In a world where screens rule our lives however, the attraction of tangible printed objects hasn't waned. Whether it's for educational purposes such as creative projects or simply to add an element of personalization to your area, Do You Pay Taxes On Gains From A Roth Ira are now an essential source. For this piece, we'll take a dive deep into the realm of "Do You Pay Taxes On Gains From A Roth Ira," exploring what they are, how you can find them, and how they can add value to various aspects of your life.

Get Latest Do You Pay Taxes On Gains From A Roth Ira Below

Do You Pay Taxes On Gains From A Roth Ira

Do You Pay Taxes On Gains From A Roth Ira -

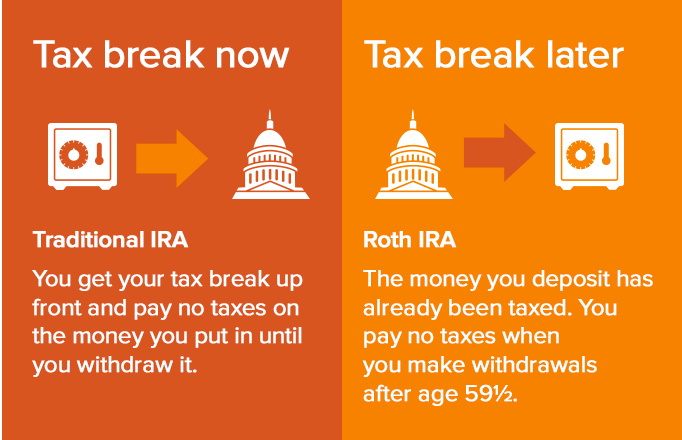

Roth IRAs aren t taxed on capital gains like so many investments that you may be used to They share this in common with traditional IRAs This applies to both short term and long term capital gains and it doesn t matter if you keep the money in the account or if you withdraw it

You fund a Roth IRA with money you ve already paid income taxes on As long as you wait until you re 59 and you ve held the account for at least five years your gains are tax free You can withdraw your Roth IRA contributions without paying taxes or a penalty at any time

Do You Pay Taxes On Gains From A Roth Ira offer a wide collection of printable materials online, at no cost. They are available in numerous styles, from worksheets to templates, coloring pages, and many more. The value of Do You Pay Taxes On Gains From A Roth Ira is in their variety and accessibility.

More of Do You Pay Taxes On Gains From A Roth Ira

What Is A Roth IRA Taking Care Of Business

What Is A Roth IRA Taking Care Of Business

Contributions to a Roth IRA are made in after tax dollars which means that you pay the taxes upfront You can withdraw your contributions at any time for any reason without tax

You cannot deduct contributions to a Roth IRA If you satisfy the requirements qualified distributions are tax free You can make contributions to your Roth IRA after you reach age 70 You can leave amounts in your Roth IRA as long as you live The account or annuity must be designated as a Roth IRA when it is set up

Do You Pay Taxes On Gains From A Roth Ira have garnered immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Flexible: It is possible to tailor the design to meet your needs such as designing invitations to organize your schedule or even decorating your house.

-

Educational Value: The free educational worksheets cater to learners of all ages, which makes them a vital source for educators and parents.

-

The convenience of The instant accessibility to various designs and templates cuts down on time and efforts.

Where to Find more Do You Pay Taxes On Gains From A Roth Ira

Savings Account Vs Roth IRA What s The Difference

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Savings Account Vs Roth IRA What s The Difference

According to Internal Revenue Service IRS rules qualified distributions are any payments made after the five year period beginning with the first tax year when you made a contribution to a

No Since you contribute to a Roth IRA using after tax money no deduction can be taken in the year when you make the contribution to the account

We've now piqued your interest in printables for free and other printables, let's discover where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Do You Pay Taxes On Gains From A Roth Ira to suit a variety of uses.

- Explore categories like design, home decor, management, and craft.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets or flashcards as well as learning tools.

- The perfect resource for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- These blogs cover a wide variety of topics, that range from DIY projects to party planning.

Maximizing Do You Pay Taxes On Gains From A Roth Ira

Here are some fresh ways create the maximum value of Do You Pay Taxes On Gains From A Roth Ira:

1. Home Decor

- Print and frame stunning artwork, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home and in class.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions like weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

Do You Pay Taxes On Gains From A Roth Ira are an abundance of innovative and useful resources for a variety of needs and preferences. Their availability and versatility make they a beneficial addition to both professional and personal lives. Explore the vast array of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really gratis?

- Yes you can! You can print and download these resources at no cost.

-

Do I have the right to use free printouts for commercial usage?

- It's all dependent on the conditions of use. Always check the creator's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright concerns with Do You Pay Taxes On Gains From A Roth Ira?

- Certain printables may be subject to restrictions concerning their use. Be sure to review the conditions and terms of use provided by the creator.

-

How can I print Do You Pay Taxes On Gains From A Roth Ira?

- You can print them at home with your printer or visit an in-store print shop to get the highest quality prints.

-

What software must I use to open printables free of charge?

- A majority of printed materials are in PDF format. They can be opened with free programs like Adobe Reader.

