In a world in which screens are the norm, the charm of tangible printed materials isn't diminishing. Be it for educational use for creative projects, simply to add a personal touch to your home, printables for free are now an essential resource. This article will dive deeper into "Does Federal Government Tax Pensions And Social Security," exploring the different types of printables, where to get them, as well as how they can add value to various aspects of your daily life.

Get Latest Does Federal Government Tax Pensions And Social Security Below

Does Federal Government Tax Pensions And Social Security

Does Federal Government Tax Pensions And Social Security -

A retiree can use the Tax Withholding Estimator to enter any pension income or Social Security benefits they or their spouse receive The tool then automatically calculates the taxable portion and incorporates it into an overall estimate of their projected tax liability and withholding for the year

Krey l ayisyen IRS Tax Tip 2022 22 February 9 2022 A new tax season has arrived The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits Social Security benefits include monthly retirement survivor and disability benefits

Does Federal Government Tax Pensions And Social Security include a broad assortment of printable materials online, at no cost. They come in many types, like worksheets, coloring pages, templates and more. One of the advantages of Does Federal Government Tax Pensions And Social Security is their flexibility and accessibility.

More of Does Federal Government Tax Pensions And Social Security

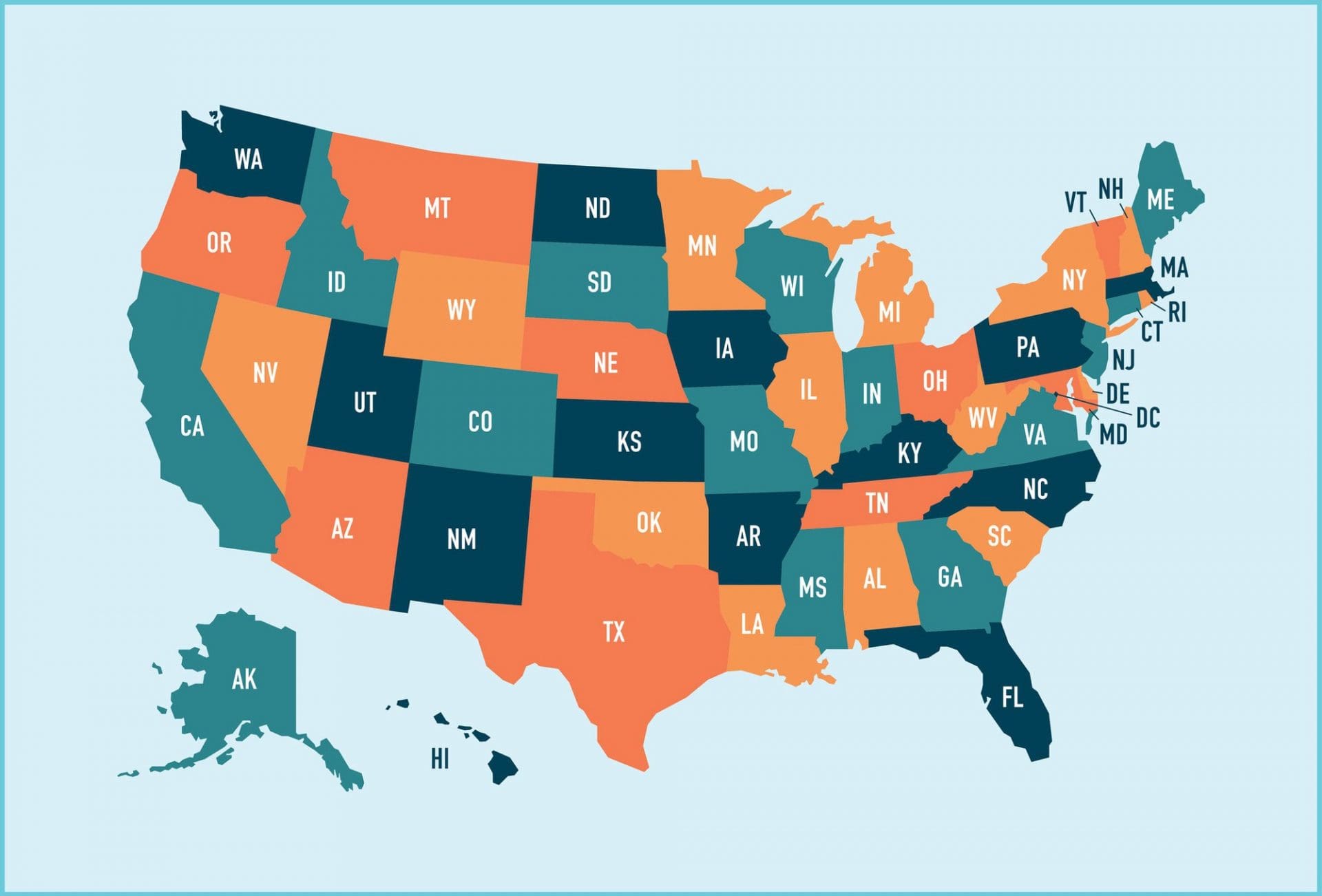

Social Security Benefits What Are The Best States To Retire For Taxes

Social Security Benefits What Are The Best States To Retire For Taxes

File a federal tax return as an individual and your combined income is Between 25 000 and 34 000 you may have to pay income tax on up to 50 of your benefits More than 34 000 up to 85 of your benefits may be taxable File a joint return and you and your spouse have a combined income that is

How is Social Security taxed By AARP En espa ol Published October 10 2018 Updated December 21 2022 If your total income is more than 25 000 for an individual or 32 000 for a married couple filing jointly you must pay federal income taxes on your Social Security benefits Below those thresholds your benefits are not taxed

Does Federal Government Tax Pensions And Social Security have gained a lot of popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Modifications: The Customization feature lets you tailor print-ready templates to your specific requirements when it comes to designing invitations planning your schedule or decorating your home.

-

Educational Use: The free educational worksheets can be used by students from all ages, making them a valuable tool for teachers and parents.

-

The convenience of Access to many designs and templates helps save time and effort.

