In the age of digital, when screens dominate our lives it's no wonder that the appeal of tangible printed objects hasn't waned. Be it for educational use or creative projects, or simply adding a personal touch to your space, Do You Pay Sales Tax On Vehicles In Texas have proven to be a valuable resource. We'll dive into the world "Do You Pay Sales Tax On Vehicles In Texas," exploring what they are, where they are available, and the ways that they can benefit different aspects of your daily life.

Get Latest Do You Pay Sales Tax On Vehicles In Texas Below

Do You Pay Sales Tax On Vehicles In Texas

Do You Pay Sales Tax On Vehicles In Texas -

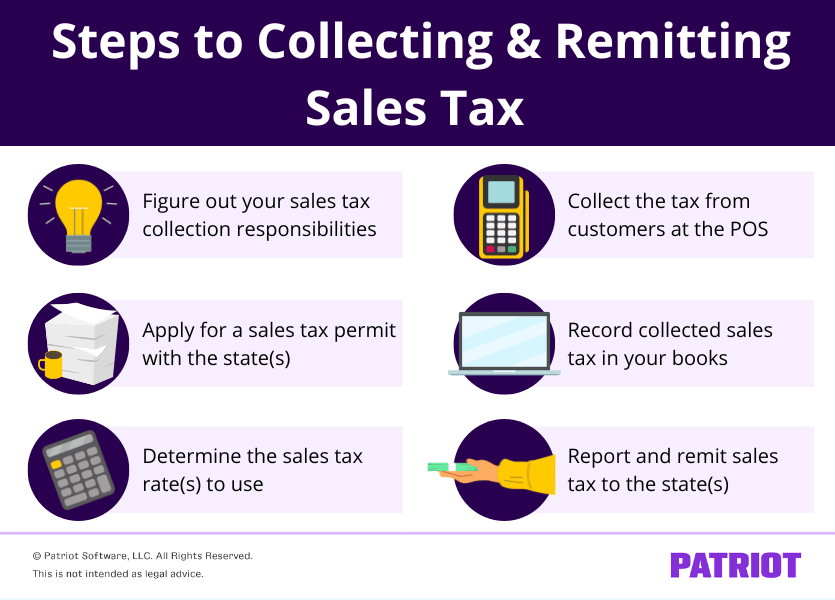

Texas collects a 6 25 state sales tax rate on the purchase of all vehicles Some dealerships may charge a documentary fee of 125 dollars In addition to taxes car purchases in Texas may be subject to other fees like registration title and plate fees

The sales tax for cars in Texas is 6 25 of the final sales price The Texas Comptroller states that payment of motor vehicle sales taxes has to be sent to the local county s

Do You Pay Sales Tax On Vehicles In Texas include a broad assortment of printable documents that can be downloaded online at no cost. These materials come in a variety of formats, such as worksheets, templates, coloring pages, and more. The attraction of printables that are free is their flexibility and accessibility.

More of Do You Pay Sales Tax On Vehicles In Texas

Do You Pay Sales Tax On A House In AZ AZ FLAT FEE

Do You Pay Sales Tax On A House In AZ AZ FLAT FEE

If buying from an individual a motor vehicle sales tax 6 25 percent on either the purchase price or standard presumptive value whichever is the highest value must be paid when the vehicle is titled

Do I owe motor vehicle tax A motor vehicle purchased in Texas to be leased is subject to motor vehicle sales tax The lessor is responsible for the tax and it is paid when the vehicle is registered at the local county tax assessor collector s office The lease contract is not subject to tax Do I owe tax if I bring a leased motor vehicle into

The Do You Pay Sales Tax On Vehicles In Texas have gained huge popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Modifications: We can customize printing templates to your own specific requirements such as designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational value: Free educational printables are designed to appeal to students of all ages, making these printables a powerful instrument for parents and teachers.

-

Affordability: Instant access to an array of designs and templates is time-saving and saves effort.

Where to Find more Do You Pay Sales Tax On Vehicles In Texas

Do You Pay Sales Tax On A Semi Truck RCTruckStop

Do You Pay Sales Tax On A Semi Truck RCTruckStop

Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 6 25 percent on the purchase price or standard presumptive value SPV whichever is the highest value SPV applies wherever you buy the vehicle in Texas or out of state

All purchases in Texas are subject to a statewide 6 25 sales tax This tax applies to all car sales new and used Depending on where you purchase your car you may have to pay county and local taxes on top of that You ll find the highest car sales tax rates in Texas are in Houston Dallas San Antonio Austin El Paso

Now that we've piqued your interest in Do You Pay Sales Tax On Vehicles In Texas Let's see where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection in Do You Pay Sales Tax On Vehicles In Texas for different objectives.

