In this age of technology, with screens dominating our lives, the charm of tangible printed material hasn't diminished. Whether it's for educational purposes or creative projects, or simply adding an extra personal touch to your area, Does The Federal Government Tax Pensions And Social Security are now a useful resource. This article will dive to the depths of "Does The Federal Government Tax Pensions And Social Security," exploring their purpose, where they are available, and how they can enrich various aspects of your life.

Get Latest Does The Federal Government Tax Pensions And Social Security Below

Does The Federal Government Tax Pensions And Social Security

Does The Federal Government Tax Pensions And Social Security -

Are my wages exempt from federal income tax withholding Determine if your retirement income is taxable Use the Interactive Tax Assistant to get retirement income information including pensions IRAs and Social Security Social Security and railroad retirement benefits Determine if these benefits are taxable Review the tax rules

The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits Social Security benefits include monthly retirement survivor and disability benefits They don t include supplemental security income payments which aren t taxable

Does The Federal Government Tax Pensions And Social Security cover a large variety of printable, downloadable resources available online for download at no cost. These printables come in different designs, including worksheets coloring pages, templates and more. The appeal of printables for free lies in their versatility as well as accessibility.

More of Does The Federal Government Tax Pensions And Social Security

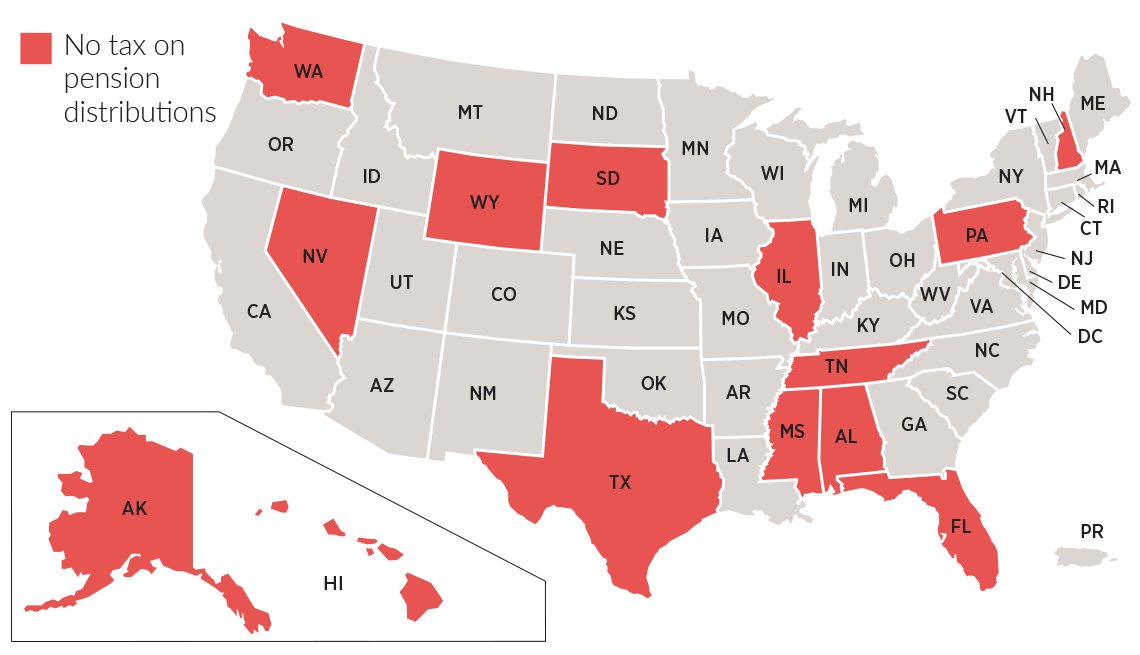

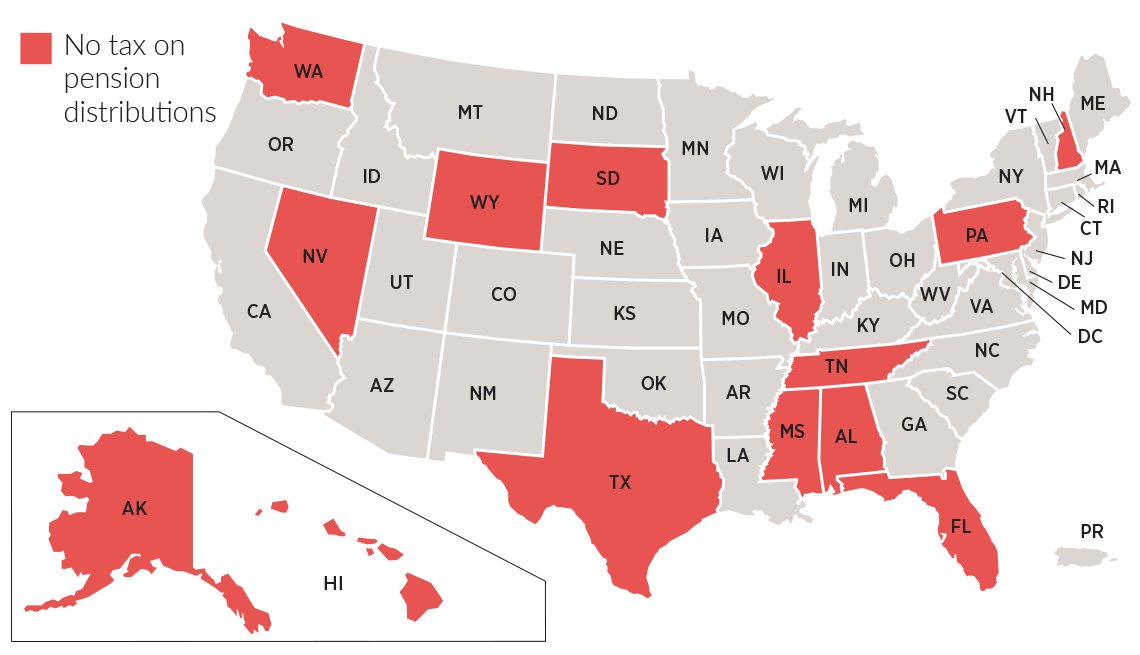

Social Security Benefits What Are The Best States To Retire For Taxes

Social Security Benefits What Are The Best States To Retire For Taxes

Social Security income is generally taxable at the federal level though whether or not you have to pay taxes on your Social Security benefits depends on your income level If you have other sources of retirement income such as a 401 k or a part time job then you should expect to pay some income taxes on your Social Security

The taxable part of your pension or annuity payments is generally subject to federal income tax withholding You may be able to choose not to have income tax withheld from your pension or annuity payments or may want to specify how much tax is withheld

Does The Federal Government Tax Pensions And Social Security have risen to immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Customization: This allows you to modify designs to suit your personal needs when it comes to designing invitations making your schedule, or decorating your home.

-

Education Value Educational printables that can be downloaded for free are designed to appeal to students of all ages, which makes the perfect instrument for parents and teachers.

-