Where to Find more Does Federal Government Tax Pensions And Social Security

State by State Guide To Taxes On Retirees Flagel Huber Flagel

State by State Guide To Taxes On Retirees Flagel Huber Flagel

You must pay taxes on up to 85 of your Social Security benefits if you file a Federal tax return as an individual and your combined income exceeds 25 000 Joint return and you and your spouse have combined income of more than 32 000 If you are married and file a separate return you probably will have to pay taxes on your benefits

Social Security retirement benefits are subject to federal income tax for most people though a portion of the benefits are exempt from taxes People with lower total retirement income

In the event that we've stirred your curiosity about Does Federal Government Tax Pensions And Social Security, let's explore where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Does Federal Government Tax Pensions And Social Security for various motives.

- Explore categories like decoration for your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets with flashcards and other teaching materials.

- The perfect resource for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- These blogs cover a wide array of topics, ranging all the way from DIY projects to planning a party.

Maximizing Does Federal Government Tax Pensions And Social Security

Here are some unique ways of making the most of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print free worksheets to build your knowledge at home also in the classes.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners including to-do checklists, daily lists, and meal planners.

Conclusion

Does Federal Government Tax Pensions And Social Security are an abundance of practical and innovative resources that can meet the needs of a variety of people and pursuits. Their accessibility and versatility make them a great addition to any professional or personal life. Explore the world of Does Federal Government Tax Pensions And Social Security and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually completely free?

- Yes they are! You can download and print the resources for free.

-

Can I download free printing templates for commercial purposes?

- It depends on the specific terms of use. Always consult the author's guidelines before using any printables on commercial projects.

-

Do you have any copyright violations with printables that are free?

- Certain printables could be restricted on usage. Check the terms and condition of use as provided by the creator.

-

How do I print Does Federal Government Tax Pensions And Social Security?

- You can print them at home with an printer, or go to a local print shop to purchase top quality prints.

-

What program do I require to view printables that are free?

- The majority of printed documents are as PDF files, which can be opened with free software such as Adobe Reader.

