In this age of electronic devices, with screens dominating our lives and the appeal of physical printed products hasn't decreased. If it's to aid in education in creative or artistic projects, or just adding the personal touch to your space, Do You Report Social Security Tax Withheld On 1040 have proven to be a valuable resource. We'll dive to the depths of "Do You Report Social Security Tax Withheld On 1040," exploring what they are, how you can find them, and ways they can help you improve many aspects of your daily life.

Get Latest Do You Report Social Security Tax Withheld On 1040 Below

Do You Report Social Security Tax Withheld On 1040

Do You Report Social Security Tax Withheld On 1040 -

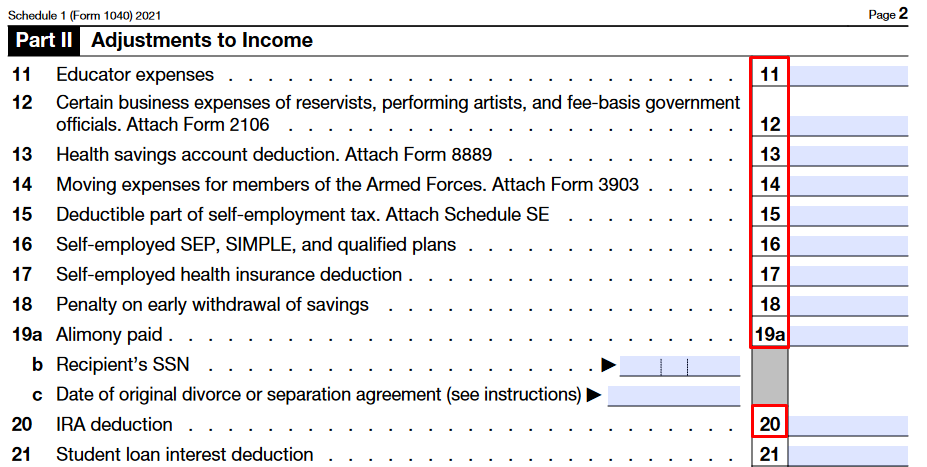

On the 1040 form Line 5a is where all benefits go Image source Getty Images However Line 5a doesn t get factored into your income In order to come up with what goes into Line 5b

