In this age of technology, where screens dominate our lives and the appeal of physical printed items hasn't gone away. In the case of educational materials, creative projects, or simply adding an individual touch to your home, printables for free can be an excellent source. Through this post, we'll dive into the world of "Do You Claim 401k Contributions On Taxes," exploring the different types of printables, where to find them, and what they can do to improve different aspects of your life.

Get Latest Do You Claim 401k Contributions On Taxes Below

Do You Claim 401k Contributions On Taxes

Do You Claim 401k Contributions On Taxes -

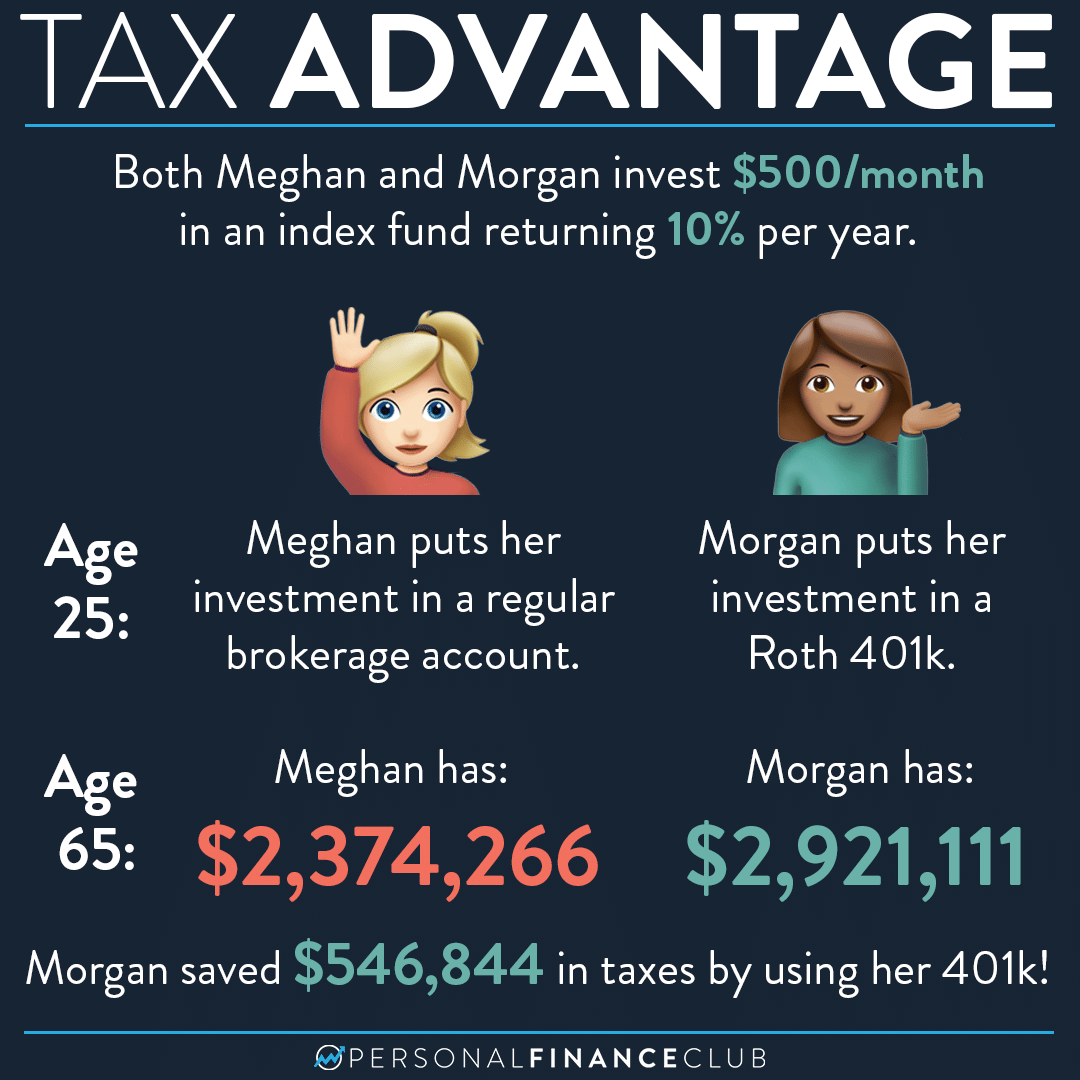

Contributions to a 401 k are not subject to income taxes but are subject to Medicare and Social Security taxes You pay income taxes on withdrawals

You cannot deduct your 401 k contributions on your income tax return per se but the money you save in your 401 k is deducted from your gross income which can potentially lower how

The Do You Claim 401k Contributions On Taxes are a huge selection of printable and downloadable content that can be downloaded from the internet at no cost. The resources are offered in a variety formats, such as worksheets, templates, coloring pages, and much more. The attraction of printables that are free lies in their versatility and accessibility.

