In this age of electronic devices, in which screens are the norm and the appeal of physical printed material hasn't diminished. For educational purposes in creative or artistic projects, or just adding a personal touch to your space, Does North Carolina Tax Federal Retirement Income For Retirees have become an invaluable resource. For this piece, we'll take a dive into the world of "Does North Carolina Tax Federal Retirement Income For Retirees," exploring what they are, how they are, and how they can enhance various aspects of your daily life.

Get Latest Does North Carolina Tax Federal Retirement Income For Retirees Below

Does North Carolina Tax Federal Retirement Income For Retirees

Does North Carolina Tax Federal Retirement Income For Retirees -

North Carolina taxes on retirees North Carolina taxes most types of retirement income But the state has a low flat income tax rate and that rate will drop

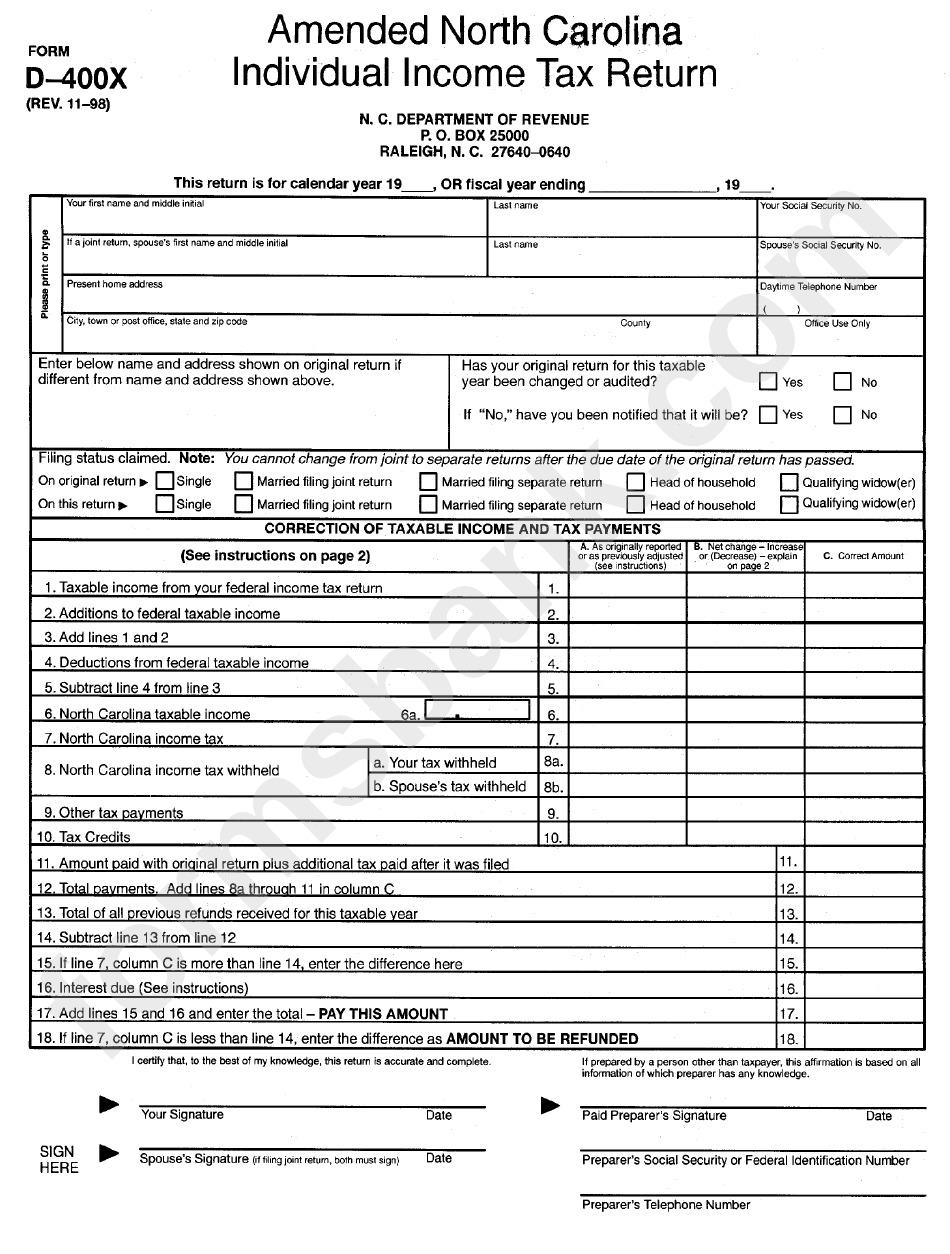

A retiree entitled to exclude retirement benefits from North Carolina income tax should claim a deduction on Line 20 Form D 400 Schedule S 2023 Supplemental Schedule for

Does North Carolina Tax Federal Retirement Income For Retirees provide a diverse variety of printable, downloadable content that can be downloaded from the internet at no cost. These materials come in a variety of types, like worksheets, coloring pages, templates and more. The great thing about Does North Carolina Tax Federal Retirement Income For Retirees lies in their versatility as well as accessibility.