Roth IRA Who Can Contribute The TurboTax Blog

Retiradas De Roth IRA Leia Isto Primeiro Economia E Negocios

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

Check more sample of Do You Pay Taxes On Gains From A Roth Ira below

Taxes You ll Pay Cashing In A 401k Traditional Or ROTH IRA YouTube

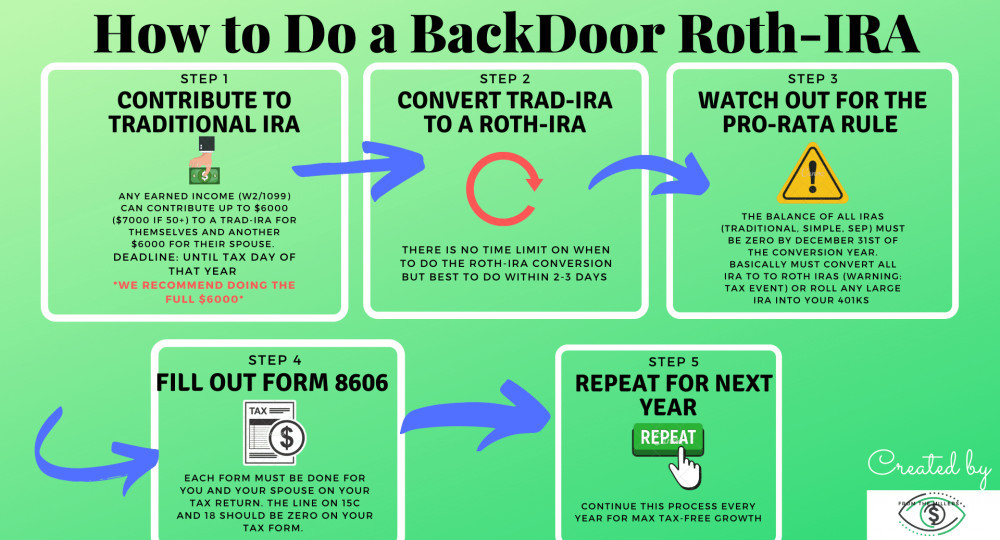

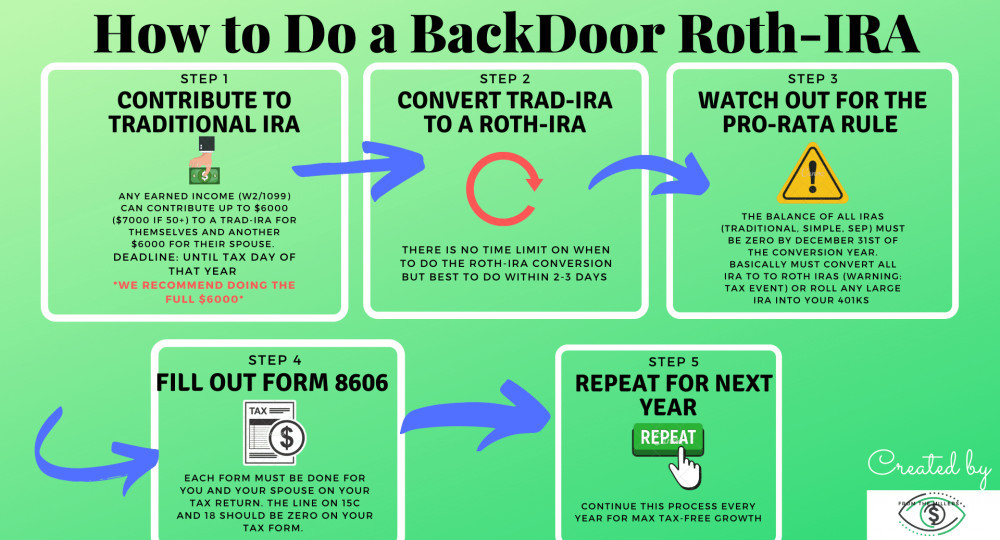

What Is A Backdoor Roth IRA How Does It Work In 2021 Personal

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

What Happens If You Don t Pay Your Taxes A Complete Guide All

How To Pay Taxes Quarterly A Simple Tax Guide For The Self Employed

When Can I Withdraw From Roth IRA Retirement News Daily

https://www.thebalancemoney.com/do-you-pay-taxes...

You fund a Roth IRA with money you ve already paid income taxes on As long as you wait until you re 59 and you ve held the account for at least five years your gains are tax free You can withdraw your Roth IRA contributions without paying taxes or a penalty at any time

https://www.advantaira.com/blog/do-you-pay-taxes...

Possibly the most asked question from people comparing retirement plan options is Do you pay taxes on gains in a Roth IRA The simple answer is no In fact one of the smartest moves you can make to grow and protect your hard earned retirement wealth is investing with a Roth IRA

You fund a Roth IRA with money you ve already paid income taxes on As long as you wait until you re 59 and you ve held the account for at least five years your gains are tax free You can withdraw your Roth IRA contributions without paying taxes or a penalty at any time

Possibly the most asked question from people comparing retirement plan options is Do you pay taxes on gains in a Roth IRA The simple answer is no In fact one of the smartest moves you can make to grow and protect your hard earned retirement wealth is investing with a Roth IRA

What Happens If You Don t Pay Your Taxes A Complete Guide All

What Is A Backdoor Roth IRA How Does It Work In 2021 Personal

How To Pay Taxes Quarterly A Simple Tax Guide For The Self Employed

When Can I Withdraw From Roth IRA Retirement News Daily

Do You Pay Taxes On Stocks Sold In Roth Ira Choosing Your Gold IRA

How Roth IRA Taxes Work NextAdvisor With TIME

How Roth IRA Taxes Work NextAdvisor With TIME

How To Pay Payroll Taxes A Step by step Guide