In a world where screens rule our lives, the charm of tangible printed products hasn't decreased. For educational purposes and creative work, or simply adding personal touches to your space, Does Idaho Charge Income Tax On Social Security are now a useful source. With this guide, you'll dive into the sphere of "Does Idaho Charge Income Tax On Social Security," exploring the benefits of them, where they are available, and what they can do to improve different aspects of your life.

Get Latest Does Idaho Charge Income Tax On Social Security Below

Does Idaho Charge Income Tax On Social Security

Does Idaho Charge Income Tax On Social Security -

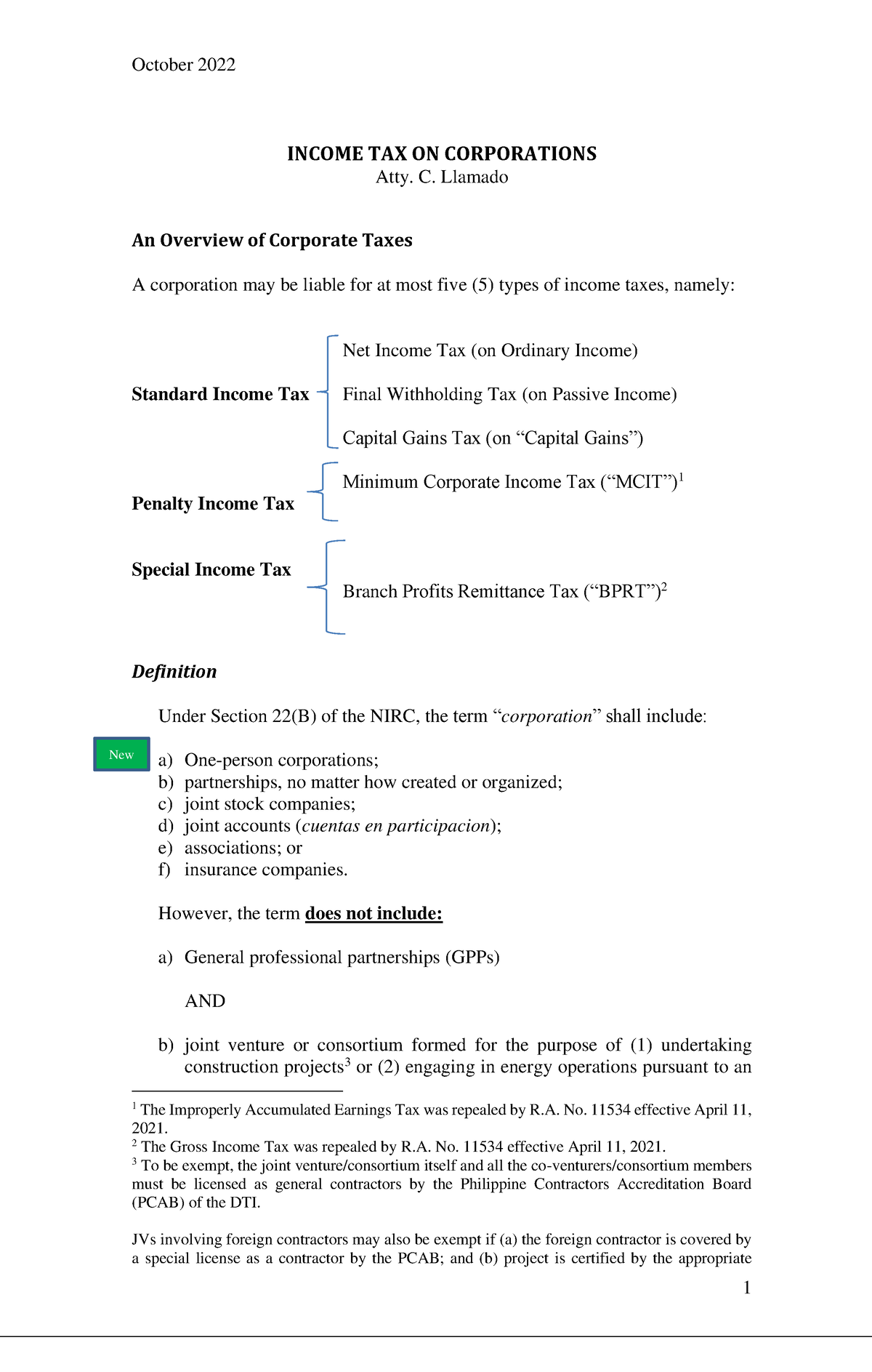

Idaho imposes a flat income tax rate of 5 8 on taxable income over 2 500 5 000 for joint filers for tax year 2023 The threshold will be adjusted annually for inflation Idaho

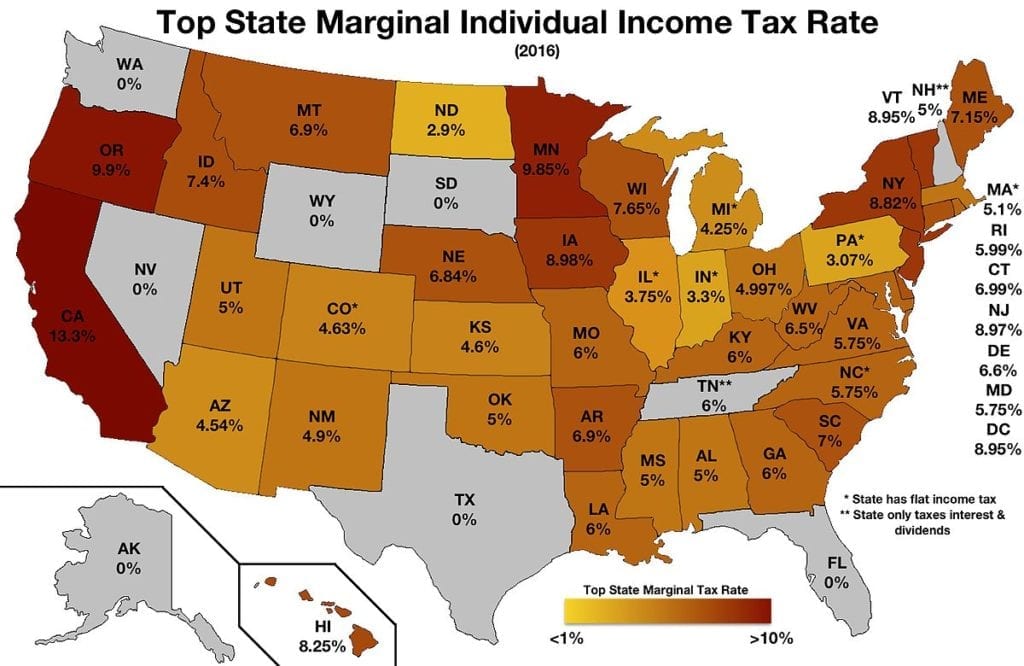

Thirty seven states and D C either have no income tax AK FL NV SD TN TX WA WY or do not include Social Security benefits in their calculation for

Does Idaho Charge Income Tax On Social Security include a broad selection of printable and downloadable materials online, at no cost. They are available in a variety of designs, including worksheets templates, coloring pages, and much more. The great thing about Does Idaho Charge Income Tax On Social Security is in their versatility and accessibility.

More of Does Idaho Charge Income Tax On Social Security

Social Security Benefit Taxes By State 13 States Might Tax Benefits

Social Security Benefit Taxes By State 13 States Might Tax Benefits

For joint filers only those with an AGI of more than 111 200 are subject to Rhode Island state tax on Social Security Benefits For single filers only retirees with

One important thing to know about Idaho income taxes is that Social Security income is not taxable Railroad Retirement benefits are also completely tax free

The Does Idaho Charge Income Tax On Social Security have gained huge popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Modifications: We can customize designs to suit your personal needs whether you're designing invitations, organizing your schedule, or even decorating your house.

