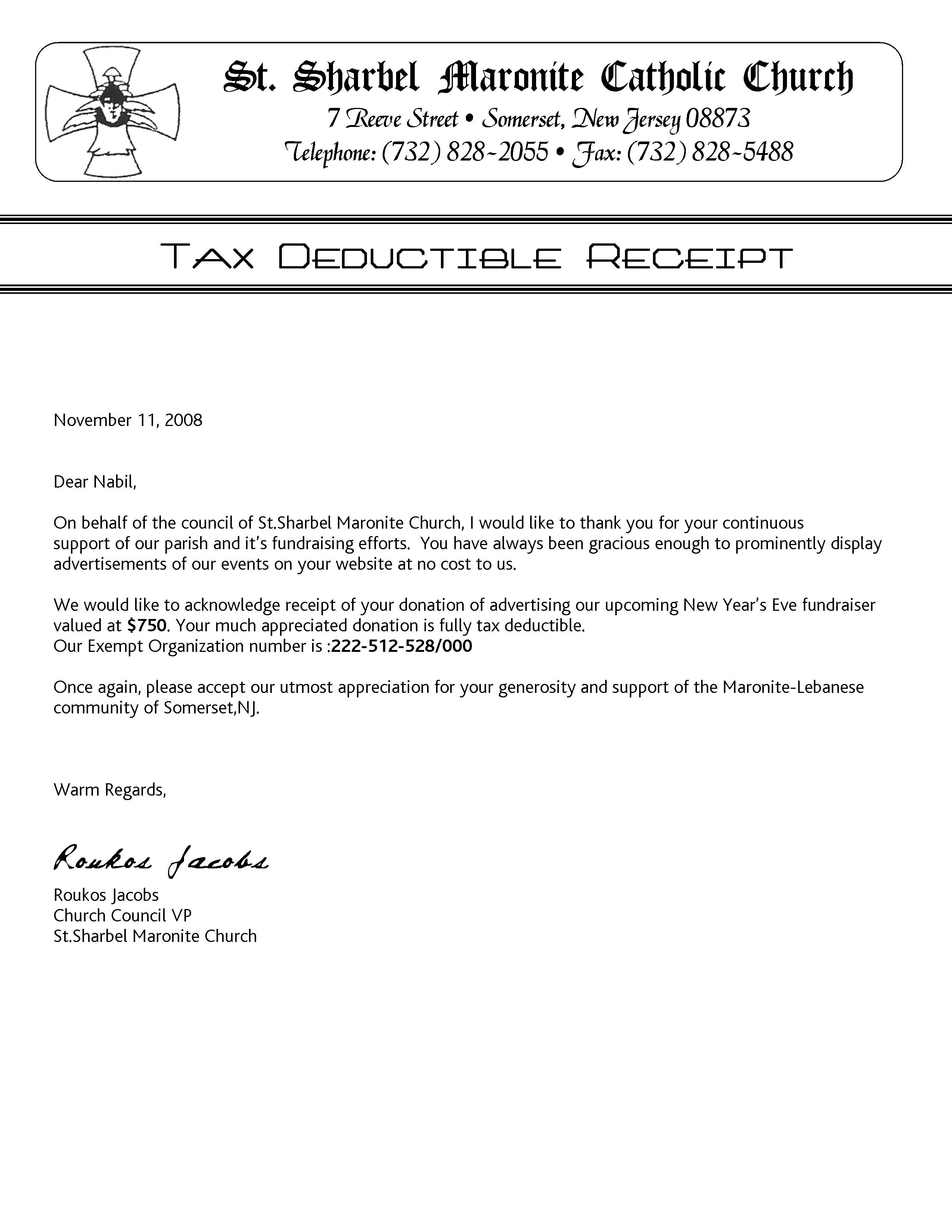

Donation Tax Receipt Template Inspirational 10 Donation Receipt

Donation Tax Receipt Template Inspirational 10 Donation Receipt

What are tax deductible donations These donations are tax deductible Expand all 1 Cash donations for local causes 2 Cash donations for overseas causes 3 Shares donations 4 Artefact donations 5 Donations under the public art tax incentive scheme PATIS 6 Land building donations 7 Naming donations

The Internal Revenue Service has a special new provision that will allow more people to easily deduct up to 300 in donations to qualifying charities this year even if they don t itemize Following special tax law changes made earlier this year cash donations of up to 300 made before December 31 2020 are now deductible when people file

Donation For Tax Deduction have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Personalization This allows you to modify printables to your specific needs whether you're designing invitations or arranging your schedule or even decorating your house.

