In a world in which screens are the norm The appeal of tangible printed materials hasn't faded away. Whatever the reason, whether for education as well as creative projects or just adding the personal touch to your area, Does Texas Have Sales Tax can be an excellent source. With this guide, you'll take a dive into the sphere of "Does Texas Have Sales Tax," exploring the benefits of them, where to locate them, and how they can add value to various aspects of your daily life.

Get Latest Does Texas Have Sales Tax Below

Does Texas Have Sales Tax

Does Texas Have Sales Tax -

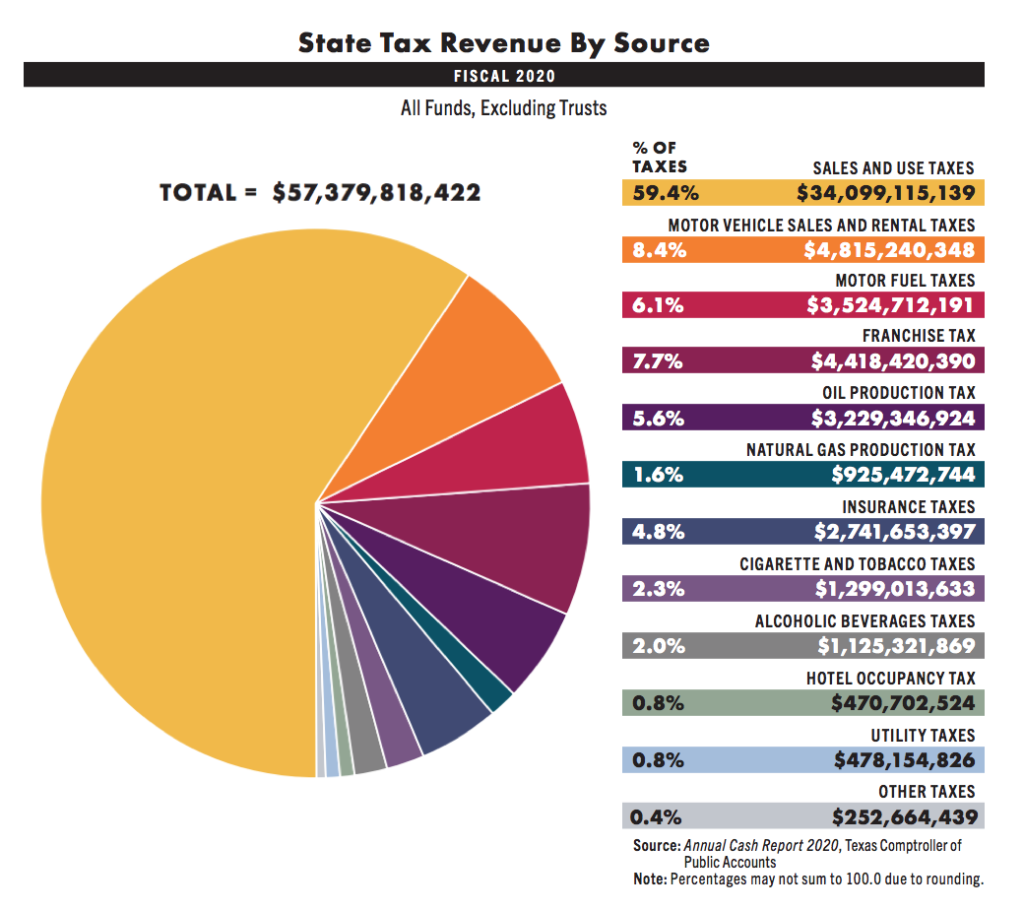

Sales tax The state sales tax rate is 6 25 percent on all retail sales rentals leases taxable services and goods unless that item or service is exempt Use tax The use tax is the sales tax s partner The state imposes this tax on the consumption and storage of tangible personal property or services that are taxable