More of Do You Claim 401k Contributions On Taxes

Do I Have To Report Mega Backdoor Roth Solo 401k Contributions On

Do I Have To Report Mega Backdoor Roth Solo 401k Contributions On

Employers can contribute to employees accounts Distributions including earnings are includible in taxable income at retirement except for qualified distributions

The contributions you make to your 401 k plan can reduce your tax liability at the end of the year as well as your tax withholding each pay period However you don t actually take a tax deduction on your

Do You Claim 401k Contributions On Taxes have garnered immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Flexible: They can make designs to suit your personal needs for invitations, whether that's creating them as well as organizing your calendar, or even decorating your home.

-

Educational Worth: These Do You Claim 401k Contributions On Taxes are designed to appeal to students of all ages, making them a vital resource for educators and parents.

-

Affordability: immediate access the vast array of design and templates cuts down on time and efforts.

Where to Find more Do You Claim 401k Contributions On Taxes

Solopreneur 401k FAQ Where Do I Report My Roth Solo 401k Employee

Solopreneur 401k FAQ Where Do I Report My Roth Solo 401k Employee

While 401 k contributions are not technically tax deductible these retirement accounts offer significant tax benefits Contributing pretax into a traditional

With a traditional 401 k your entire withdrawal contributions and earnings will be taxed as income These distributions are taxed like the money you earn from a job

After we've peaked your interest in printables for free Let's see where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Do You Claim 401k Contributions On Taxes for various needs.

- Explore categories such as home decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free for flashcards, lessons, and worksheets. tools.

- Ideal for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates for no cost.

- These blogs cover a wide range of interests, from DIY projects to planning a party.

Maximizing Do You Claim 401k Contributions On Taxes

Here are some unique ways that you can make use of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print free worksheets for teaching at-home and in class.

3. Event Planning

- Create invitations, banners, and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Do You Claim 401k Contributions On Taxes are a treasure trove of useful and creative resources designed to meet a range of needs and needs and. Their access and versatility makes them an essential part of the professional and personal lives of both. Explore the vast collection of Do You Claim 401k Contributions On Taxes today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Do You Claim 401k Contributions On Taxes truly completely free?

- Yes, they are! You can print and download these items for free.

-

Can I download free printing templates for commercial purposes?

- It's determined by the specific usage guidelines. Always verify the guidelines provided by the creator prior to printing printables for commercial projects.

-

Are there any copyright problems with printables that are free?

- Certain printables might have limitations on their use. Make sure you read the conditions and terms of use provided by the creator.

-

How can I print Do You Claim 401k Contributions On Taxes?

- You can print them at home with the printer, or go to a local print shop to purchase premium prints.

-

What program do I need to run printables free of charge?

- The majority of printed documents are as PDF files, which is open with no cost programs like Adobe Reader.