An easy way to access HTML0: instant access numerous designs and templates will save you time and effort.

Where to Find more Does The Federal Government Tax Pensions And Social Security

State by State Guide To Taxes On Retirees Flagel Huber Flagel

State by State Guide To Taxes On Retirees Flagel Huber Flagel

You must pay taxes on up to 85 of your Social Security benefits if you file a Federal tax return as an individual and your combined income exceeds 25 000 Joint return and you and your spouse have combined income of more than 32 000

If your total income is more than 25 000 for an individual or 32 000 for a married couple filing jointly you must pay federal income taxes on your Social Security benefits Below those thresholds your benefits are not taxed

We hope we've stimulated your curiosity about Does The Federal Government Tax Pensions And Social Security, let's explore where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Does The Federal Government Tax Pensions And Social Security to suit a variety of uses.

- Explore categories such as decoration for your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing, flashcards, and learning materials.

- Ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- The blogs covered cover a wide range of interests, everything from DIY projects to party planning.

Maximizing Does The Federal Government Tax Pensions And Social Security

Here are some inventive ways how you could make the most of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or other seasonal decorations to fill your living spaces.

2. Education

- Use these printable worksheets free of charge to build your knowledge at home and in class.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions like weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars checklists for tasks, as well as meal planners.

Conclusion

Does The Federal Government Tax Pensions And Social Security are a treasure trove filled with creative and practical information that can meet the needs of a variety of people and passions. Their availability and versatility make them a valuable addition to every aspect of your life, both professional and personal. Explore the vast world of Does The Federal Government Tax Pensions And Social Security today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really free?

- Yes, they are! You can download and print these items for free.

-

Can I use free printing templates for commercial purposes?

- It's determined by the specific conditions of use. Make sure you read the guidelines for the creator prior to printing printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Certain printables could be restricted regarding usage. Be sure to check these terms and conditions as set out by the author.

-

How can I print printables for free?

- Print them at home with your printer or visit any local print store for higher quality prints.

-

What software must I use to open printables that are free?

- The majority are printed in the format of PDF, which can be opened with free software like Adobe Reader.

