In the age of digital, where screens have become the dominant feature of our lives, the charm of tangible printed materials isn't diminishing. If it's to aid in education such as creative projects or just adding some personal flair to your home, printables for free have become a valuable resource. Through this post, we'll dive into the world "Does South Carolina Tax Withdrawals From Retirement Accounts," exploring the benefits of them, where they are available, and how they can enhance various aspects of your lives.

Get Latest Does South Carolina Tax Withdrawals From Retirement Accounts Below

Does South Carolina Tax Withdrawals From Retirement Accounts

Does South Carolina Tax Withdrawals From Retirement Accounts -

RETIREMENT INCOME DEDUCTION South Carolina Code 12 6 1170 A provides an annual deduction from South Carolina taxable income for retirement income to the original owner of a qualified retirement account

After reaching age 65 they may deduct up to 10 000 of such retirement income annually Deduction for those 65 and older Resident individuals who are 65 or older by the end of the tax year are allowed an Income Tax deduction of up to 15 000 against any South Carolina taxable income

Printables for free include a vast range of downloadable, printable materials available online at no cost. These resources come in many types, such as worksheets templates, coloring pages, and many more. The appealingness of Does South Carolina Tax Withdrawals From Retirement Accounts is in their versatility and accessibility.

More of Does South Carolina Tax Withdrawals From Retirement Accounts

I R S Decides Most Special State Payments Are Not Taxable The New

I R S Decides Most Special State Payments Are Not Taxable The New

Is my retirement income taxable to South Carolina South Carolina allows for a deduction in retirement income based off of your age If you are under 65 you can deduct up to 3 000 of qualified retirement income If you are 65 or olde r you can deduct up to 10 000 of qualified retirement income What is Qualified Retirement Income

While retirement income sources like 401 k and IRA plans government pensions and public pensions are taxable they are heavily deductible For taxpayers under age 65 the deduction is 3 000

Does South Carolina Tax Withdrawals From Retirement Accounts have garnered immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

customization It is possible to tailor designs to suit your personal needs, whether it's designing invitations and schedules, or even decorating your house.

-

Educational value: Printing educational materials for no cost offer a wide range of educational content for learners from all ages, making them a useful device for teachers and parents.

-

Convenience: You have instant access a variety of designs and templates can save you time and energy.

