In the digital age, when screens dominate our lives it's no wonder that the appeal of tangible printed materials isn't diminishing. Whatever the reason, whether for education or creative projects, or simply adding a personal touch to your area, Does Irs Tax 401k Withdrawals are now a useful source. In this article, we'll take a dive to the depths of "Does Irs Tax 401k Withdrawals," exploring their purpose, where to locate them, and the ways that they can benefit different aspects of your daily life.

Get Latest Does Irs Tax 401k Withdrawals Below

Does Irs Tax 401k Withdrawals

Does Irs Tax 401k Withdrawals -

There is no need to show a hardship to take a distribution However your distribution will be includible in your taxable income and it may be subject to a 10 additional tax if you re under age 59 1 2 The additional tax is 25 if you take a distribution from your SIMPLE IRA in the first 2 years you participate in the SIMPLE IRA plan

Transparent pricing Hassle free tax filing is 50 for all tax situations no hidden costs or fees Maximum refund guaranteed Get every dollar you deserve when you file with this tax

Does Irs Tax 401k Withdrawals offer a wide assortment of printable, downloadable material that is available online at no cost. These printables come in different styles, from worksheets to templates, coloring pages and much more. The attraction of printables that are free lies in their versatility as well as accessibility.

More of Does Irs Tax 401k Withdrawals

The Maximum 401 k Contribution Limit For 2021

The Maximum 401 k Contribution Limit For 2021

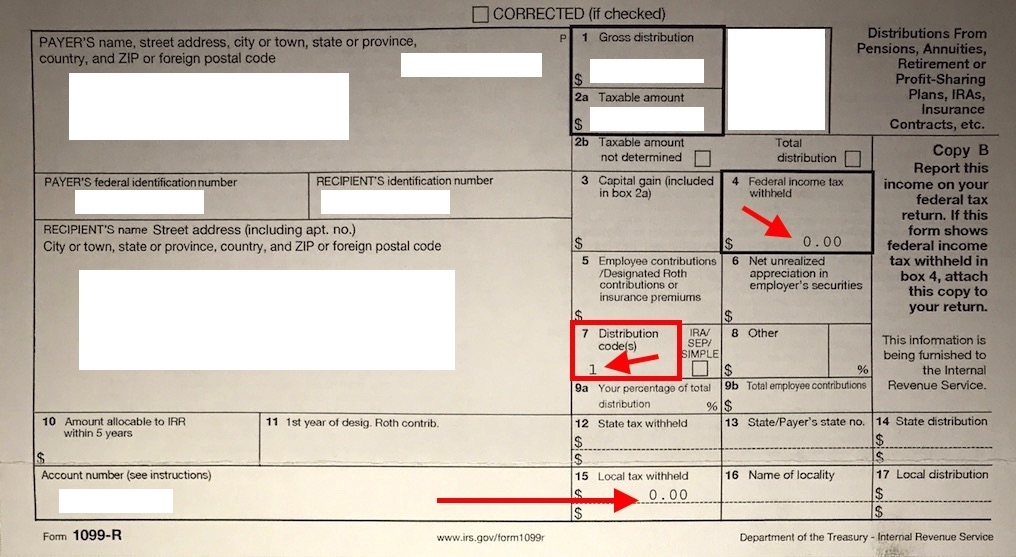

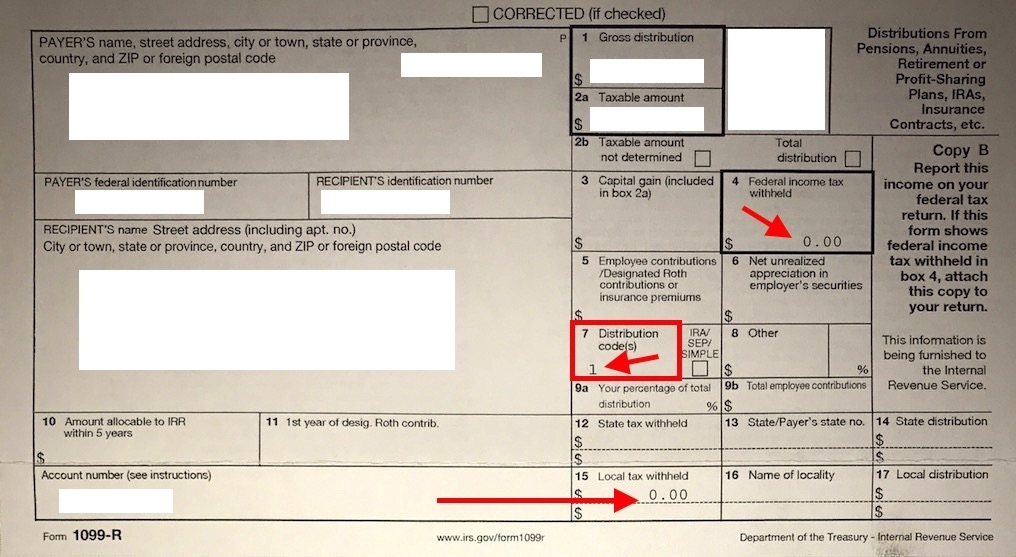

How does a 401 k withdrawal affect your tax return Once you start withdrawing from your 401 k or traditional IRA your withdrawals are taxed as ordinary income You ll report the taxable part of your distribution directly on your Form 1040 Keep in mind the tax considerations for a Roth 401 k or Roth IRA are different

The Internal Revenue Service IRS allows you to begin taking distributions from your 401 k without a 10 early withdrawal penalty as soon as you are 59 years old

Does Irs Tax 401k Withdrawals have risen to immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Customization: It is possible to tailor designs to suit your personal needs when it comes to designing invitations planning your schedule or decorating your home.

-

Educational Value: Free educational printables can be used by students from all ages, making them a valuable resource for educators and parents.

-

Accessibility: immediate access a variety of designs and templates reduces time and effort.