Are You Due A Huge Pension Tax Refund Which News

14 States That Don t Tax Pensions AND Social Security

Check more sample of Does The Federal Government Tax Pensions And Social Security below

Retiring These States Won t Tax Your Distributions

Social Security Income Inflation Protection

Government Spending The Meme Policeman

Here s Where Your Federal Income Tax Dollars Go NBC News

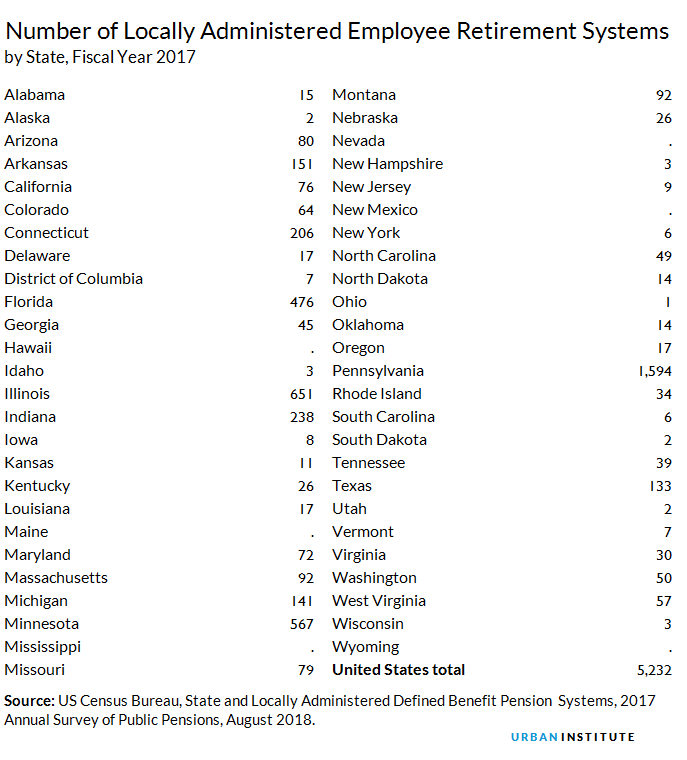

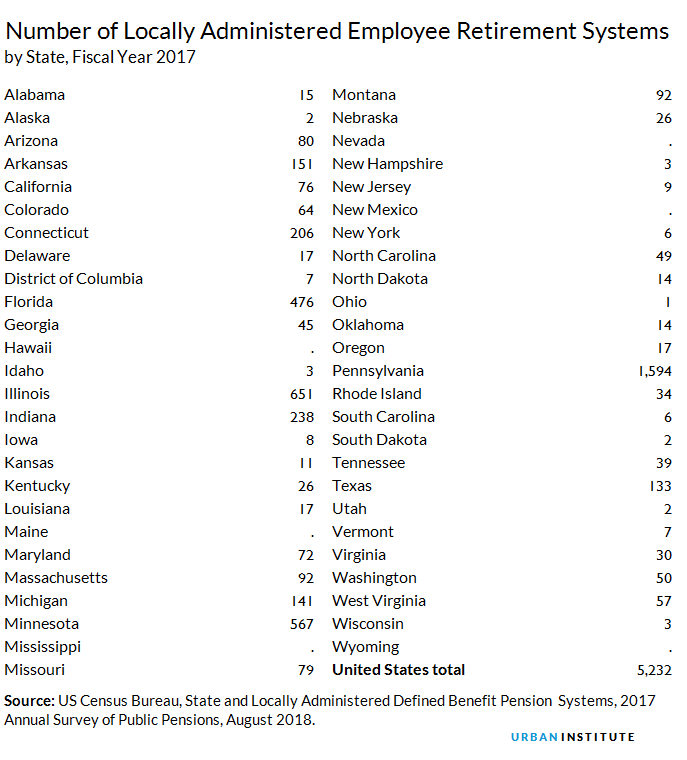

State And Local Government Pensions Urban Institute

What States Do Not Tax Federal Pensions Government Deal Funding

https://www.irs.gov/newsroom/irs-reminds-taxpayers...

