In the digital age, where screens rule our lives, the charm of tangible printed items hasn't gone away. No matter whether it's for educational uses in creative or artistic projects, or simply adding a personal touch to your home, printables for free have proven to be a valuable resource. The following article is a take a dive to the depths of "Does The State Of Ga Tax Retirement Income," exploring what they are, how they are available, and the ways that they can benefit different aspects of your lives.

Get Latest Does The State Of Ga Tax Retirement Income Below

Does The State Of Ga Tax Retirement Income

Does The State Of Ga Tax Retirement Income -

Georgia Retirement Taxes Social Security is tax exempt Georgia offers an income tax exclusion to taxpayers who are 62 years of age or older or individuals with a total and permanent

Yes as Georgia does not tax Social Security and provides a deduction of 65 000 per person on all types of retirement income for anyone age 65 and older If you re age 62 to 64 this deduction drops to 35 000

Does The State Of Ga Tax Retirement Income offer a wide collection of printable resources available online for download at no cost. They are available in numerous designs, including worksheets templates, coloring pages, and more. The appealingness of Does The State Of Ga Tax Retirement Income is in their variety and accessibility.

More of Does The State Of Ga Tax Retirement Income

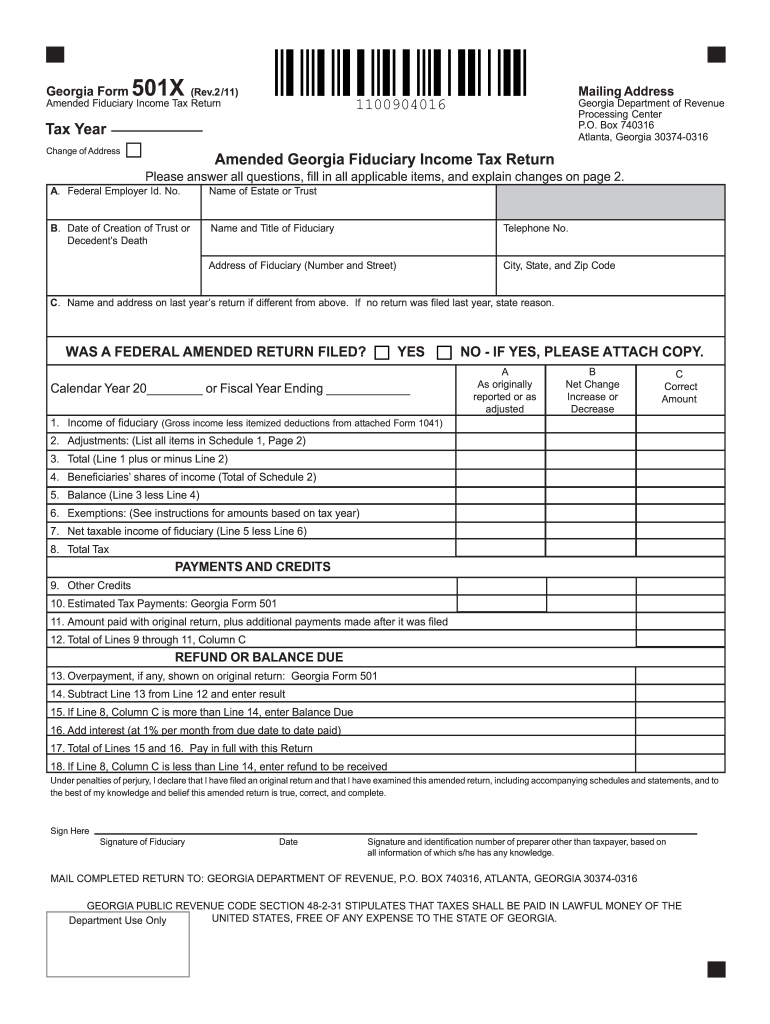

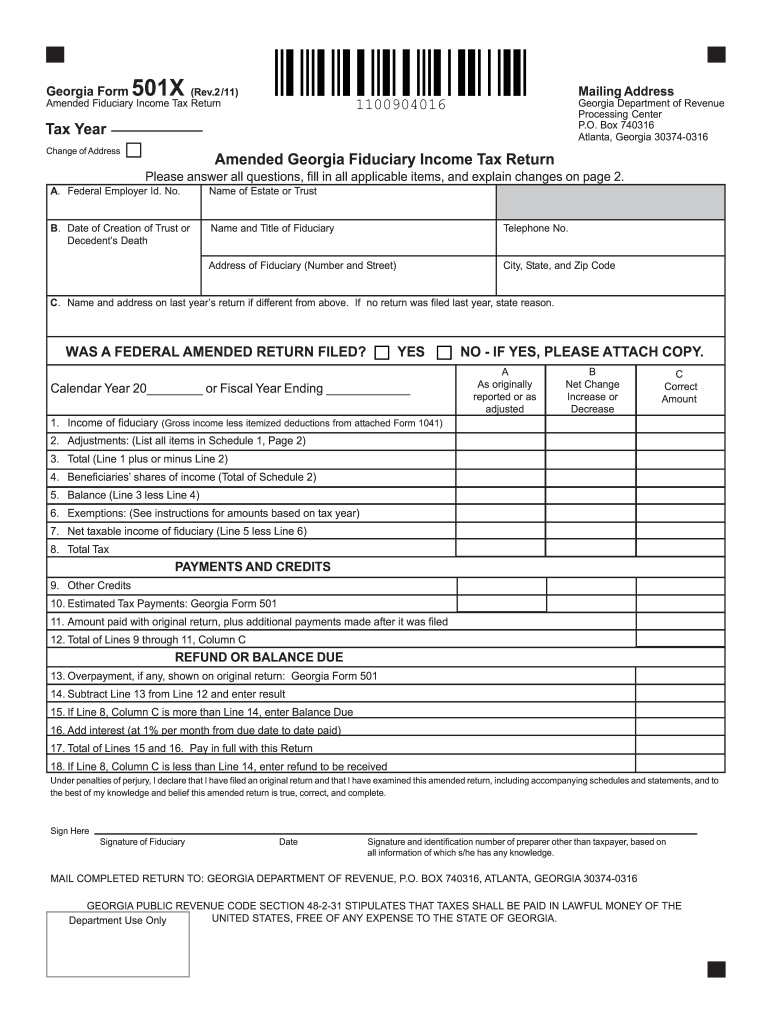

Ga Income Tax Form Fill Out And Sign Printable PDF Template SignNow

Ga Income Tax Form Fill Out And Sign Printable PDF Template SignNow

The state does not tax Social Security benefits withdrawals from pensions and retirement accounts are only partially taxed and anyone over 62 or who are permanently disabled

You may see an increase in the net amount of your retirement benefit beginning with your January 31 2024 payment Governor Kemp signed HB 1437 into law on April 26 2022

Does The State Of Ga Tax Retirement Income have risen to immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Individualization They can make printed materials to meet your requirements in designing invitations, organizing your schedule, or even decorating your home.

-

Education Value Education-related printables at no charge offer a wide range of educational content for learners of all ages. This makes them a great tool for parents and teachers.

-

It's easy: immediate access an array of designs and templates cuts down on time and efforts.

