In the digital age, where screens dominate our lives but the value of tangible printed objects isn't diminished. Be it for educational use such as creative projects or just adding an extra personal touch to your space, Does Minnesota Tax Ira Withdrawals are a great resource. With this guide, you'll dive deeper into "Does Minnesota Tax Ira Withdrawals," exploring the benefits of them, where they can be found, and how they can enhance various aspects of your daily life.

Get Latest Does Minnesota Tax Ira Withdrawals Below

Does Minnesota Tax Ira Withdrawals

Does Minnesota Tax Ira Withdrawals -

Sometimes the answer is zero you owe no taxes In other cases you owe income tax on the money you withdraw You can even owe an additional penalty if you withdraw funds

Withdrawals and any earnings are tax free conditions apply see below Contributions are tax deferred your current taxable income is reduced by the amount you contribute Pay

Does Minnesota Tax Ira Withdrawals offer a wide collection of printable materials that are accessible online for free cost. They are available in a variety of designs, including worksheets templates, coloring pages, and much more. The great thing about Does Minnesota Tax Ira Withdrawals lies in their versatility as well as accessibility.

More of Does Minnesota Tax Ira Withdrawals

Do You Pay State Income Tax On Ira Withdrawals Tax Walls

Do You Pay State Income Tax On Ira Withdrawals Tax Walls

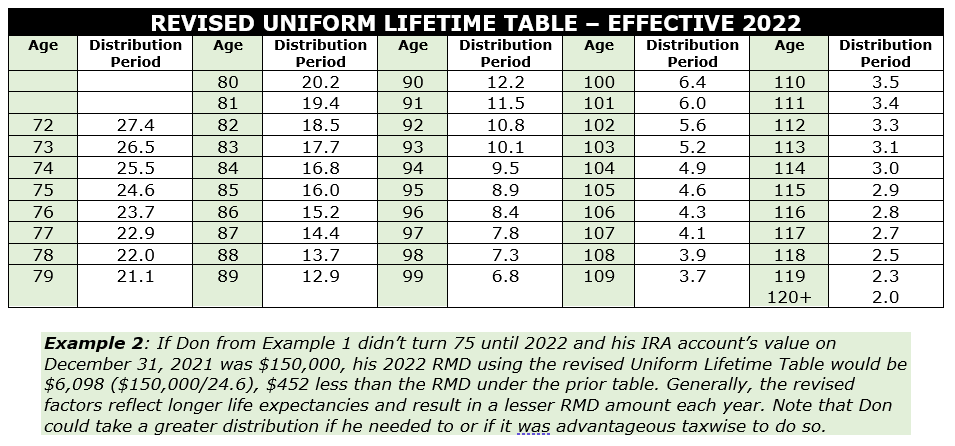

Last Updated January 29 2024 A qualified lump sum distribution is the payment of your qualified retirement plan s entire balance including pension profit sharing or stock

Service support Tax Center State tax withholding for withdrawals from IRAs and qualified plans ARTICLE TAKEAWAYS Criteria that may impact the amount to withhold

Print-friendly freebies have gained tremendous popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Flexible: You can tailor designs to suit your personal needs, whether it's designing invitations and schedules, or even decorating your house.

-

Educational Worth: Printing educational materials for no cost can be used by students from all ages, making them an essential tool for teachers and parents.

-

The convenience of Quick access to various designs and templates will save you time and effort.

Where to Find more Does Minnesota Tax Ira Withdrawals

Do You Pay Taxes On Stocks Sold In Roth Ira Choosing Your Gold IRA

Do You Pay Taxes On Stocks Sold In Roth Ira Choosing Your Gold IRA

Withdrawals from IRAs are subject to specific taxation rules that vary depending on the age of the account holder and the type of IRA Generally if you withdraw funds from your

Your MNDCP withdrawal is subject to federal and state income taxes Tax withholding is based on a default established by the IRS and Minnesota Department of Revenue or

If we've already piqued your interest in Does Minnesota Tax Ira Withdrawals Let's look into where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Does Minnesota Tax Ira Withdrawals to suit a variety of goals.

- Explore categories like home decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets, flashcards, and learning materials.

- This is a great resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- These blogs cover a broad variety of topics, that includes DIY projects to party planning.

Maximizing Does Minnesota Tax Ira Withdrawals

Here are some ideas that you can make use use of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use printable worksheets from the internet to reinforce learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Be organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Does Minnesota Tax Ira Withdrawals are a treasure trove of fun and practical tools catering to different needs and preferences. Their access and versatility makes them an invaluable addition to your professional and personal life. Explore the vast array of Does Minnesota Tax Ira Withdrawals and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes you can! You can download and print these files for free.

-

Do I have the right to use free printouts for commercial usage?

- It's based on the rules of usage. Always consult the author's guidelines before using their printables for commercial projects.

-

Do you have any copyright violations with Does Minnesota Tax Ira Withdrawals?

- Certain printables could be restricted on usage. Be sure to review the terms and regulations provided by the author.

-

How do I print Does Minnesota Tax Ira Withdrawals?

- You can print them at home using either a printer or go to a local print shop to purchase superior prints.

-

What software do I need to run printables for free?

- Many printables are offered in PDF format. They is open with no cost software, such as Adobe Reader.

Roth Ira Withdrawal Tax Calculator TaniyaSuphi

IRA Withdrawal Rules

Check more sample of Does Minnesota Tax Ira Withdrawals below

How To Cut Taxes On Your IRA Withdrawals Marotta On Money

Ways To Avoid The IRA Early Withdrawal Penalty The Ira Ira Higher

2023 IRS Contribution Limits And Tax Rates By Kristin McKenna Harvest

These Are The Rules About Roth IRA Withdrawals Roth Ira Withdrawal

States That Won t Tax Your Retirement Distributions In 2021

The 5 Year Rules For Roth IRA Withdrawals Pure Financial Advisors

https://www.msrs.state.mn.us/pretax-aftertax-mndcp

Withdrawals and any earnings are tax free conditions apply see below Contributions are tax deferred your current taxable income is reduced by the amount you contribute Pay

https://www.msrs.state.mn.us/sites/default/files...

Pre tax contributions are tax deferred This means that taxes aren t withheld when you contribute which lowers your current taxable income by the amount you contribute

Withdrawals and any earnings are tax free conditions apply see below Contributions are tax deferred your current taxable income is reduced by the amount you contribute Pay

Pre tax contributions are tax deferred This means that taxes aren t withheld when you contribute which lowers your current taxable income by the amount you contribute

These Are The Rules About Roth IRA Withdrawals Roth Ira Withdrawal

Ways To Avoid The IRA Early Withdrawal Penalty The Ira Ira Higher

States That Won t Tax Your Retirement Distributions In 2021

The 5 Year Rules For Roth IRA Withdrawals Pure Financial Advisors

What You Need To Know About Withdrawing From An IRA Infographic

_Withdrawals_-_FI.png#keepProtocol)

Penalty Free Individual Retirement Arrangement IRA Withdrawals

_Withdrawals_-_FI.png#keepProtocol)

Penalty Free Individual Retirement Arrangement IRA Withdrawals

IRA Withdrawal Planning Can Save On Taxes The Wealth Guardians