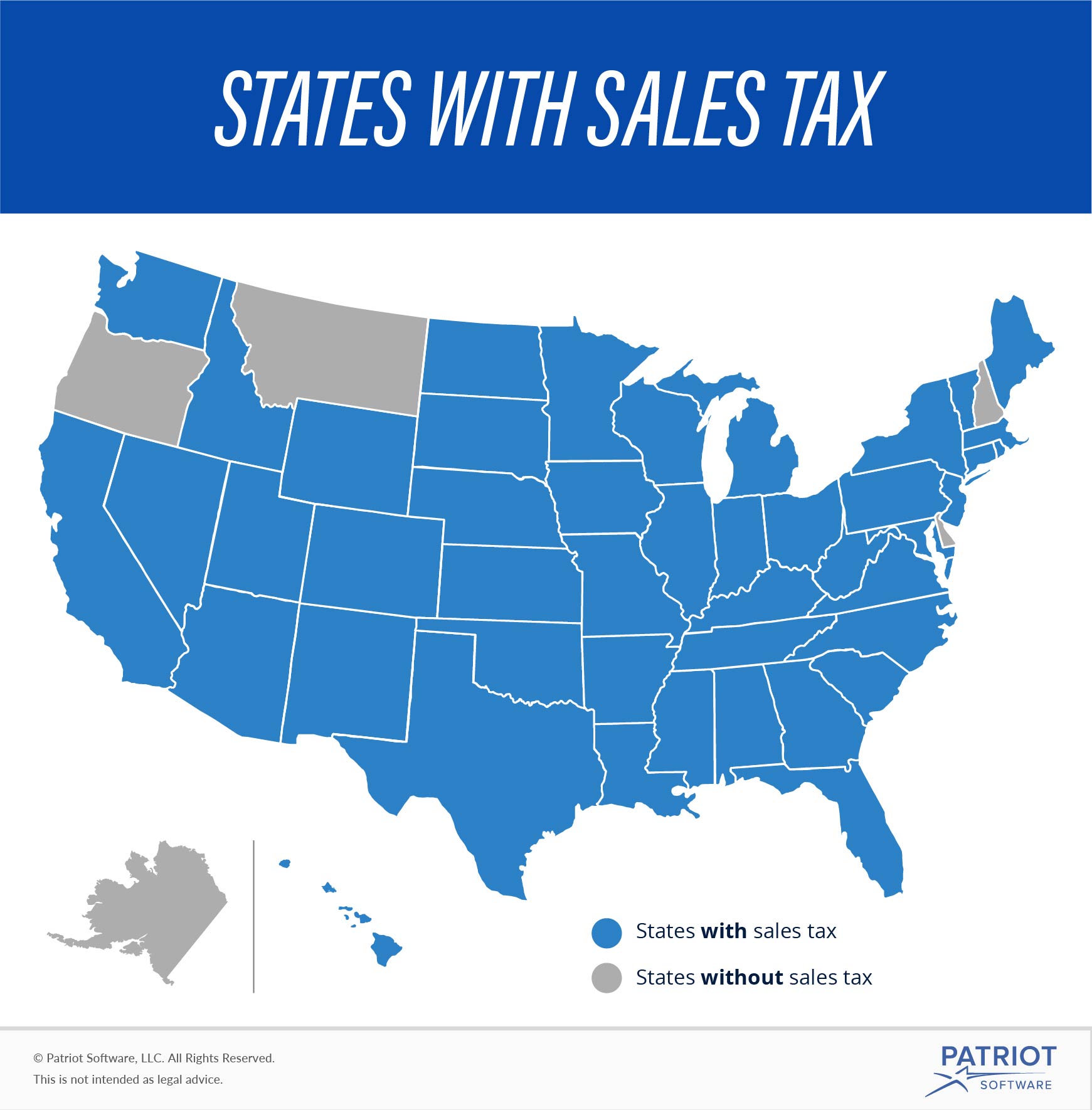

Texas has no income tax and it doesn t tax estates either Its inheritance tax was repealed in 2015 The sales tax is 6 25 at the state level and local taxes can be added on Texas also imposes a cigarette tax a gas tax and a hotel tax There s no personal property tax except on property used for business purposes

Does Texas Have Sales Tax encompass a wide range of printable, free material that is available online at no cost. They are available in numerous forms, like worksheets templates, coloring pages and more. The attraction of printables that are free is in their versatility and accessibility.