Where to Find more Does The State Of Ga Tax Retirement Income

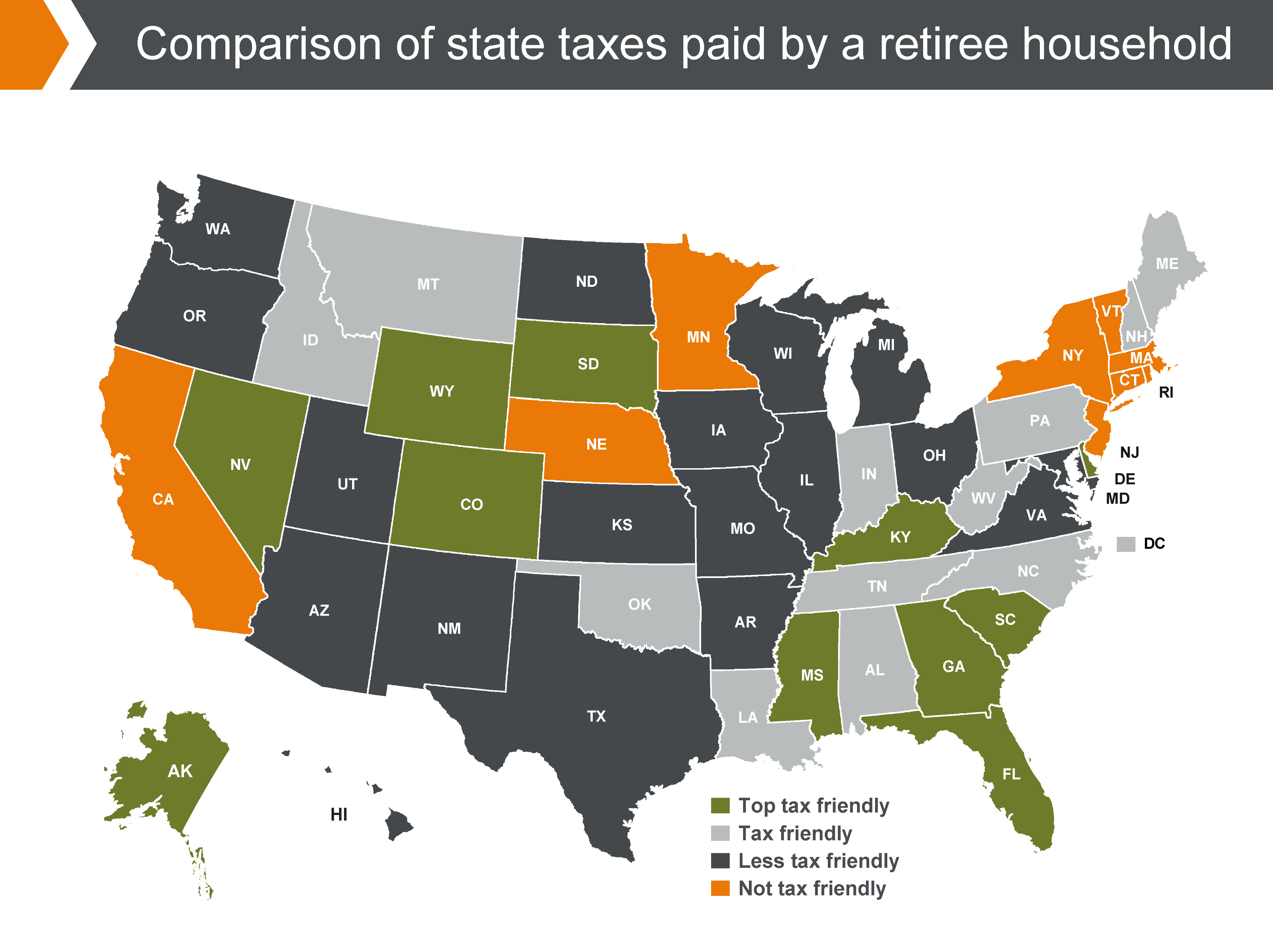

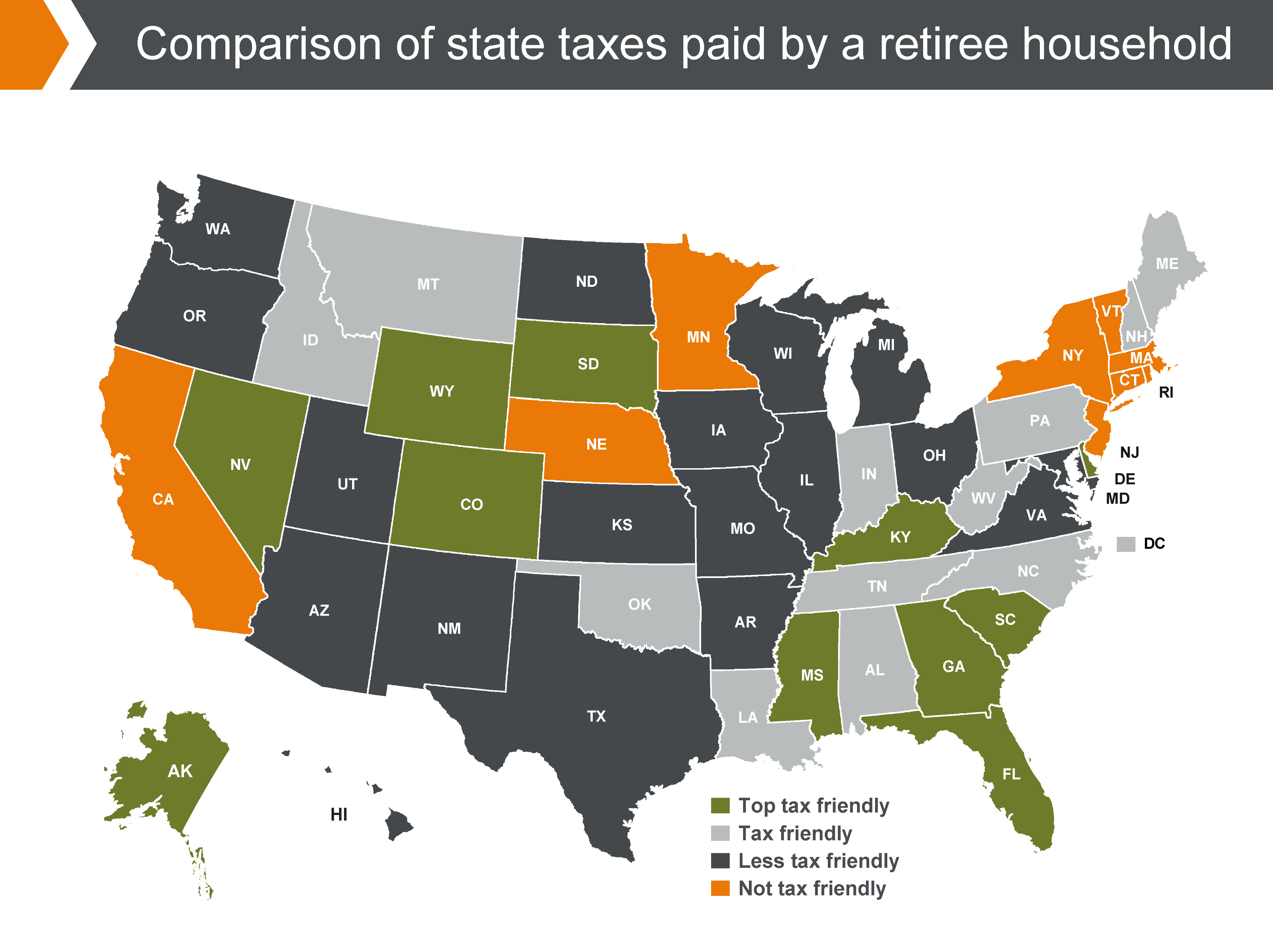

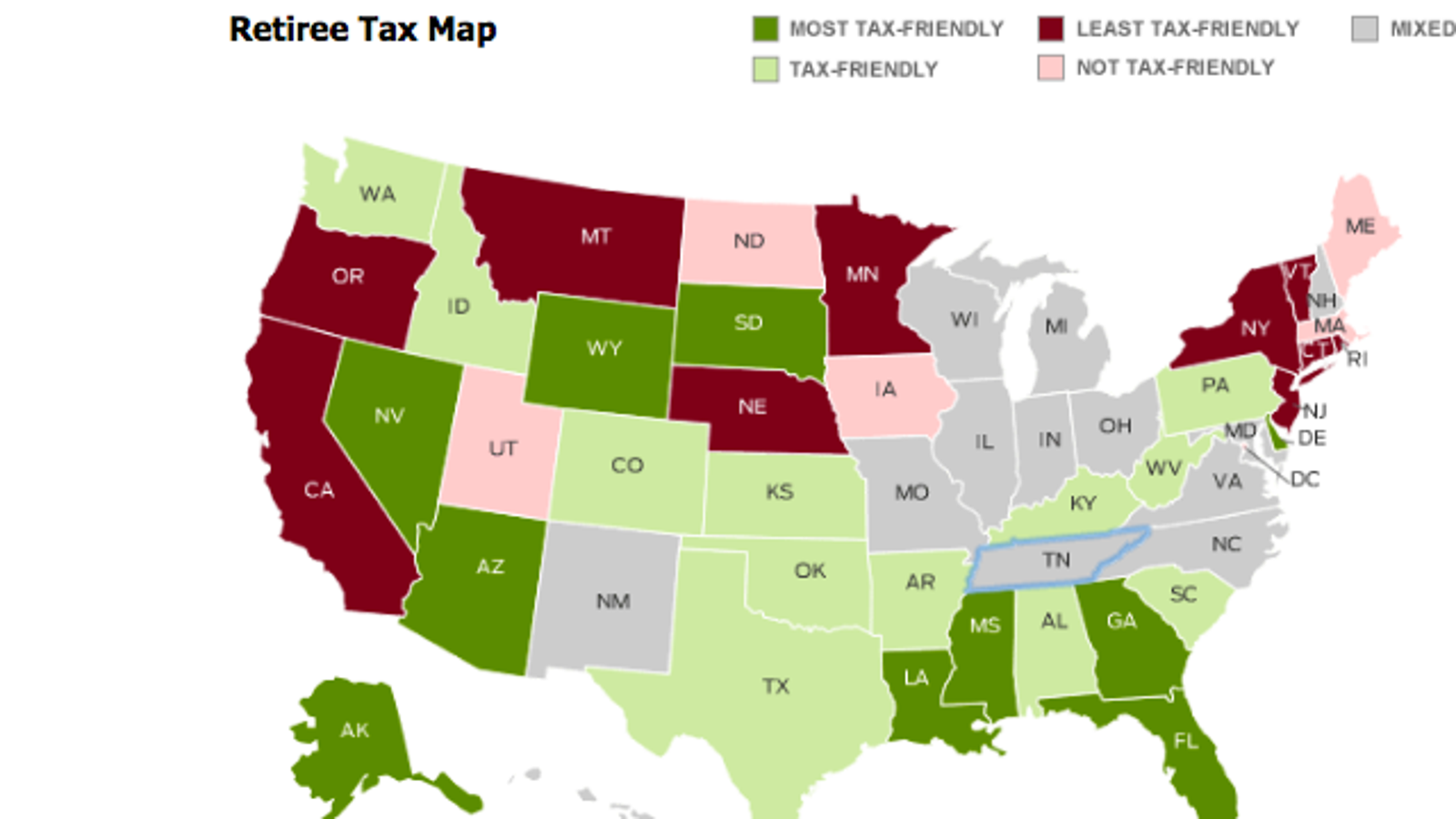

State by State Guide To Taxes On Retirees Flagel Huber Flagel

State by State Guide To Taxes On Retirees Flagel Huber Flagel

Georgia allows for taxpayers to subtract a portion of their retirement income on their Georgia return The maximum retirement exclusion for taxpayers that are 62 64 years

Georgia state income taxes depend on taxable income and residency status In 2024 the state transitioned from a bracket system to a flat tax rate of 5 49 Retirement Retirement planning

We hope we've stimulated your interest in printables for free and other printables, let's discover where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Does The State Of Ga Tax Retirement Income to suit a variety of objectives.

- Explore categories such as interior decor, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free Flashcards, worksheets, and other educational tools.

- Ideal for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- These blogs cover a broad range of interests, starting from DIY projects to party planning.

Maximizing Does The State Of Ga Tax Retirement Income

Here are some ideas to make the most use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or even seasonal decorations to decorate your living spaces.

2. Education

- Use free printable worksheets to help reinforce your learning at home as well as in the class.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

