Today, when screens dominate our lives yet the appeal of tangible printed objects hasn't waned. In the case of educational materials and creative work, or simply to add a personal touch to your home, printables for free are now a vital resource. In this article, we'll take a dive into the world of "Does Tax Exempt Apply To Food," exploring the different types of printables, where you can find them, and what they can do to improve different aspects of your life.

Get Latest Does Tax Exempt Apply To Food Below

Does Tax Exempt Apply To Food

Does Tax Exempt Apply To Food -

The Food Tax Grocery Tax by State Most states don t have a food tax But these 13 states still tax groceries

Answering your questions about Ontario s Harmonized Sales Tax Here are examples of common products and services and how they will be affected by the HST CLOTHING AND FOOTWEAR GST taxable before July 1 2010 PST taxable before July 1 2010

Does Tax Exempt Apply To Food encompass a wide variety of printable, downloadable material that is available online at no cost. The resources are offered in a variety forms, including worksheets, coloring pages, templates and much more. The benefit of Does Tax Exempt Apply To Food is their versatility and accessibility.

More of Does Tax Exempt Apply To Food

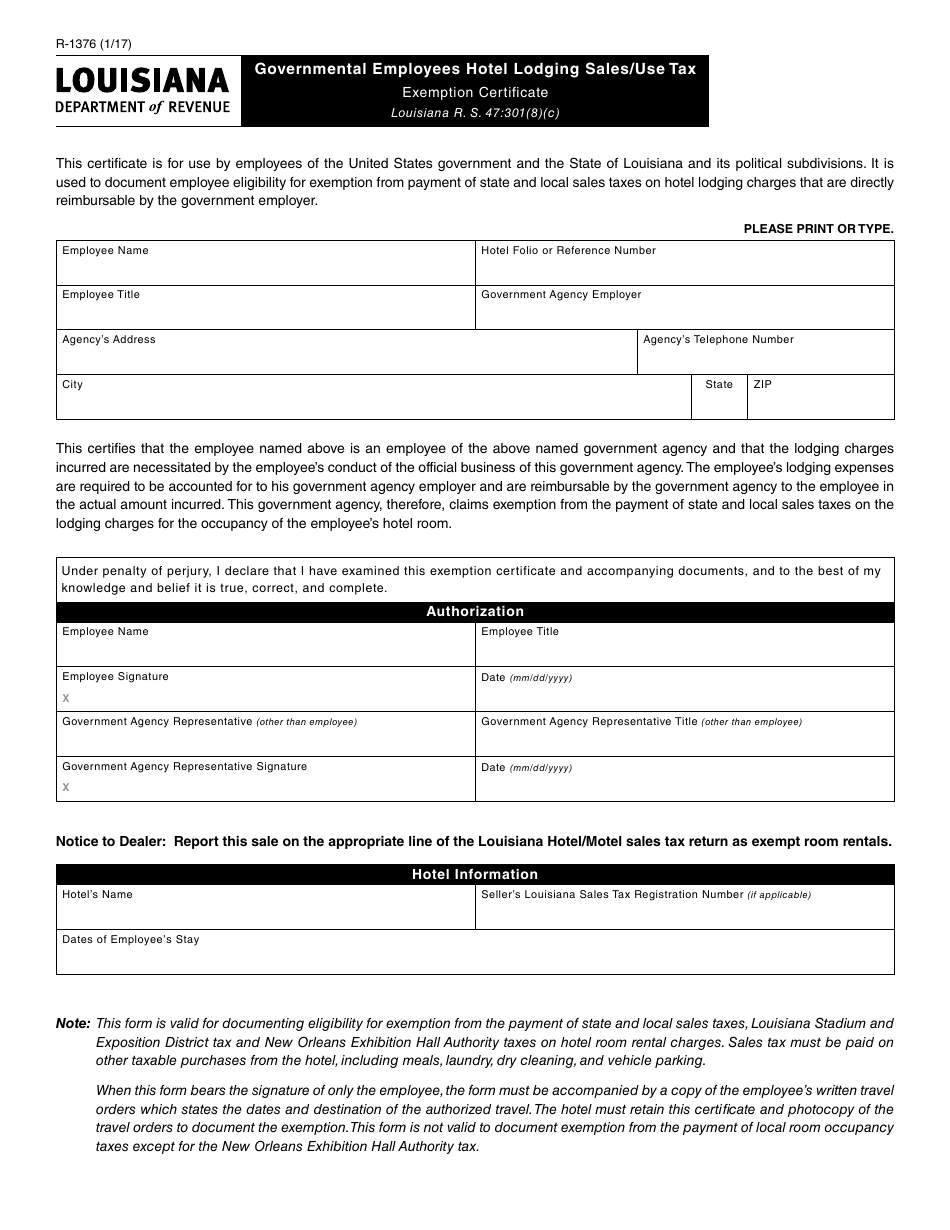

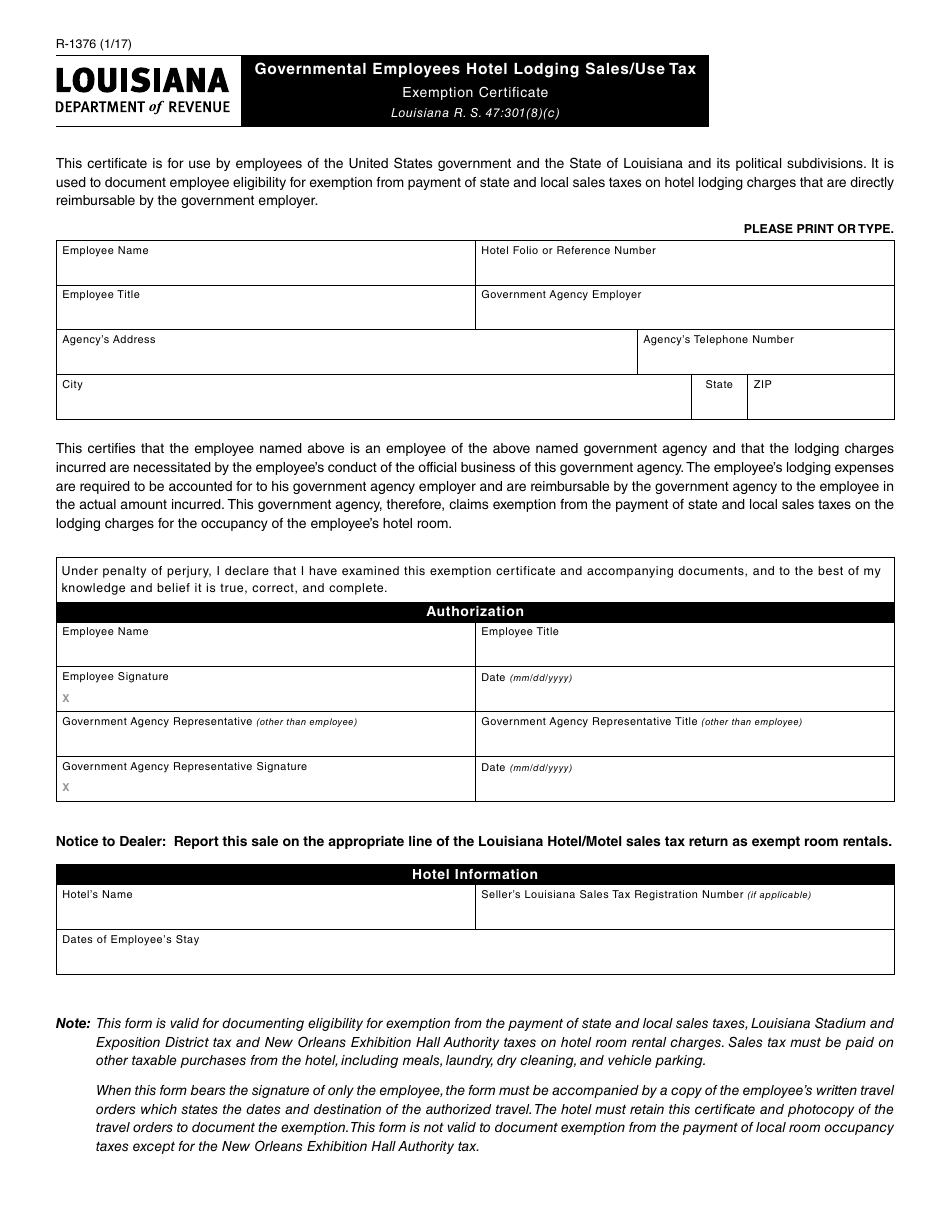

Form R 1376 Fill Out Sign Online And Download Fillable PDF

Form R 1376 Fill Out Sign Online And Download Fillable PDF

This memorandum provides detailed information on zero rated basic grocery products as they relate to the goods and services tax harmonized sales tax GST HST provisions of the Excise Tax Act the Act

Five OECD member countries apply a zero rate exemption GST free to specific food items These are Australia Canada Mexico Ireland and the United Kingdom However most European countries apply reduced rates to various food items or exempt them from GST or value added tax VAT as it is called in many countries as input taxed supplies

The Does Tax Exempt Apply To Food have gained huge recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Flexible: There is the possibility of tailoring printing templates to your own specific requirements, whether it's designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational value: Educational printables that can be downloaded for free can be used by students of all ages, making them an invaluable tool for parents and teachers.

