In this day and age where screens have become the dominant feature of our lives however, the attraction of tangible printed objects hasn't waned. No matter whether it's for educational uses, creative projects, or simply adding an extra personal touch to your area, Do You Pay Taxes On Roth Ira Distribution are now a useful source. We'll dive in the world of "Do You Pay Taxes On Roth Ira Distribution," exploring their purpose, where to find them, and how they can add value to various aspects of your lives.

Get Latest Do You Pay Taxes On Roth Ira Distribution Below

Do You Pay Taxes On Roth Ira Distribution

Do You Pay Taxes On Roth Ira Distribution -

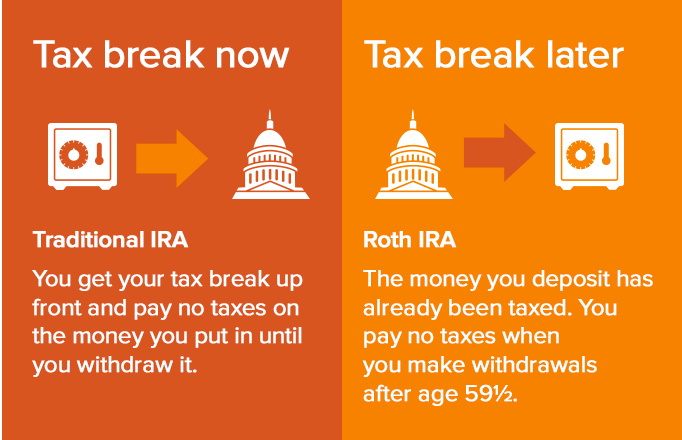

You pay taxes on money put into a Roth IRA but the earnings are tax free When you reach 59 have the account for at least 5 years withdrawals are tax free

First of all distributions of Roth IRA assets from regular participant contributions and nontaxable conversions can be taken at any time tax free and penalty free However

Do You Pay Taxes On Roth Ira Distribution provide a diverse range of downloadable, printable items that are available online at no cost. They come in many forms, including worksheets, templates, coloring pages, and more. The appeal of printables for free lies in their versatility as well as accessibility.

More of Do You Pay Taxes On Roth Ira Distribution

What Is A Roth IRA Taking Care Of Business

What Is A Roth IRA Taking Care Of Business

This interview will help you determine if your distribution from a Roth IRA or designated Roth account is taxable This topic doesn t address either the return of a Roth IRA contribution or return of a prior year s excess contribution or a corrective distribution of excess contribution from a designated Roth account

Generally you ll owe income taxes and a 10 penalty if you withdraw earnings from your account if you ve owned it for less than five years You can avoid the penalty but not the income

Do You Pay Taxes On Roth Ira Distribution have gained a lot of popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

customization Your HTML0 customization options allow you to customize the templates to meet your individual needs for invitations, whether that's creating them as well as organizing your calendar, or decorating your home.

-

Educational value: Free educational printables are designed to appeal to students of all ages. This makes these printables a powerful aid for parents as well as educators.

-

Accessibility: You have instant access various designs and templates can save you time and energy.

Where to Find more Do You Pay Taxes On Roth Ira Distribution

Retiradas De Roth IRA Leia Isto Primeiro Economia E Negocios

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

Retiradas De Roth IRA Leia Isto Primeiro Economia E Negocios

So when you make withdrawals in retirement you won t have to pay taxes on the returns you ve earned over the years Your Roth IRA can hold a variety of types of assets including stocks bonds and mutual funds Say you contribute 5 000 to a Roth IRA each year starting at age 35 By the time you reach age 65 you will have contributed

The annual contribution limit to both traditional and Roth IRAs is 7 000 for 2024 which is a 500 increase from 2023 Individuals aged 50 and over can deposit a catch up contribution of

In the event that we've stirred your curiosity about Do You Pay Taxes On Roth Ira Distribution We'll take a look around to see where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection with Do You Pay Taxes On Roth Ira Distribution for all reasons.

- Explore categories such as decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free as well as flashcards and other learning tools.