- Explore categories such as the home, decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free along with flashcards, as well as other learning materials.

- Great for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- These blogs cover a broad selection of subjects, all the way from DIY projects to planning a party.

Maximizing Do You Pay Sales Tax On Vehicles In Texas

Here are some creative ways create the maximum value use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or festive decorations to decorate your living spaces.

2. Education

- Print worksheets that are free to aid in learning at your home and in class.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

Do You Pay Sales Tax On Vehicles In Texas are an abundance of fun and practical tools that cater to various needs and hobbies. Their access and versatility makes them a fantastic addition to every aspect of your life, both professional and personal. Explore the vast collection of Do You Pay Sales Tax On Vehicles In Texas today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes they are! You can print and download these resources at no cost.

-

Are there any free printables in commercial projects?

- It's determined by the specific usage guidelines. Always check the creator's guidelines before using printables for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Some printables may come with restrictions on their use. Make sure to read the terms and regulations provided by the author.

-

How do I print Do You Pay Sales Tax On Vehicles In Texas?

- Print them at home with an printer, or go to a local print shop to purchase premium prints.

-

What software do I require to open Do You Pay Sales Tax On Vehicles In Texas?

- The majority are printed in PDF format. They can be opened using free software such as Adobe Reader.

How To Pay Sales Tax For Online Business The Mumpreneur Show

Do You Pay Sales Tax On A Leased Car In Missouri Retha Hynes

