In a world with screens dominating our lives and the appeal of physical printed items hasn't gone away. Be it for educational use for creative projects, simply adding the personal touch to your area, Does Florida Tax 401k Distributions have become a valuable resource. For this piece, we'll take a dive in the world of "Does Florida Tax 401k Distributions," exploring the different types of printables, where to locate them, and how they can enhance various aspects of your life.

Get Latest Does Florida Tax 401k Distributions Below

Does Florida Tax 401k Distributions

Does Florida Tax 401k Distributions -

In addition to 0 state income tax Florida does not tax pension income or income from the IRA a 401K or Social Security There is also no inheritance or estate

Let s start with the eight states that have no income tax whatsoever Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming A ninth state New

Does Florida Tax 401k Distributions encompass a wide selection of printable and downloadable content that can be downloaded from the internet at no cost. These materials come in a variety of types, such as worksheets coloring pages, templates and much more. The great thing about Does Florida Tax 401k Distributions lies in their versatility as well as accessibility.

More of Does Florida Tax 401k Distributions

Indexed Universal Life IUL Vs 401 k Finance Strategists

Indexed Universal Life IUL Vs 401 k Finance Strategists

But no you don t pay taxes twice on 401 k withdrawals With the 20 withholding on your distribution you re essentially paying part of your taxes upfront Depending on your tax situation the amount

Florida is one of the nation s most tax friendly states for retirees but working residents benefit from these exemptions too Below we explain various Florida state taxes affecting

Does Florida Tax 401k Distributions have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

customization You can tailor printables to your specific needs for invitations, whether that's creating them to organize your schedule or decorating your home.

-

Educational Benefits: The free educational worksheets offer a wide range of educational content for learners of all ages, which makes them an invaluable resource for educators and parents.

-

It's easy: The instant accessibility to many designs and templates is time-saving and saves effort.

Where to Find more Does Florida Tax 401k Distributions

Cares Act 401k Withdrawal Taxes Calculator FayezTarran

Cares Act 401k Withdrawal Taxes Calculator FayezTarran

Retirement Planning 401 k How Are 401 k Withdrawals Taxed for Nonresidents By Amy Bell Updated June 03 2021 Reviewed by Chip

How much tax do you pay on a 401 K withdrawal The 10 early withdrawal penalty The 401 k 20 mandatory fed tax withholding When do you remit the taxes and penalties to

In the event that we've stirred your curiosity about Does Florida Tax 401k Distributions we'll explore the places you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Does Florida Tax 401k Distributions suitable for many objectives.

- Explore categories like decoration for your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing along with flashcards, as well as other learning tools.

- Ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- These blogs cover a broad array of topics, ranging starting from DIY projects to planning a party.

Maximizing Does Florida Tax 401k Distributions

Here are some ideas create the maximum value use of Does Florida Tax 401k Distributions:

1. Home Decor

- Print and frame beautiful art, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use free printable worksheets for reinforcement of learning at home also in the classes.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Does Florida Tax 401k Distributions are a treasure trove with useful and creative ideas designed to meet a range of needs and needs and. Their accessibility and versatility make they a beneficial addition to both professional and personal lives. Explore the world that is Does Florida Tax 401k Distributions today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Does Florida Tax 401k Distributions truly cost-free?

- Yes you can! You can print and download these free resources for no cost.

-

Can I utilize free printouts for commercial usage?

- It's based on specific usage guidelines. Make sure you read the guidelines for the creator before using printables for commercial projects.

-

Do you have any copyright issues with printables that are free?

- Some printables may come with restrictions on use. Be sure to read the conditions and terms of use provided by the creator.

-

How do I print Does Florida Tax 401k Distributions?

- Print them at home with either a printer at home or in a print shop in your area for superior prints.

-

What program is required to open printables at no cost?

- A majority of printed materials are as PDF files, which can be opened with free software, such as Adobe Reader.

