In this age of technology, when screens dominate our lives yet the appeal of tangible printed materials isn't diminishing. Whatever the reason, whether for education project ideas, artistic or simply to add personal touches to your space, Do You Have To Pay Local Taxes On Early 401k Withdrawal have become a valuable source. For this piece, we'll take a dive deep into the realm of "Do You Have To Pay Local Taxes On Early 401k Withdrawal," exploring their purpose, where to find them and ways they can help you improve many aspects of your life.

Get Latest Do You Have To Pay Local Taxes On Early 401k Withdrawal Below

Do You Have To Pay Local Taxes On Early 401k Withdrawal

Do You Have To Pay Local Taxes On Early 401k Withdrawal -

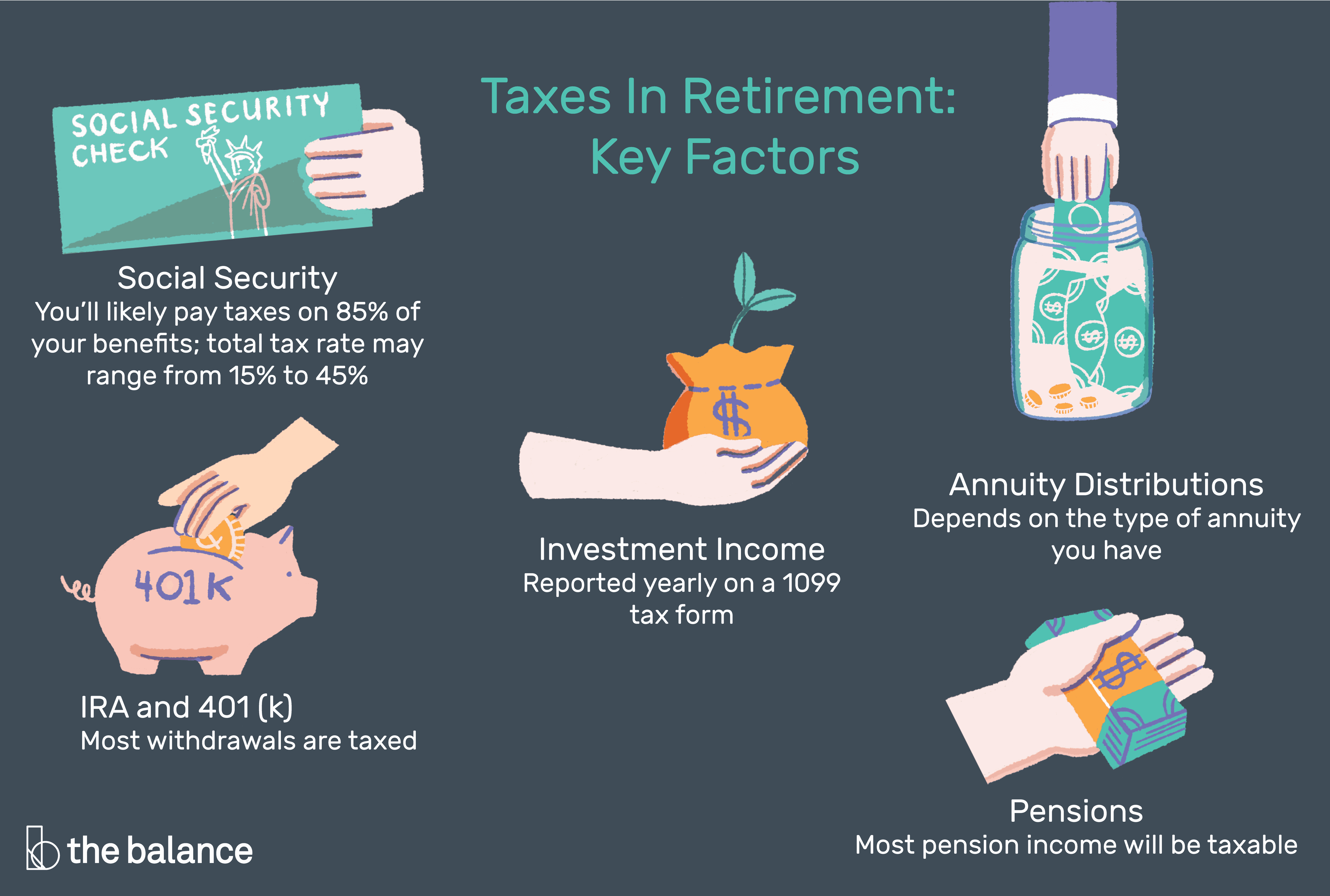

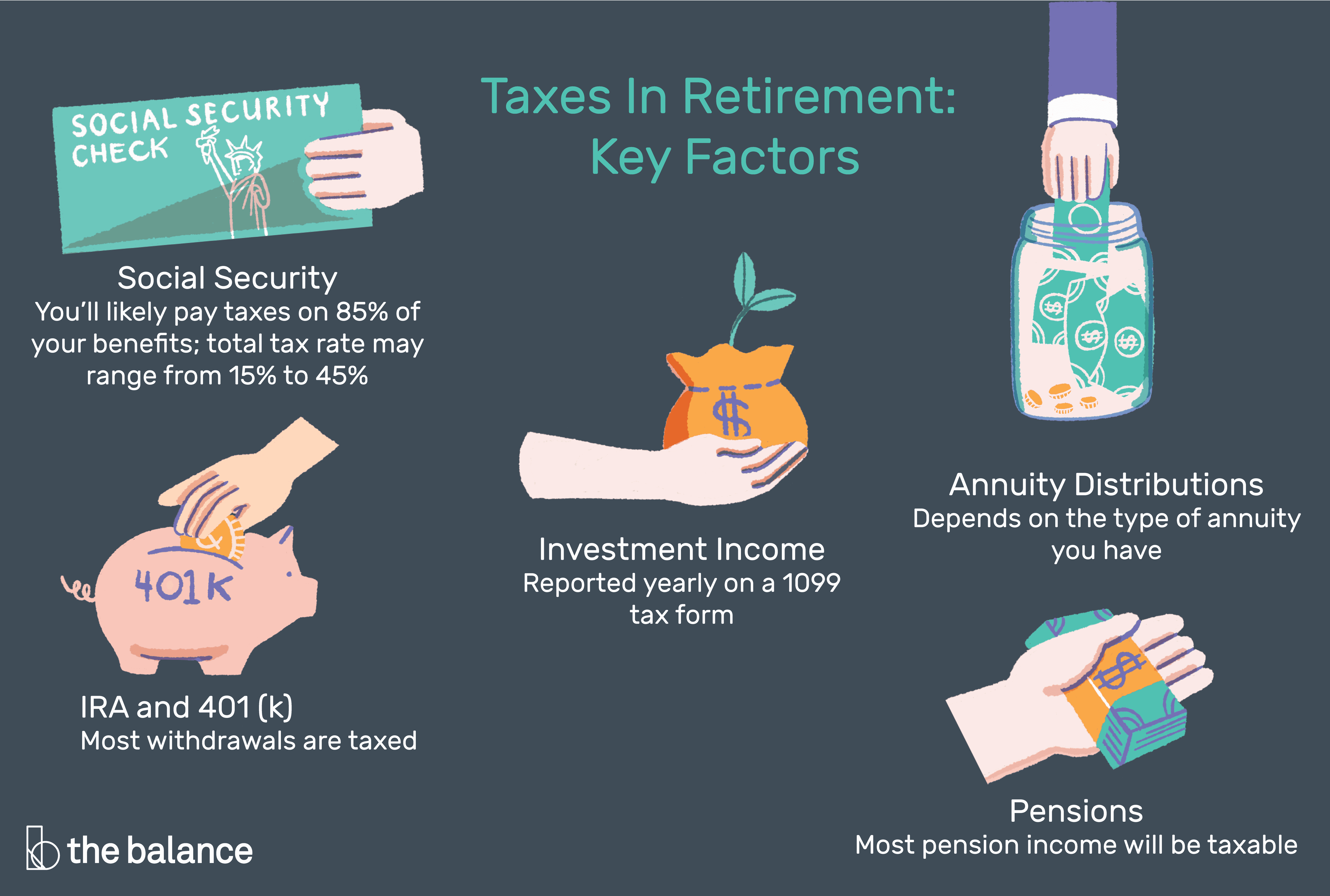

When Do You Pay The 10 Early Withdrawal Penalty If you are subject to the 10 early withdrawal penalty it is assessed when you file your taxes they do not withhold it from the distribution amount so you must