More of Does North Carolina Tax Federal Retirement Income For Retirees

States That Don t Tax Federal Retirement Benefits Federal Educators

States That Don t Tax Federal Retirement Benefits Federal Educators

North Carolina cannot tax certain retirement benefits received by retirees or by beneficiaries of retirees of the U S government and the state of North Carolina and its

North Carolina offers a deduction for retirement income Taxpayers who are 65 years or older can deduct up to 8 000 of their retirement income if filing jointly or

The Does North Carolina Tax Federal Retirement Income For Retirees have gained huge popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Personalization It is possible to tailor the templates to meet your individual needs whether you're designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational Use: These Does North Carolina Tax Federal Retirement Income For Retirees are designed to appeal to students of all ages, making them a valuable source for educators and parents.

-

Easy to use: Access to a plethora of designs and templates cuts down on time and efforts.

Where to Find more Does North Carolina Tax Federal Retirement Income For Retirees

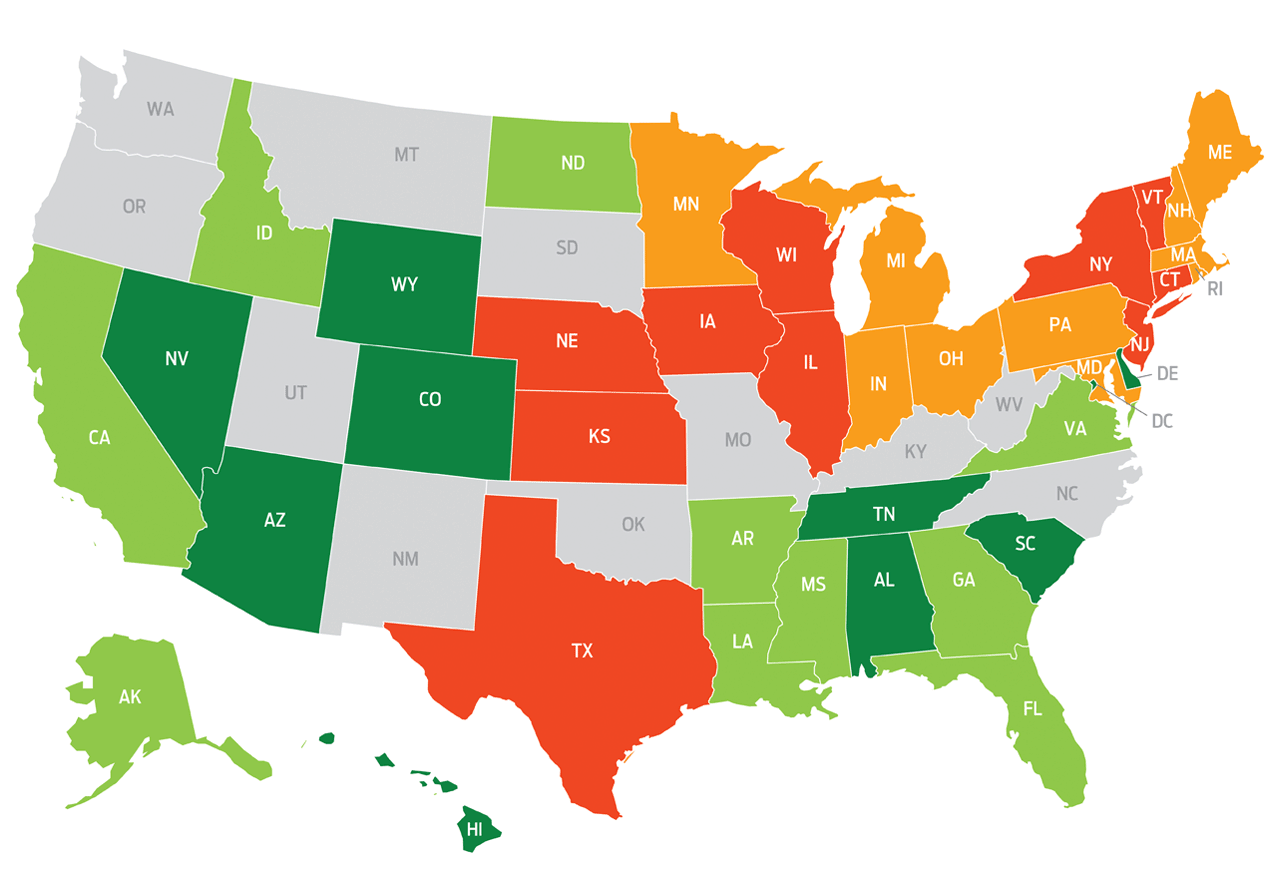

The 10 Best States For Retirees When It Comes To Taxes With Images

The 10 Best States For Retirees When It Comes To Taxes With Images

In North Carolina your Social Security benefits are not taxable however the state taxes most other retirement income at the flat rate of 4 75