The Maximum 401k Contribution Limit Harry Point

Pre Tax Vs After Tax 401k Roth Or Traditional Investdale

Check more sample of Does Florida Tax 401k Distributions below

Form 1040 Line 4 And Line 5 IRA Distributions Pensions And Annuities

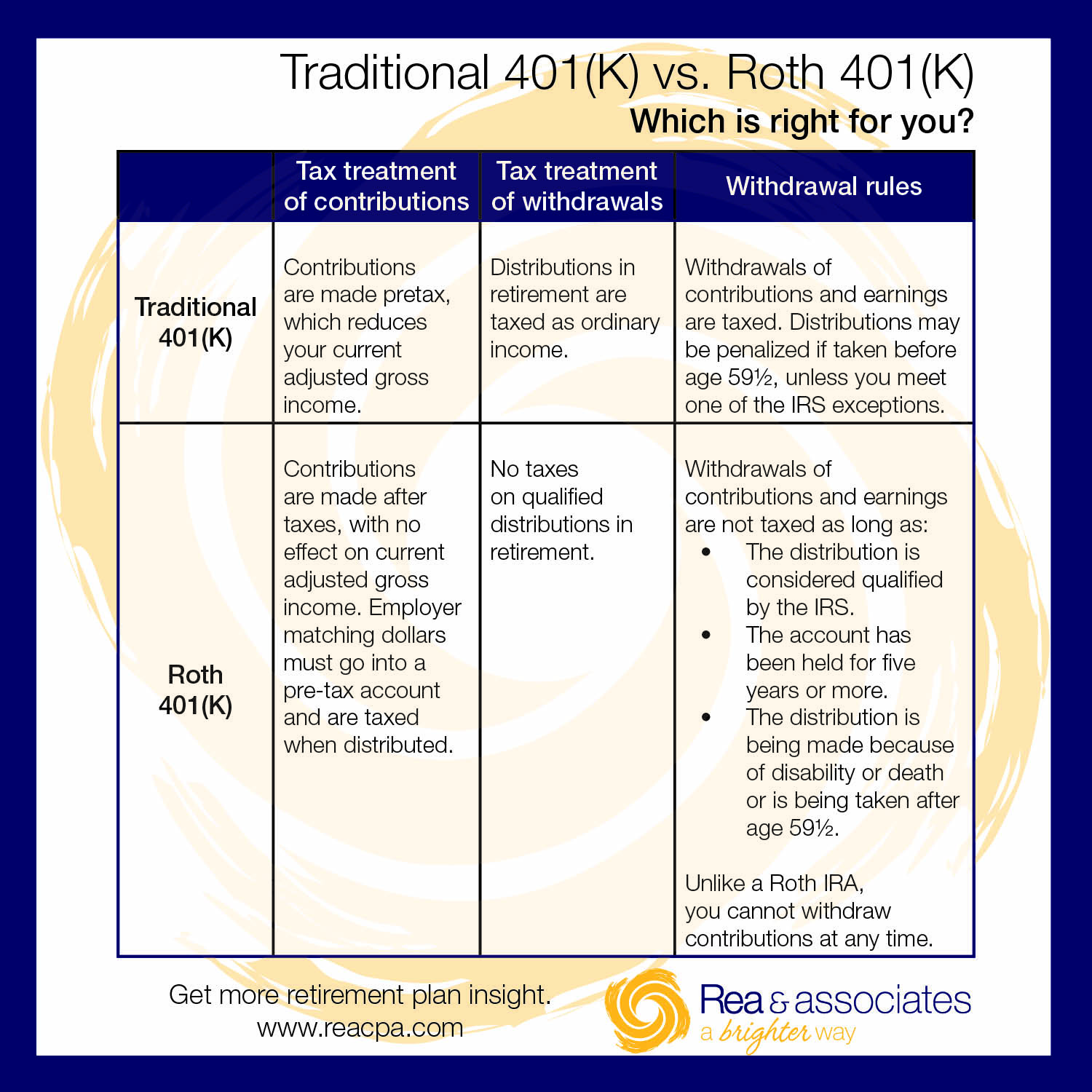