-

Educational Benefits: Educational printables that can be downloaded for free offer a wide range of educational content for learners of all ages, which makes these printables a powerful tool for teachers and parents.

-

Easy to use: The instant accessibility to various designs and templates can save you time and energy.

Where to Find more Donation For Tax Deduction

Goodwill Printable Donation Receipt Printable World Holiday

Goodwill Printable Donation Receipt Printable World Holiday

Donations may be tax deductible here s what to know Fidelity Viewpoints Key takeaways Charitable donations of cash investments and physical property may be tax deductible But you must itemize to deduct your donations If the standard deduction is larger than your itemized deductions you would use that instead

Charitable giving tax deduction limits are set by the IRS as a percentage of your income Cash contributions in 2023 and 2024 can make up 60 of your AGI The limit for appreciated assets in 2023 and 2024 including stock is 30 of your AGI Contributions must be made to a qualified organization

We hope we've stimulated your interest in Donation For Tax Deduction Let's see where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Donation For Tax Deduction suitable for many objectives.

- Explore categories such as the home, decor, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- Ideal for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- These blogs cover a broad selection of subjects, all the way from DIY projects to planning a party.

Maximizing Donation For Tax Deduction

Here are some ideas ensure you get the very most use of Donation For Tax Deduction:

1. Home Decor

- Print and frame stunning art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use these printable worksheets free of charge to enhance learning at home, or even in the classroom.

3. Event Planning

- Design invitations and banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Donation For Tax Deduction are a treasure trove filled with creative and practical information that satisfy a wide range of requirements and interests. Their accessibility and flexibility make them a fantastic addition to the professional and personal lives of both. Explore the vast array of Donation For Tax Deduction now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes, they are! You can print and download these free resources for no cost.

-

Can I make use of free printing templates for commercial purposes?

- It's all dependent on the conditions of use. Always consult the author's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Certain printables may be subject to restrictions regarding their use. Be sure to review the terms and conditions set forth by the creator.

-

How can I print Donation For Tax Deduction?

- You can print them at home using any printer or head to an in-store print shop to get high-quality prints.

-

What program do I require to open printables at no cost?

- The majority of printed documents are in the format of PDF, which can be opened with free software like Adobe Reader.