-

Education Value Education-related printables at no charge cater to learners from all ages, making them an invaluable tool for parents and educators.

-

The convenience of immediate access various designs and templates is time-saving and saves effort.

Where to Find more Does Idaho Charge Income Tax On Social Security

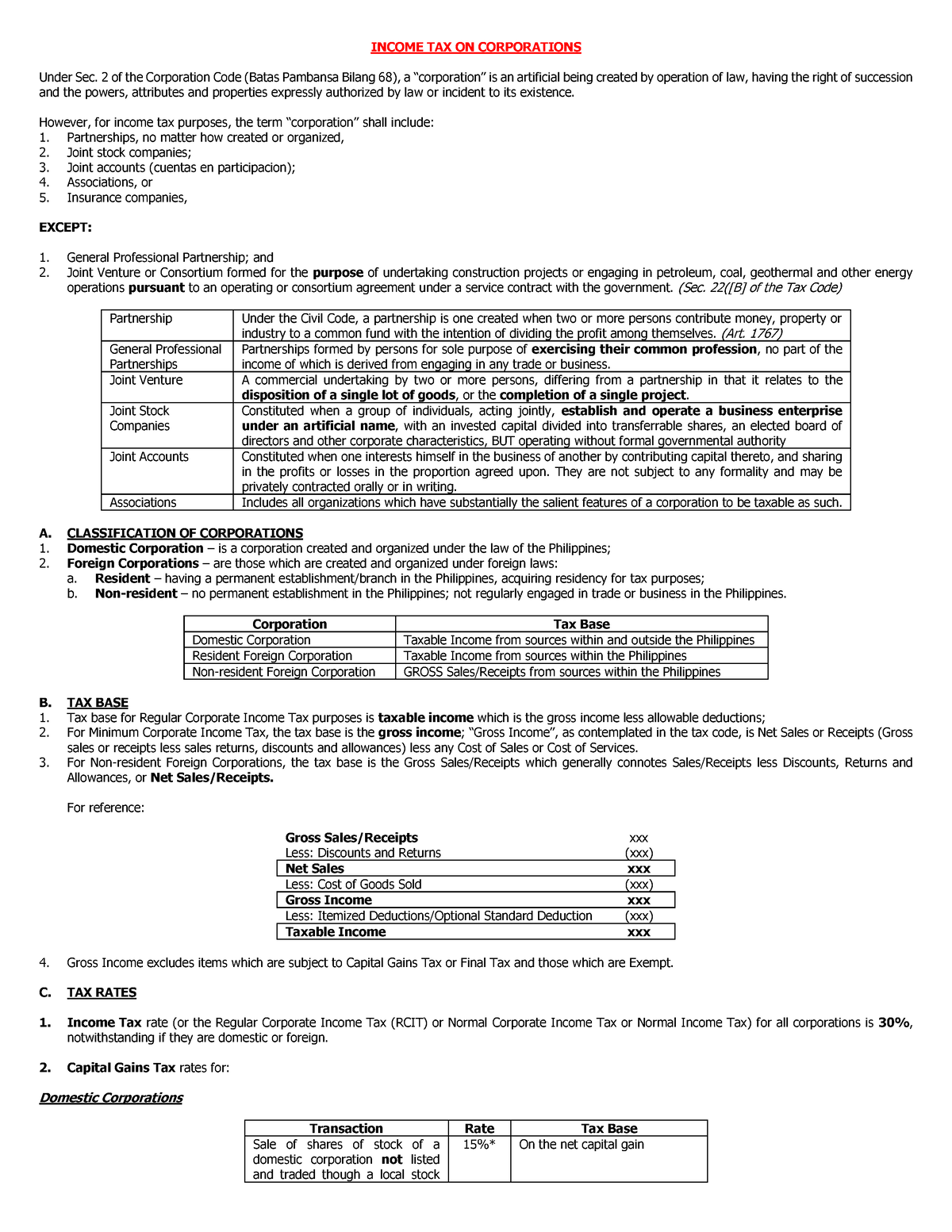

CPAR Tax On Corporations Batch 92 Handout INCOME TAX ON

CPAR Tax On Corporations Batch 92 Handout INCOME TAX ON

Single filers with a combined income of 25 000 to 34 000 must pay income taxes on up to 50 of their Social Security benefits If your combined income is more

You will pay tax on your Social Security benefits based on Internal Revenue Service IRS rules if you File a federal tax return as an individual and your combined income is

Now that we've piqued your interest in printables for free Let's take a look at where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of printables that are free for a variety of applications.

- Explore categories such as design, home decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets along with flashcards, as well as other learning tools.

- Perfect for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- The blogs covered cover a wide range of interests, all the way from DIY projects to planning a party.

Maximizing Does Idaho Charge Income Tax On Social Security

Here are some ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use these printable worksheets free of charge to aid in learning at your home also in the classes.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners checklists for tasks, as well as meal planners.

Conclusion

Does Idaho Charge Income Tax On Social Security are an abundance of useful and creative resources for a variety of needs and interest. Their accessibility and flexibility make these printables a useful addition to both professional and personal lives. Explore the endless world of Does Idaho Charge Income Tax On Social Security today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Does Idaho Charge Income Tax On Social Security really available for download?

