In this age of technology, where screens dominate our lives, the charm of tangible printed items hasn't gone away. If it's to aid in education and creative work, or simply adding some personal flair to your area, Does North Carolina Tax Your Social Security Income are now a useful resource. In this article, we'll dive into the world "Does North Carolina Tax Your Social Security Income," exploring their purpose, where to find them and ways they can help you improve many aspects of your daily life.

Get Latest Does North Carolina Tax Your Social Security Income Below

Does North Carolina Tax Your Social Security Income

Does North Carolina Tax Your Social Security Income -

Social Security income is generally taxable at the federal level though whether or not you have to pay taxes on your Social Security benefits depends on your income level If you have other sources of retirement income such as a 401 k or a part time job then you should expect to pay some income taxes on your Social Security

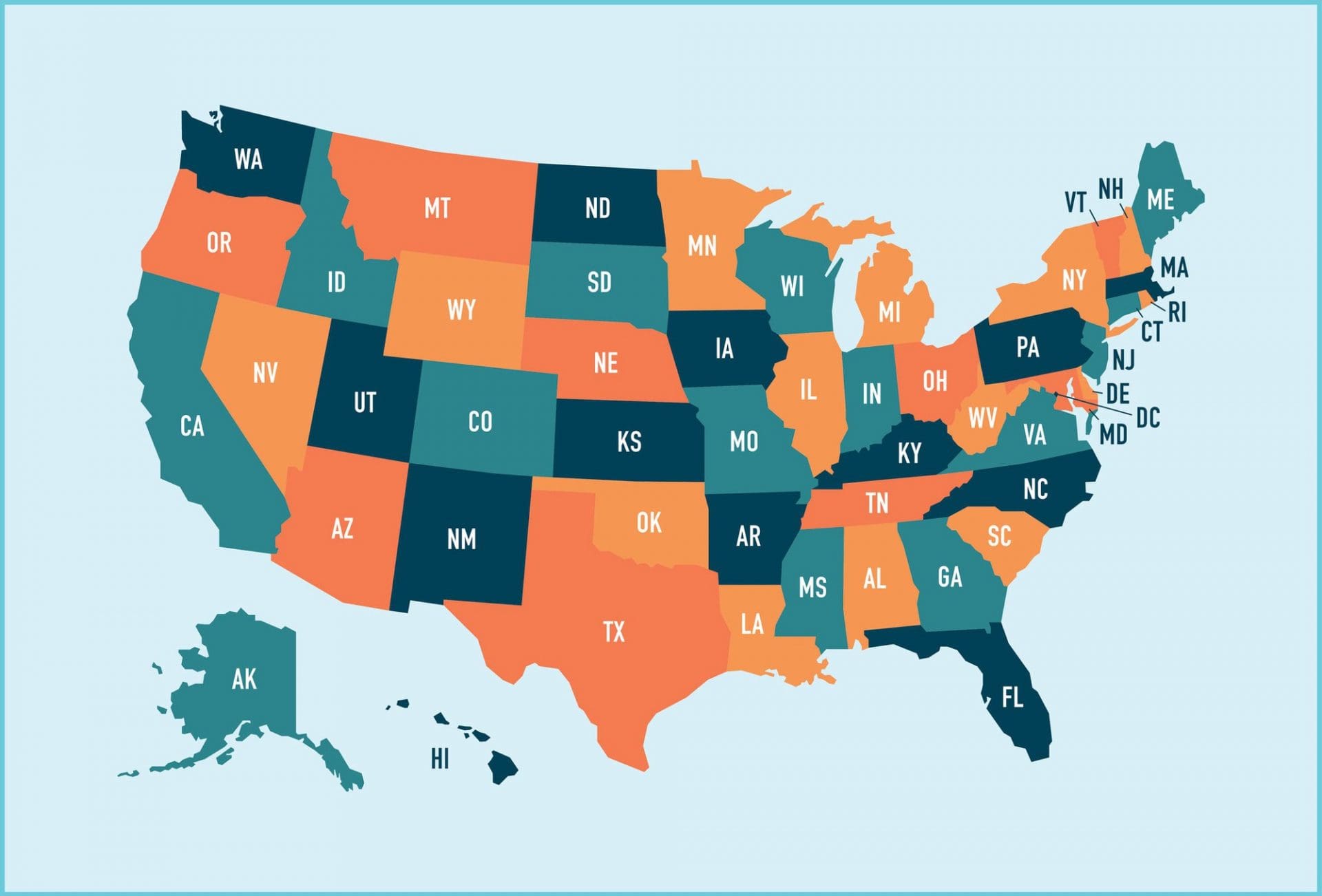

Thirty seven states and D C either have no income tax AK FL NV SD TN TX WA WY or do not include Social Security benefits in their calculation for taxable income AL AZ AR CA DE DC GA HI ID IL IN IA KY LA ME MD MA MI MS NH NJ NY NC OH OK OR PA SC VA WI

Does North Carolina Tax Your Social Security Income encompass a wide variety of printable, downloadable material that is available online at no cost. These resources come in many formats, such as worksheets, templates, coloring pages and more. The benefit of Does North Carolina Tax Your Social Security Income is in their variety and accessibility.