14 States That Don t Tax Pensions AND Social Security

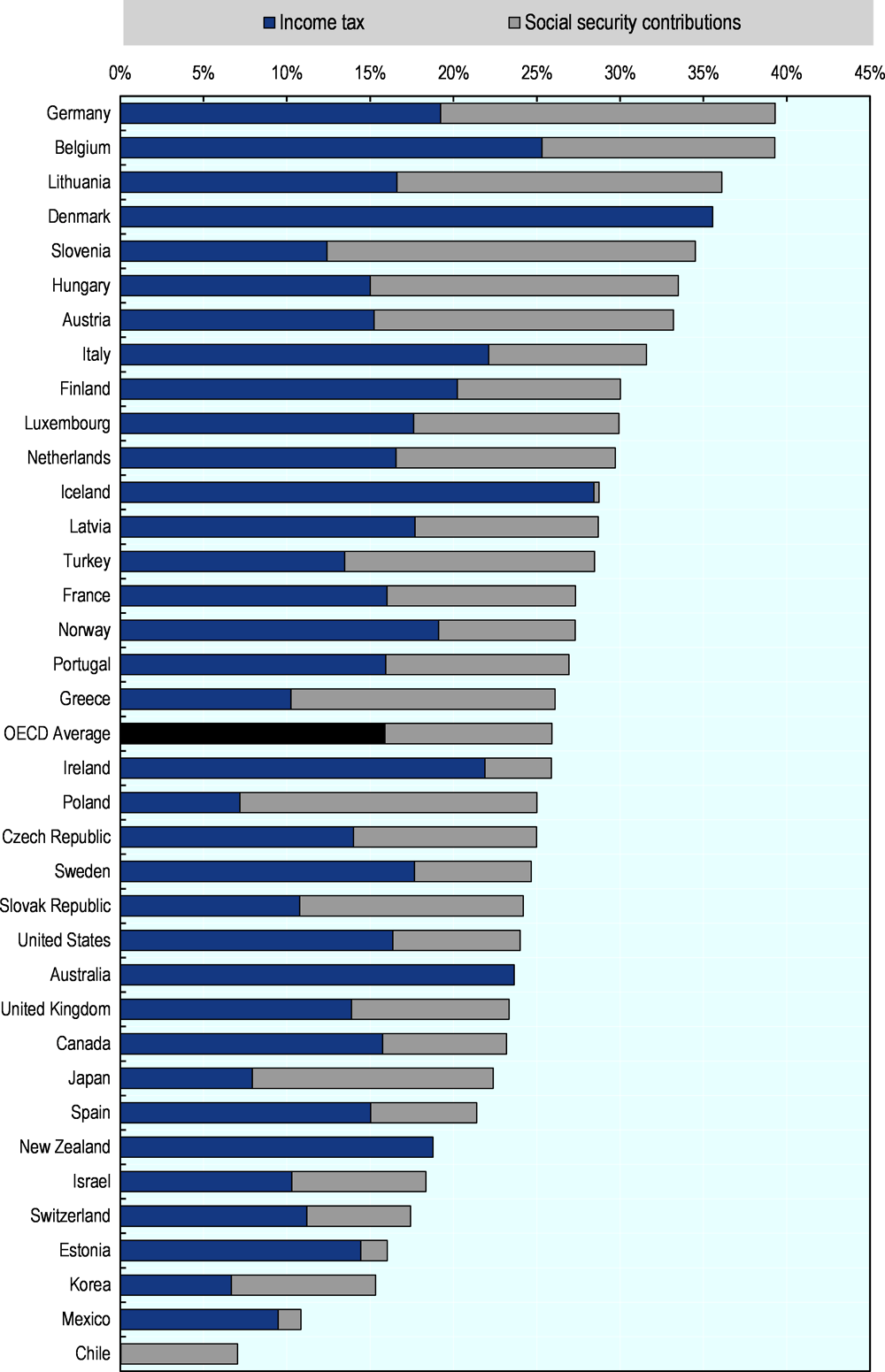

Overview Taxing Wages 2020 OECD ILibrary

Check more sample of Does Federal Government Tax Pensions And Social Security below