More of Does Texas Have Sales Tax

Hawaii Sales Taxes Highest Per Capita In USA Hawaii Free Press

Hawaii Sales Taxes Highest Per Capita In USA Hawaii Free Press

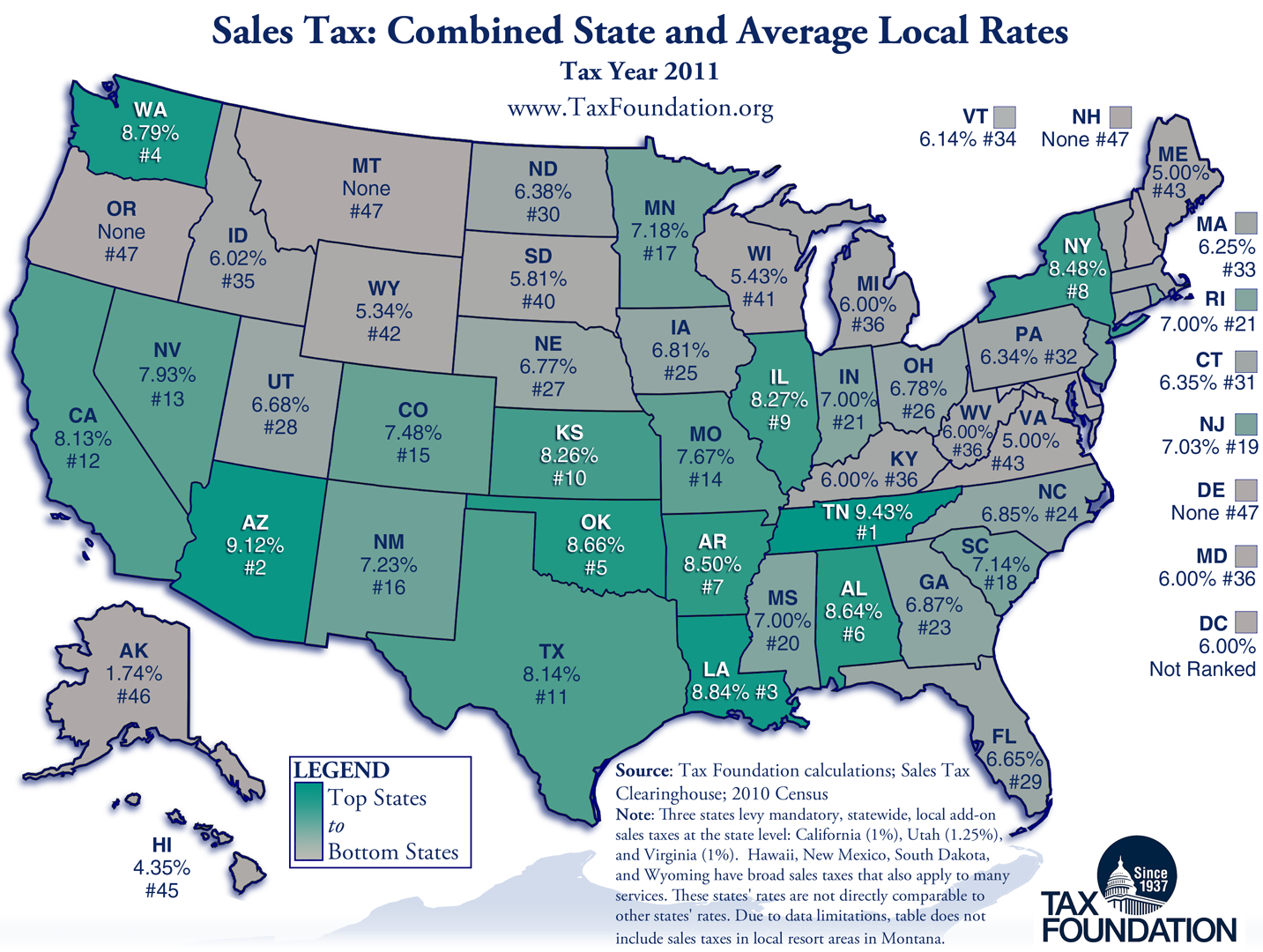

Texas has state sales tax of 6 25 and allows local governments to collect a local option sales tax of up to 2 There are a total of 982 local tax jurisdictions across the state collecting an average local tax of 1 697 Click here for a larger sales tax map or here for a sales tax table

An overview of Texas sales and use tax Sales tax is a tax paid to state and local tax authorities in Texas for the sale of certain goods and services First adopted in 1961 and known as the Limited Sales and Use Tax sales tax is most commonly collected from the buyer at the point of sale Municiple sales tax was enacted in 1967

Does Texas Have Sales Tax have garnered immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

Individualization The Customization feature lets you tailor the templates to meet your individual needs be it designing invitations as well as organizing your calendar, or even decorating your house.