Where to Find more Does Irs Tax 401k Withdrawals

401 k Hardship Withdrawal What You Need To Know Discover

401 k Hardship Withdrawal What You Need To Know Discover

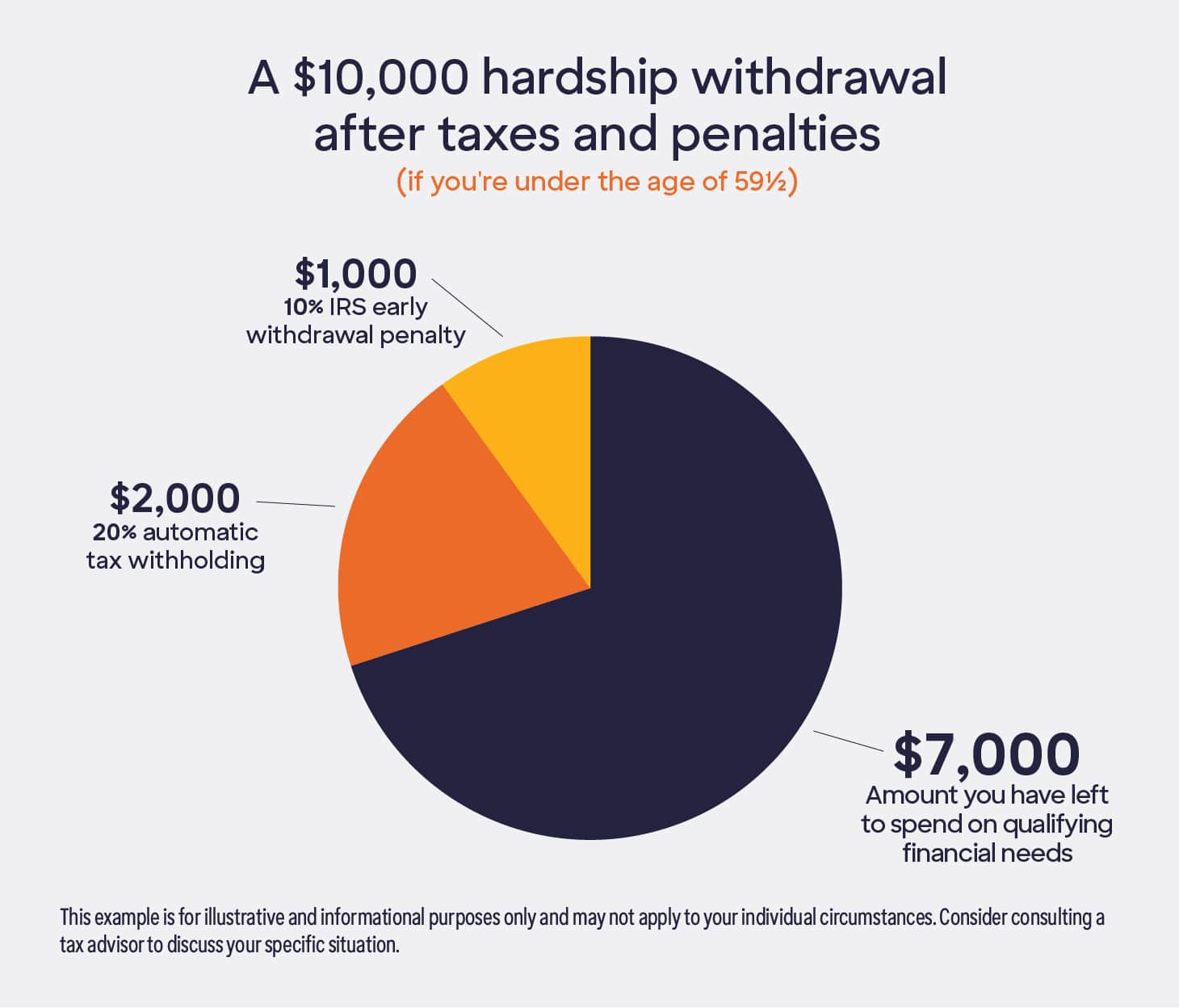

If you withdraw money from your 401 k before you re 59 the IRS usually assesses a 10 tax as an early distribution penalty That could mean giving the government 1 000 or 10 of a

Are There Always Taxes Associated With 401 k Withdrawals Unfortunately yes there are taxes associated with 401 k withdrawals Regardless of whether you are under 59 5 or over 59 5 there is a mandatory 20 withholding on distributions If withdrawing before the age of 59 5 you may also pay a 10 early

If we've already piqued your interest in printables for free, let's explore where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Does Irs Tax 401k Withdrawals suitable for many goals.

- Explore categories such as furniture, education, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets including flashcards, learning materials.

- Ideal for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- The blogs are a vast variety of topics, everything from DIY projects to party planning.

Maximizing Does Irs Tax 401k Withdrawals

Here are some creative ways create the maximum value use of Does Irs Tax 401k Withdrawals:

1. Home Decor

- Print and frame gorgeous art, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Utilize free printable worksheets to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners, and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Does Irs Tax 401k Withdrawals are an abundance filled with creative and practical information that cater to various needs and preferences. Their access and versatility makes them a valuable addition to your professional and personal life. Explore the many options of Does Irs Tax 401k Withdrawals and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Does Irs Tax 401k Withdrawals truly for free?

- Yes, they are! You can download and print these materials for free.

-

Can I use free templates for commercial use?

- It depends on the specific conditions of use. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues in Does Irs Tax 401k Withdrawals?

- Some printables may contain restrictions regarding their use. You should read the terms and conditions provided by the creator.

-

How can I print printables for free?

