In a world where screens have become the dominant feature of our lives but the value of tangible printed objects isn't diminished. No matter whether it's for educational uses or creative projects, or just adding an individual touch to the area, Do Mini Splits Qualify For Tax Credit are a great source. For this piece, we'll dive into the sphere of "Do Mini Splits Qualify For Tax Credit," exploring the different types of printables, where to find them, and the ways that they can benefit different aspects of your life.

Get Latest Do Mini Splits Qualify For Tax Credit Below

Do Mini Splits Qualify For Tax Credit

Do Mini Splits Qualify For Tax Credit -

More information about reliance is available IRS FAQ Page Last Reviewed or Updated 05 Dec 2023 IR 2022 225 December 22 2022 The Internal Revenue Service today released frequently asked questions FAQs about energy efficient home improvements and residential clean energy property credits

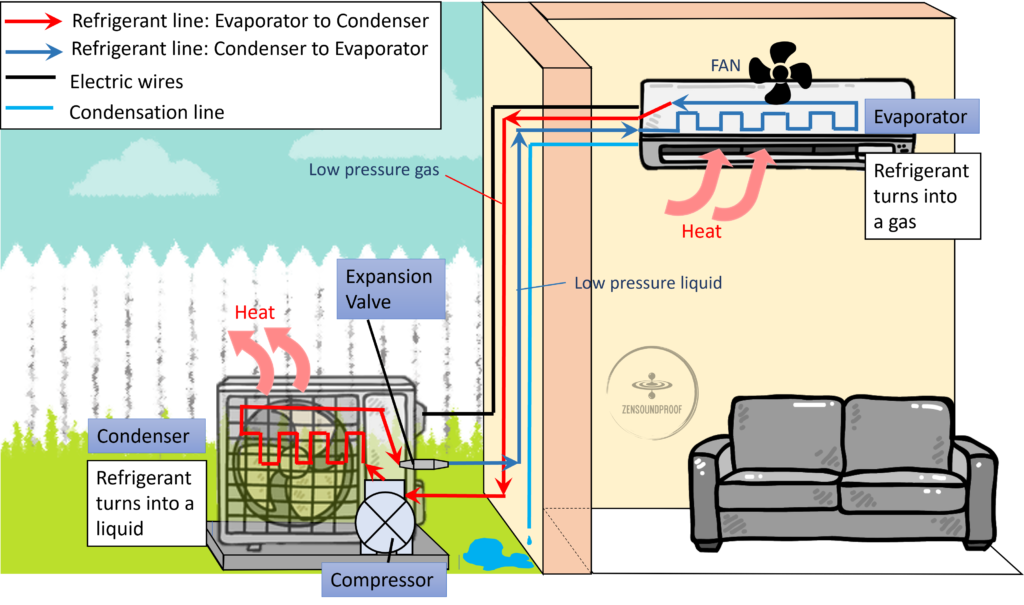

Mini split systems provide a range of benefits from energy efficient heating and cooling to versatile mount options They also qualify for federal tax credits As a homeowner you can claim up to 500 dollars in tax credits with a mini split system that meets the

Do Mini Splits Qualify For Tax Credit encompass a wide array of printable documents that can be downloaded online at no cost. These resources come in many types, like worksheets, coloring pages, templates and many more. The great thing about Do Mini Splits Qualify For Tax Credit is their versatility and accessibility.

More of Do Mini Splits Qualify For Tax Credit

Which Electric Vehicles Qualify For Federal Tax Credits The New York

Which Electric Vehicles Qualify For Federal Tax Credits The New York

Do Mini Splits Qualify for Tax Credits in 2024 The good news is ductless mini splits still qualify for home energy tax credits in 2024 However as before there are specific efficiency criteria your mini split must meet to be eligible federal tax credits

Do Mini Splits Qualify for Tax Credits in 2023 One of the central questions homeowners have is whether mini splits qualify for ferderal tax credits even in the year 2023 The answer is indeed yes but there are specific conditions that must be met to be eligible for these tax credits

The Do Mini Splits Qualify For Tax Credit have gained huge popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Flexible: It is possible to tailor print-ready templates to your specific requirements such as designing invitations or arranging your schedule or even decorating your house.