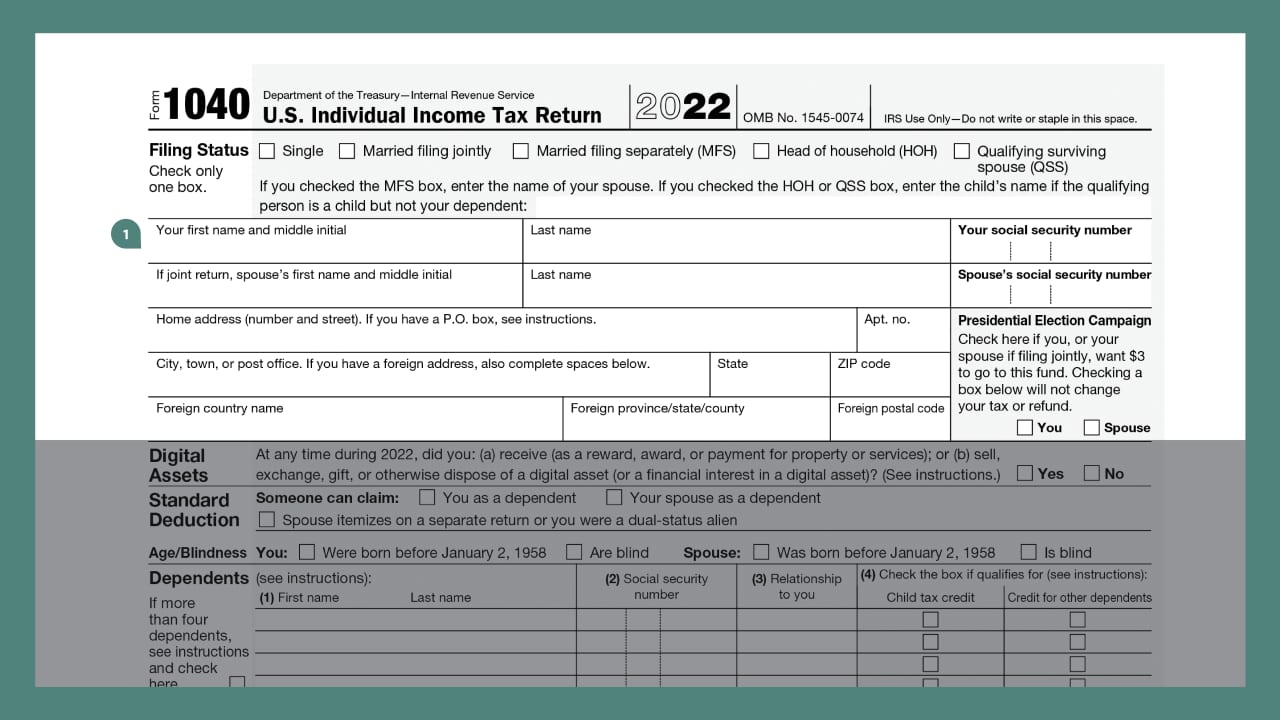

You do not need to attach the form SSA 1099 to your tax return The instructions to the IRS form 1040 line 25 b which is where you need to put the value from box 6 explicitly mention form SSA 1099 but also explicitly only instruct to

Do You Report Social Security Tax Withheld On 1040 encompass a wide range of downloadable, printable resources available online for download at no cost. These resources come in many designs, including worksheets templates, coloring pages and much more. The value of Do You Report Social Security Tax Withheld On 1040 lies in their versatility and accessibility.

More of Do You Report Social Security Tax Withheld On 1040

How To Calculate Taxable Social Security Form 1040 Line 6b Marotta

How To Calculate Taxable Social Security Form 1040 Line 6b Marotta

If you ve paid Social Security tax above income of 110 100 you are entitled to a credit from the IRS If you are eligible you enter the excess amount on Line 69 of your Form 1040 or Line 41

You can have 7 10 12 or 22 percent of your monthly benefit withheld for taxes Only these percentages can be withheld Flat dollar amounts are not accepted Sign the form and return it to your local Social Security office by mail or in person

Do You Report Social Security Tax Withheld On 1040 have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Customization: You can tailor printing templates to your own specific requirements for invitations, whether that's creating them and schedules, or even decorating your home.

-

Educational Benefits: Printables for education that are free are designed to appeal to students of all ages, which makes them a vital aid for parents as well as educators.

-

Accessibility: Access to an array of designs and templates reduces time and effort.

Where to Find more Do You Report Social Security Tax Withheld On 1040

W2 Form Social Security Tax Withheld Universal Network

W2 Form Social Security Tax Withheld Universal Network

If you get Social Security you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes See Withholding Income Tax From Your Social Security Benefits for more information

Do I pay Social Security tax or income tax on my Social Security benefit payments If you earn between 25 000 and 34 000 per year as a single filer or 32 000 to 44 000 if you re married filing jointly you will pay income taxes on up to 50 of your Social Security benefits

Now that we've piqued your interest in printables for free we'll explore the places you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection with Do You Report Social Security Tax Withheld On 1040 for all uses.

- Explore categories such as home decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free for flashcards, lessons, and worksheets. tools.

- This is a great resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- These blogs cover a wide variety of topics, ranging from DIY projects to party planning.

Maximizing Do You Report Social Security Tax Withheld On 1040

Here are some creative ways how you could make the most of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Utilize free printable worksheets to enhance your learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

Do You Report Social Security Tax Withheld On 1040 are an abundance of practical and innovative resources that satisfy a wide range of requirements and needs and. Their availability and versatility make them an essential part of your professional and personal life. Explore the plethora of Do You Report Social Security Tax Withheld On 1040 right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Do You Report Social Security Tax Withheld On 1040 truly are they free?