Does The State Of Ga Tax Retirement Income are an abundance of practical and imaginative resources that satisfy a wide range of requirements and interest. Their accessibility and versatility make them an invaluable addition to both professional and personal lives. Explore the vast array of Does The State Of Ga Tax Retirement Income and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes they are! You can print and download these items for free.

-

Does it allow me to use free templates for commercial use?

- It's based on the rules of usage. Be sure to read the rules of the creator before utilizing printables for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables may come with restrictions concerning their use. Always read these terms and conditions as set out by the creator.

-

How do I print Does The State Of Ga Tax Retirement Income?

- Print them at home with an printer, or go to a local print shop to purchase top quality prints.

-

What program do I need to open Does The State Of Ga Tax Retirement Income?

- The majority are printed as PDF files, which can be opened with free software, such as Adobe Reader.

State by State Guide To Taxes On Retirees Retirement Retirement

Every State With A Progressive Tax Also Taxes Retirement Income

Check more sample of Does The State Of Ga Tax Retirement Income below

States That Won t Tax Your Retirement Distributions In 2021

Map Here Are The Best And Worst U S States For Retirement Cashay

States That Don t Tax Military Retirement Pay Discover Here

7 States That Do Not Tax Retirement Income

Georgia Sales Tax Exemption Form St 5 ExemptForm

States With The Highest and Lowest Taxes For Retirees Money

https:// smartasset.com /.../georgia-retirem…

Yes as Georgia does not tax Social Security and provides a deduction of 65 000 per person on all types of retirement income for anyone age 65 and older If you re age 62 to 64 this deduction drops to 35 000

https:// dor.georgia.gov /retirees-faq

A retirement exclusion is allowed provided the taxpayer is 62 years of age or older or the taxpayer is totally and permanently disabled Retirement income includes items such

Yes as Georgia does not tax Social Security and provides a deduction of 65 000 per person on all types of retirement income for anyone age 65 and older If you re age 62 to 64 this deduction drops to 35 000

A retirement exclusion is allowed provided the taxpayer is 62 years of age or older or the taxpayer is totally and permanently disabled Retirement income includes items such

7 States That Do Not Tax Retirement Income

Map Here Are The Best And Worst U S States For Retirement Cashay

Georgia Sales Tax Exemption Form St 5 ExemptForm

States With The Highest and Lowest Taxes For Retirees Money

Pay Less Retirement Taxes

15 States That Don t Tax Retirement Income Pensions Social Security

15 States That Don t Tax Retirement Income Pensions Social Security

The Most Tax Friendly States For Retirement