Even if it were covered by an exception all early withdrawals from your 401 k are taxed as ordinary income The IRS typically withholds 20 of an early withdrawal to cover taxes So if

Do You Have To Pay Local Taxes On Early 401k Withdrawal offer a wide selection of printable and downloadable materials available online at no cost. These resources come in various forms, including worksheets, templates, coloring pages and much more. The value of Do You Have To Pay Local Taxes On Early 401k Withdrawal is their versatility and accessibility.

More of Do You Have To Pay Local Taxes On Early 401k Withdrawal

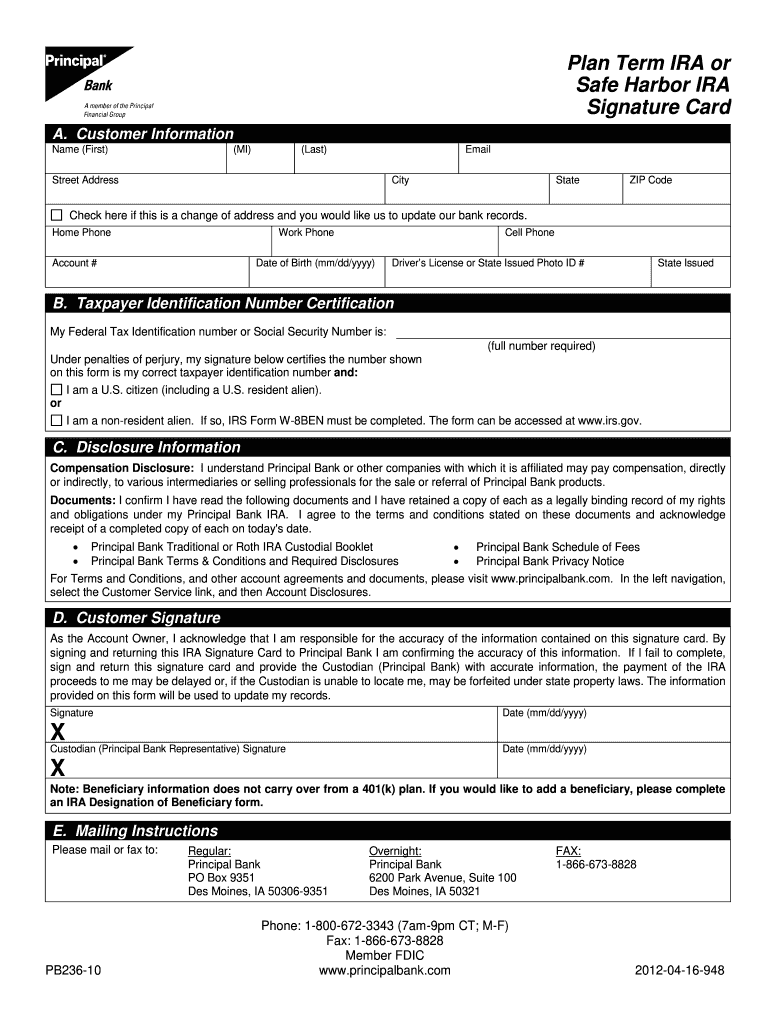

Principal 401k Withdrawal Fill Out Sign Online DocHub

Principal 401k Withdrawal Fill Out Sign Online DocHub

With the rule of 55 those who leave a job in the year they turn 55 or later can remove funds from that employer s 401 k or 403 b without having to pay a 10 early withdrawal penalty

If you make a withdrawal from your 401 K it will be subject to a 10 early withdrawal penalty on top of the income taxes due on the amount of pre tax dollars withdrawn Your plan administrator will withhold 20 of your

Do You Have To Pay Local Taxes On Early 401k Withdrawal have garnered immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Personalization The Customization feature lets you tailor the design to meet your needs whether you're designing invitations and schedules, or decorating your home.