-

Educational Worth: Downloads of educational content for free provide for students from all ages, making them an invaluable source for educators and parents.

-

The convenience of immediate access numerous designs and templates saves time and effort.

Where to Find more Do Mini Splits Qualify For Tax Credit

5 Reasons To Buy A 2022 Hyundai Ioniq 5 Not A Ford Mustang Mach E

5 Reasons To Buy A 2022 Hyundai Ioniq 5 Not A Ford Mustang Mach E

Specific Criteria To qualify for these tax credits your mini split system must meet certain criteria such as minimum energy efficiency standards It s crucial to check the latest guidelines and specifications to ensure you qualify

Resources Inflation Reduction Act of 2022 Frequently asked questions about energy efficient home improvements and residential clean energy property credits Credits and deductions under the Inflation Reduction Act of 2022 Interactive guide to energy credits available under the Inflation Reduction Act

Since we've got your curiosity about Do Mini Splits Qualify For Tax Credit we'll explore the places you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Do Mini Splits Qualify For Tax Credit to suit a variety of objectives.

- Explore categories like the home, decor, management, and craft.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing with flashcards and other teaching materials.

- Great for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- The blogs are a vast selection of subjects, ranging from DIY projects to party planning.

Maximizing Do Mini Splits Qualify For Tax Credit

Here are some new ways in order to maximize the use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print worksheets that are free to reinforce learning at home or in the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable planners with to-do lists, planners, and meal planners.

Conclusion

Do Mini Splits Qualify For Tax Credit are an abundance of innovative and useful resources that satisfy a wide range of requirements and passions. Their access and versatility makes them a wonderful addition to the professional and personal lives of both. Explore the vast world of Do Mini Splits Qualify For Tax Credit today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes, they are! You can print and download the resources for free.

-

Can I download free printables for commercial purposes?

- It's determined by the specific usage guidelines. Always review the terms of use for the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright problems with printables that are free?

- Certain printables could be restricted in use. Be sure to read the terms and condition of use as provided by the designer.

-

How can I print Do Mini Splits Qualify For Tax Credit?

- You can print them at home using an printer, or go to a local print shop to purchase high-quality prints.

-

What program do I require to view printables that are free?

- The majority of printed documents are as PDF files, which can be opened with free software like Adobe Reader.

Top 9 Quietest Mini Split Air Conditioners Which Ductless AC To Pick

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

Check more sample of Do Mini Splits Qualify For Tax Credit below

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

Ioniq 5 And Many Other EVs May Lose Federal Tax Credit Eligibility

Income Tax Credit Electric Vehicle Update Income Tax Payments Deferred

Do Mini Splits Run On 110 Or 220

Rivian Forums R1T R1S Owners News Discussions RIVN Stock

The Best Self Employed Tax Deductions And Credits In 2022

https://www.pioneerminisplit.com/blogs/news/do-mini-split-units...

Mini split systems provide a range of benefits from energy efficient heating and cooling to versatile mount options They also qualify for federal tax credits As a homeowner you can claim up to 500 dollars in tax credits with a mini split system that meets the

https://www.irs.gov/credits-deductions/energy-efficient-home...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Mini split systems provide a range of benefits from energy efficient heating and cooling to versatile mount options They also qualify for federal tax credits As a homeowner you can claim up to 500 dollars in tax credits with a mini split system that meets the

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Do Mini Splits Run On 110 Or 220

Ioniq 5 And Many Other EVs May Lose Federal Tax Credit Eligibility

Rivian Forums R1T R1S Owners News Discussions RIVN Stock

The Best Self Employed Tax Deductions And Credits In 2022

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Federal Tax Credits For Air Conditioners Heat Pumps 2023

Federal Tax Credits For Air Conditioners Heat Pumps 2023

Ac Unit Mini Shop Deals Save 41 Jlcatj gob mx