Do I Have To Claim 401k Withdrawal On My Taxes YouTube

Solo 401k FAQ Do I Report Both Employee And Employer Solo 401k

Check more sample of Do You Claim 401k Contributions On Taxes below

How To Claim Solo 401k Contributions On Your Tax Return Nabers

Do I Report My Solo 401k Contributions On Schedule C 1040 My Solo

Fill Edit And Print Sworn Statement Supporting Claim Against Estate

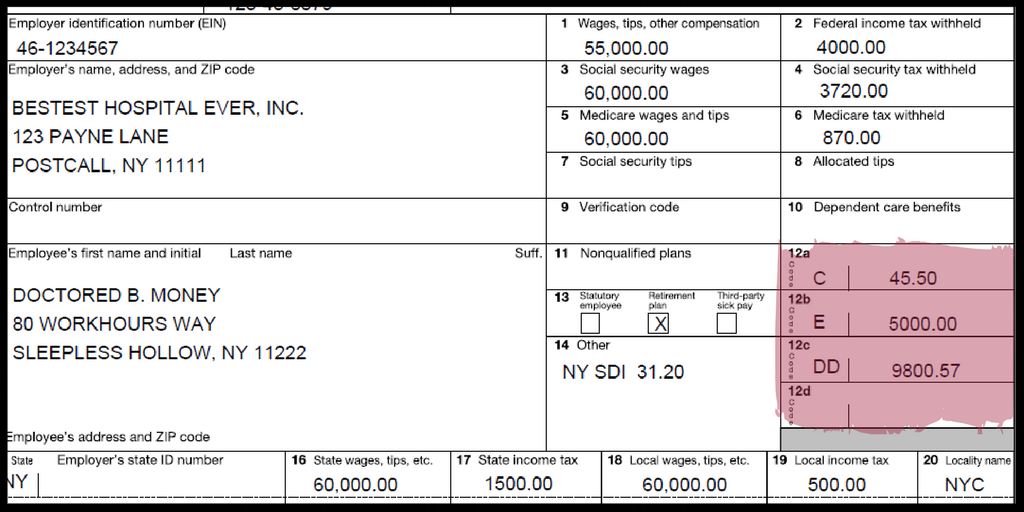

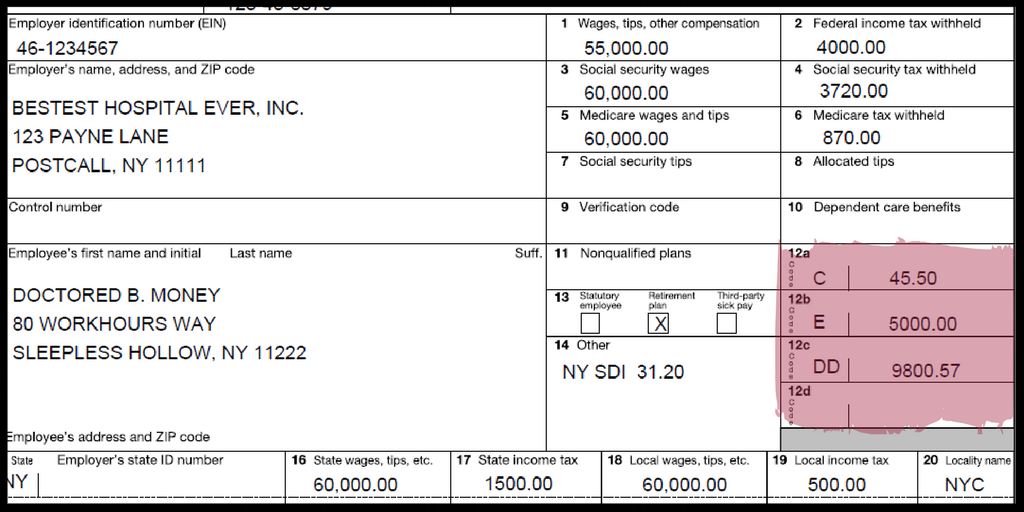

Understanding Your Forms W 2 Wage Tax Statement Tax Tax Refund

W 2 Doctored Money

How To Use Your 401K Contributions To Save On Your Taxes Investing

https://www.sofi.com/learn/content/401k …

You cannot deduct your 401 k contributions on your income tax return per se but the money you save in your 401 k is deducted from your gross income which can potentially lower how

https://www.freshbooks.com/hub/taxes…

It Depends 401k contributions are made pre tax As such they are not included in your taxable income However if a person takes distributions from their 401k then by law that income has to be reported

You cannot deduct your 401 k contributions on your income tax return per se but the money you save in your 401 k is deducted from your gross income which can potentially lower how

It Depends 401k contributions are made pre tax As such they are not included in your taxable income However if a person takes distributions from their 401k then by law that income has to be reported

Understanding Your Forms W 2 Wage Tax Statement Tax Tax Refund

Do I Report My Solo 401k Contributions On Schedule C 1040 My Solo

W 2 Doctored Money

How To Use Your 401K Contributions To Save On Your Taxes Investing

How To Claim Solo 401k Contributions On Your Tax Return Solo 401k

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money From My 401 k Before I Retire

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money From My 401 k Before I Retire

Can My Ex Make A Claim To My 401K After Waiving Rights YouTube