In the digital age, with screens dominating our lives but the value of tangible, printed materials hasn't diminished. For educational purposes and creative work, or simply to add an individual touch to the home, printables for free have become an invaluable resource. This article will dive into the world "Do Pension Contributions Reduce Taxable Income For Self Employed," exploring the benefits of them, where they can be found, and how they can be used to enhance different aspects of your lives.

Get Latest Do Pension Contributions Reduce Taxable Income For Self Employed Below

Do Pension Contributions Reduce Taxable Income For Self Employed

Do Pension Contributions Reduce Taxable Income For Self Employed -

For a self employed person contributing to their own SEP IRA contributions are deducted as an adjustment to income on Form 1040 line 10a using Schedule 1 SEP contributions reduce a person s

You can deduct your pension contributions from your taxable income For example if your annual earnings were 50 000 and you contribute 2 000 into

Do Pension Contributions Reduce Taxable Income For Self Employed cover a large collection of printable materials online, at no cost. They are available in a variety of kinds, including worksheets templates, coloring pages and more. The beauty of Do Pension Contributions Reduce Taxable Income For Self Employed lies in their versatility and accessibility.

More of Do Pension Contributions Reduce Taxable Income For Self Employed

Self Funded Pension Plan To Reduce Taxable Income Royal Legal Solutions

Self Funded Pension Plan To Reduce Taxable Income Royal Legal Solutions

Income from self employment 85 000 income from property 20 000 bank interest 10 000 Bill makes private pension contributions without tax relief of

After taking all allowable business deductions and reporting that income on their personal tax return self employed people can still reduce their taxable income by making contributions to retirement

Print-friendly freebies have gained tremendous popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Individualization There is the possibility of tailoring printables to fit your particular needs for invitations, whether that's creating them making your schedule, or even decorating your home.

-

Educational Value Downloads of educational content for free can be used by students of all ages, making them a vital tool for teachers and parents.

-

An easy way to access HTML0: instant access numerous designs and templates, which saves time as well as effort.

Where to Find more Do Pension Contributions Reduce Taxable Income For Self Employed

RRIFs Registered Retirement Income Funds 101 Modern Money

RRIFs Registered Retirement Income Funds 101 Modern Money

3 Make a charity donation now to reduce your tax bill If you have the spare cash making a charitable donation before 31 January 2024 could reduce your tax bill for the 2022 23 tax year This is

Simplified Employee Pension Contribute as much as 25 of your net earnings from self employment not including contributions for yourself up to

In the event that we've stirred your interest in printables for free Let's see where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection with Do Pension Contributions Reduce Taxable Income For Self Employed for all uses.

- Explore categories such as design, home decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing including flashcards, learning materials.

- Perfect for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates, which are free.

- These blogs cover a broad array of topics, ranging that includes DIY projects to party planning.

Maximizing Do Pension Contributions Reduce Taxable Income For Self Employed

Here are some unique ways ensure you get the very most use of Do Pension Contributions Reduce Taxable Income For Self Employed:

1. Home Decor

- Print and frame stunning artwork, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Print free worksheets to help reinforce your learning at home also in the classes.

3. Event Planning

- Make invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars along with lists of tasks, and meal planners.

Conclusion

Do Pension Contributions Reduce Taxable Income For Self Employed are an abundance filled with creative and practical information that can meet the needs of a variety of people and interest. Their availability and versatility make they a beneficial addition to your professional and personal life. Explore the vast array of Do Pension Contributions Reduce Taxable Income For Self Employed today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes you can! You can print and download these materials for free.

-

Can I download free printables for commercial uses?

- It's based on the usage guidelines. Always consult the author's guidelines prior to printing printables for commercial projects.

-

Are there any copyright concerns with Do Pension Contributions Reduce Taxable Income For Self Employed?

- Some printables may come with restrictions regarding usage. You should read the terms and conditions provided by the designer.

-

How can I print printables for free?

- Print them at home with either a printer at home or in a local print shop to purchase premium prints.

-

What software must I use to open printables at no cost?

- The majority are printed as PDF files, which can be opened using free software like Adobe Reader.

Mac Financial Making Pension Contributions Before The End Of The Tax

OS Payroll Your P60 Document Explained

Check more sample of Do Pension Contributions Reduce Taxable Income For Self Employed below

Debt Options For Self Employed Company Directors DebtBuffer

National Insurance Contributions Explained IFS Taxlab

National Insurance contribution rates%2C 2021–22.png?itok=iGs8c8Ix)

Do RRSP Contributions Reduce Taxable Income

Workers Compensation Insurance For Self employed People Here s What

IRS Tax Tables Federal Withholding Tables 2021

How To Calculate Taxable Income For Self employed Individuals Agro

https://www.onlinemoneyadvisor.co.uk/pensions/self...