- It is ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- These blogs cover a wide spectrum of interests, that range from DIY projects to planning a party.

Maximizing Do You Pay Taxes On Roth Ira Distribution

Here are some ideas how you could make the most use of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print worksheets that are free for teaching at-home or in the classroom.

3. Event Planning

- Invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars, to-do lists, and meal planners.

Conclusion

Do You Pay Taxes On Roth Ira Distribution are an abundance with useful and creative ideas catering to different needs and needs and. Their accessibility and flexibility make these printables a useful addition to the professional and personal lives of both. Explore the wide world of Do You Pay Taxes On Roth Ira Distribution and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really absolutely free?

- Yes you can! You can print and download the resources for free.

-

Do I have the right to use free templates for commercial use?

- It's contingent upon the specific terms of use. Always read the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues in Do You Pay Taxes On Roth Ira Distribution?

- Some printables may have restrictions in their usage. Always read the terms and conditions provided by the designer.

-

How can I print Do You Pay Taxes On Roth Ira Distribution?

- You can print them at home with a printer or visit a local print shop to purchase top quality prints.

-

What software do I need in order to open Do You Pay Taxes On Roth Ira Distribution?

- The majority of printed documents are in the PDF format, and is open with no cost programs like Adobe Reader.

Do You Pay Taxes On Stocks Sold In Roth Ira Choosing Your Gold IRA

Roth IRA Who Can Contribute The TurboTax Blog

Check more sample of Do You Pay Taxes On Roth Ira Distribution below

Roth IRA N L G V L m Th N o M M t Roth IRA Kinh Doanh

Roth IRA Withdrawal Rules And Penalties First Finance News

Are Roth Contributions Right For Me

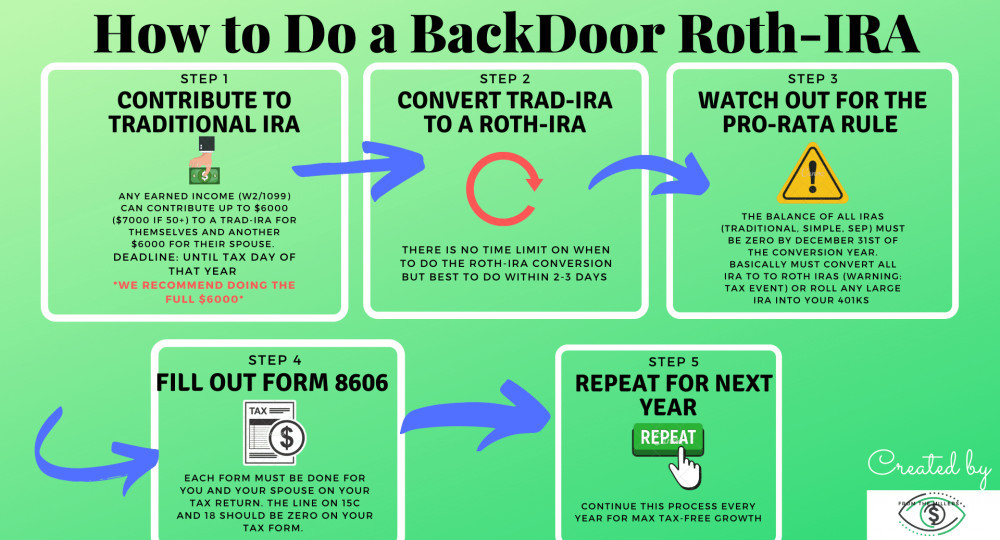

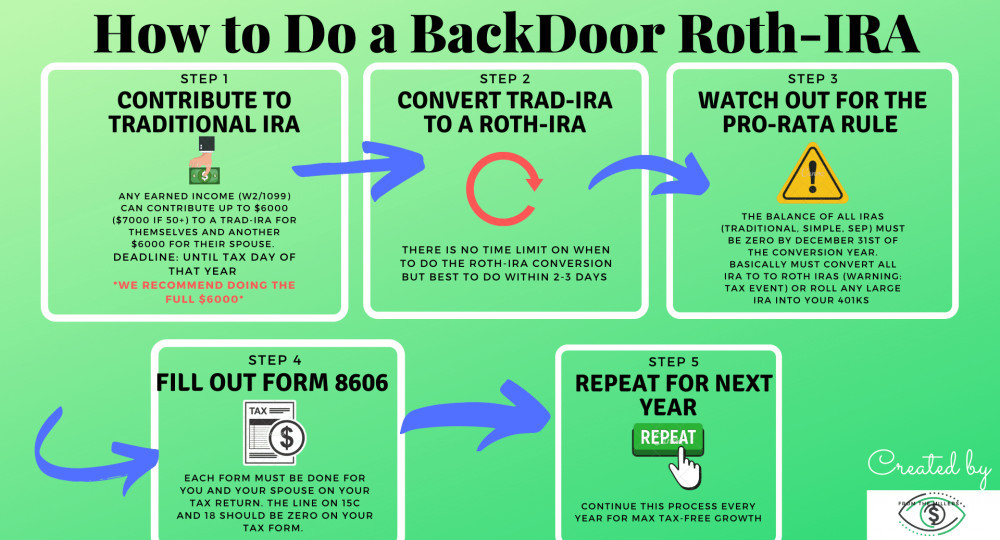

What Is A Backdoor Roth IRA How Does It Work In 2021 Personal

How To Legally Never Pay Taxes Again YouTube

Roth IRA Rules Contribution Limits And How To Get Started The

https://www.investopedia.com/retirement/tax...

First of all distributions of Roth IRA assets from regular participant contributions and nontaxable conversions can be taken at any time tax free and penalty free However

https://www.morningstar.com/financial-advice/is...

Distributions from Layer 2 are tax free However if the distribution occurs before the Roth IRA owner is at least age 59 it is subject to a 10 early distribution penalty tax unless the

First of all distributions of Roth IRA assets from regular participant contributions and nontaxable conversions can be taken at any time tax free and penalty free However

Distributions from Layer 2 are tax free However if the distribution occurs before the Roth IRA owner is at least age 59 it is subject to a 10 early distribution penalty tax unless the