-

Educational Value Educational printables that can be downloaded for free cater to learners of all ages, which makes them a great device for teachers and parents.

-

Simple: Fast access a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more Do You Have To Pay Local Taxes On Early 401k Withdrawal

Pin On Retirement

Pin On Retirement

Key Takeaways Contributions and earnings in a Roth 401 k can be withdrawn without paying taxes and penalties if you are at least 59 and have had your account for at least five years

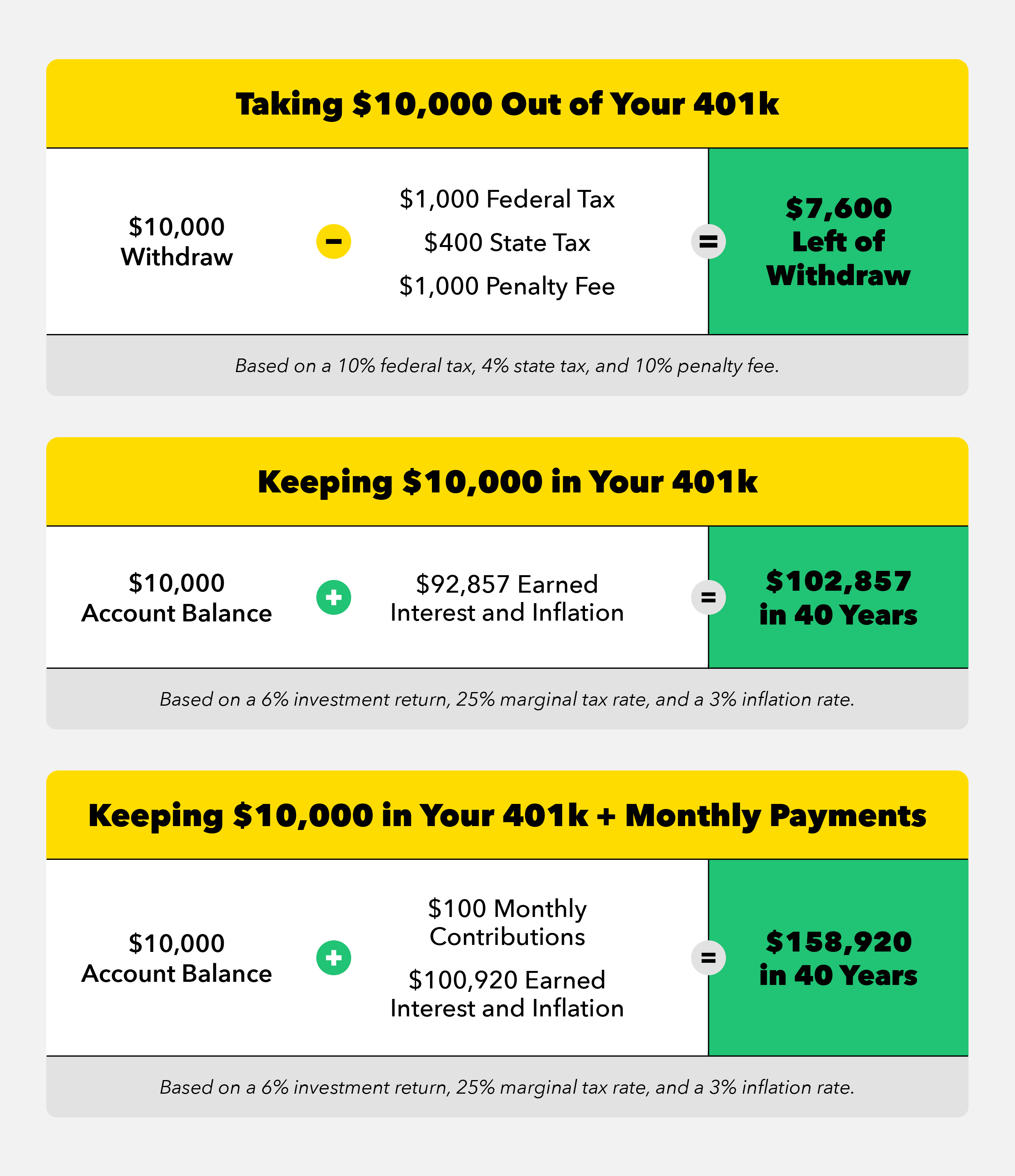

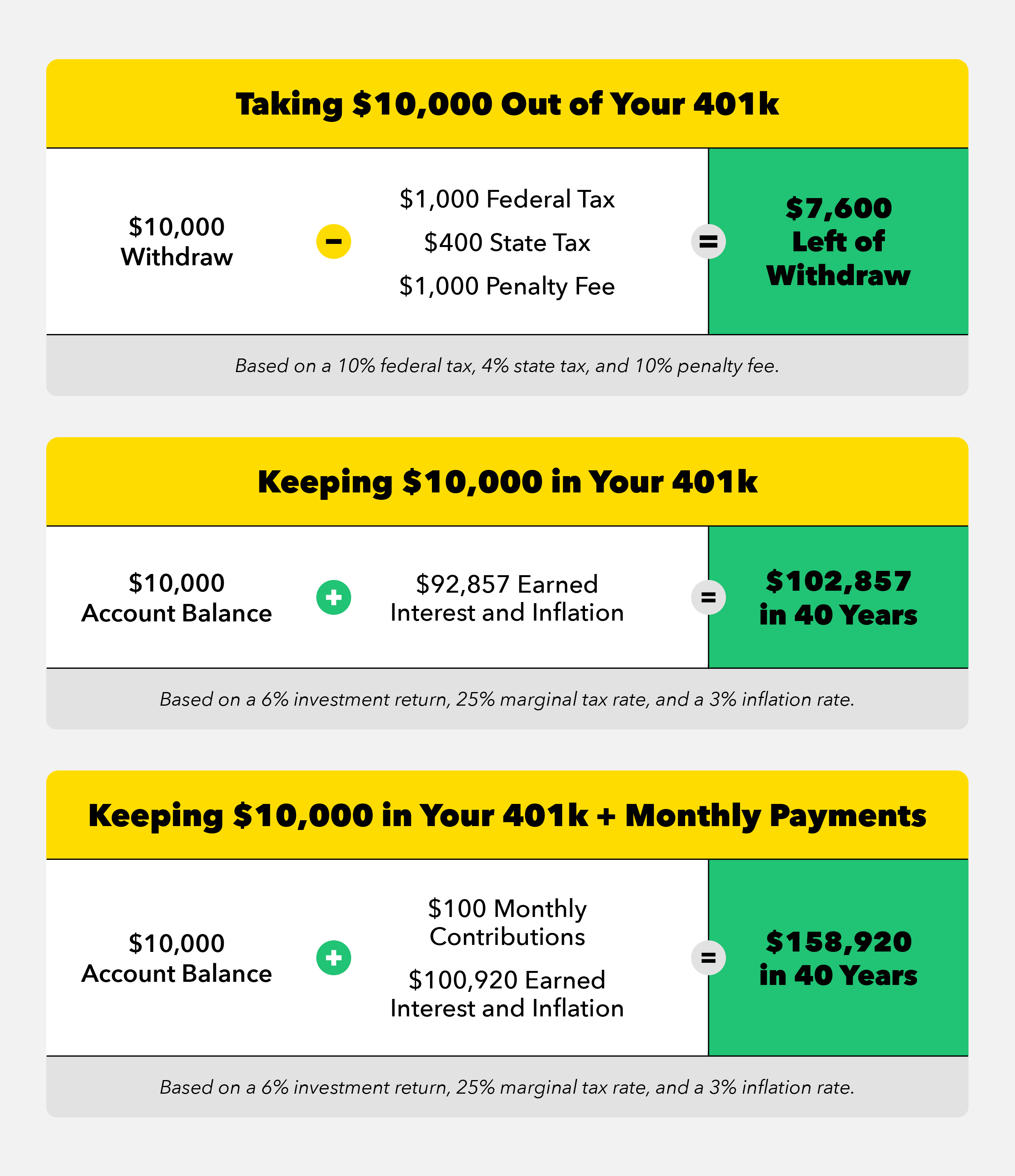

You can expect 20 of an early 401 k withdrawal to be withheld for taxes In the case of a 40 year old paying a 24 tax rate who withdraws 10 000 some funds would be set

We've now piqued your interest in Do You Have To Pay Local Taxes On Early 401k Withdrawal Let's take a look at where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection in Do You Have To Pay Local Taxes On Early 401k Withdrawal for different goals.

- Explore categories like decorating your home, education, the arts, and more.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets or flashcards as well as learning tools.

- The perfect resource for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- The blogs are a vast spectrum of interests, ranging from DIY projects to party planning.

Maximizing Do You Have To Pay Local Taxes On Early 401k Withdrawal