-

An easy way to access HTML0: instant access numerous designs and templates, which saves time as well as effort.

Where to Find more Does Tax Exempt Apply To Food

California Sales Tax Exemption Certificate Video Bokep Ngentot

California Sales Tax Exemption Certificate Video Bokep Ngentot

However complimentary food or drink provided by such businesses in connection with the purchase of a meal is considered part of the taxable meal sold and use tax is not due Examples include chips and salsa rolls or bread appetizers or desserts

Sales of the following types of food products for consumption off the premises of the retailer are exempt from tax Retailer prepared food for immediate consumption candy candy coated items candy products and certain beverages are taxable

In the event that we've stirred your interest in printables for free Let's find out where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Does Tax Exempt Apply To Food suitable for many applications.

- Explore categories such as home decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free with flashcards and other teaching materials.

- Ideal for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- The blogs covered cover a wide range of topics, ranging from DIY projects to party planning.

Maximizing Does Tax Exempt Apply To Food

Here are some inventive ways how you could make the most use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use free printable worksheets to aid in learning at your home and in class.

3. Event Planning

- Create invitations, banners, and decorations for special events such as weddings and birthdays.

4. Organization

- Stay organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Does Tax Exempt Apply To Food are an abundance of practical and imaginative resources that cater to various needs and needs and. Their accessibility and flexibility make them an invaluable addition to both professional and personal life. Explore the world that is Does Tax Exempt Apply To Food today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly free?

- Yes they are! You can print and download these files for free.

-

Are there any free printouts for commercial usage?

- It's all dependent on the terms of use. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright violations with Does Tax Exempt Apply To Food?

- Certain printables might have limitations regarding usage. Always read the terms and conditions offered by the designer.

-

How can I print printables for free?

- Print them at home with either a printer at home or in the local print shop for more high-quality prints.

-

What software do I require to open printables at no cost?

- The majority of printed documents are in the format of PDF, which can be opened with free software, such as Adobe Reader.

Listings Of Taxable And Exempt Foods And Beverages Sold By Food Stores

5 Steps To Forming A Tax exempt Nonprofit Corporation CHL Law

Check more sample of Does Tax Exempt Apply To Food below

What Does Tax exempt Mean YouTube

Image Of 2020 IRS Form 1040 With Line 2a Highlighted

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

How Does Tax Exempt IU Contribute To Bloomington YouTube

Properly Using A Sales Tax Resale Certificate For Your Small Business

Nevada Tax Exemption Fill Online Printable Fillable Blank PdfFiller

https:// cpa.ca /cpasite/UserFiles/Documents/...

Answering your questions about Ontario s Harmonized Sales Tax Here are examples of common products and services and how they will be affected by the HST CLOTHING AND FOOTWEAR GST taxable before July 1 2010 PST taxable before July 1 2010

https:// totalfood.com /making-sense-of-sales-tax-exemption-certificates

Sales and use taxes apply to most purchase and sale transactions conducted by a restaurant However certain transactions are tax exempt at restaurants Understanding when an exemption applies and how to document that exemption through the proper use of an exemption certificate is a necessary piece of the sales tax puzzle

Answering your questions about Ontario s Harmonized Sales Tax Here are examples of common products and services and how they will be affected by the HST CLOTHING AND FOOTWEAR GST taxable before July 1 2010 PST taxable before July 1 2010

Sales and use taxes apply to most purchase and sale transactions conducted by a restaurant However certain transactions are tax exempt at restaurants Understanding when an exemption applies and how to document that exemption through the proper use of an exemption certificate is a necessary piece of the sales tax puzzle

How Does Tax Exempt IU Contribute To Bloomington YouTube

Image Of 2020 IRS Form 1040 With Line 2a Highlighted

Properly Using A Sales Tax Resale Certificate For Your Small Business

Nevada Tax Exemption Fill Online Printable Fillable Blank PdfFiller

Tax Exempt Fill Out And Sign Printable PDF Template SignNow

What Does Tax Exempt Mean Capital One

What Does Tax Exempt Mean Capital One

How To Apply For Federal Tax Exempt Status For Your Nonprofit YouTube