You can deduct your pension contributions from your taxable income For example if your annual earnings were 50 000 and you contribute 2 000 into

https://blog.moneyfarm.com/en/investing-101/…

Yes you can get a pension if you are self employed There are several types of pensions for self employed people they include private pensions SIPPs Nest and LISAs How much can self

You can deduct your pension contributions from your taxable income For example if your annual earnings were 50 000 and you contribute 2 000 into

Yes you can get a pension if you are self employed There are several types of pensions for self employed people they include private pensions SIPPs Nest and LISAs How much can self

Workers Compensation Insurance For Self employed People Here s What

National Insurance contribution rates%2C 2021–22.png?itok=iGs8c8Ix)

National Insurance Contributions Explained IFS Taxlab

IRS Tax Tables Federal Withholding Tables 2021

How To Calculate Taxable Income For Self employed Individuals Agro

Changes In NHS Pension Contributions Are You A Winner Or Loser

Solved Linda Who Files As A Single Taxpayer Had AGI Of Chegg

Solved Linda Who Files As A Single Taxpayer Had AGI Of Chegg

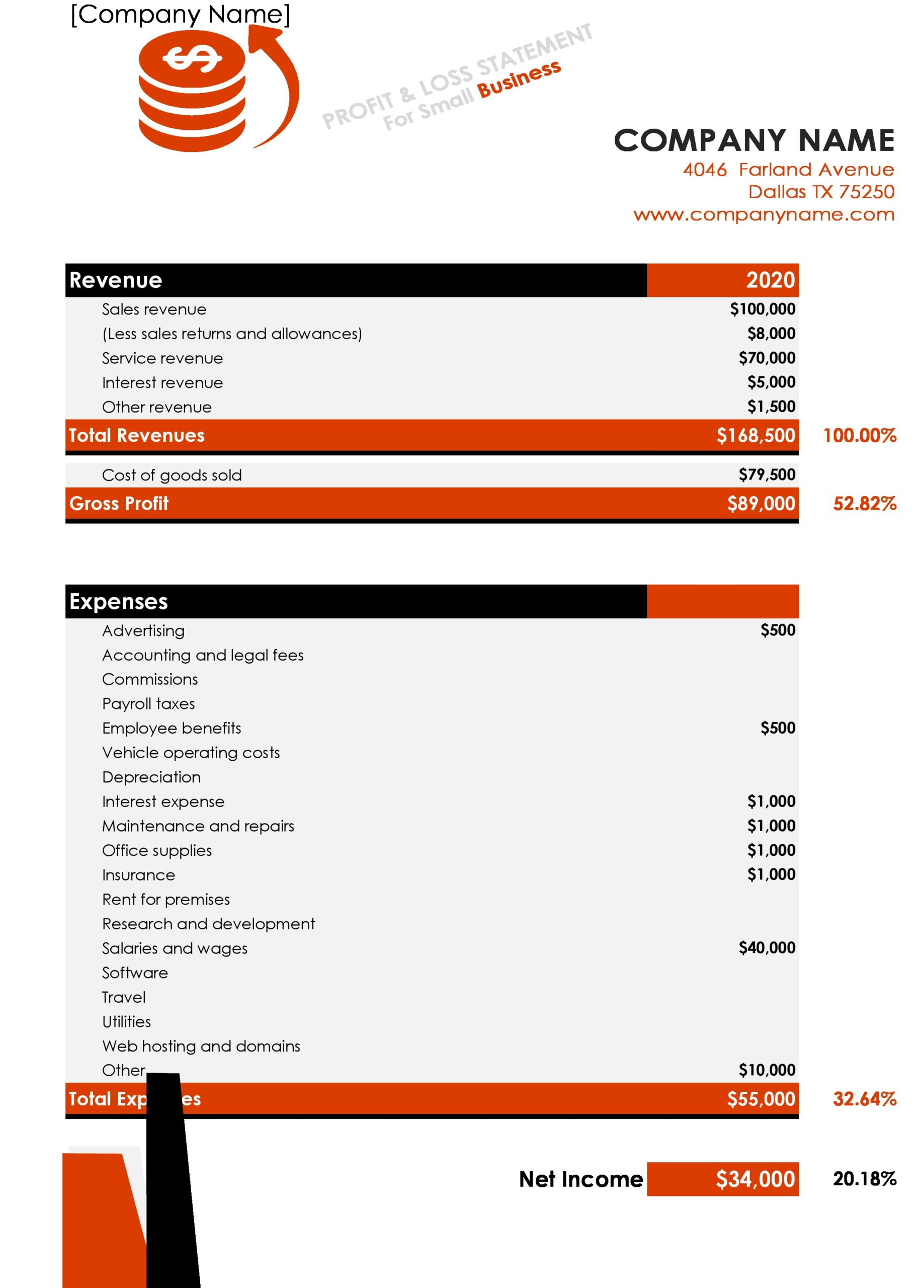

53 Profit And Loss Statement Templates Forms Excel PDF