In the age of digital, in which screens are the norm The appeal of tangible printed materials hasn't faded away. It doesn't matter if it's for educational reasons and creative work, or simply to add personal touches to your space, Does Maine Tax Roth Ira Distributions have become an invaluable resource. The following article is a dive in the world of "Does Maine Tax Roth Ira Distributions," exploring what they are, where they are available, and how they can be used to enhance different aspects of your daily life.

Get Latest Does Maine Tax Roth Ira Distributions Below

Does Maine Tax Roth Ira Distributions

Does Maine Tax Roth Ira Distributions -

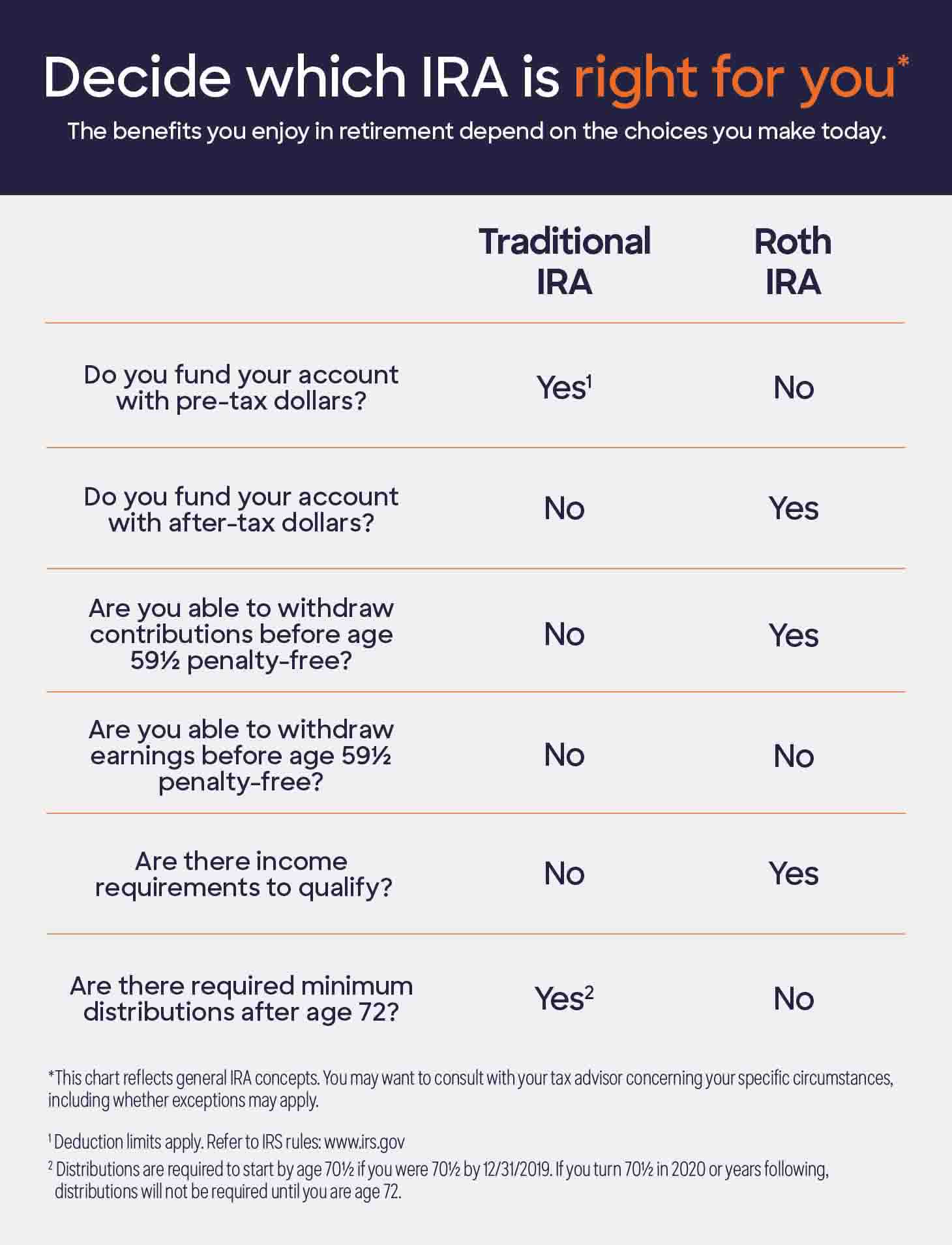

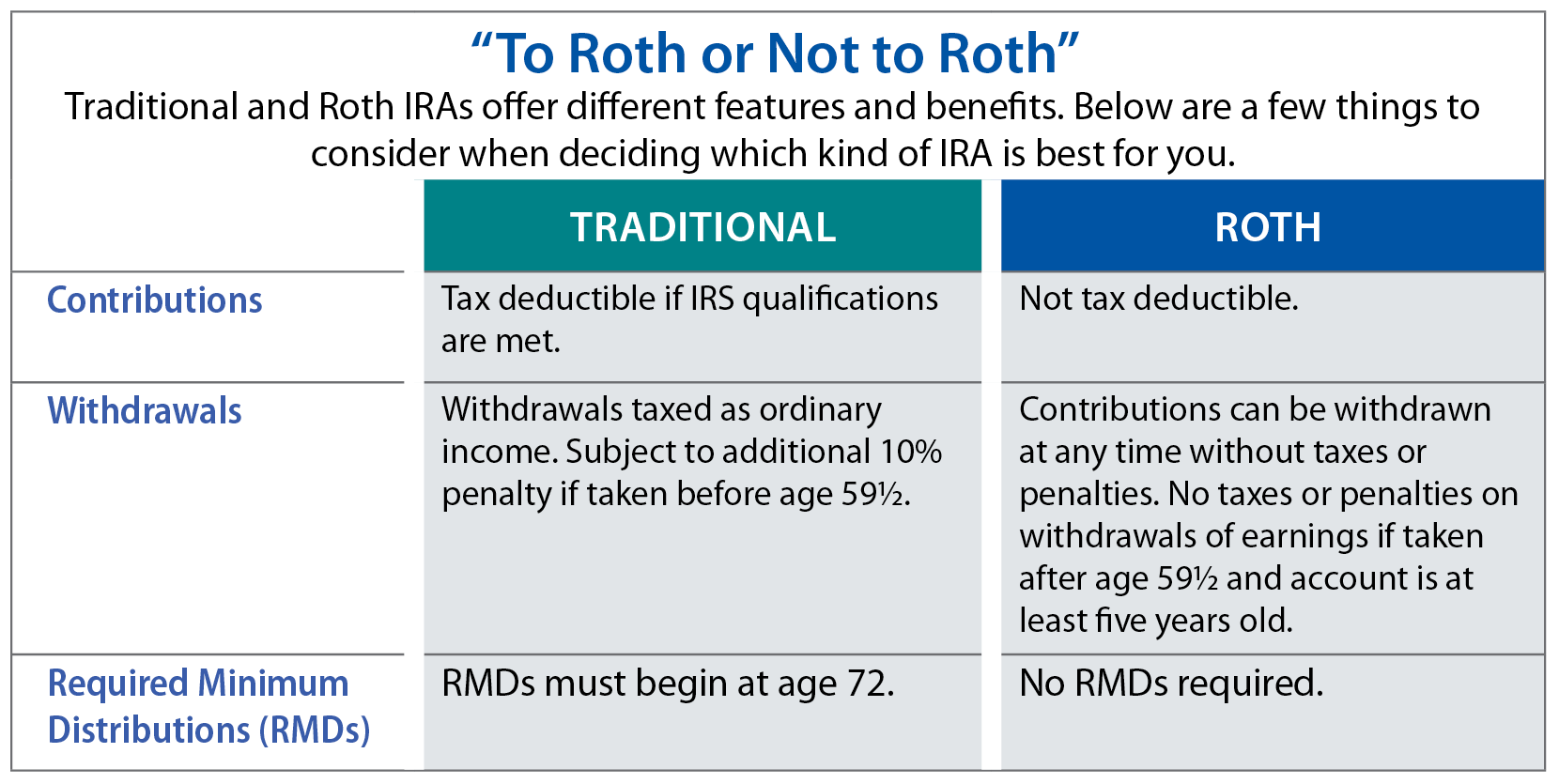

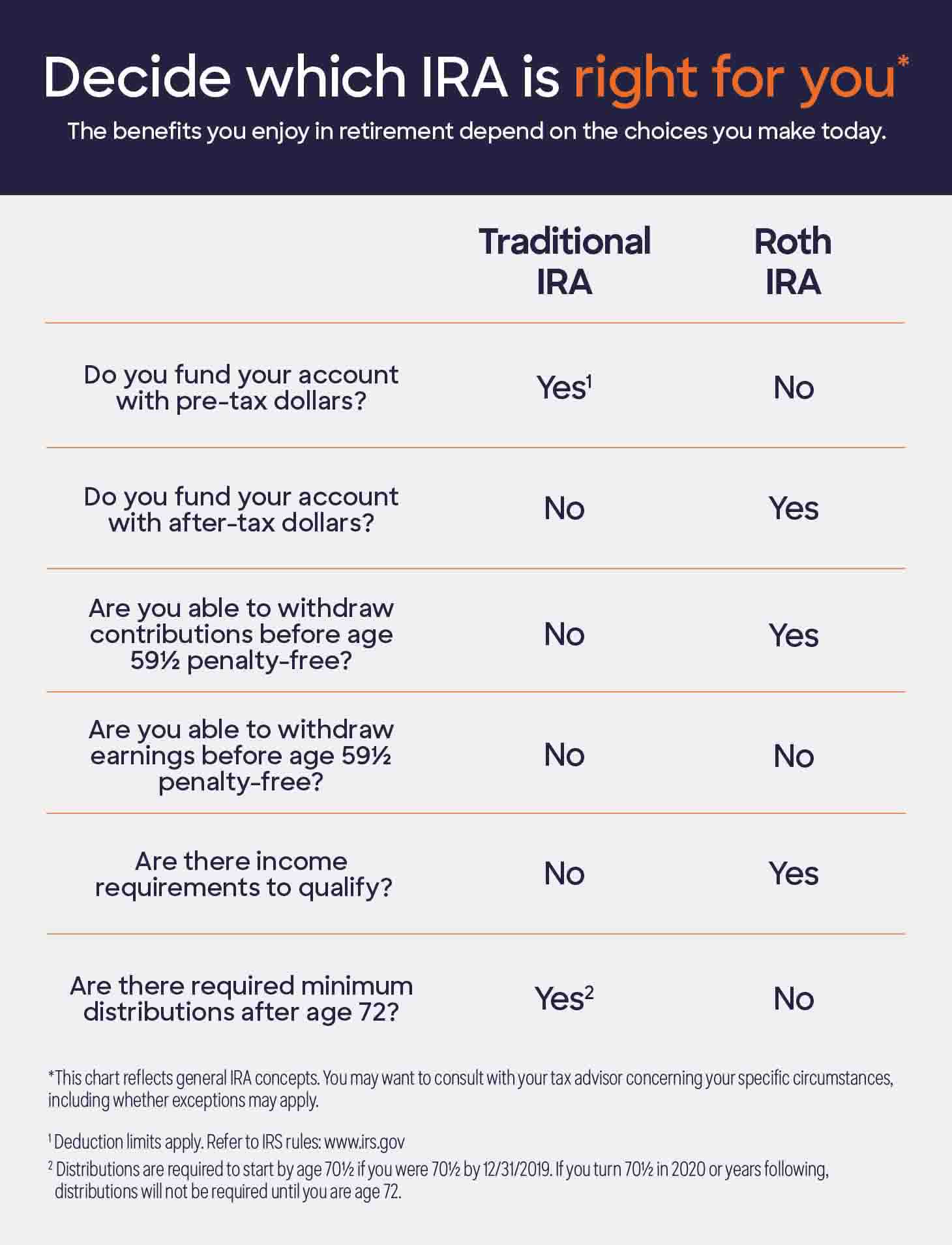

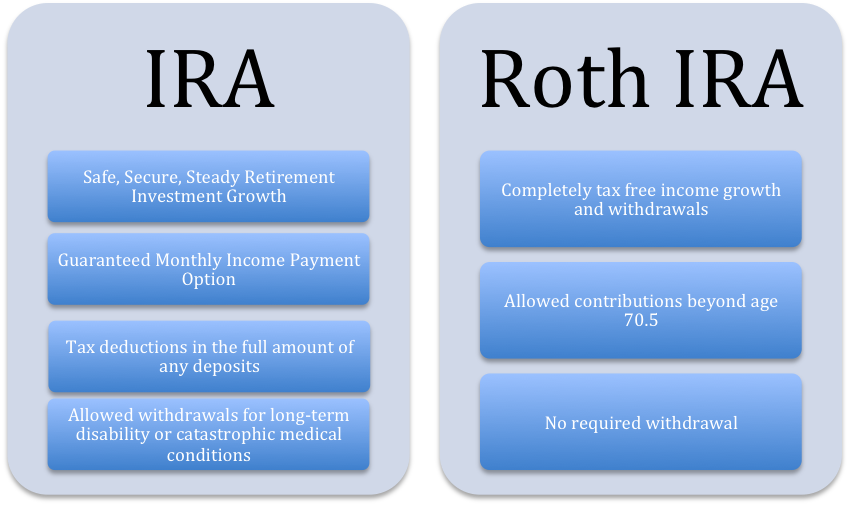