What Is A Backdoor Roth IRA How Does It Work In 2021 Personal

Roth IRA Withdrawal Rules And Penalties First Finance News

How To Legally Never Pay Taxes Again YouTube

Roth IRA Rules Contribution Limits And How To Get Started The

Roth IRA Withdrawal Rules And Penalties The TurboTax Blog

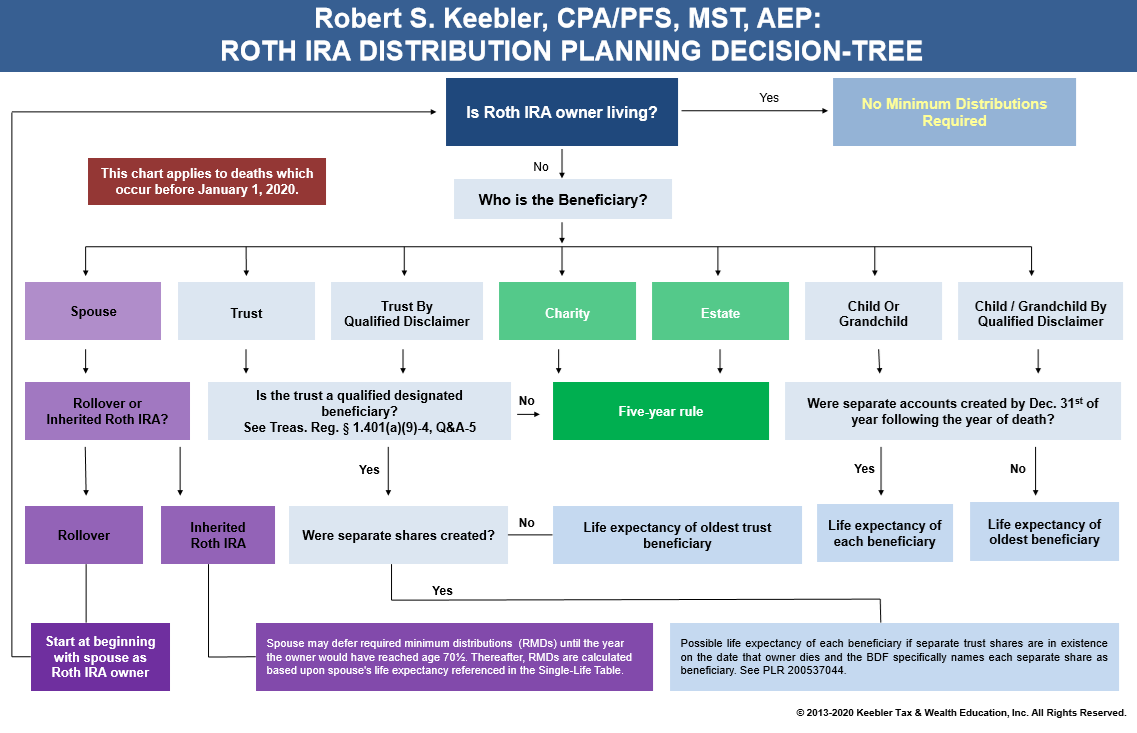

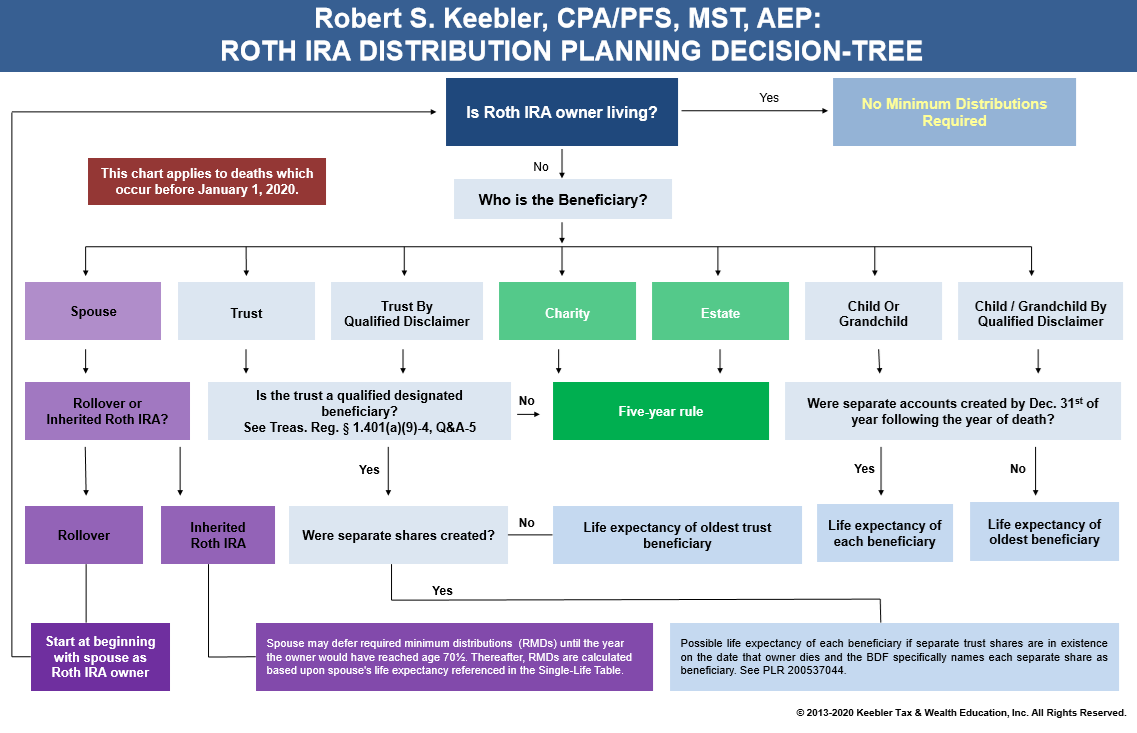

2023 Roth IRA Distribution Chart Ultimate Estate Planner

2023 Roth IRA Distribution Chart Ultimate Estate Planner

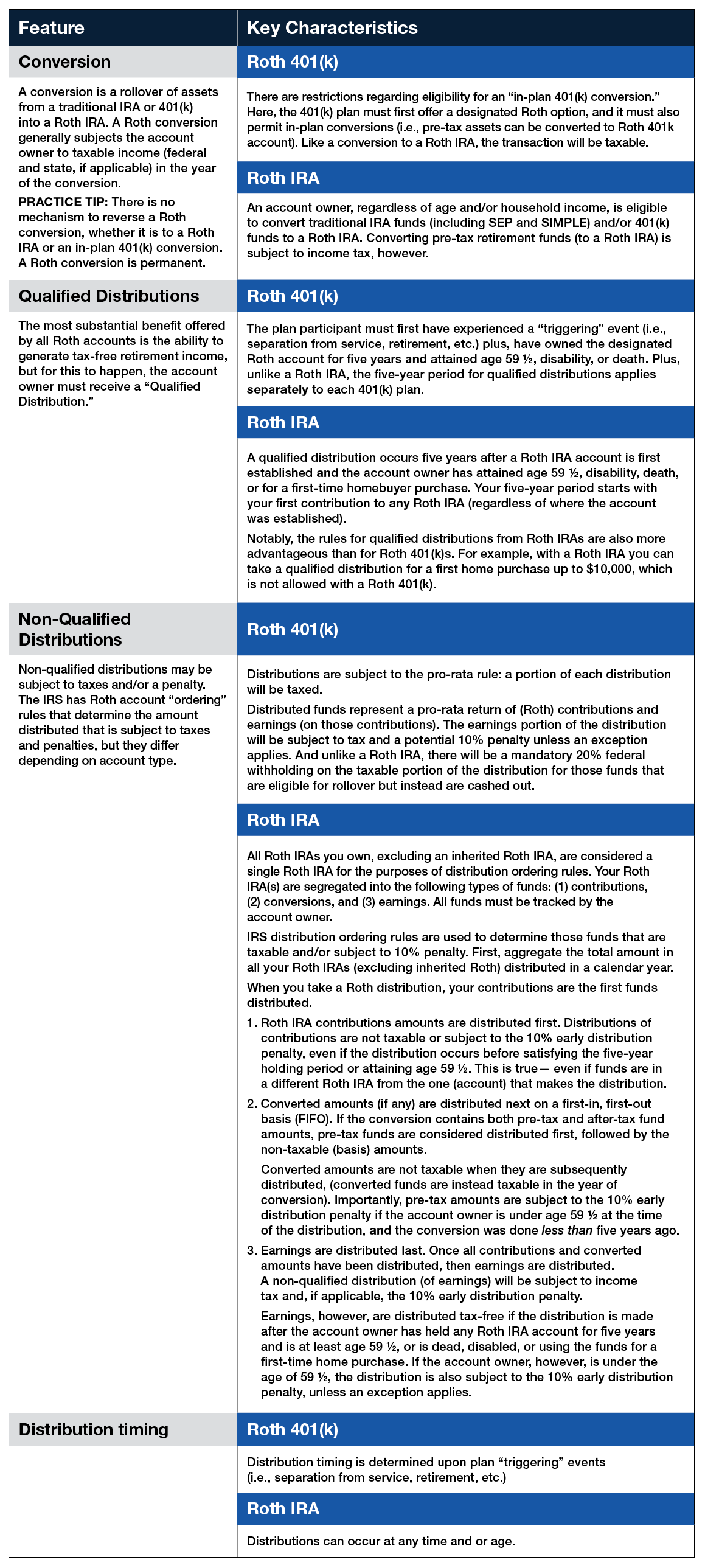

Roth 401 k Vs Roth IRA Key Differences In Contributions Distributions