Are You Due A Huge Pension Tax Refund Which News

Retiring These States Won t Tax Your Distributions

Social Security Income Inflation Protection

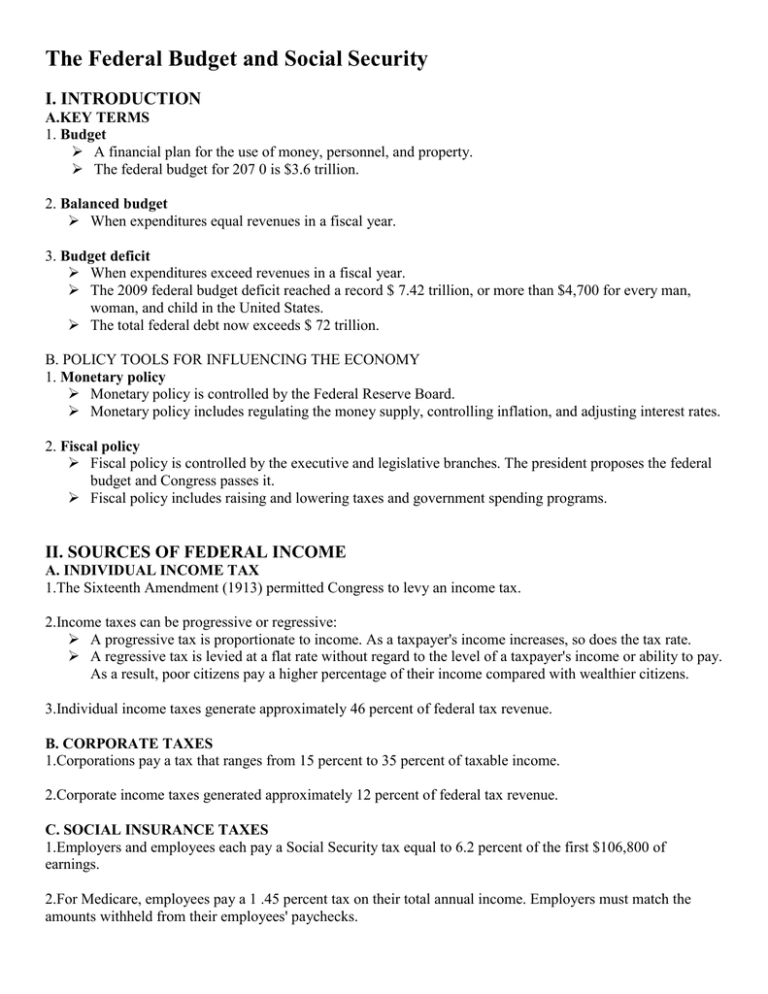

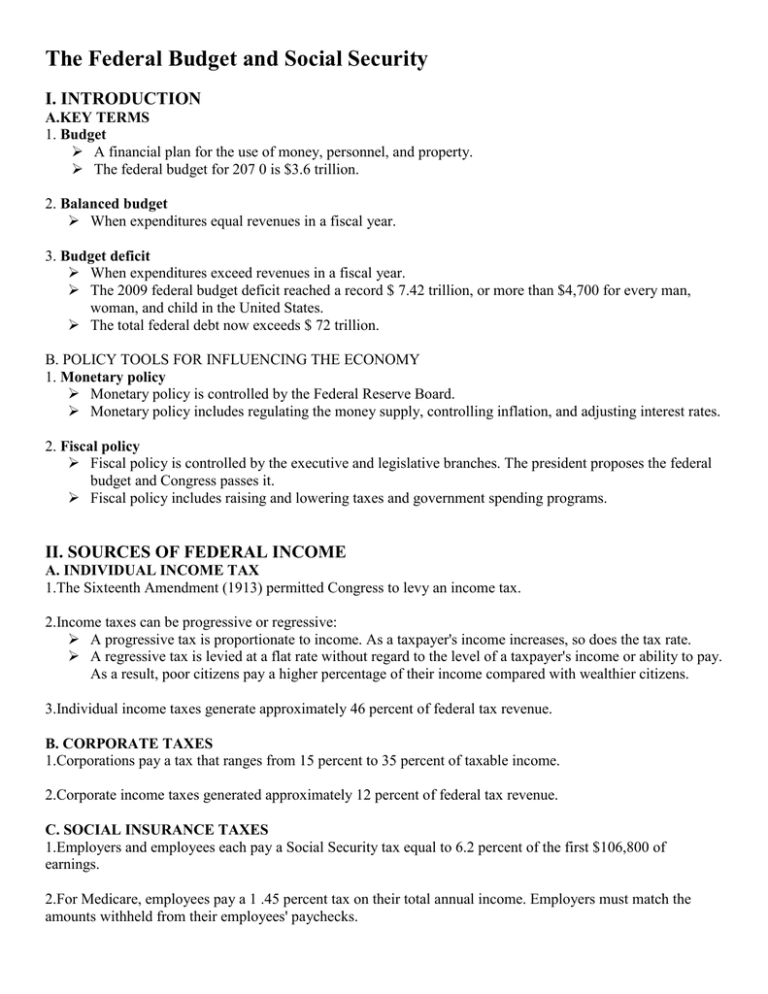

The Federal Budget And Social Security I INTRODUCTION

Want To Retire In Arizona Here s What You Need To Know Vision

Government Health Insurance Schemes And Other Benefits Digit Kerala

https://www.irs.gov/newsroom/irs-reminds-taxpayers...

Krey l ayisyen IRS Tax Tip 2022 22 February 9 2022 A new tax season has arrived The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits Social Security benefits include monthly retirement survivor and disability benefits

https://www.irs.gov/pub/irs-pdf/p4190.pdf

When retired you may receive a Form SSA 1099 for social security benefits and or a Form 1099 R for pension income You will include these types of retirement income on your Form 1040 in addition to any other income you may have received during the tax year WHAT TYPES OF INCOME ARE TAXABLE