- You can print them at home with printing equipment or visit a local print shop for premium prints.

-

What software is required to open printables at no cost?

- Most printables come with PDF formats, which is open with no cost software such as Adobe Reader.

What To Do If You Have To Take An Early Withdrawal From Your Solo 401k

401K Withdrawal Before You Do Review The Limits Penalty Early

Check more sample of Does Irs Tax 401k Withdrawals below

What Is A Roth IRA The Fancy Accountant

401K Withdrawal Before You Do Review The Limits Penalty Early

6 Things To Know About Roth 401 k Withdrawals The Motley Fool

401k Early Withdrawal What To Know Before You Cash Out Community Charter

401k Early Withdrawal What To Know Before You Cash Out DotNet Books

The High Price Of A 401 k Withdrawal DaveRamsey

https://www.nerdwallet.com/article/taxes/401k-taxes

Transparent pricing Hassle free tax filing is 50 for all tax situations no hidden costs or fees Maximum refund guaranteed Get every dollar you deserve when you file with this tax

https://www.irs.gov/retirement-plans/plan...

You can choose to have your 401 k plan transfer a distribution directly to another eligible plan or to an IRA Under this option no taxes are withheld If you are under age 59 at the time of the distribution any taxable portion not rolled over may be subject to a 10 additional tax on early distributions discussed below

Transparent pricing Hassle free tax filing is 50 for all tax situations no hidden costs or fees Maximum refund guaranteed Get every dollar you deserve when you file with this tax

You can choose to have your 401 k plan transfer a distribution directly to another eligible plan or to an IRA Under this option no taxes are withheld If you are under age 59 at the time of the distribution any taxable portion not rolled over may be subject to a 10 additional tax on early distributions discussed below

401k Early Withdrawal What To Know Before You Cash Out Community Charter

401K Withdrawal Before You Do Review The Limits Penalty Early

401k Early Withdrawal What To Know Before You Cash Out DotNet Books

The High Price Of A 401 k Withdrawal DaveRamsey

How To Report A 1099 R Rollover To Your Self Directed 401k YouTube

What Is A Roth IRA The Fancy Accountant

What Is A Roth IRA The Fancy Accountant

What Is A ROTH 401k And How Does It Work Compared To A 401k