More of Does North Carolina Tax Your Social Security Income

37 States That Don t Tax Social Security Benefits Citybiz

37 States That Don t Tax Social Security Benefits Citybiz

In North Carolina your Social Security benefits are not taxable however the state taxes most other retirement income at the flat rate of 4 75 Additionally North Carolina has

Social Security income in North Carolina is not taxed However withdrawals from retirement accounts are fully taxed Additionally pension incomes are fully taxed Source smartasset Should You Consider Moving to a Retirement Community in

The Does North Carolina Tax Your Social Security Income have gained huge popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Personalization It is possible to tailor printables to fit your particular needs whether you're designing invitations and schedules, or even decorating your home.

-

Educational Value: The free educational worksheets are designed to appeal to students from all ages, making them a great tool for parents and educators.

-

It's easy: Instant access to many designs and templates is time-saving and saves effort.

Where to Find more Does North Carolina Tax Your Social Security Income

AskNC Why Does North Carolina Tax The Pensions Of Some Military

AskNC Why Does North Carolina Tax The Pensions Of Some Military

You will pay tax on your Social Security benefits based on Internal Revenue Service IRS rules if you Between 25 000 and 34 000 you may have to pay income tax on up to 50 of your benefits More than 34 000 up to 85 of your benefits may be taxable Between 32 000 and 44 000 you may have to pay income tax on up to 50 of your benefits

Income Tax on Taxable Income Low of 2 on up to 500 for single filers and 1 000 for joint filers and a high of 5 on more than 3 000 for single filers and 6 000 for joint filers

If we've already piqued your curiosity about Does North Carolina Tax Your Social Security Income Let's find out where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of printables that are free for a variety of goals.

- Explore categories like design, home decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing including flashcards, learning materials.

- This is a great resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- The blogs are a vast selection of subjects, from DIY projects to planning a party.

Maximizing Does North Carolina Tax Your Social Security Income

Here are some unique ways of making the most of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets for free to enhance learning at home and in class.

3. Event Planning

- Design invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

Does North Carolina Tax Your Social Security Income are a treasure trove of practical and innovative resources that can meet the needs of a variety of people and preferences. Their access and versatility makes them a wonderful addition to every aspect of your life, both professional and personal. Explore the plethora of Does North Carolina Tax Your Social Security Income right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually absolutely free?

- Yes they are! You can print and download these free resources for no cost.

-

Does it allow me to use free printables in commercial projects?

- It's based on the rules of usage. Be sure to read the rules of the creator before using their printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Some printables may contain restrictions regarding their use. Be sure to read the conditions and terms of use provided by the author.

-

How do I print printables for free?

- Print them at home with either a printer at home or in a local print shop to purchase top quality prints.

-

What program will I need to access printables at no cost?

- Most printables come in PDF format, which is open with no cost software, such as Adobe Reader.

Social Security Benefit Taxes By State 13 States Might Tax Benefits

North Carolina Income Tax Withholding Form 2022 WithholdingForm

Check more sample of Does North Carolina Tax Your Social Security Income below

Is Social Security Taxable In NC Hopler Wilms And Hanna

A Way To Cut Tax On Social Security Benefits

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Are North Carolina Retirement Taxes Affordable For Retirees

How Should North Carolina Slice The Tax Revenue Pie The Perfect And

Exploring Diaper Production In North Carolina A Look At The Different

https://taxfoundation.org/data/all/state/states...

Thirty seven states and D C either have no income tax AK FL NV SD TN TX WA WY or do not include Social Security benefits in their calculation for taxable income AL AZ AR CA DE DC GA HI ID IL IN IA KY LA ME MD MA MI MS NH NJ NY NC OH OK OR PA SC VA WI

https://smartasset.com/retirement/north-carolina-retirement-taxes

North Carolina exempts all Social Security retirement benefits from income taxes Other forms of retirement income are taxed at the North Carolina flat income tax rate of 4 75 The state s property and sales taxes are both moderate

Thirty seven states and D C either have no income tax AK FL NV SD TN TX WA WY or do not include Social Security benefits in their calculation for taxable income AL AZ AR CA DE DC GA HI ID IL IN IA KY LA ME MD MA MI MS NH NJ NY NC OH OK OR PA SC VA WI

North Carolina exempts all Social Security retirement benefits from income taxes Other forms of retirement income are taxed at the North Carolina flat income tax rate of 4 75 The state s property and sales taxes are both moderate

Are North Carolina Retirement Taxes Affordable For Retirees

A Way To Cut Tax On Social Security Benefits

How Should North Carolina Slice The Tax Revenue Pie The Perfect And

Exploring Diaper Production In North Carolina A Look At The Different

8 2023 Social Security Tax Limit Ideas 2023 GDS

Social Security Cost Of Living Adjustments 2023

Social Security Cost Of Living Adjustments 2023

Do This During Tax Season To Maximize Your Social Security Benefits