Check more sample of Do You Pay Sales Tax On Vehicles In Texas below

How Much Are Used Car Sales Taxes In Nevada PrivateAuto

Do You Pay Sales Tax On Wayfair Tax Walls

Sales Tax By State Here s How Much You re Really Paying Sales Tax

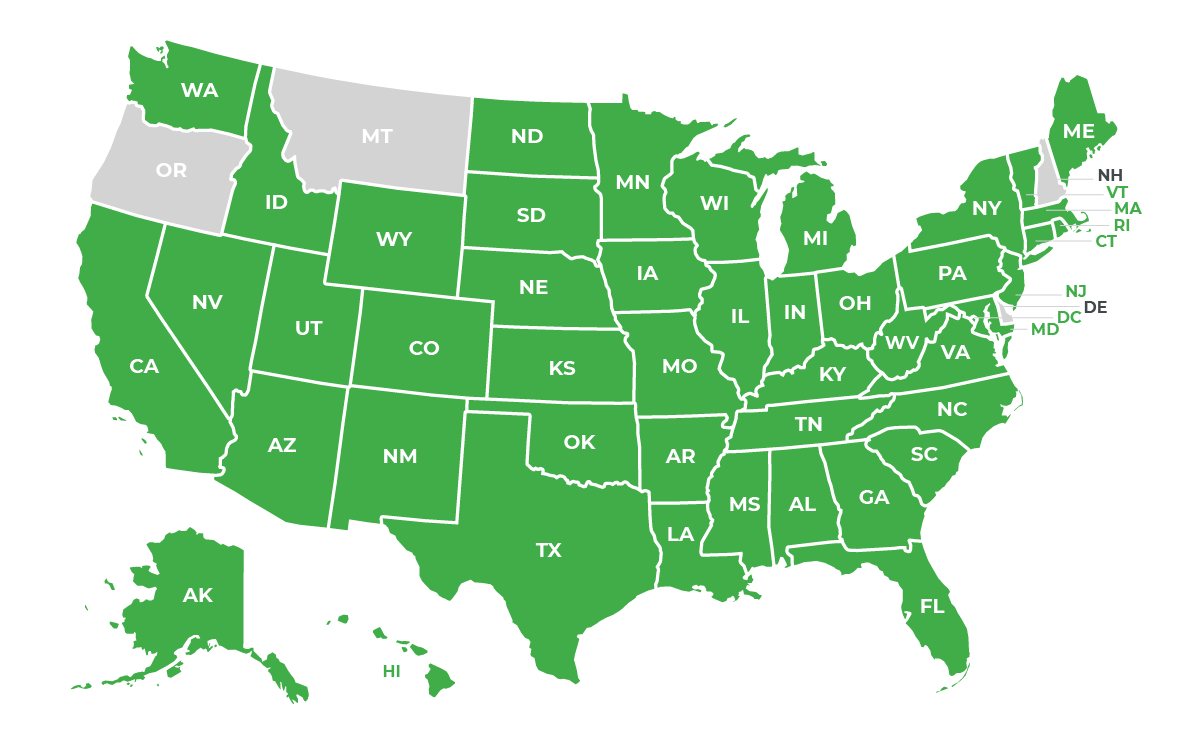

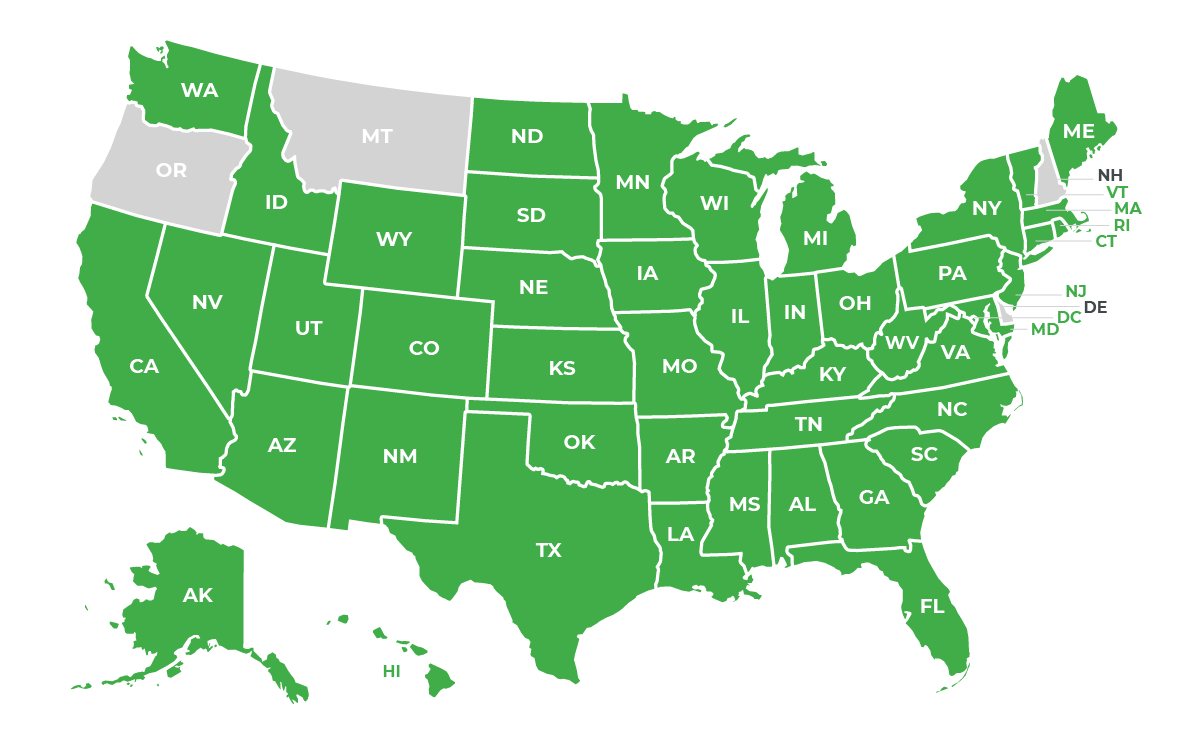

U S States Without Sales Tax 2021 UpdateTaxJar Blog

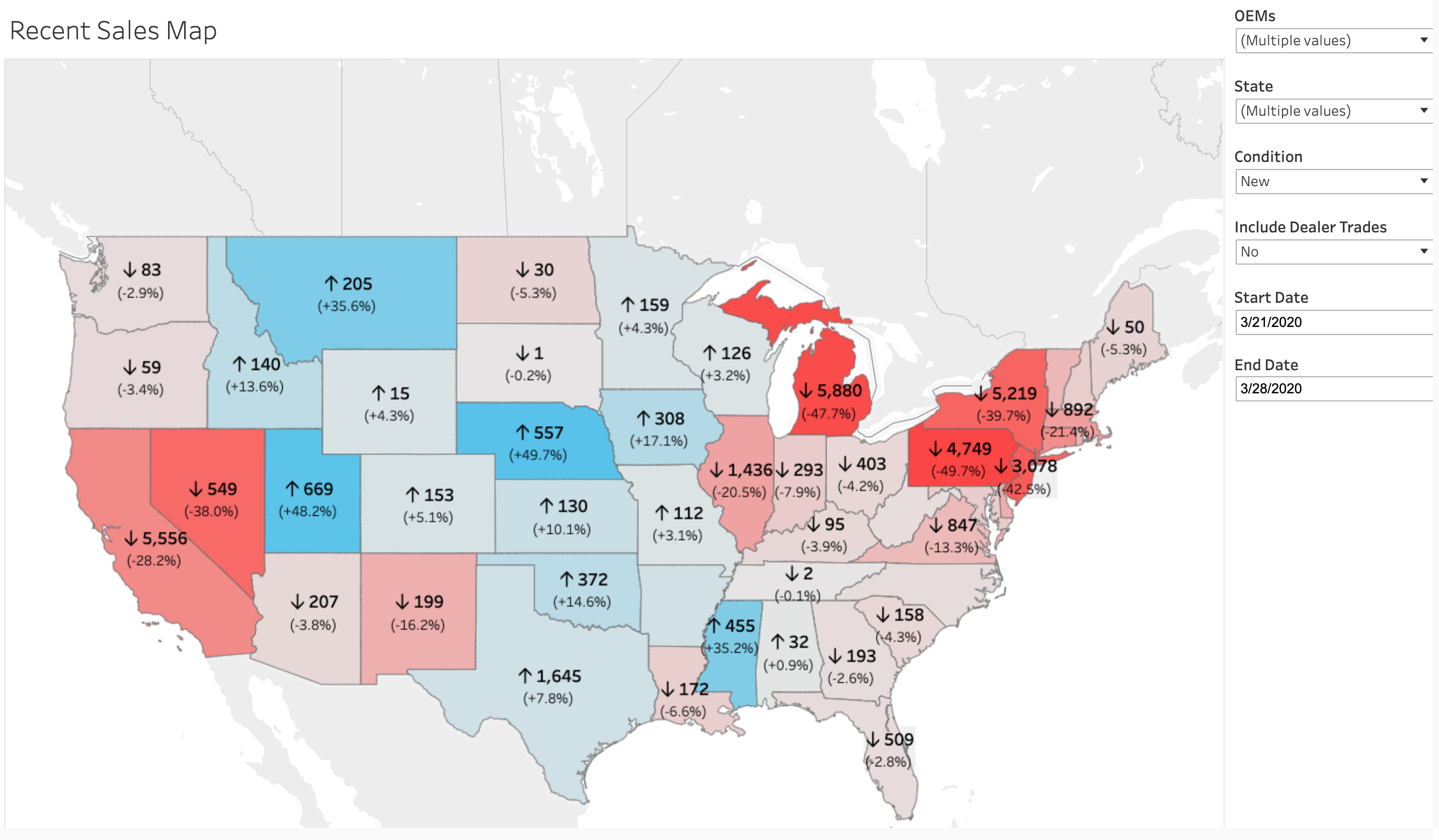

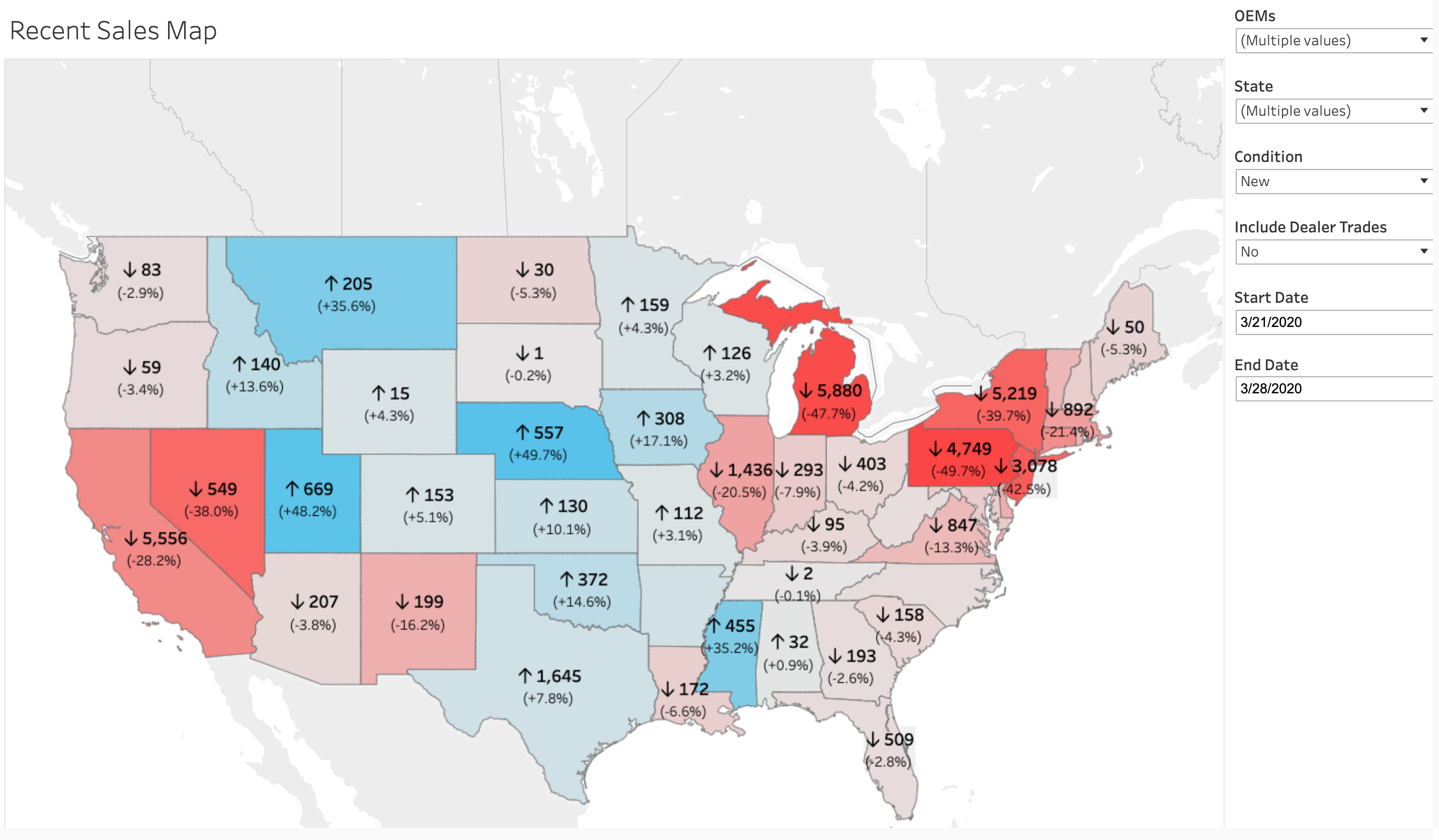

Data Analysis U S New Car Sales By State

Do You Pay Sales Tax On A Used Car From Private Seller In Illinois

https://www. caranddriver.com /.../texas-car-sales-tax

The sales tax for cars in Texas is 6 25 of the final sales price The Texas Comptroller states that payment of motor vehicle sales taxes has to be sent to the local county s

https://www. findthebestcarprice.com /texas-vehicle-sales-tax-fees

There is a 6 25 sales tax on the sale of vehicles in Texas However there may be an extra local or county sales tax added onto the base 6 25 state tax Local tax rates range from 0 to 2 with an average of 1 647 The max combined sales tax you can expect to pay in Texas is 8 25

The sales tax for cars in Texas is 6 25 of the final sales price The Texas Comptroller states that payment of motor vehicle sales taxes has to be sent to the local county s

There is a 6 25 sales tax on the sale of vehicles in Texas However there may be an extra local or county sales tax added onto the base 6 25 state tax Local tax rates range from 0 to 2 with an average of 1 647 The max combined sales tax you can expect to pay in Texas is 8 25

U S States Without Sales Tax 2021 UpdateTaxJar Blog

Do You Pay Sales Tax On Wayfair Tax Walls

Data Analysis U S New Car Sales By State

Do You Pay Sales Tax On A Used Car From Private Seller In Illinois

Do You Pay Sales Tax On A Used Car NerdWallet

How Do You Figure Sales Tax On A Car In Ohio AutoacService

How Do You Figure Sales Tax On A Car In Ohio AutoacService

Do You Pay Sales Tax On Leased Vehicles Tax Walls