Roth Vs Traditional 401 K Retirement Ohio CPA Firm Rea CPA

Tax Reduction Company Inc

What To Do If You Have To Take An Early Withdrawal From Your Solo 401k

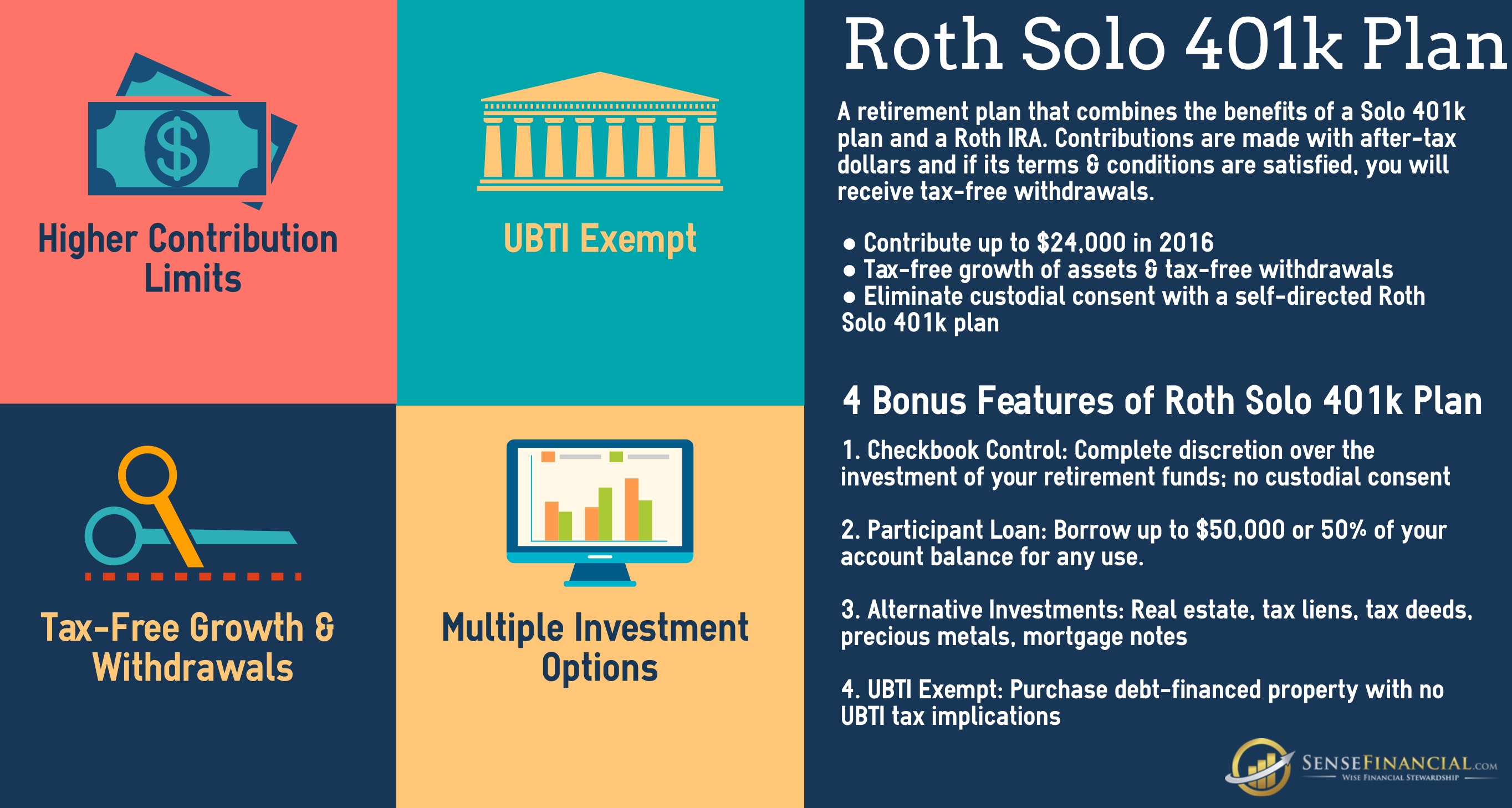

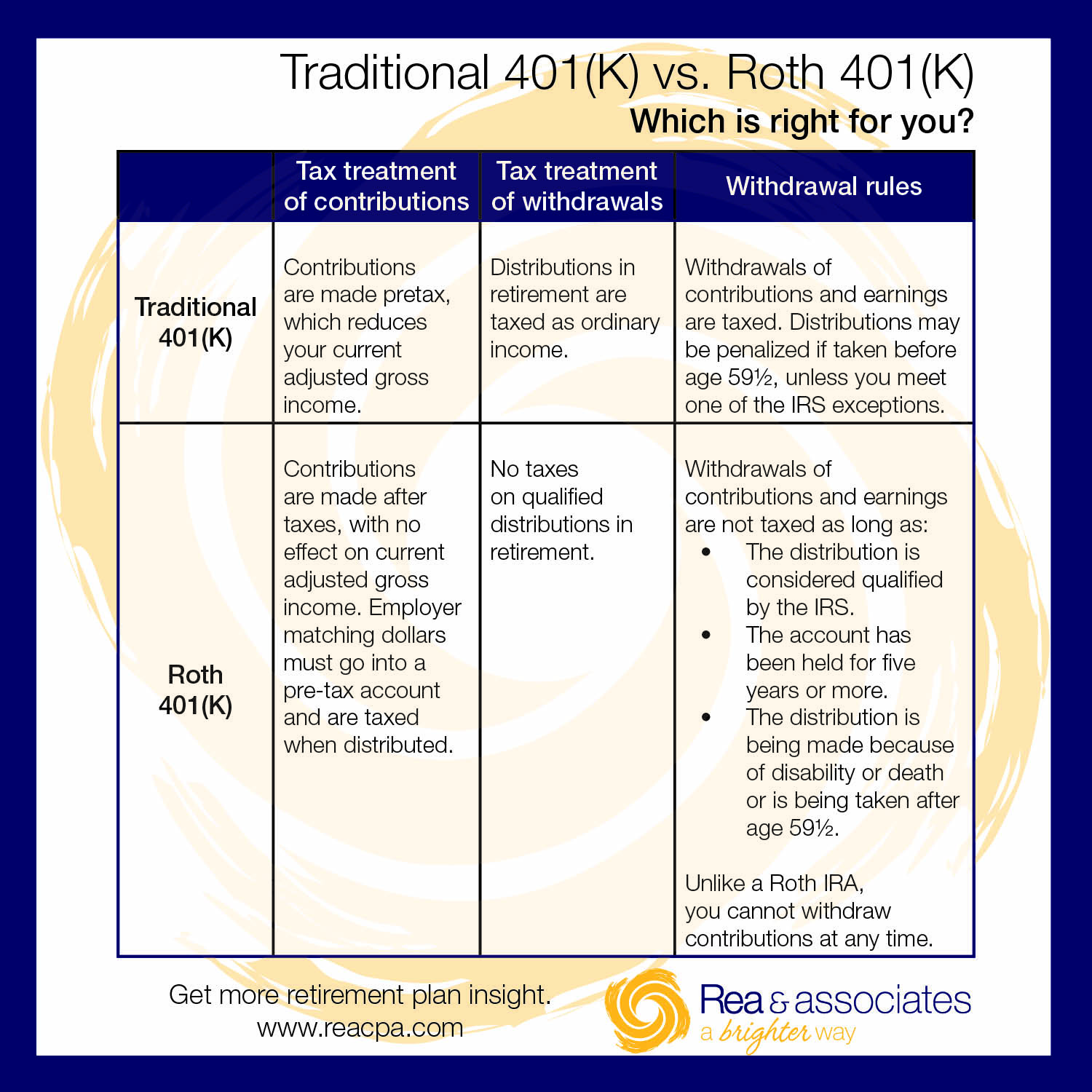

Infographics Why Choosing A Roth Solo 401 K Plan Makes Sense

What Reasons Can You Withdraw From 401k Without Penalty Covid

https://www.aarp.org/money/taxes/info …

Let s start with the eight states that have no income tax whatsoever Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming A ninth state New