- Yes they are! You can print and download these materials for free.

-

Can I download free printables for commercial use?

- It's determined by the specific rules of usage. Make sure you read the guidelines for the creator before using their printables for commercial projects.

-

Do you have any copyright issues when you download Do You Report Social Security Tax Withheld On 1040?

- Some printables may come with restrictions regarding usage. Make sure you read the terms and conditions set forth by the author.

-

How can I print Do You Report Social Security Tax Withheld On 1040?

- Print them at home with your printer or visit any local print store for more high-quality prints.

-

What software do I need in order to open printables for free?

- Many printables are offered in the format PDF. This is open with no cost programs like Adobe Reader.

Form W2 Everything You Ever Wanted To Know

Social Security Tax Withholding What Do YOU Pay YouTube

Check more sample of Do You Report Social Security Tax Withheld On 1040 below

Social Security GuangGurpage

Tax On Social Security Benefits Social Security Intelligence

Pin On Finance

What Is Social Security Tax Insurance Noon

The Social Security Tax Was Withheld At The Rate Of 6 0 On The First

How To Fill Out A Form 1040 Buy Side From WSJ

https://money.stackexchange.com/questions/156288/reporting-taxes...

You do not need to attach the form SSA 1099 to your tax return The instructions to the IRS form 1040 line 25 b which is where you need to put the value from box 6 explicitly mention form SSA 1099 but also explicitly only instruct to

https://www.irs.gov/instructions/i1040ss

Report and pay employee social security and Medicare tax on a unreported tips b wages from an employer with no social security or Medicare tax withheld and c uncollected social security and Medicare tax on tips or

You do not need to attach the form SSA 1099 to your tax return The instructions to the IRS form 1040 line 25 b which is where you need to put the value from box 6 explicitly mention form SSA 1099 but also explicitly only instruct to

Report and pay employee social security and Medicare tax on a unreported tips b wages from an employer with no social security or Medicare tax withheld and c uncollected social security and Medicare tax on tips or

What Is Social Security Tax Insurance Noon

Tax On Social Security Benefits Social Security Intelligence

The Social Security Tax Was Withheld At The Rate Of 6 0 On The First

How To Fill Out A Form 1040 Buy Side From WSJ

IRS Courseware Link Learn Taxes

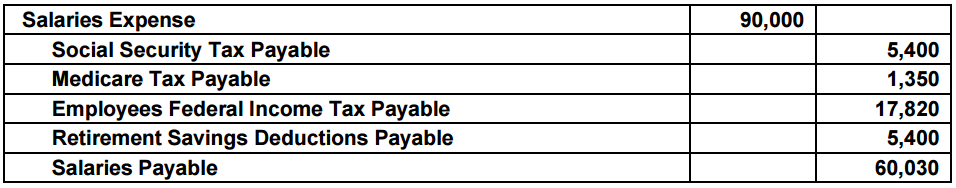

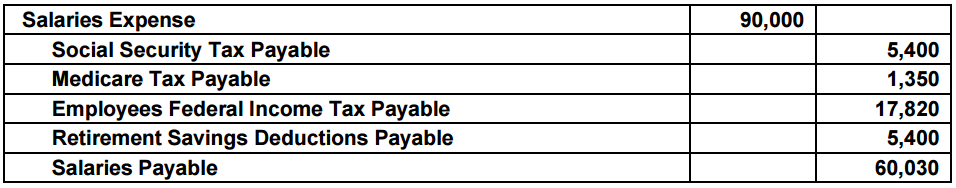

Accounting Question Answers Homeworks The Payroll Register Of Longboat

Accounting Question Answers Homeworks The Payroll Register Of Longboat

W2 Tax Stock Photos Pictures Royalty Free Images IStock