Today, where screens rule our lives The appeal of tangible printed products hasn't decreased. Whether it's for educational purposes and creative work, or just adding an element of personalization to your space, Does Massachusetts Have Sales Tax are now a useful source. The following article is a dive deeper into "Does Massachusetts Have Sales Tax," exploring the benefits of them, where to locate them, and ways they can help you improve many aspects of your daily life.

Get Latest Does Massachusetts Have Sales Tax Below

Does Massachusetts Have Sales Tax

Does Massachusetts Have Sales Tax -

Massachusetts first adopted a general state sales tax in 1966 and since that time the rate has risen to 6 25 percent In many states localities are able to impose local sales taxes on top of the state sales tax However as of March 2019 there are no local sales taxes in Massachusetts

Sales and Use Tax for Individuals Learn what is and isn t subject to sales and use tax in Massachusetts LOG IN Request a Motor Vehicle Sales or Use Tax Abatement with MassTaxConnect Pay Sales or Use tax Form ST 6 or Claim an Exemption Form ST 6E with MassTaxConnect

Does Massachusetts Have Sales Tax cover a large assortment of printable materials that are accessible online for free cost. They are available in numerous designs, including worksheets templates, coloring pages, and much more. The great thing about Does Massachusetts Have Sales Tax lies in their versatility as well as accessibility.

More of Does Massachusetts Have Sales Tax

Massachusetts Sales Tax Rate Step By Step Business

Massachusetts Sales Tax Rate Step By Step Business

2024 List of Massachusetts Local Sales Tax Rates Lowest sales tax 6 25 Highest sales tax 6 25 Massachusetts Sales Tax 6 25 Average Sales Tax With Local 6 25 Massachusetts has state sales tax of 6 25 and allows local governments to collect a local option sales tax of up to N A

Massachusetts Sales Tax By The Numbers Massachusetts has a higher than average state sales tax rate but the actual sales tax rates in most Massachusetts cities are lower than average when local sales taxes from Massachusetts s 228 local tax jurisdictions are taken into account

Does Massachusetts Have Sales Tax have garnered immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Flexible: You can tailor designs to suit your personal needs whether it's making invitations or arranging your schedule or decorating your home.

-

Educational value: The free educational worksheets offer a wide range of educational content for learners from all ages, making them a valuable tool for parents and teachers.

-

Simple: Instant access to a myriad of designs as well as templates saves time and effort.

Where to Find more Does Massachusetts Have Sales Tax

Massachusetts Sales Tax Calculator Step By Step Business

Massachusetts Sales Tax Calculator Step By Step Business

Massachusetts sales tax range for 2024 6 25 Base state sales tax rate 6 25 Total rate range 6 25 Rates are rounded to the nearest hundredth Due to varying local sales tax rates we strongly recommend our lookup and calculator tools on this page for the most accurate rates Sales tax rate lookup and sales tax item calculator

Massachusetts Sales Tax Guide for Businesses Statewide sales tax rate 6 25 Economic Sales Threshold 100 000 Transactions Threshold NA Website Department of Revenue Tax Line 617 887 6367 Massachusetts Sales Tax Calculator Calculate Rates are for reference only may not include all information needed for filing

Now that we've ignited your interest in Does Massachusetts Have Sales Tax we'll explore the places you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Does Massachusetts Have Sales Tax to suit a variety of uses.

- Explore categories such as design, home decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational materials.

- This is a great resource for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates free of charge.

- The blogs covered cover a wide array of topics, ranging starting from DIY projects to party planning.

Maximizing Does Massachusetts Have Sales Tax

Here are some new ways that you can make use use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use free printable worksheets for reinforcement of learning at home (or in the learning environment).

3. Event Planning

- Designs invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Get organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Does Massachusetts Have Sales Tax are a treasure trove of innovative and useful resources catering to different needs and interests. Their accessibility and versatility make them a fantastic addition to your professional and personal life. Explore the plethora of Does Massachusetts Have Sales Tax right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually free?

- Yes they are! You can print and download these tools for free.

-

Can I utilize free printables for commercial use?

- It's all dependent on the usage guidelines. Be sure to read the rules of the creator prior to using the printables in commercial projects.

-

Do you have any copyright concerns when using Does Massachusetts Have Sales Tax?

- Certain printables may be subject to restrictions regarding usage. Be sure to read the terms and regulations provided by the creator.

-

How can I print Does Massachusetts Have Sales Tax?

- You can print them at home using a printer or visit a print shop in your area for better quality prints.

-

What software do I need in order to open printables free of charge?

- Most printables come in the format PDF. This can be opened using free software like Adobe Reader.