4 75 Prescription drugs and medical equipment are exempt Food is subject to a 2 county tax Counties may also add up to 2 75 tax North Carolina Income Taxes A flat rate of 4 99 for the

Now that we've piqued your interest in printables for free Let's see where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Does North Carolina Tax Federal Retirement Income For Retirees designed for a variety goals.

- Explore categories such as decoration for your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free as well as flashcards and other learning materials.

- This is a great resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- These blogs cover a broad variety of topics, from DIY projects to planning a party.

Maximizing Does North Carolina Tax Federal Retirement Income For Retirees

Here are some new ways of making the most of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print out free worksheets and activities to build your knowledge at home, or even in the classroom.

3. Event Planning

- Design invitations and banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Does North Carolina Tax Federal Retirement Income For Retirees are an abundance of useful and creative resources for a variety of needs and needs and. Their accessibility and versatility make them an essential part of every aspect of your life, both professional and personal. Explore the world of Does North Carolina Tax Federal Retirement Income For Retirees to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually absolutely free?

- Yes they are! You can download and print these tools for free.

-

Can I download free printing templates for commercial purposes?

- It's determined by the specific rules of usage. Always read the guidelines of the creator before utilizing printables for commercial projects.

-

Do you have any copyright issues with Does North Carolina Tax Federal Retirement Income For Retirees?

- Some printables may have restrictions on usage. Be sure to read the conditions and terms of use provided by the creator.

-

How can I print printables for free?

- Print them at home using either a printer at home or in any local print store for superior prints.

-

What software do I need to run printables that are free?

- A majority of printed materials are with PDF formats, which can be opened using free software like Adobe Reader.

Map Here Are The Best And Worst U S States For Retirement Cashay

Retirees In These 15 States Can Save With These Tax Tips GOBankingRates

Check more sample of Does North Carolina Tax Federal Retirement Income For Retirees below