When you withdraw money from your IRA or employer sponsored retirement plan your state may require you to have income tax withheld from your distribution Your

Social Security is exempt from taxation in Maine but other forms of retirement income are not Seniors who receive retirement income from a 401 k IRA or pension will pay tax rates as high as 7 15 though a

Does Maine Tax Roth Ira Distributions offer a wide array of printable resources available online for download at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages, and much more. The beauty of Does Maine Tax Roth Ira Distributions lies in their versatility and accessibility.

More of Does Maine Tax Roth Ira Distributions

Roth IRA Withdrawal Rules Oblivious Investor

Roth IRA Withdrawal Rules Oblivious Investor

Deductible pension income also includes benefits received from individual retirement accounts including ROTH and SIMPLE IRAs and simplified employee

Maine Tax Return Begins with Federal AGI Review the discussion about Differences with Federal taxes The deferred income that is in retirement accounts like an IRA or a 401

Does Maine Tax Roth Ira Distributions have garnered immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

customization You can tailor the design to meet your needs in designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Value The free educational worksheets cater to learners of all ages, making them a useful source for educators and parents.

-

An easy way to access HTML0: Quick access to numerous designs and templates reduces time and effort.

Where to Find more Does Maine Tax Roth Ira Distributions

Qualified Vs Non Qualified Roth IRA Distributions

Qualified Vs Non Qualified Roth IRA Distributions

All an individual s Roth IRAs not including beneficiary Roth IRAs are aggregated and treated as one to determine an individual s total amount in Layer 1

MERIT is a state sponsored Roth IRA retirement program The default contribution rate is 5 but employees can change their contribution rate or opt out of

Now that we've ignited your interest in Does Maine Tax Roth Ira Distributions We'll take a look around to see where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of reasons.

- Explore categories such as decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- It is ideal for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs or templates for download.

- The blogs are a vast selection of subjects, including DIY projects to party planning.

