Today, when screens dominate our lives yet the appeal of tangible printed objects isn't diminished. If it's to aid in education as well as creative projects or simply adding personal touches to your area, Does South Carolina Tax Retirement Income For Retirees are now an essential resource. This article will take a dive deep into the realm of "Does South Carolina Tax Retirement Income For Retirees," exploring the benefits of them, where you can find them, and how they can be used to enhance different aspects of your life.

Get Latest Does South Carolina Tax Retirement Income For Retirees Below

Does South Carolina Tax Retirement Income For Retirees

Does South Carolina Tax Retirement Income For Retirees -

Additionally South Carolina offers a generous retirement income deduction Individuals who are 65 and older can deduct up to 15 000 of retirement income including

Is South Carolina tax friendly for retirees South Carolina does not tax Social Security retirement benefits whatsoever It provides a substantial deduction on all other types of retirement income including income from

Does South Carolina Tax Retirement Income For Retirees provide a diverse variety of printable, downloadable materials available online at no cost. These materials come in a variety of designs, including worksheets templates, coloring pages and more. The appealingness of Does South Carolina Tax Retirement Income For Retirees lies in their versatility and accessibility.

More of Does South Carolina Tax Retirement Income For Retirees

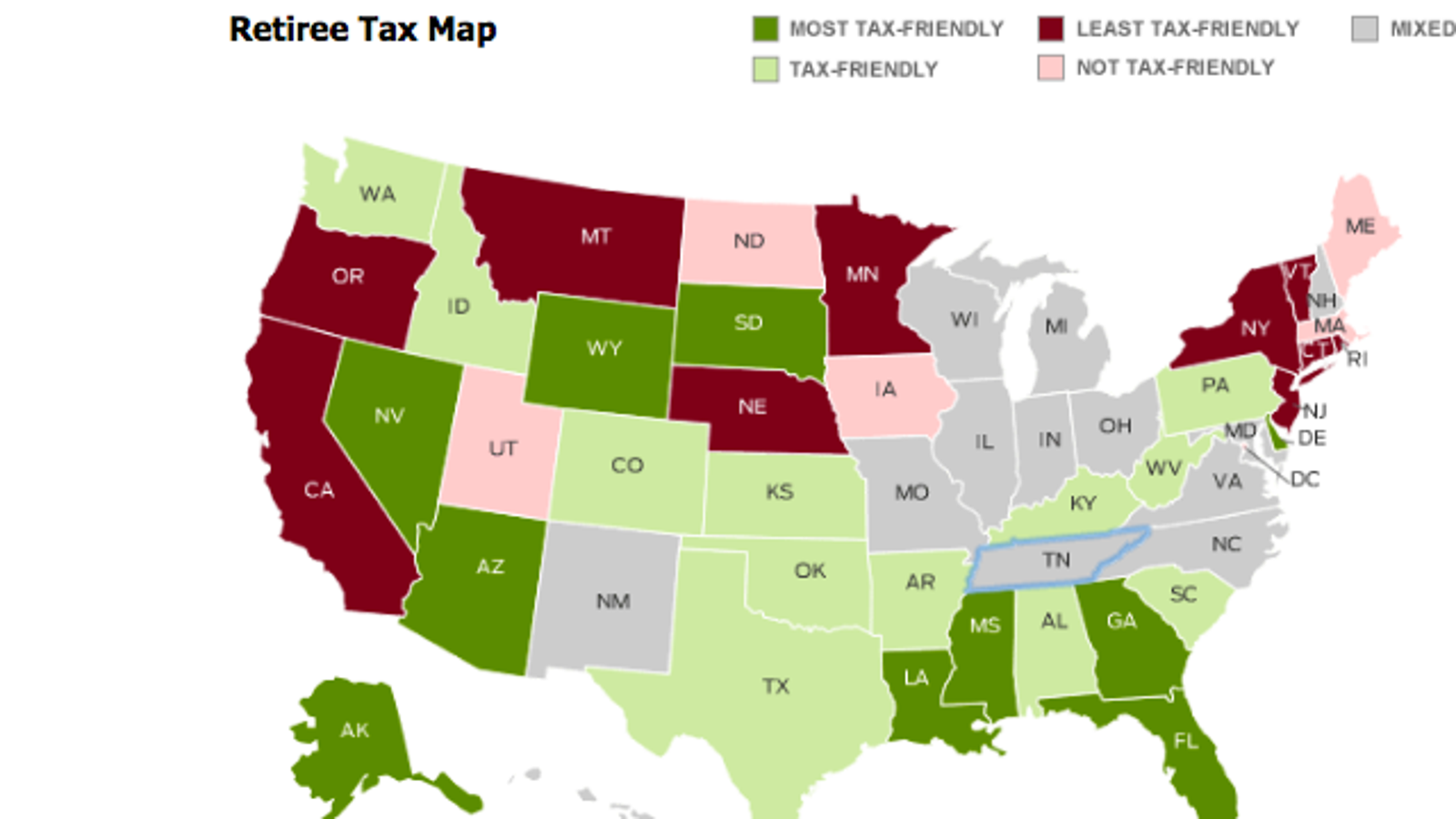

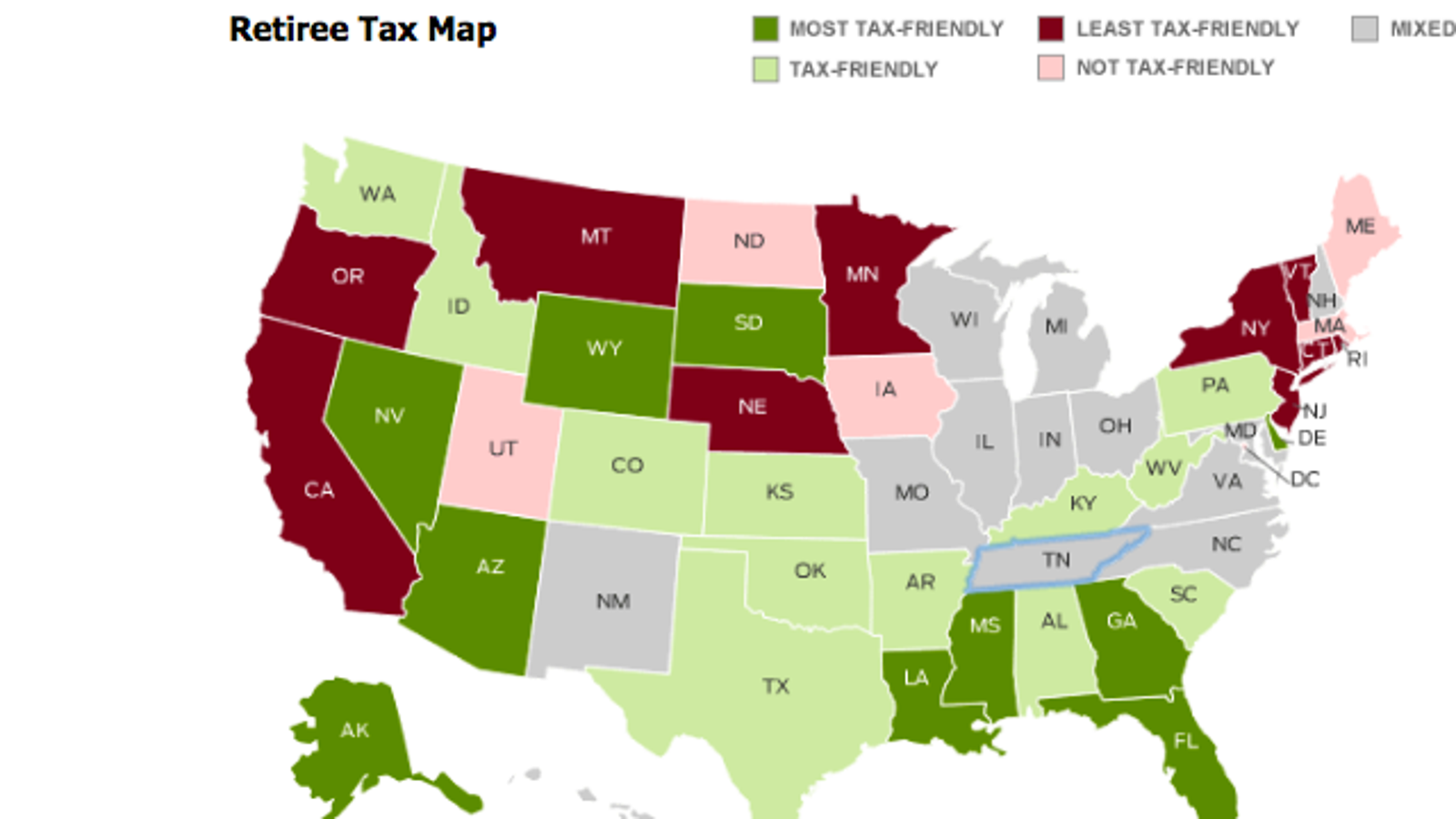

State by State Guide To Taxes On Retirees Retirement Retirement

State by State Guide To Taxes On Retirees Retirement Retirement