The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits Social Security benefits include monthly retirement survivor and disability benefits They don t include supplemental security income payments which aren t taxable

https://www.kiplinger.com/taxes/how-retirement-income-is-taxed

Social Security Benefits Depending on provisional income up to 85 of Social Security benefits can be taxed by the IRS at ordinary income tax rates Pensions Pension payments are

The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits Social Security benefits include monthly retirement survivor and disability benefits They don t include supplemental security income payments which aren t taxable

Social Security Benefits Depending on provisional income up to 85 of Social Security benefits can be taxed by the IRS at ordinary income tax rates Pensions Pension payments are

Here s Where Your Federal Income Tax Dollars Go NBC News

Social Security Income Inflation Protection

State And Local Government Pensions Urban Institute

What States Do Not Tax Federal Pensions Government Deal Funding

Social Security What Laws May Affect Government Pensions

14 States Don t Tax Retirement Pension Payouts

14 States Don t Tax Retirement Pension Payouts

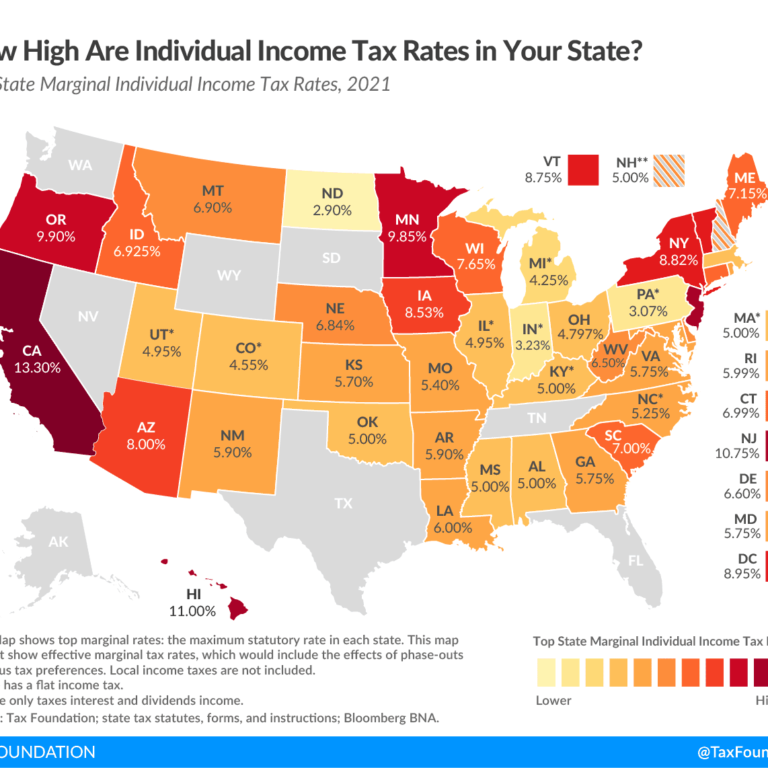

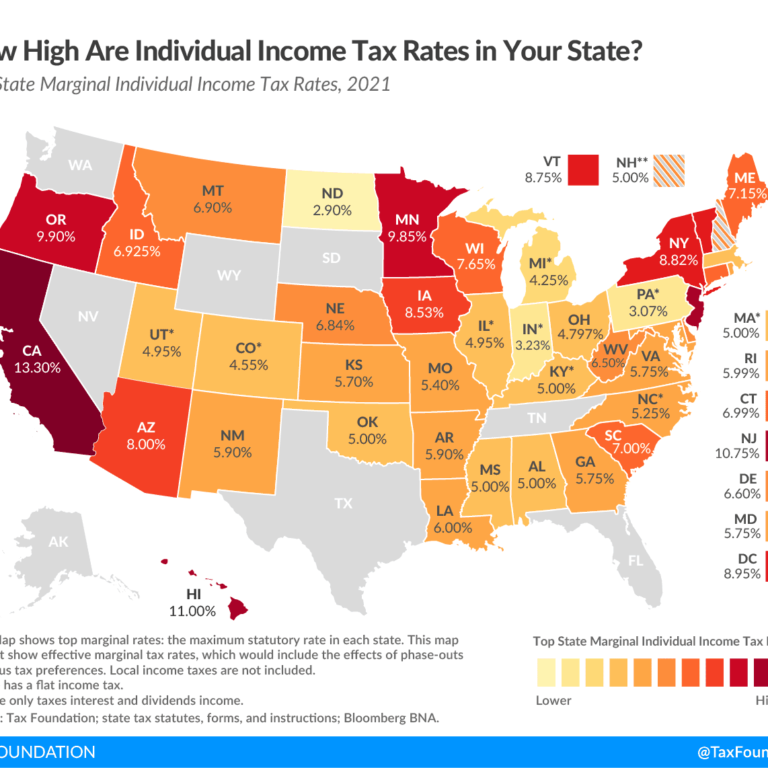

Sources Of US Tax Revenue By Tax Type 2022 Tax Foundation