Maximizing Does Maine Tax Roth Ira Distributions

Here are some new ways to make the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Print worksheets that are free for reinforcement of learning at home (or in the learning environment).

3. Event Planning

- Invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Does Maine Tax Roth Ira Distributions are a treasure trove of useful and creative resources for a variety of needs and preferences. Their accessibility and versatility make them a wonderful addition to both professional and personal life. Explore the plethora that is Does Maine Tax Roth Ira Distributions today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes, they are! You can download and print these resources at no cost.

-

Can I use free printables for commercial use?

- It's based on specific conditions of use. Always check the creator's guidelines prior to printing printables for commercial projects.

-

Do you have any copyright issues when you download Does Maine Tax Roth Ira Distributions?

- Some printables may come with restrictions on their use. Be sure to read the terms of service and conditions provided by the author.

-

How can I print printables for free?

- Print them at home with either a printer or go to the local print shops for better quality prints.

-

What program do I need to open printables free of charge?

- Many printables are offered in the format of PDF, which can be opened using free programs like Adobe Reader.

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

Does A Roth IRA Account Make Sense For You Gorfine Schiller Gardyn

Check more sample of Does Maine Tax Roth Ira Distributions below

Understanding Non Qualified Roth IRA Distributions

/shutterstock_240823573.Roth.IRA.cropped-fd86349be2cd4f42a0ea35dd6956813d.jpg)

Roth Ira Which Term Is Best Whats Apy

The Advantages Of Owning Traditional And Roth IRAs

What Is A Roth IRA The Fancy Accountant

Does Ohio Tax Roth IRA Distributions OPRS

Roth IRA Withdrawals Read This First

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

https://smartasset.com/.../maine-retirement-ta…

Social Security is exempt from taxation in Maine but other forms of retirement income are not Seniors who receive retirement income from a 401 k IRA or pension will pay tax rates as high as 7 15 though a

https://themoneyknowhow.com/are-roth-ira-distributions-taxable-by-states

While Roth IRA contributions aren t tax deductible qualified distributions from a Roth account are tax free at the federal level However the tax treatment of Roth

Social Security is exempt from taxation in Maine but other forms of retirement income are not Seniors who receive retirement income from a 401 k IRA or pension will pay tax rates as high as 7 15 though a

While Roth IRA contributions aren t tax deductible qualified distributions from a Roth account are tax free at the federal level However the tax treatment of Roth

What Is A Roth IRA The Fancy Accountant

Roth Ira Which Term Is Best Whats Apy

Does Ohio Tax Roth IRA Distributions OPRS

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

Roth IRA Withdrawals Read This First

The Basics About The Roth IRA Blog hubcfo

+1000px.jpg)