South Carolina is very tax friendly for retirees Social Security benefits are not taxed and while retirement income is partially taxed individuals aged 65 and older can claim up to

Retirement income is partially taxed in South Carolina However individuals aged 65 and older can claim up to 10 000 in retirement income deductions from pensions 401 k s

Does South Carolina Tax Retirement Income For Retirees have garnered immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

Personalization There is the possibility of tailoring the templates to meet your individual needs such as designing invitations planning your schedule or even decorating your house.

-

Educational value: The free educational worksheets offer a wide range of educational content for learners of all ages, making them an essential tool for teachers and parents.

-

An easy way to access HTML0: Access to a plethora of designs and templates saves time and effort.

Where to Find more Does South Carolina Tax Retirement Income For Retirees

Does South Carolina Tax Your Pension JP Real Estate Experts

Does South Carolina Tax Your Pension JP Real Estate Experts

For South Carolina residents younger than 65 years old the state income tax will apply to any pension retirement system distributions with a sizable 3 000 deduction But seniors anyone 65 and older receive a massive

Is retirement income taxed in South Carolina South Carolina offers a retirement income exclusion of up to 10 000 If you have taxable income that exceeds that amount you ll pay income taxes

If we've already piqued your interest in Does South Carolina Tax Retirement Income For Retirees Let's find out where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection with Does South Carolina Tax Retirement Income For Retirees for all goals.

- Explore categories like decoration for your home, education, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free as well as flashcards and other learning tools.

- Great for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- These blogs cover a wide variety of topics, all the way from DIY projects to party planning.

Maximizing Does South Carolina Tax Retirement Income For Retirees

Here are some innovative ways that you can make use of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets from the internet to enhance your learning at home and in class.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Does South Carolina Tax Retirement Income For Retirees are an abundance of useful and creative resources that cater to various needs and needs and. Their access and versatility makes these printables a useful addition to the professional and personal lives of both. Explore the vast array of Does South Carolina Tax Retirement Income For Retirees right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes, they are! You can download and print these items for free.

-

Do I have the right to use free printables to make commercial products?

- It's contingent upon the specific usage guidelines. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright issues in Does South Carolina Tax Retirement Income For Retirees?

- Some printables may come with restrictions on use. Be sure to read these terms and conditions as set out by the creator.

-

How can I print Does South Carolina Tax Retirement Income For Retirees?

- Print them at home using an printer, or go to a print shop in your area for more high-quality prints.

-

What software do I need to run printables for free?

- The majority are printed in the PDF format, and can be opened using free programs like Adobe Reader.