Where to Find more Does South Carolina Tax Withdrawals From Retirement Accounts

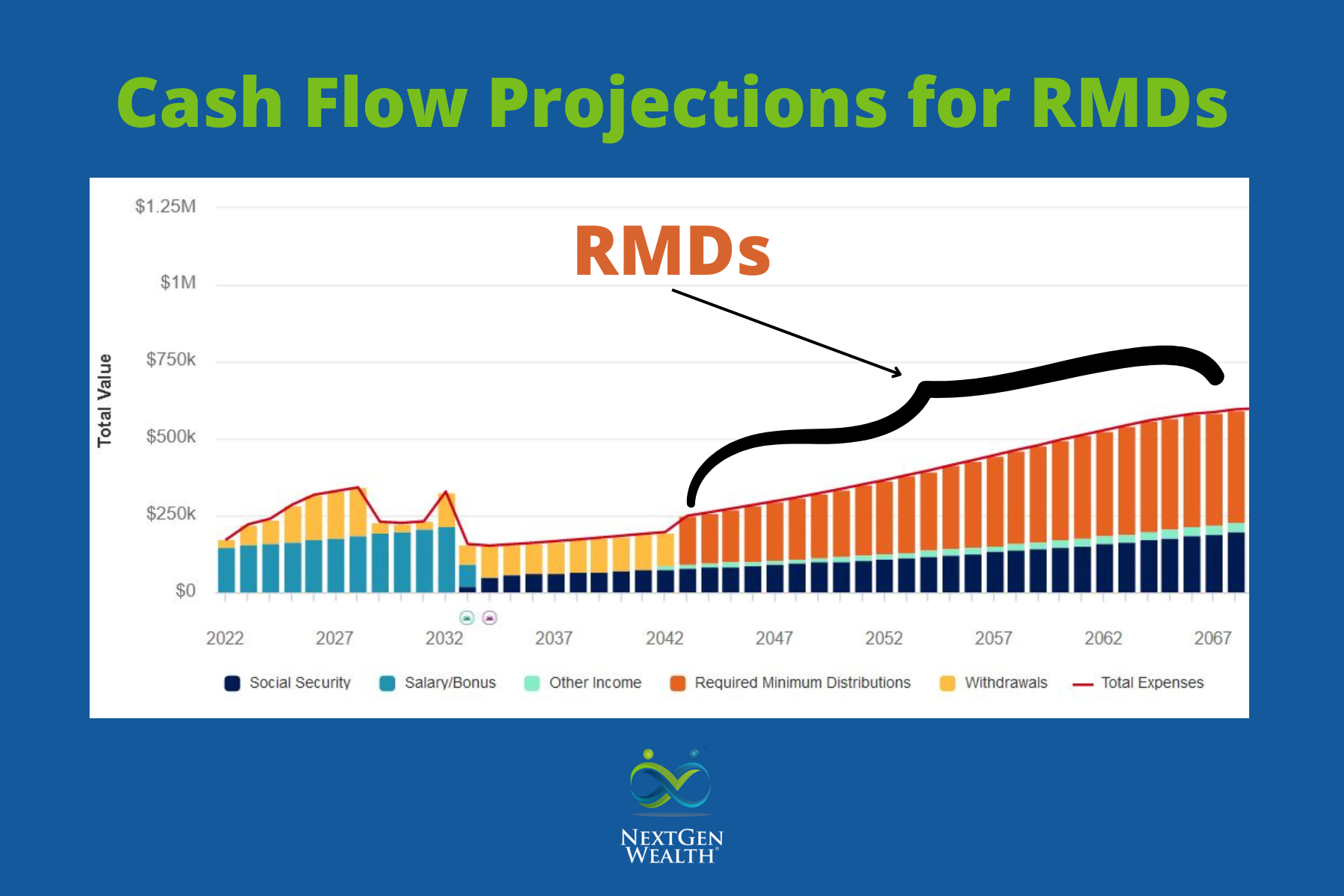

Will Required Minimum Distributions Affect My Retirement

Will Required Minimum Distributions Affect My Retirement

Income Tax on Taxable Income Low of 2 on up to 500 for single filers and 1 000 for joint filers and a high of 5 on more than 3 000 for single filers and 6 000 for joint filers Social

Many taxpayers who hold traditional IRAs or other retirement accounts must make annual withdrawals called Required Minimum Distributions or RMDs The CARES Act waived most RMDs for tax year 2020 and also created special tax rules for 2020 RMDs that were reclassified as coronavirus related distributions

Now that we've ignited your interest in printables for free Let's look into where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Does South Carolina Tax Withdrawals From Retirement Accounts designed for a variety uses.

- Explore categories such as decorating your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- This is a great resource for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- These blogs cover a broad spectrum of interests, ranging from DIY projects to planning a party.

Maximizing Does South Carolina Tax Withdrawals From Retirement Accounts

Here are some innovative ways create the maximum value of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Utilize free printable worksheets to reinforce learning at home as well as in the class.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Does South Carolina Tax Withdrawals From Retirement Accounts are a treasure trove of fun and practical tools that meet a variety of needs and interests. Their accessibility and flexibility make them an essential part of any professional or personal life. Explore the many options of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really for free?

- Yes they are! You can download and print these resources at no cost.

-

Can I use free printables for commercial purposes?

- It's dependent on the particular conditions of use. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Are there any copyright rights issues with Does South Carolina Tax Withdrawals From Retirement Accounts?

- Some printables may have restrictions in their usage. Be sure to check the terms and conditions set forth by the author.

-

How do I print Does South Carolina Tax Withdrawals From Retirement Accounts?

- You can print them at home using the printer, or go to a local print shop to purchase higher quality prints.

-

What program do I require to open printables for free?

- Many printables are offered in PDF format. They is open with no cost software, such as Adobe Reader.

Savvy Tax Withdrawals Fidelity Social Security Benefits 24 Years

Retiring These States Won t Tax Your Distributions

Check more sample of Does South Carolina Tax Withdrawals From Retirement Accounts below

Which Accounts To Tap First In Retirement

States With No Taxes On Retirement Income

Does South Carolina Tax Your Pension JP Real Estate Experts

How The SECURE Act Affects Your Retirement Planning Hassell Wealth

Claiming Military Retiree State Income Tax Exemption In SC Veterans

Penalty Free Withdrawals From Retirement Accounts retirementaccounts

https://dor.sc.gov/resources-site/media-site/Pages/...

After reaching age 65 they may deduct up to 10 000 of such retirement income annually Deduction for those 65 and older Resident individuals who are 65 or older by the end of the tax year are allowed an Income Tax deduction of up to 15 000 against any South Carolina taxable income

https://livewell.com/finance/how-much-will-my...

Published November 27 2023 Learn about the tax implications for your pension in South Carolina and plan your finances wisely Find out how much your pension will be taxed in this comprehensive guide Share Many of the links in this article redirect to a specific reviewed product

After reaching age 65 they may deduct up to 10 000 of such retirement income annually Deduction for those 65 and older Resident individuals who are 65 or older by the end of the tax year are allowed an Income Tax deduction of up to 15 000 against any South Carolina taxable income

Published November 27 2023 Learn about the tax implications for your pension in South Carolina and plan your finances wisely Find out how much your pension will be taxed in this comprehensive guide Share Many of the links in this article redirect to a specific reviewed product

How The SECURE Act Affects Your Retirement Planning Hassell Wealth

States With No Taxes On Retirement Income

Claiming Military Retiree State Income Tax Exemption In SC Veterans

Penalty Free Withdrawals From Retirement Accounts retirementaccounts

NC Gives Veterans Tax Credits On Income And Property Taxes Wfmynews2

Income Tax Diary Income Tax Automated Teller Machine Income Tax Return

Income Tax Diary Income Tax Automated Teller Machine Income Tax Return

Betway Withdrawal Timing For Each Payment Method