Krey l ayisyen IRS Tax Tip 2022 22 February 9 2022 A new tax season has arrived The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits Social Security benefits include monthly retirement survivor and disability benefits

When retired you may receive a Form SSA 1099 for social security benefits and or a Form 1099 R for pension income You will include these types of retirement income on your Form 1040 in addition to any other income you may have received during the tax year WHAT TYPES OF INCOME ARE TAXABLE

The Federal Budget And Social Security I INTRODUCTION

Retiring These States Won t Tax Your Distributions

Want To Retire In Arizona Here s What You Need To Know Vision

Government Health Insurance Schemes And Other Benefits Digit Kerala

Social Security What Laws May Affect Government Pensions

37 States That Don t Tax Social Security Benefits Citybiz

37 States That Don t Tax Social Security Benefits Citybiz

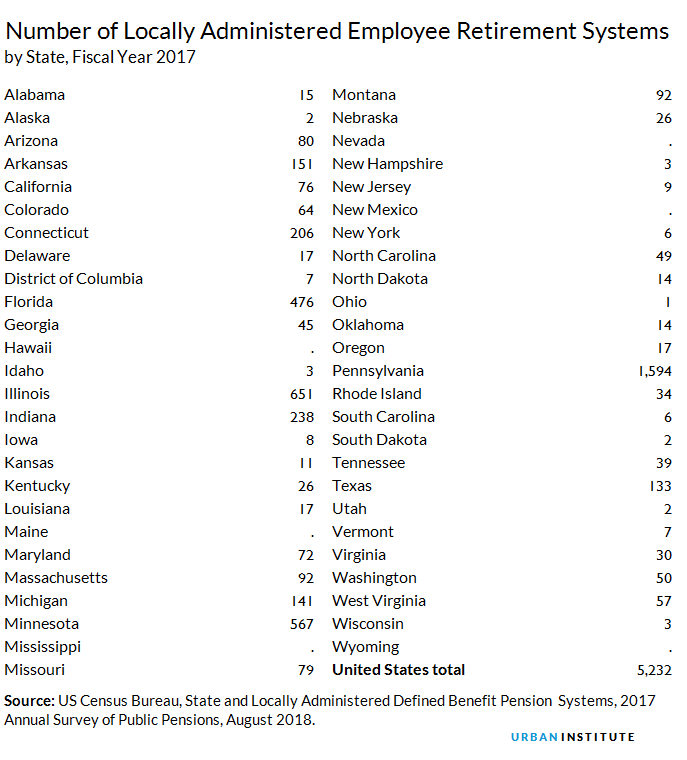

State And Local Government Pensions Urban Institute