I R S Decides Most Special State Payments Are Not Taxable The New

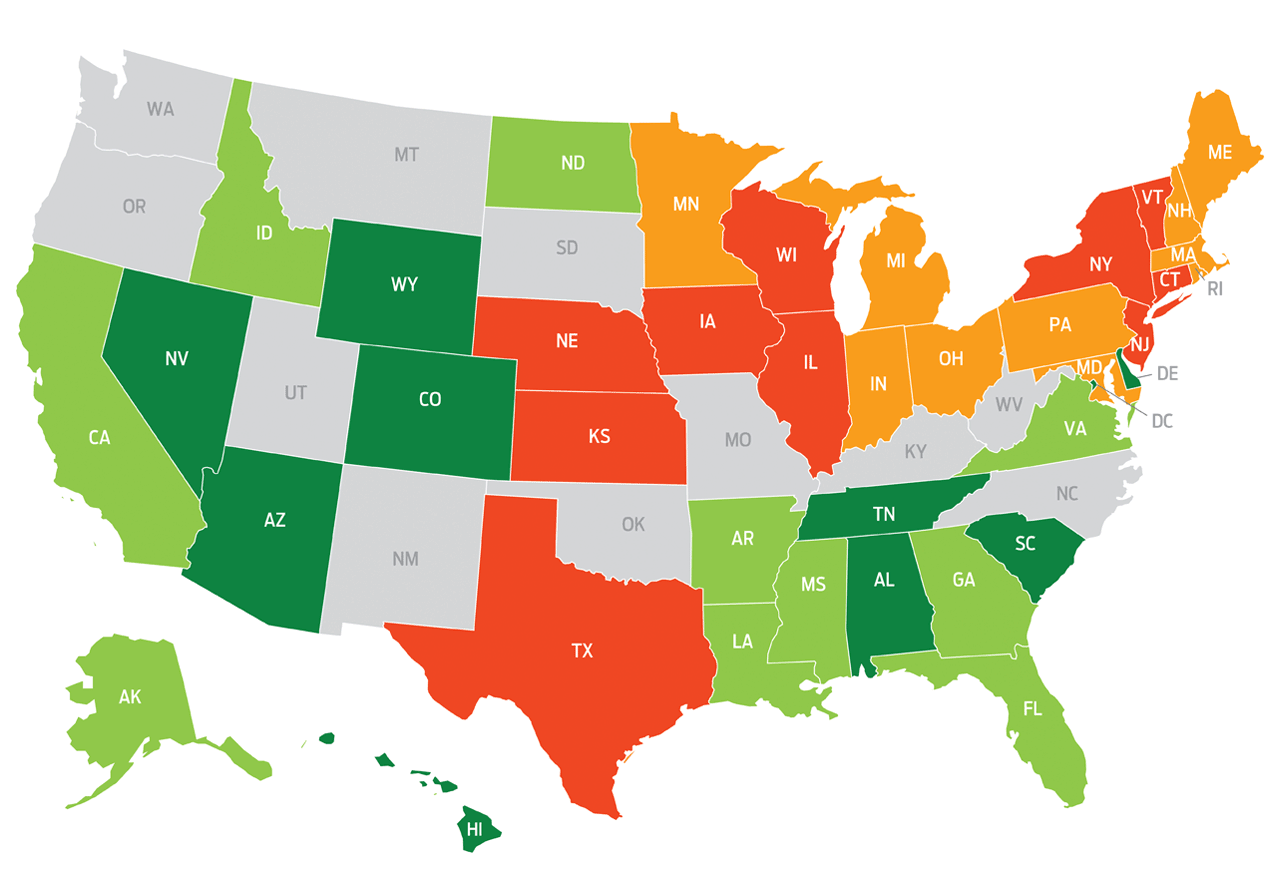

Retiring These States Won t Tax Your Distributions

Check more sample of Does South Carolina Tax Retirement Income For Retirees below

