In this age of technology, where screens dominate our lives, the charm of tangible printed material hasn't diminished. Whether it's for educational purposes for creative projects, just adding an element of personalization to your home, printables for free have become a valuable source. In this article, we'll take a dive into the world "Does Ga Tax Federal Retirement Income," exploring the benefits of them, where they can be found, and how they can improve various aspects of your life.

Get Latest Does Ga Tax Federal Retirement Income Below

Does Ga Tax Federal Retirement Income

Does Ga Tax Federal Retirement Income -

Like many states these exempt some retirement income including income from federal sources from taxation The difference is that their exemptions are quite scanty compared with the

Taxpayers who are 62 or older or permanently and totally disabled regardless of age may be eligible for a retirement income adjustment on their Georgia tax return Retirement

Printables for free cover a broad range of printable, free materials that are accessible online for free cost. They are available in numerous formats, such as worksheets, templates, coloring pages, and more. The appealingness of Does Ga Tax Federal Retirement Income lies in their versatility as well as accessibility.

More of Does Ga Tax Federal Retirement Income

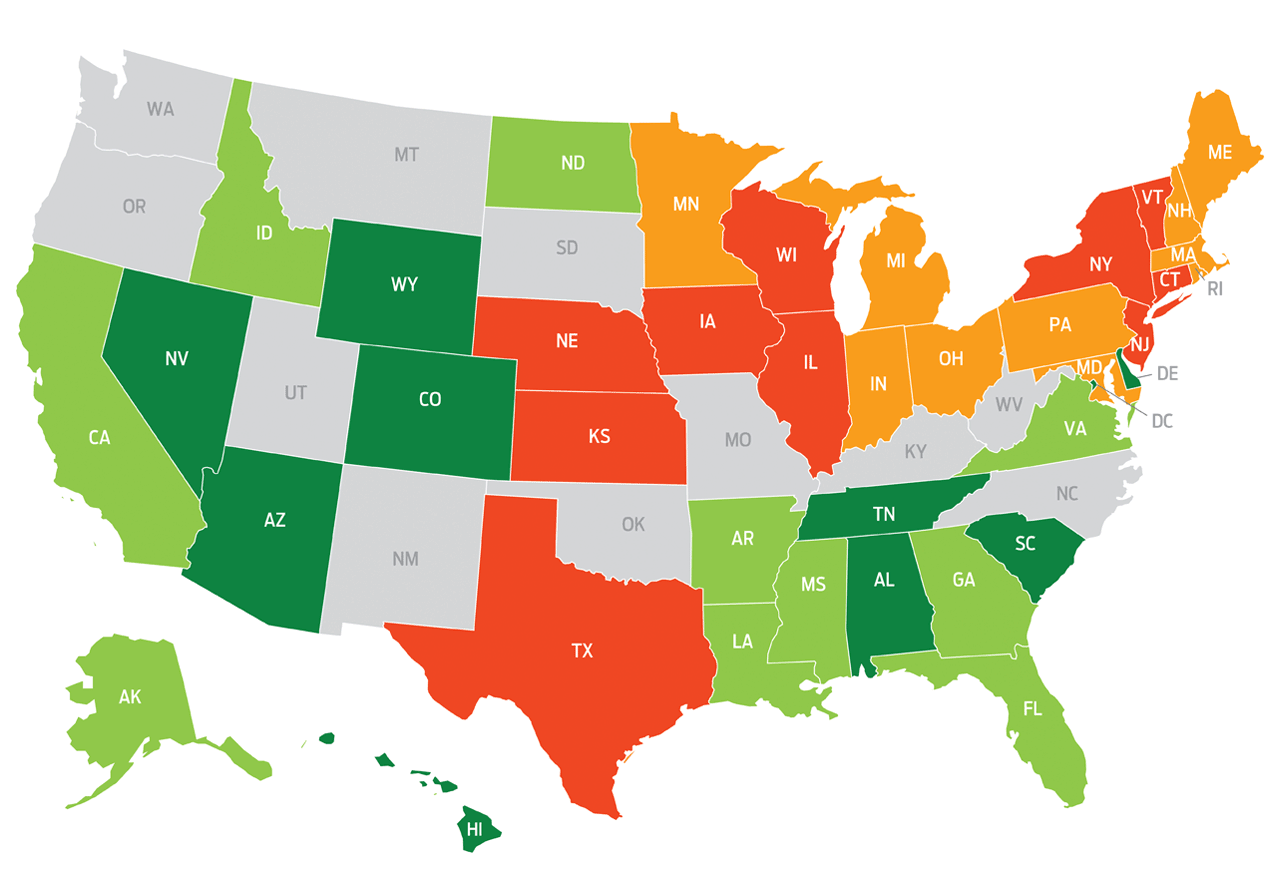

Map Here Are The Best And Worst U S States For Retirement Cashay

Map Here Are The Best And Worst U S States For Retirement Cashay

The state does not tax Social Security benefits withdrawals from pensions and retirement accounts are only partially taxed and anyone over 62 or who are permanently disabled