- Yes they are! You can download and print these documents for free.

-

Can I use free printables for commercial purposes?

- It's determined by the specific terms of use. Make sure you read the guidelines for the creator before using any printables on commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Certain printables could be restricted on usage. Check the terms of service and conditions provided by the author.

-

How can I print printables for free?

- You can print them at home using a printer or visit an area print shop for more high-quality prints.

-

What software is required to open printables free of charge?

- A majority of printed materials are in the format of PDF, which is open with no cost software like Adobe Reader.

Income Tax And Social Security Benefits GYF

Social Security Income Limit What Counts As Income YouTube

Check more sample of Does Idaho Charge Income Tax On Social Security below

Social Security Tax Deferment ArmyReenlistment

TAX Income Tax On Corporations INCOME TAX ON CORPORATIONS Under Sec

The High Tax State Of Idaho

CT Tax Exemption For Retirees

Taxes On Social Security Benefits Inflation Protection

Watch Out For What Your Clients May Owe In Income Taxes On Social

https://taxfoundation.org/data/all/state/states...

Thirty seven states and D C either have no income tax AK FL NV SD TN TX WA WY or do not include Social Security benefits in their calculation for

https://smartasset.com/.../idaho-retirement-ta…

The good news is that Idaho doesn t tax Social Security income at the state level Additionally the state s property and sales taxes are relatively low The bad news is that other forms of retirement income are taxed

Thirty seven states and D C either have no income tax AK FL NV SD TN TX WA WY or do not include Social Security benefits in their calculation for

The good news is that Idaho doesn t tax Social Security income at the state level Additionally the state s property and sales taxes are relatively low The bad news is that other forms of retirement income are taxed

