In this digital age, in which screens are the norm, the charm of tangible, printed materials hasn't diminished. In the case of educational materials project ideas, artistic or simply to add a personal touch to your home, printables for free have become an invaluable resource. This article will take a dive through the vast world of "Do You Pay Social Security On K1 Income," exploring what they are, where they are available, and how they can enrich various aspects of your lives.

Get Latest Do You Pay Social Security On K1 Income Below

Do You Pay Social Security On K1 Income

Do You Pay Social Security On K1 Income -

Is it correct Should you be reporting your share of LLC income as self employment earnings If you do you now have an additional tax to pay called the self employment tax This self employment tax is imposed in addition to the regular income tax you already pay and is imposed on your self employment earnings

In most cases yes Unless you were a Limited Partner and did not work for the LLC the income on your Partnership K 1 would be earned income If that is the case there would usually be a number in box 14 of your K 1 and that counts towards the Social Security earnings limit if you were under full retirement age

Printables for free cover a broad collection of printable materials available online at no cost. These printables come in different forms, like worksheets templates, coloring pages, and much more. The appealingness of Do You Pay Social Security On K1 Income is their flexibility and accessibility.

More of Do You Pay Social Security On K1 Income

Social Security Back Pay Londoneligibilty

Social Security Back Pay Londoneligibilty

Schedule K 1 is an Internal Revenue Service IRS tax form issued annually to the individuals in business partnerships The purpose of Schedule K 1 is to report each partner s share of the

S Corp taxes If you re self employed you ll usually have to pay higher Social Security and Medicare taxes collectively known as self employment taxes than if you were an employee of a company One way to help avoid these higher taxes is to organize your business as an S corporation

Print-friendly freebies have gained tremendous popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

The ability to customize: The Customization feature lets you tailor printed materials to meet your requirements when it comes to designing invitations as well as organizing your calendar, or decorating your home.

-

Educational value: Downloads of educational content for free cater to learners of all ages, which makes these printables a powerful tool for parents and educators.

-

Affordability: instant access a myriad of designs as well as templates can save you time and energy.

Where to Find more Do You Pay Social Security On K1 Income

13 Things You Need To Know About Social Security Vision Retirement

13 Things You Need To Know About Social Security Vision Retirement

FICA taxes include a 12 4 Social Security tax up to the Social Security wage base which will be 127 200 in 2017 plus another 2 9 of Medicare taxes for an unlimited amount of income In addition there s another 0 9 Medicare surtax on earned income above 200 000 for individuals or 250 000 for married couples

If you re self employed you pay the combined employee and employer amount This amount is a 12 4 Social Security tax on up to 168 600 of your net earnings and a 2 9 Medicare tax on your entire net earnings If your earned income is more than 200 000 250 000 for married couples filing jointly you must pay 0 9 more in Medicare taxes

We hope we've stimulated your interest in Do You Pay Social Security On K1 Income, let's explore where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Do You Pay Social Security On K1 Income designed for a variety goals.

- Explore categories such as decorating your home, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free as well as flashcards and other learning tools.

- Perfect for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- These blogs cover a wide spectrum of interests, all the way from DIY projects to party planning.

Maximizing Do You Pay Social Security On K1 Income

Here are some fresh ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print out free worksheets and activities to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Do You Pay Social Security On K1 Income are a treasure trove of practical and innovative resources that can meet the needs of a variety of people and interests. Their accessibility and flexibility make they a beneficial addition to both professional and personal lives. Explore the vast collection of Do You Pay Social Security On K1 Income today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free available for download?

- Yes they are! You can print and download these documents for free.

-

Can I download free printables for commercial purposes?

- It depends on the specific terms of use. Always review the terms of use for the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright concerns with Do You Pay Social Security On K1 Income?

- Some printables may contain restrictions in use. Check the conditions and terms of use provided by the designer.

-

How can I print Do You Pay Social Security On K1 Income?

- Print them at home using the printer, or go to a local print shop for premium prints.

-

What software do I require to view printables that are free?

- Most PDF-based printables are available in the PDF format, and can be opened with free software like Adobe Reader.

Do You Pay Taxes On Social Security Benefits YouTube

Got A Job At Age 70 Do I Pay Into Social Security Again

Check more sample of Do You Pay Social Security On K1 Income below

3 Reasons To File For Social Security On Time The Motley Fool

Do You Pay Your Employees A Salary Integrated HR

168 K 1 168

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Social Security GuangGurpage

Pay Social Security Contributions Via E payment Of GSB Mekha News

https://ttlc.intuit.com/community/retirement/...

In most cases yes Unless you were a Limited Partner and did not work for the LLC the income on your Partnership K 1 would be earned income If that is the case there would usually be a number in box 14 of your K 1 and that counts towards the Social Security earnings limit if you were under full retirement age

https://www.sapling.com/6919952/k1-income-taxed

Updated Mar 2 2022 Fact Checked K 1 income or loss is passed through to the individual tax return If you re a shareholder of an S corporation or a partner in a partnership you may receive a Schedule K 1 form which is similar to a 1099 form

In most cases yes Unless you were a Limited Partner and did not work for the LLC the income on your Partnership K 1 would be earned income If that is the case there would usually be a number in box 14 of your K 1 and that counts towards the Social Security earnings limit if you were under full retirement age

Updated Mar 2 2022 Fact Checked K 1 income or loss is passed through to the individual tax return If you re a shareholder of an S corporation or a partner in a partnership you may receive a Schedule K 1 form which is similar to a 1099 form

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

168 K 1 168

Social Security GuangGurpage

Pay Social Security Contributions Via E payment Of GSB Mekha News

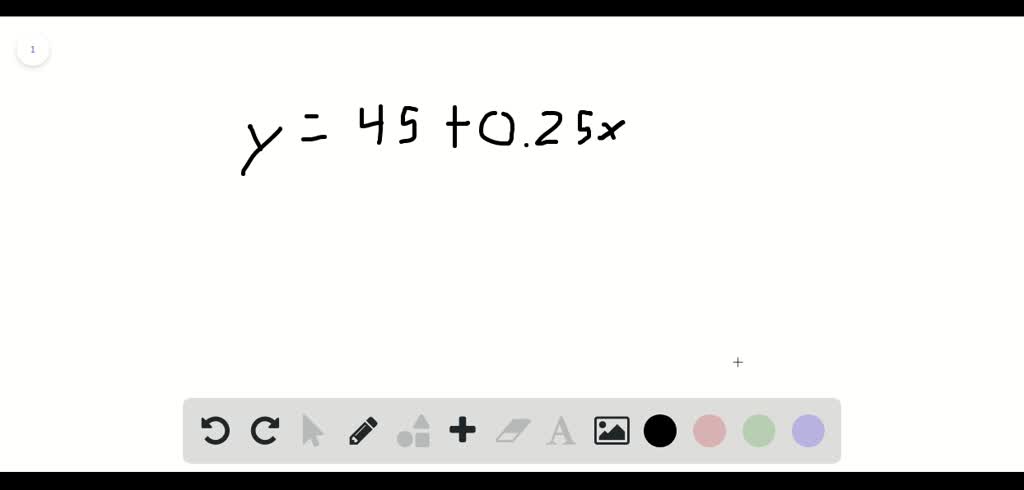

SOLVED How Much Do You Pay In Total

How Do I Pay Off My Target RedCard Leia Aqui How Do You Pay Off Your

How Do I Pay Off My Target RedCard Leia Aqui How Do You Pay Off Your

When Do You Pay Your Accountant Paris Accounting Corp