Here are some innovative ways in order to maximize the use use of Do You Have To Pay Local Taxes On Early 401k Withdrawal:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Invitations, banners and decorations for special events such as weddings and birthdays.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Do You Have To Pay Local Taxes On Early 401k Withdrawal are a treasure trove of innovative and useful resources that meet a variety of needs and desires. Their access and versatility makes them a valuable addition to both professional and personal lives. Explore the endless world of Do You Have To Pay Local Taxes On Early 401k Withdrawal and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes, they are! You can print and download these files for free.

-

Can I use free printables for commercial purposes?

- It is contingent on the specific rules of usage. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Certain printables could be restricted in use. Make sure you read the terms of service and conditions provided by the designer.

-

How can I print printables for free?

- Print them at home using an printer, or go to the local print shop for higher quality prints.

-

What program do I require to open printables at no cost?

- The majority of PDF documents are provided as PDF files, which can be opened using free software, such as Adobe Reader.

Do Federal Employees Have To Pay State And Local Taxes List Foundation

Beware Of Cashing Out A 401 k Pension Parameters

Check more sample of Do You Have To Pay Local Taxes On Early 401k Withdrawal below

401 k Loan What To Know Before Borrowing From Your 401 k

401 K Cash Distributions Understanding The Taxes Penalties

401 k Withdrawal Rules Early No Penalty Options

What Are The Pros And Cons Of Borrowing From A 401k Leia Aqui What Is

6 Things To Know About Roth 401 k Withdrawals The Motley Fool

Roth 401k Early Withdrawal Penalty Calculator KailumTwyla

https://www.forbes.com/.../401k-early-…

Even if it were covered by an exception all early withdrawals from your 401 k are taxed as ordinary income The IRS typically withholds 20 of an early withdrawal to cover taxes So if

https://www.investopedia.com/articles/…

For early withdrawals that do not meet a qualified exemption there is a 10 penalty You will also have to pay income tax on those funds Both

Even if it were covered by an exception all early withdrawals from your 401 k are taxed as ordinary income The IRS typically withholds 20 of an early withdrawal to cover taxes So if

For early withdrawals that do not meet a qualified exemption there is a 10 penalty You will also have to pay income tax on those funds Both

What Are The Pros And Cons Of Borrowing From A 401k Leia Aqui What Is

401 K Cash Distributions Understanding The Taxes Penalties

6 Things To Know About Roth 401 k Withdrawals The Motley Fool

Roth 401k Early Withdrawal Penalty Calculator KailumTwyla

Are You Ready To Aggressively Pay Down Your Home Mortgage This

How Much Tax Will I Pay On My 401k Encinitas Daily News

How Much Tax Will I Pay On My 401k Encinitas Daily News

HI6028 Tutorial Question Assignment 1 Week 1 Taxes Are Mandatory