-

Education Value Printables for education that are free are designed to appeal to students of all ages. This makes them an invaluable instrument for parents and teachers.

-

Affordability: immediate access a variety of designs and templates reduces time and effort.

Where to Find more Does Texas Have Sales Tax

Ranking State And Local Sales Taxes Tax Foundation Texas Sales Tax

Ranking State And Local Sales Taxes Tax Foundation Texas Sales Tax

The Texas state sales and use tax rate is 6 25 percent but local taxing jurisdictions cities counties special purpose districts and transit authorities also may impose sales and use tax up to 2 percent for a total maximum combined rate of 8 25 percent You will be required to collect both state and local sales and use taxes

Sales Tax Collection Am I required to separately state the sales tax amount to my customers Is it ok to round the tax amount What happens if I do not collect tax or collect the wrong amount Are barters and exchanges taxable Are delivery or shipping charges taxable Browse FAQs by Topic Texas Sales and Use tax FAQs about sales tax

We hope we've stimulated your interest in Does Texas Have Sales Tax and other printables, let's discover where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Does Texas Have Sales Tax designed for a variety needs.

- Explore categories such as decorations for the home, education and organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. materials.

- Ideal for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates, which are free.

- These blogs cover a wide array of topics, ranging ranging from DIY projects to party planning.

Maximizing Does Texas Have Sales Tax

Here are some creative ways how you could make the most use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Use printable worksheets for free for reinforcement of learning at home and in class.

3. Event Planning

- Design invitations, banners, and decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Does Texas Have Sales Tax are an abundance of practical and innovative resources catering to different needs and pursuits. Their accessibility and flexibility make them an essential part of both professional and personal life. Explore the world of Does Texas Have Sales Tax and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really gratis?

- Yes you can! You can print and download these items for free.

-

Can I utilize free printouts for commercial usage?

- It's all dependent on the rules of usage. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Certain printables could be restricted on use. Be sure to read the terms and conditions set forth by the creator.

-

How do I print printables for free?

- You can print them at home with either a printer or go to an in-store print shop to get superior prints.

-

What software must I use to open printables that are free?

- The majority of printed documents are in PDF format. They can be opened using free programs like Adobe Reader.

What Are The Tax Rates In Texas Texapedia

The Union Role In Our Growing Taxocracy California Policy Center

Check more sample of Does Texas Have Sales Tax below

State And Local Sales Tax Rates Midyear 2013 Tax Foundation Texas

Texas Sales and Use Tax permit LEO TakeDown

Is Texas Sales Tax Recoverable

Sales Tax By State Here s How Much You re Really Paying Sales Tax

Texas Sales Tax Small Business Guide TRUiC

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

https://www.thebalancemoney.com/taxes-in-texas-a...

Texas has no income tax and it doesn t tax estates either Its inheritance tax was repealed in 2015 The sales tax is 6 25 at the state level and local taxes can be added on Texas also imposes a cigarette tax a gas tax and a hotel tax There s no personal property tax except on property used for business purposes

https://comptroller.texas.gov/taxes/sales/faq/use.php

The Texas state sales and use tax is 6 25 percent but local taxing jurisdictions cities counties special purpose districts and transit authorities may also impose sales and use tax up to 2 percent for a total maximum combined rate of 8 25 percent

Texas has no income tax and it doesn t tax estates either Its inheritance tax was repealed in 2015 The sales tax is 6 25 at the state level and local taxes can be added on Texas also imposes a cigarette tax a gas tax and a hotel tax There s no personal property tax except on property used for business purposes

The Texas state sales and use tax is 6 25 percent but local taxing jurisdictions cities counties special purpose districts and transit authorities may also impose sales and use tax up to 2 percent for a total maximum combined rate of 8 25 percent

Sales Tax By State Here s How Much You re Really Paying Sales Tax

Texas Sales and Use Tax permit LEO TakeDown

Texas Sales Tax Small Business Guide TRUiC

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Taxes Are Surprisingly Similar In Texas And California Mother Jones

How To Register For A Sales Tax Permit TaxJar

How To Register For A Sales Tax Permit TaxJar

Texas Exemption Certificate TUTORE ORG Master Of Documents