Hecht Group The Impact Of Sales Tax On Watches Shipped To Massachusetts

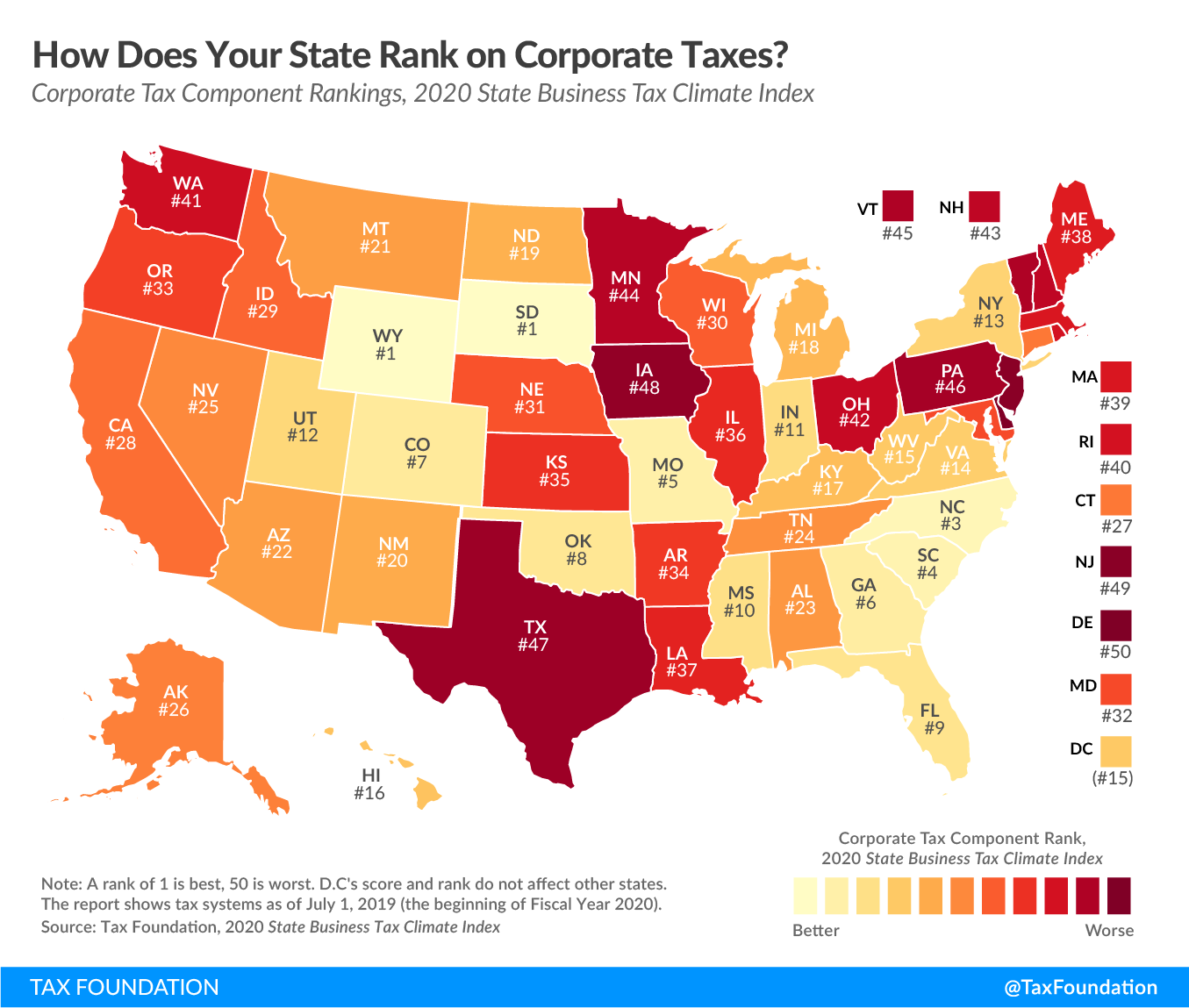

Massachusetts Should Create A More Neutral Competitive Corporate

Check more sample of Does Massachusetts Have Sales Tax below

Massachusetts Sales Tax Guide

Proposed Massachusetts Sales Tax Cut

Ultimate Massachusetts Sales Tax Guide Zamp

Sales Tax By State Here s How Much You re Really Paying Sales Tax

What You Need To Know For The Upcoming Massachusetts Sales Tax Holiday

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/KKPD6TAOO3EZ3BJ4DUT3ROMND4.jpg)

U S States Without A Sales Tax Real Estate Investing Today

https://www.mass.gov/sales-and-use-tax-for-individuals

Sales and Use Tax for Individuals Learn what is and isn t subject to sales and use tax in Massachusetts LOG IN Request a Motor Vehicle Sales or Use Tax Abatement with MassTaxConnect Pay Sales or Use tax Form ST 6 or Claim an Exemption Form ST 6E with MassTaxConnect

https://www.mass.gov/sales-and-use-tax

Updated November 4 2022 The Massachusetts sales tax is 6 25 of the sales price or rental charge on tangible personal property including certain telecommunication services sold or rented in Massachusetts Sales tax is generally collected by the seller

Sales and Use Tax for Individuals Learn what is and isn t subject to sales and use tax in Massachusetts LOG IN Request a Motor Vehicle Sales or Use Tax Abatement with MassTaxConnect Pay Sales or Use tax Form ST 6 or Claim an Exemption Form ST 6E with MassTaxConnect

Updated November 4 2022 The Massachusetts sales tax is 6 25 of the sales price or rental charge on tangible personal property including certain telecommunication services sold or rented in Massachusetts Sales tax is generally collected by the seller

Sales Tax By State Here s How Much You re Really Paying Sales Tax

Proposed Massachusetts Sales Tax Cut

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/KKPD6TAOO3EZ3BJ4DUT3ROMND4.jpg)

What You Need To Know For The Upcoming Massachusetts Sales Tax Holiday

U S States Without A Sales Tax Real Estate Investing Today

Massachusetts Sales Tax Guide

Massachusetts Sales Tax Guide

Massachusetts Sales Tax Guide

State And Local Sales Tax Rates Midyear 2021 Laura Strashny