CT Tax Exemption For Retirees

TAX Income Tax On Corporations INCOME TAX ON CORPORATIONS Under Sec

Taxes On Social Security Benefits Inflation Protection

Watch Out For What Your Clients May Owe In Income Taxes On Social

States That Won t Tax Your Retirement Distributions In 2021

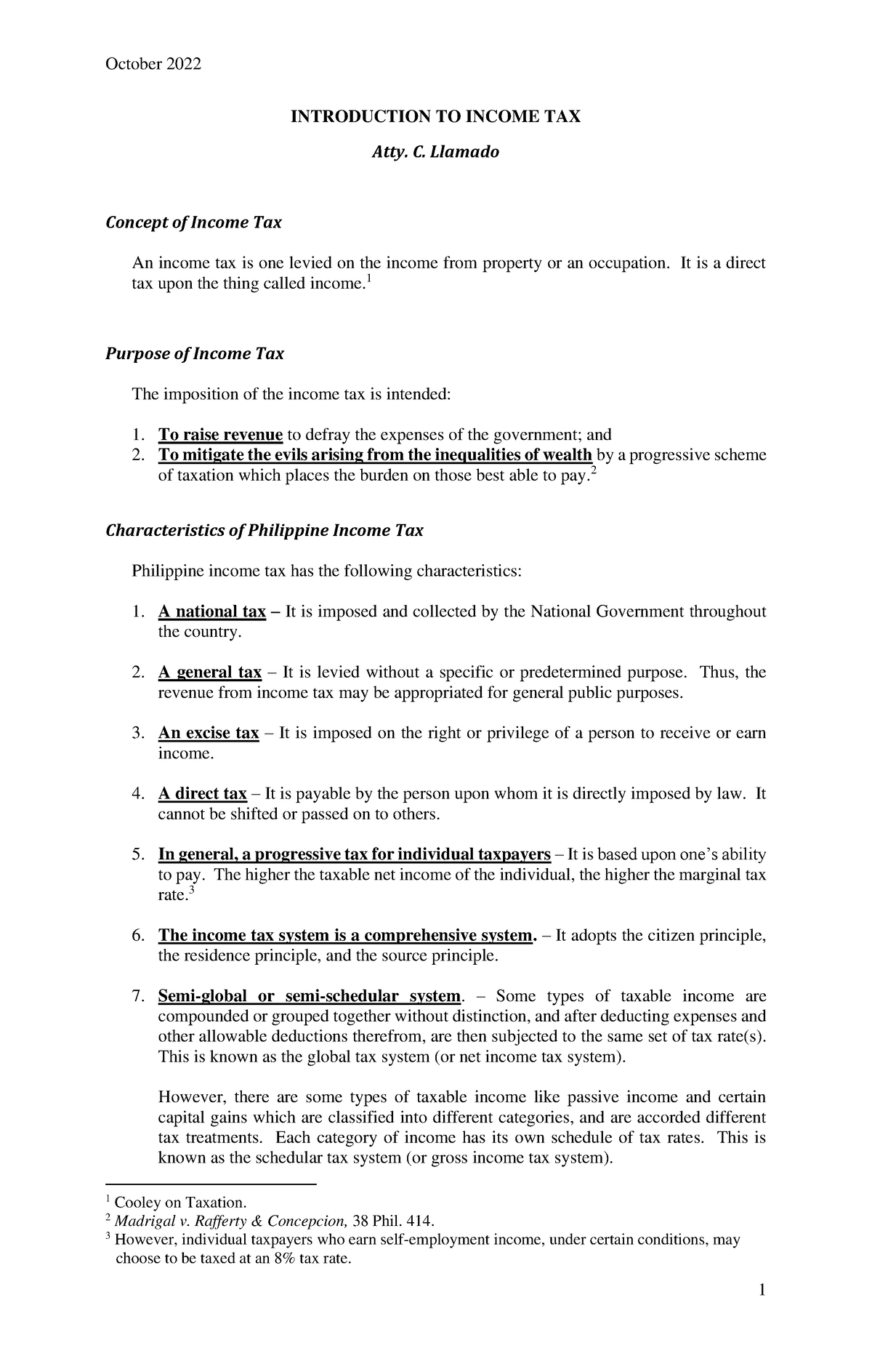

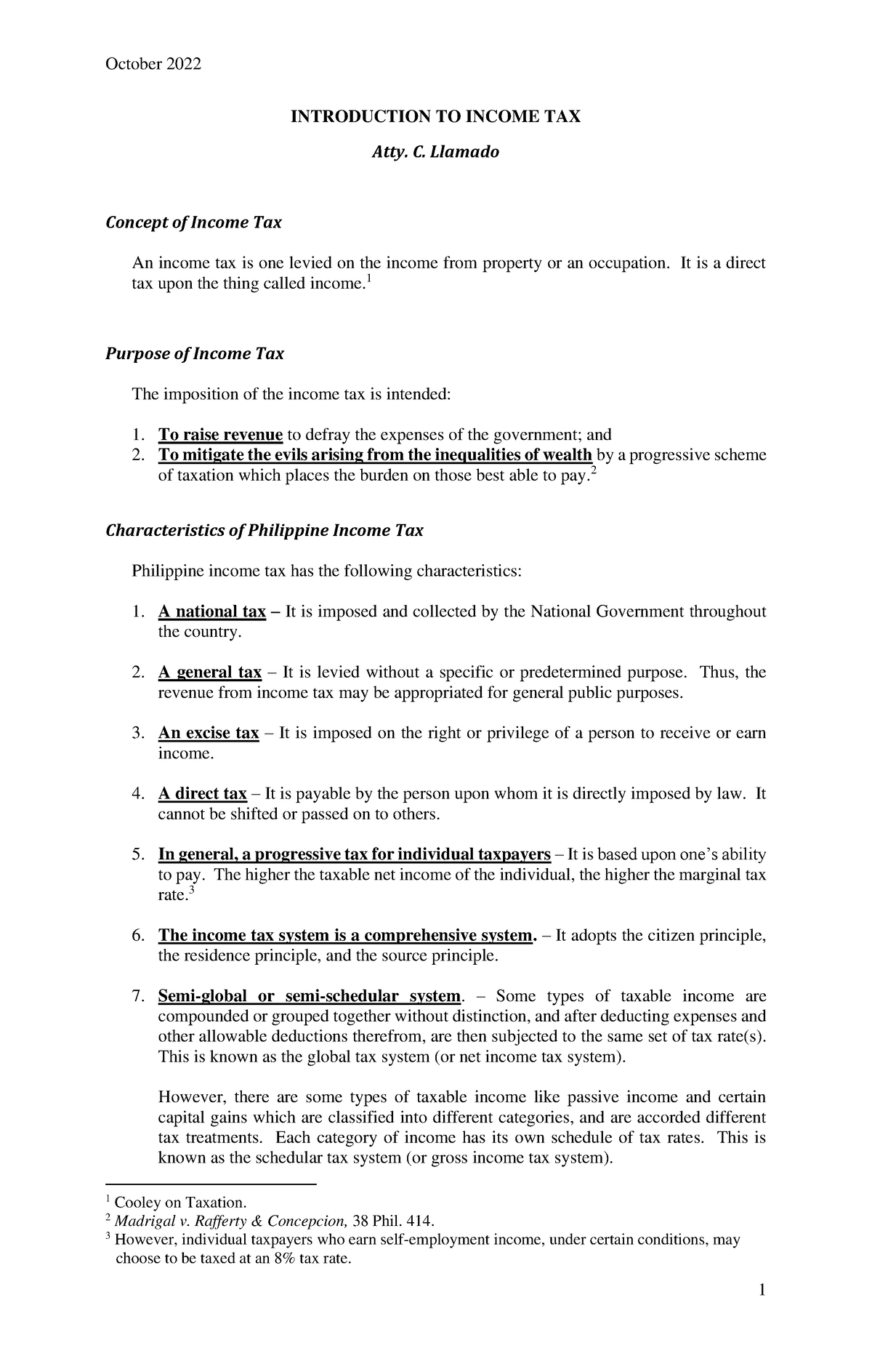

CPAR Intro To Income Tax And Income Tax On Individuals INTRODUCTION

CPAR Intro To Income Tax And Income Tax On Individuals INTRODUCTION

Understanding How Your Social Security Benefits Are Taxed Seaside