Federal taxes Marginal tax rate 22 Effective tax rate 10 94 Federal income tax 7 660 State taxes Marginal tax rate 5 75 Effective tax rate 4 84 Georgia state tax

Does Ga Tax Federal Retirement Income have risen to immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Flexible: They can make printing templates to your own specific requirements whether you're designing invitations and schedules, or decorating your home.

-

Educational Value: The free educational worksheets cater to learners of all ages, making them an essential device for teachers and parents.

-

Affordability: Fast access a variety of designs and templates saves time and effort.

Where to Find more Does Ga Tax Federal Retirement Income

Pay Less Retirement Taxes

Pay Less Retirement Taxes

The 1099 and W 2 show the total amount of pension payments for the calendar year as well as total federal and state income tax withheld The 1099 and W

Georgia allows for taxpayers to subtract a portion of their retirement income on their Georgia return The maximum retirement exclusion for taxpayers that are 62 64 years

In the event that we've stirred your curiosity about Does Ga Tax Federal Retirement Income We'll take a look around to see where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Does Ga Tax Federal Retirement Income to suit a variety of needs.

- Explore categories such as home decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets Flashcards, worksheets, and other educational tools.

- Great for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- The blogs are a vast selection of subjects, all the way from DIY projects to party planning.

Maximizing Does Ga Tax Federal Retirement Income

Here are some inventive ways for you to get the best of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use free printable worksheets for teaching at-home or in the classroom.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars along with lists of tasks, and meal planners.

Conclusion

Does Ga Tax Federal Retirement Income are a treasure trove of practical and innovative resources that meet a variety of needs and interests. Their availability and versatility make them a great addition to your professional and personal life. Explore the world of Does Ga Tax Federal Retirement Income right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes, they are! You can download and print these files for free.

-

Can I utilize free templates for commercial use?

- It is contingent on the specific rules of usage. Be sure to read the rules of the creator prior to printing printables for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables may contain restrictions on use. Be sure to read the terms and conditions offered by the creator.

-

How do I print printables for free?

- Print them at home with the printer, or go to an in-store print shop to get superior prints.

-

What program will I need to access printables at no cost?

- The majority of printed documents are in PDF format, which is open with no cost programs like Adobe Reader.