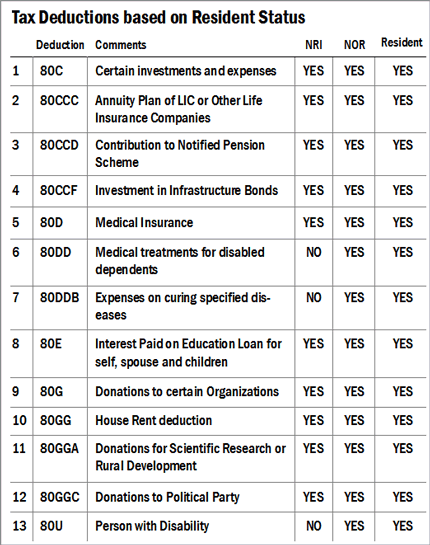

Income Tax Deduction U s 80C 80U Rajput Jain Associates

6 Donation Thank You Letters Donation Thank You Letter Thank You

Check more sample of Donation For Tax Deduction below

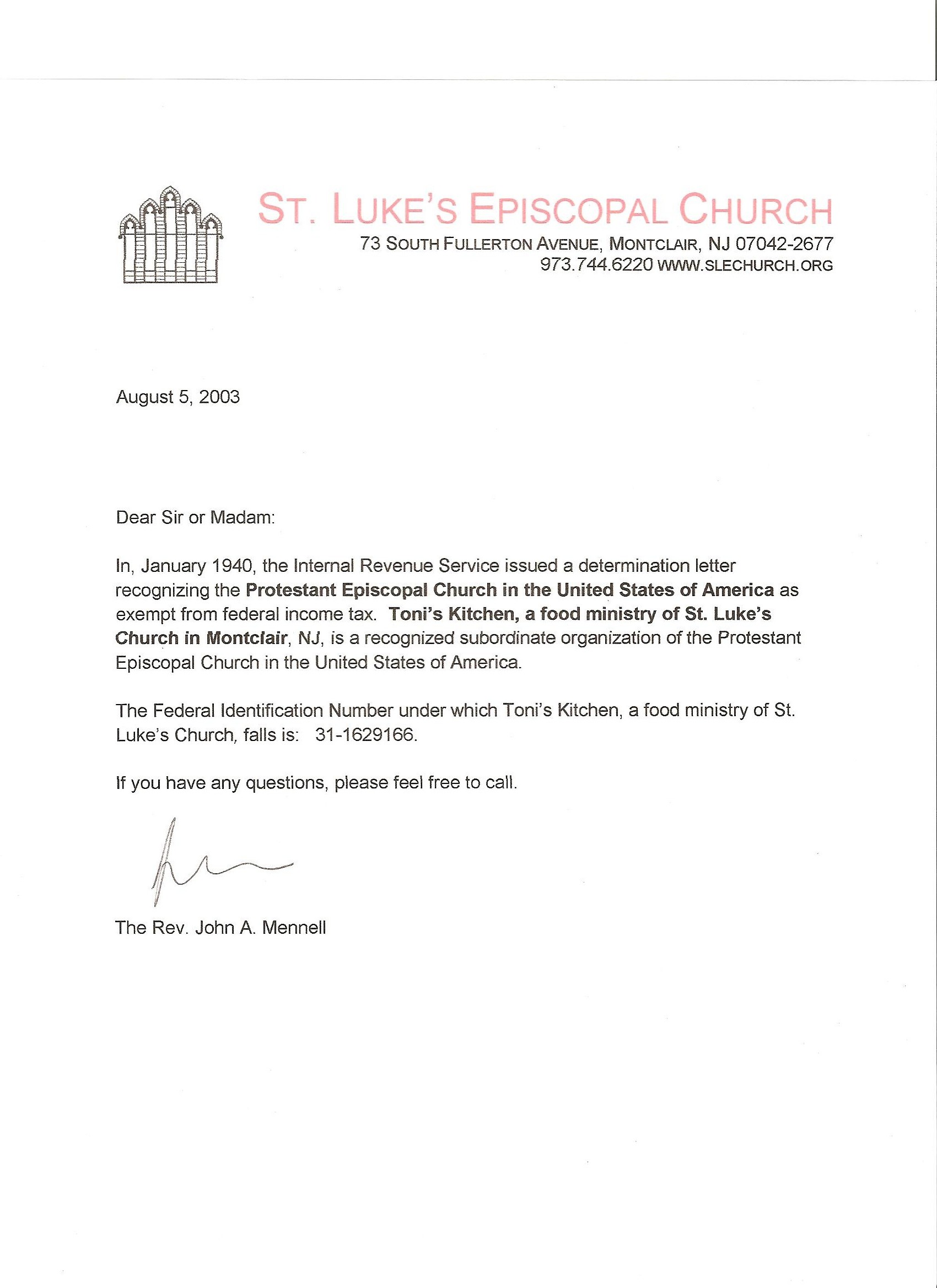

Church Donation Letter Template Fill Out Sign Online And Download

Donation Letter Template For Tax Purposes Examples Letter Template

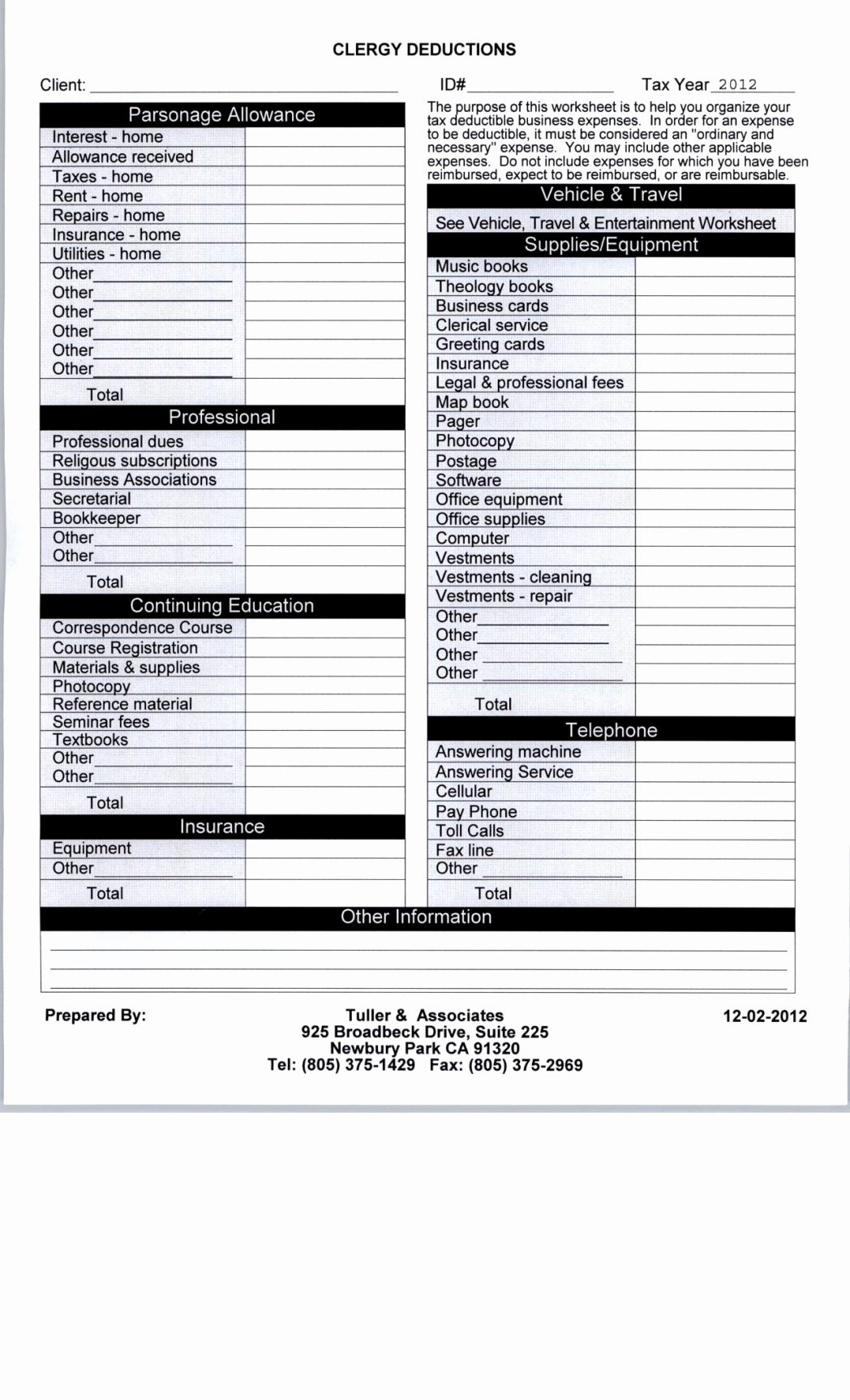

Printable Itemized Deductions Worksheet

Free Goodwill Donation Receipt Template Pdf Eforms Free Goodwill

Church Donation Letter For Tax Purposes Charlotte Clergy Coalition

Income Tax Deductions Income Tax Deductions List Pdf Gambaran

https://www.irs.gov/charities-non-profits/...

A corporation may deduct qualified contributions of up to 25 percent of its taxable income Contributions that exceed that amount can carry over to the next tax year To qualify the contribution must be a cash contribution made to a qualifying organization made during the calendar year 2020

https://www.investopedia.com/articles/personal...

The deductible amount is 20 if the contribution is 40 and the FMV of the T shirt is 20 Donated Goods and FMV Charitable contribution deductions are allowed for donations of goods such as

A corporation may deduct qualified contributions of up to 25 percent of its taxable income Contributions that exceed that amount can carry over to the next tax year To qualify the contribution must be a cash contribution made to a qualifying organization made during the calendar year 2020

The deductible amount is 20 if the contribution is 40 and the FMV of the T shirt is 20 Donated Goods and FMV Charitable contribution deductions are allowed for donations of goods such as

Free Goodwill Donation Receipt Template Pdf Eforms Free Goodwill

Donation Letter Template For Tax Purposes Examples Letter Template

Church Donation Letter For Tax Purposes Charlotte Clergy Coalition

Income Tax Deductions Income Tax Deductions List Pdf Gambaran

Donation Worksheet Goodwill

How Much Do You Need To Donate For Tax Deduction

How Much Do You Need To Donate For Tax Deduction

Chapter VI A 80G Deduction For Donation To Charitable Institution