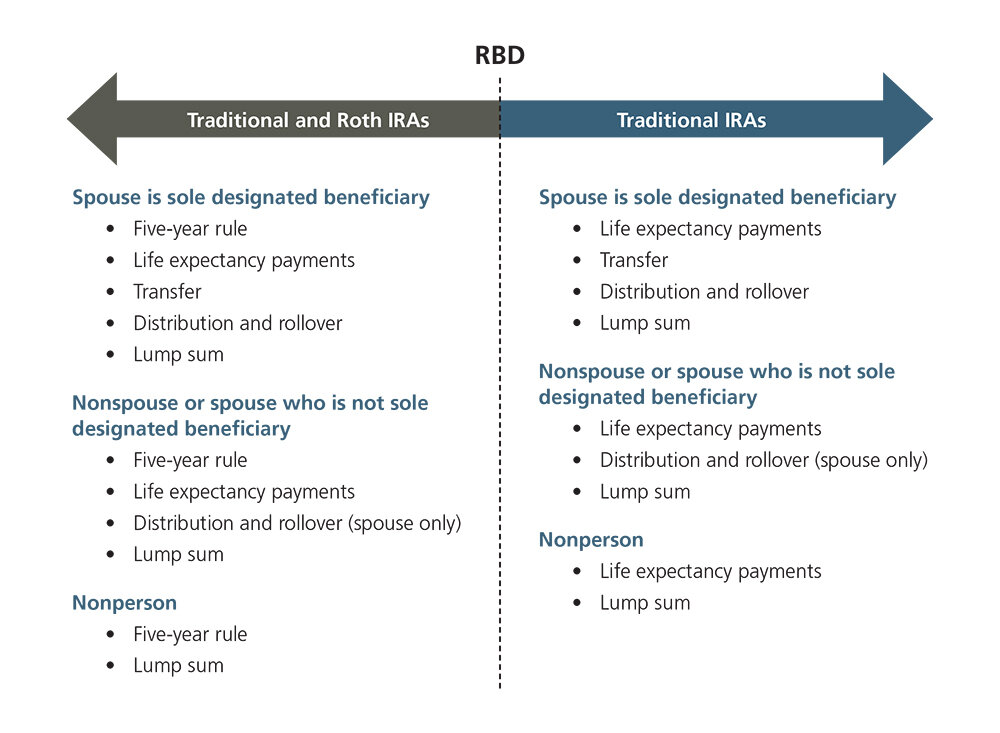

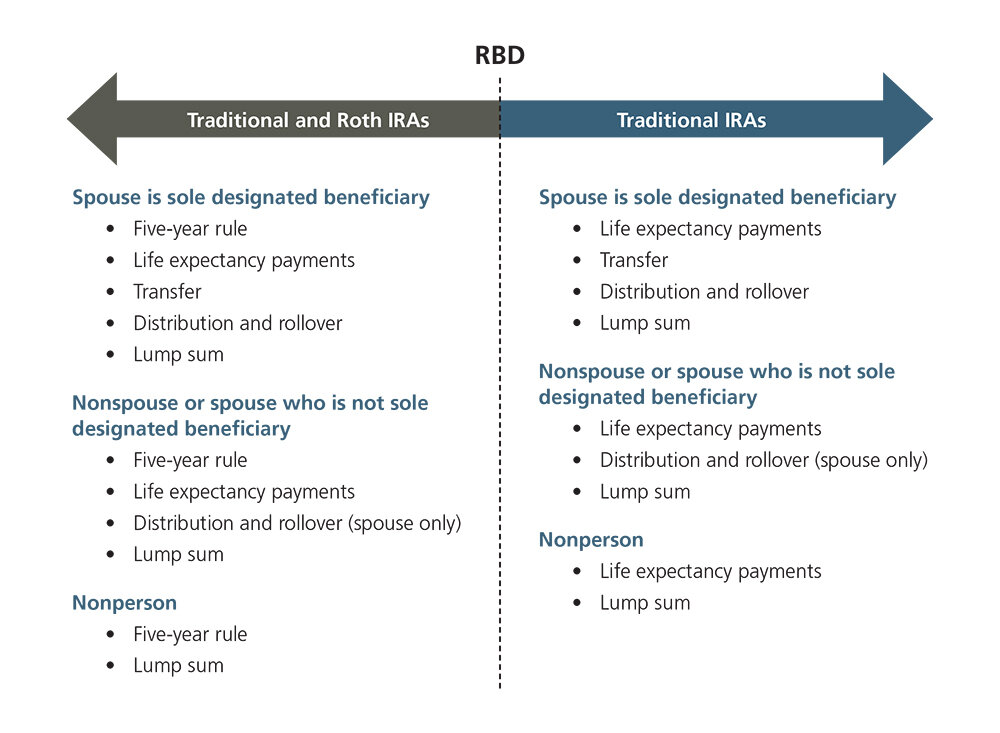

IRA Beneficiary Options For Deaths Before January 1 2020 Ascensus

+1000px.jpg)

IRA Beneficiary Options For Deaths Before January 1 2020 Ascensus

IRA And Roth IRA