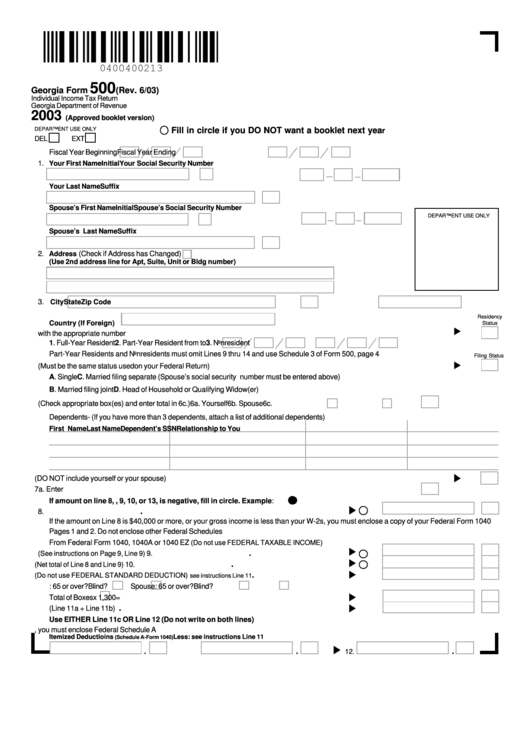

Georgia State Income Tax Form 500ez Bestkup

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

Check more sample of Does Ga Tax Federal Retirement Income below

2022 Tax Brackets PersiaKiylah

Sources Of US Tax Revenue By Tax Type 2022 Tax Foundation

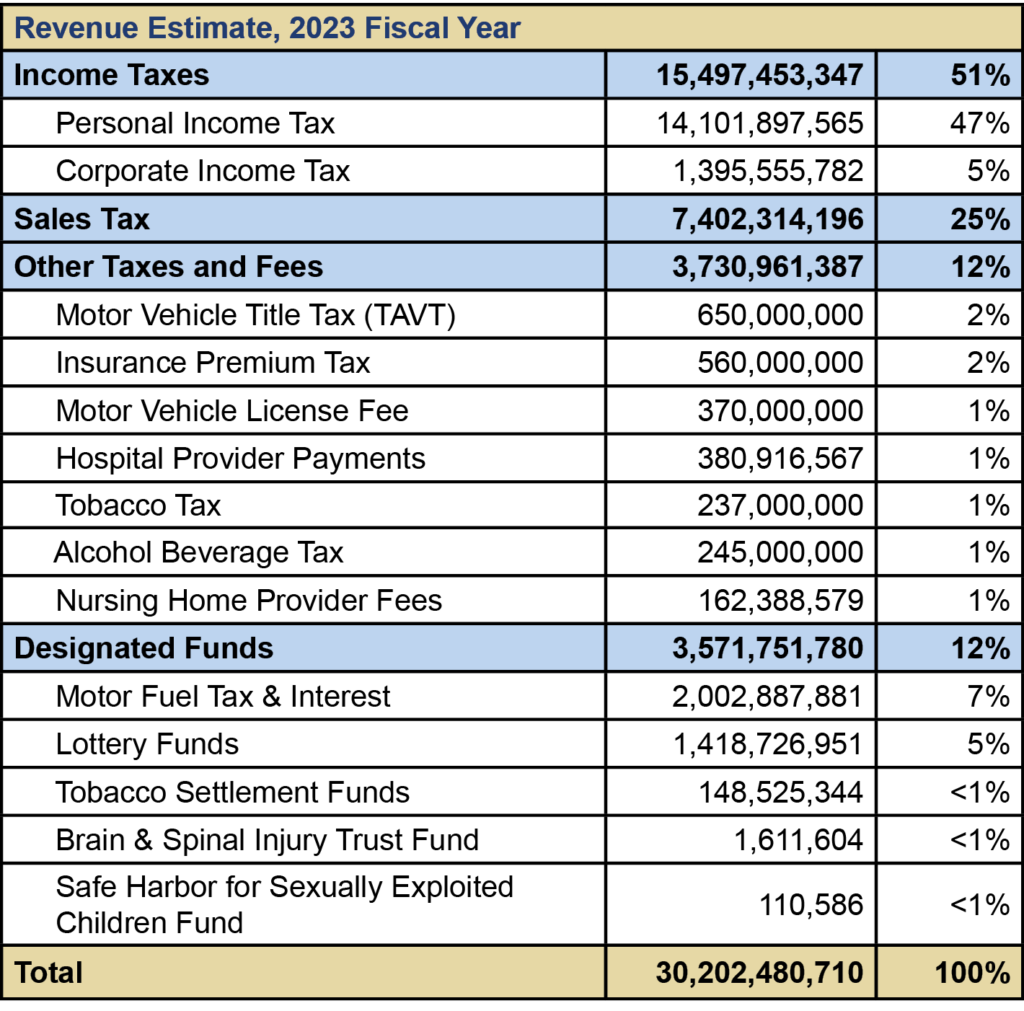

Georgia Revenue Primer For State Fiscal Year 2023 Georgia Budget And

2021 Nc Standard Deduction Standard Deduction 2021

How GEORGIA Taxes Retirees YouTube

How High Are Income Tax Rates In Your State

https://dor.georgia.gov/retirement-income-exclusion

Taxpayers who are 62 or older or permanently and totally disabled regardless of age may be eligible for a retirement income adjustment on their Georgia tax return Retirement

https://smartasset.com/.../georgia-retirem…

Is Georgia tax friendly for retirees Yes as Georgia does not tax Social Security and provides a deduction of 65 000 per person on all types of retirement income for anyone age 65 and older If you re age 62 to 64

Taxpayers who are 62 or older or permanently and totally disabled regardless of age may be eligible for a retirement income adjustment on their Georgia tax return Retirement

Is Georgia tax friendly for retirees Yes as Georgia does not tax Social Security and provides a deduction of 65 000 per person on all types of retirement income for anyone age 65 and older If you re age 62 to 64