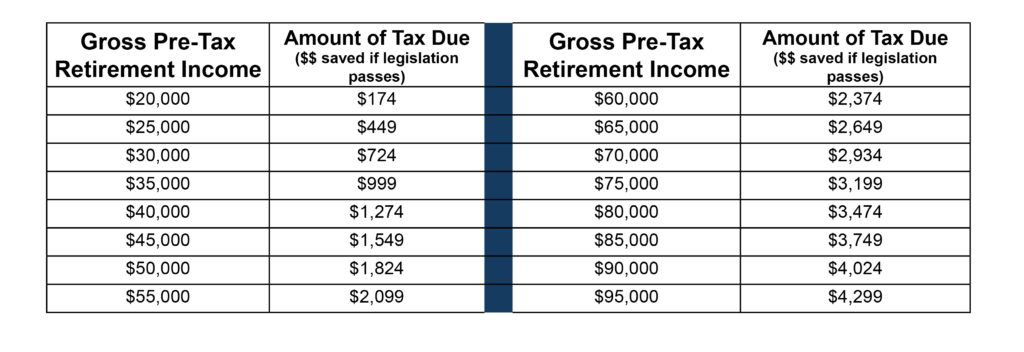

Tax Savings Chart The 4th Branch NC

Are North Carolina Retirement Taxes Affordable For Retirees

Pay Less Retirement Taxes

Retired Money How To Boost Retirement Income With Fred Vettese s 5

Recently I Wrote About Theoretical Retirement Income Options From A

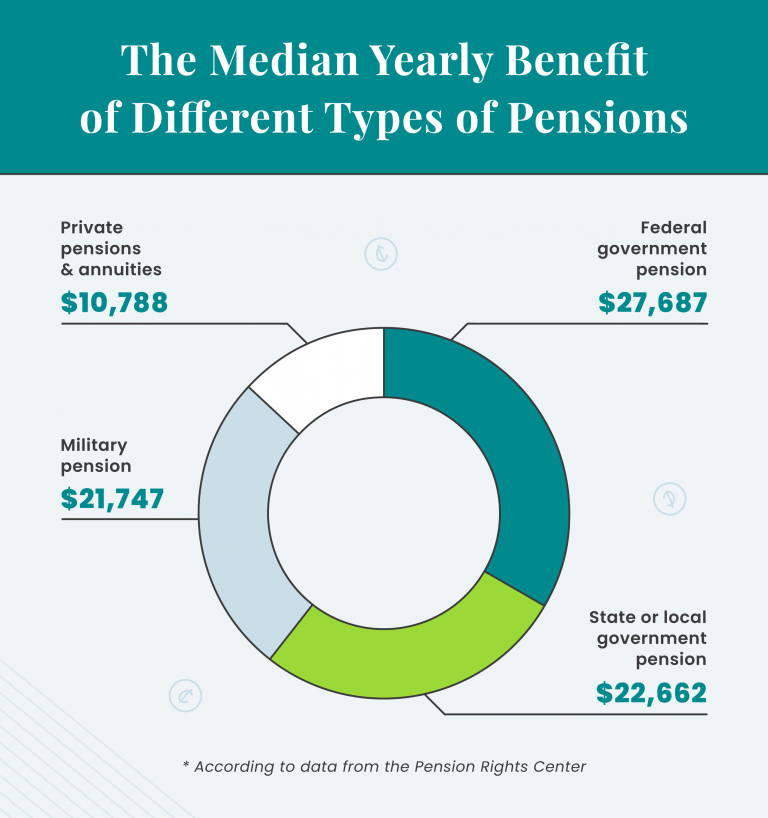

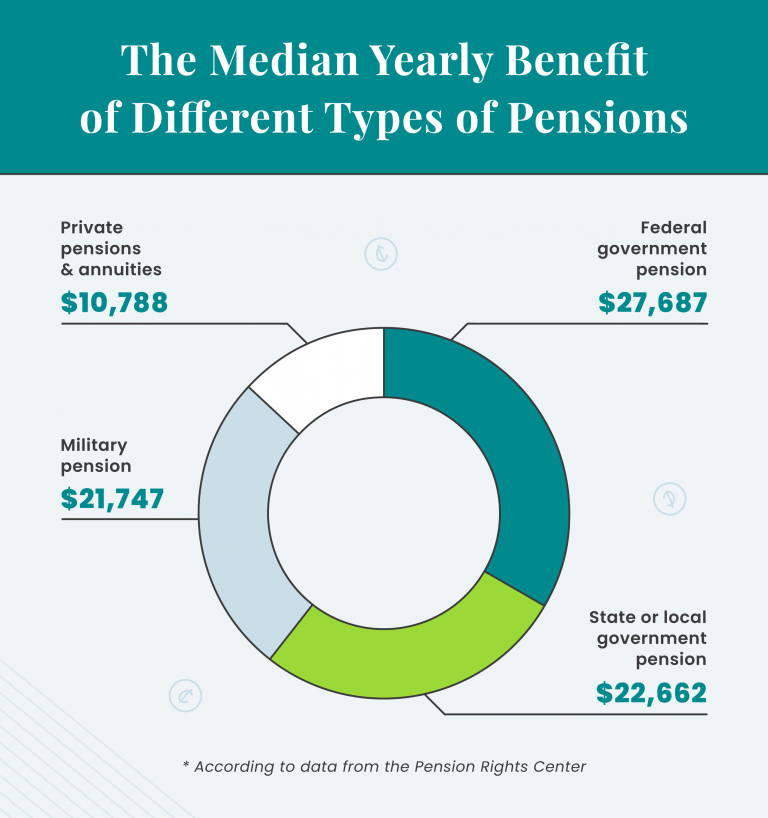

Average Retirement Income Where Do You Stand

https://www.ncdor.gov/bailey-decision-concerning...

A retiree entitled to exclude retirement benefits from North Carolina income tax should claim a deduction on Line 20 Form D 400 Schedule S 2023 Supplemental Schedule for

https://ttlc.intuit.com/community/retirement/...

1 Best answer IreneS Intuit Alumni No Social security and railroad retirement benefits are not subject to NC State income tax No Your federal retirement

A retiree entitled to exclude retirement benefits from North Carolina income tax should claim a deduction on Line 20 Form D 400 Schedule S 2023 Supplemental Schedule for

1 Best answer IreneS Intuit Alumni No Social security and railroad retirement benefits are not subject to NC State income tax No Your federal retirement

Retired Money How To Boost Retirement Income With Fred Vettese s 5

Are North Carolina Retirement Taxes Affordable For Retirees

Recently I Wrote About Theoretical Retirement Income Options From A

Average Retirement Income Where Do You Stand

12 States That Keep Retirement Dollars In Your Pocket Alhambra

Federal Tax Brackets 2021 Spanishlader

Federal Tax Brackets 2021 Spanishlader

Printable Nc State Income Tax Forms Printable Forms Free Online