https://www.investopedia.com/articles/…

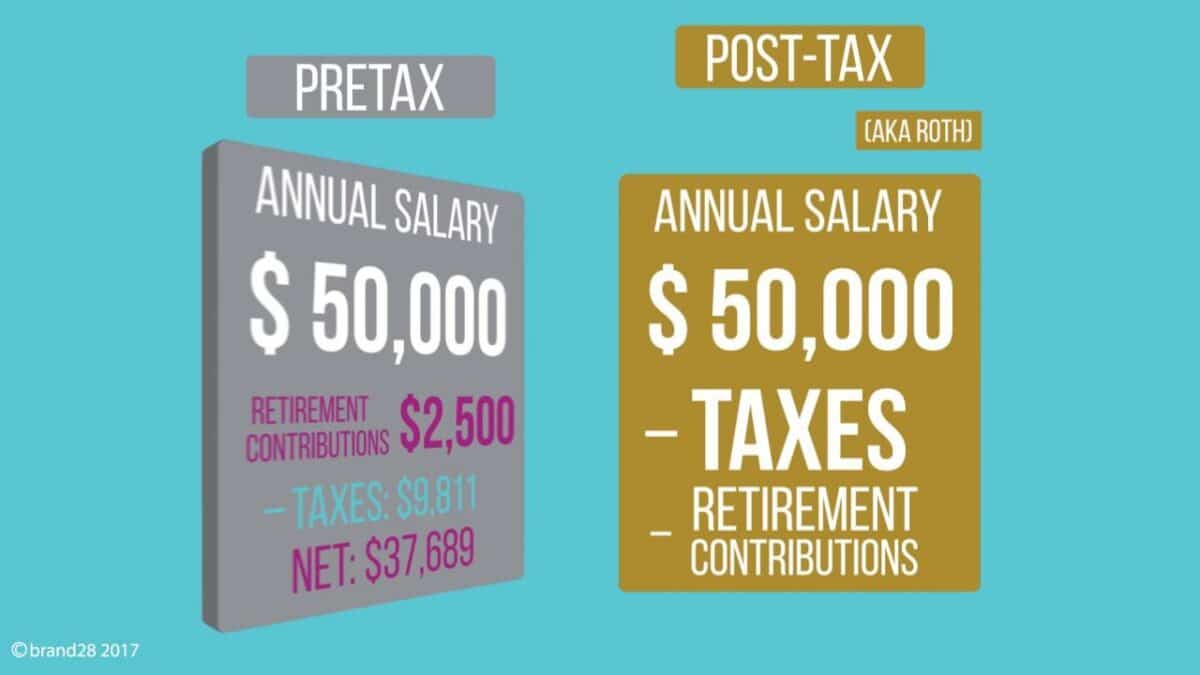

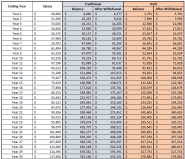

The tax treatment of 401 k distributions depends on the type of plan traditional or Roth Traditional 401 k withdrawals are taxed at an individual s current income tax rate

Let s start with the eight states that have no income tax whatsoever Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming A ninth state New

The tax treatment of 401 k distributions depends on the type of plan traditional or Roth Traditional 401 k withdrawals are taxed at an individual s current income tax rate

What To Do If You Have To Take An Early Withdrawal From Your Solo 401k

Roth Vs Traditional 401 K Retirement Ohio CPA Firm Rea CPA

Infographics Why Choosing A Roth Solo 401 K Plan Makes Sense

What Reasons Can You Withdraw From 401k Without Penalty Covid

401k Early Withdrawal What To Know Before You Cash Out Community Charter

Do I Have To Report A Loan From My 401k Leia Aqui Do I Have To Report

Do I Have To Report A Loan From My 401k Leia Aqui Do I Have To Report

Deep Dive CARES Act Distributions Payback Taxes Reporting My