Every State With A Progressive Tax Also Taxes Retirement Income

States That Won t Tax Your Retirement Distributions In 2021

How Much You Should Save In Every State For An Early Retirement

The Most Tax Friendly States For Retirement

South Carolina Taxpayers Could Soon Be Eligible For 100 Rebate Wcnc

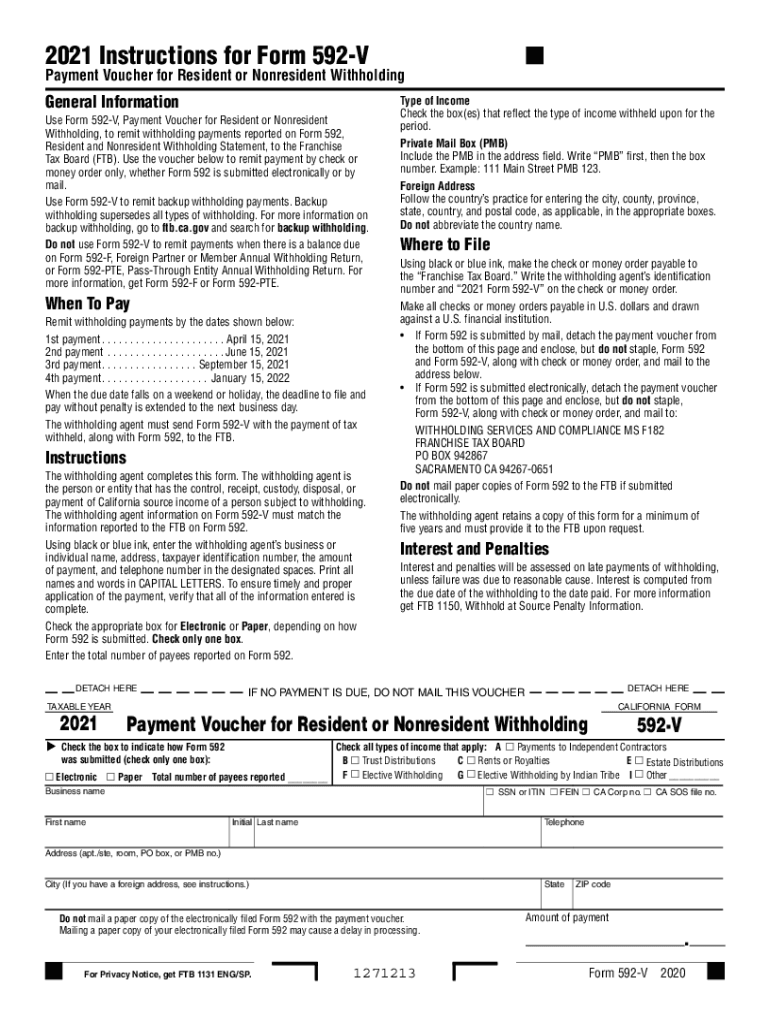

South Carolina State Tax Withholding Form 2022 WithholdingForm

https://smartasset.com/retirement/sout…

Is South Carolina tax friendly for retirees South Carolina does not tax Social Security retirement benefits whatsoever It provides a substantial deduction on all other types of retirement income including income from

https://www.retirementliving.com/sout…

Retirement income is taxed in South Carolina but the state provides exemptions and deductions Taxpayers age 65 or older can exclude up to 10 000 of retirement income 3 000 if you re younger Those who file

Is South Carolina tax friendly for retirees South Carolina does not tax Social Security retirement benefits whatsoever It provides a substantial deduction on all other types of retirement income including income from

Retirement income is taxed in South Carolina but the state provides exemptions and deductions Taxpayers age 65 or older can exclude up to 10 000 of retirement income 3 000 if you re younger Those who file

The Most Tax Friendly States For Retirement

States That Won t Tax Your Retirement Distributions In 2021

South Carolina Taxpayers Could Soon Be Eligible For 100 Rebate Wcnc

South Carolina State Tax Withholding Form 2022 WithholdingForm

Retirees In These 15 States Can Save With These Tax Tips GOBankingRates

State by State Guide To Taxes On Retirees

State by State Guide To Taxes On Retirees

Map Here Are The Best And Worst U S States For Retirement Cashay