2021 Nc Standard Deduction Standard Deduction 2021

Sources Of US Tax Revenue By Tax Type 2022 Tax Foundation

How GEORGIA Taxes Retirees YouTube

How High Are Income Tax Rates In Your State

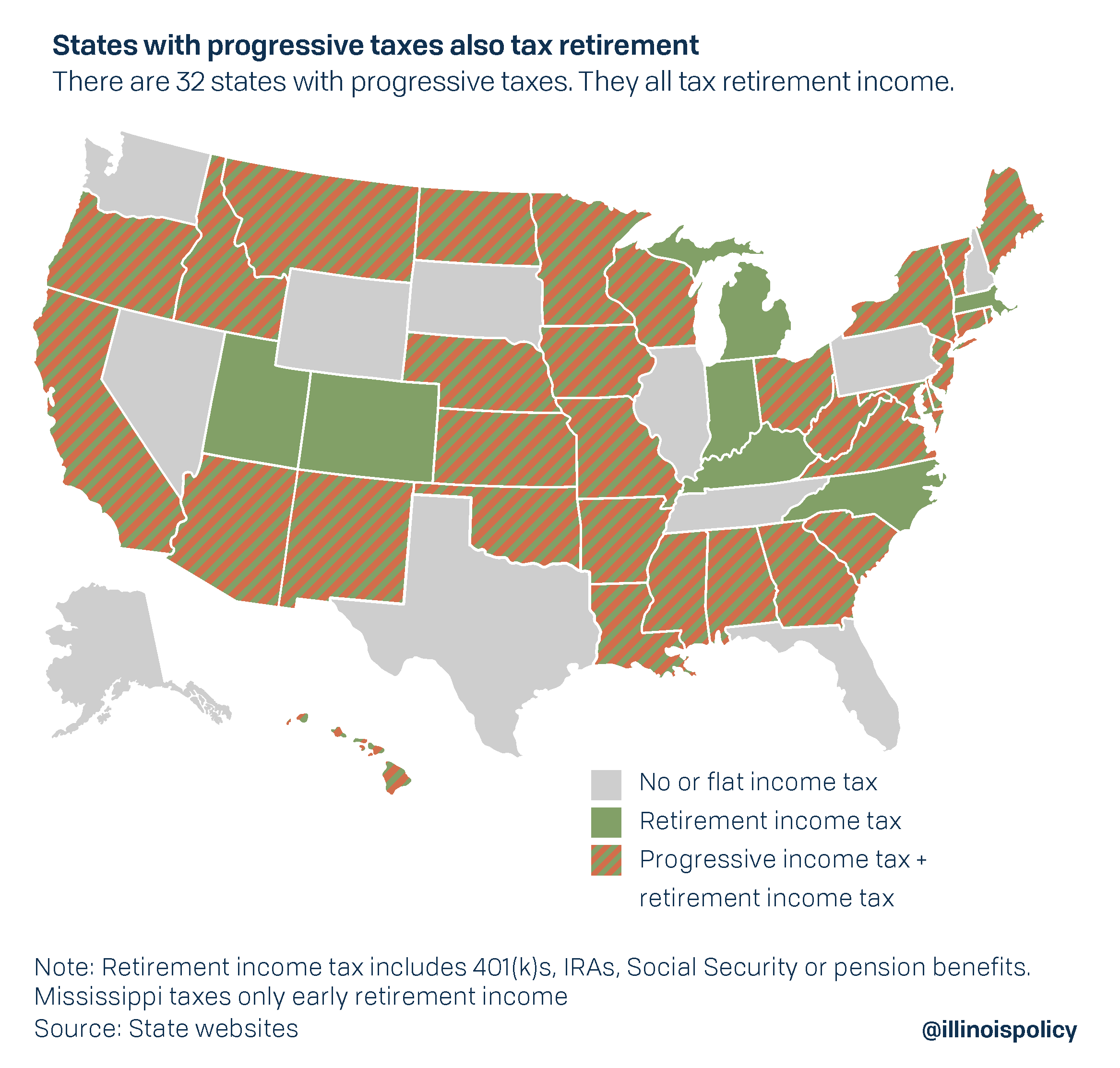

Illinois Treasurer Says fair Tax Makes Retirement Tax More Likely

Retirement Income Planning In Pennsylvania Rolek Retirement Planning

Retirement Income Planning In Pennsylvania Rolek Retirement Planning

Map Of The States That Do Not Tax Retirement Income Distributions