In this age of electronic devices, in which screens are the norm and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. For educational purposes project ideas, artistic or just adding a personal touch to your area, Do I Qualify For The Solar Tax Credit have proven to be a valuable source. With this guide, you'll take a dive into the world of "Do I Qualify For The Solar Tax Credit," exploring what they are, where they are available, and the ways that they can benefit different aspects of your life.

Get Latest Do I Qualify For The Solar Tax Credit Below

Do I Qualify For The Solar Tax Credit

Do I Qualify For The Solar Tax Credit -

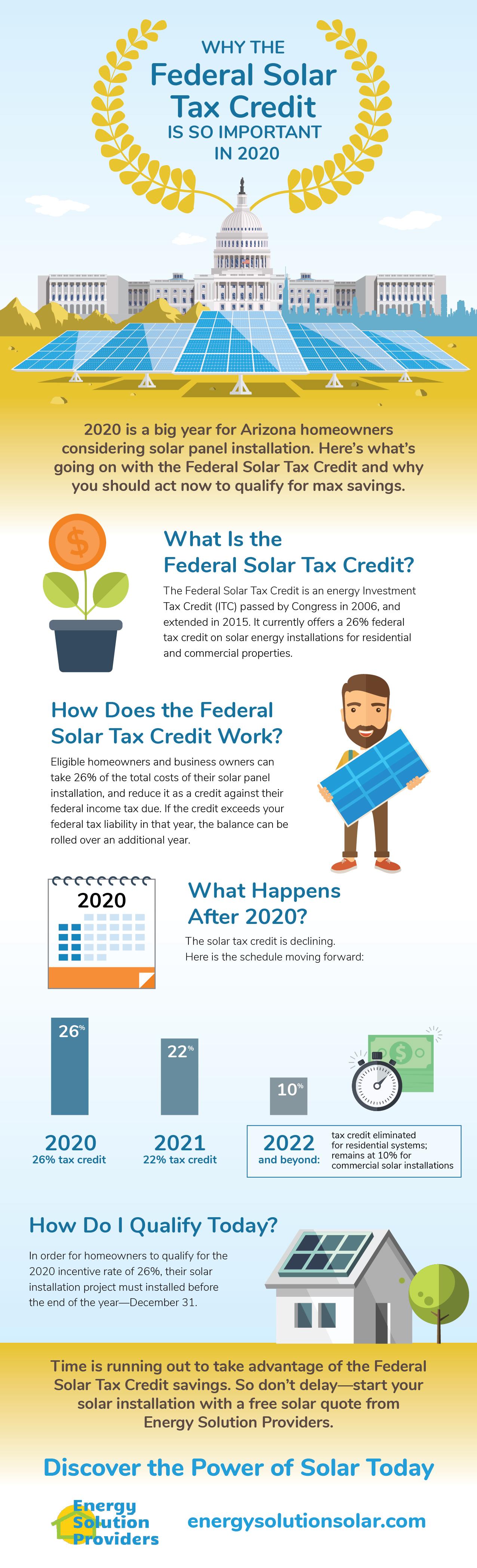

These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation

Yes Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the credit in 2023

Do I Qualify For The Solar Tax Credit offer a wide assortment of printable materials that are accessible online for free cost. They are available in numerous forms, like worksheets coloring pages, templates and much more. The benefit of Do I Qualify For The Solar Tax Credit is their flexibility and accessibility.

More of Do I Qualify For The Solar Tax Credit

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

For tax years 2022 to 2032 you can get a credit for up to 30 of the expense of installing solar panels this may include the price of the panels themselves sales taxes and labor

The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home Need to

Printables that are free have gained enormous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

customization It is possible to tailor the templates to meet your individual needs in designing invitations making your schedule, or even decorating your home.

-

Educational Benefits: Printables for education that are free can be used by students of all ages. This makes them an essential tool for teachers and parents.

-

An easy way to access HTML0: Fast access the vast array of design and templates helps save time and effort.

Where to Find more Do I Qualify For The Solar Tax Credit

How Does The Federal Solar Tax Credit Work Nicki Karen

How Does The Federal Solar Tax Credit Work Nicki Karen

The Residential Clean Energy Credit also known as the solar investment tax credit or ITC is a tax credit for homeowners who invest in solar and or battery storage Thanks to the Inflation Reduction Act the 30 credit is available for homeowners that install solar from 2022 to 2032

Installing solar panels or making other home improvements may qualify taxpayers for home energy credits Internal Revenue Service IRS Tax Tip 2023 68 May 16 2023 Homeowners who make improvements like replacing old doors and windows installing solar panels or upgrading a hot water heater may qualify for home energy tax

After we've peaked your interest in Do I Qualify For The Solar Tax Credit, let's explore where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection with Do I Qualify For The Solar Tax Credit for all goals.

- Explore categories such as interior decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. tools.

- The perfect resource for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- These blogs cover a wide variety of topics, ranging from DIY projects to party planning.

Maximizing Do I Qualify For The Solar Tax Credit

Here are some innovative ways of making the most use of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use these printable worksheets free of charge to build your knowledge at home (or in the learning environment).

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

Do I Qualify For The Solar Tax Credit are a treasure trove filled with creative and practical information designed to meet a range of needs and needs and. Their availability and versatility make them a valuable addition to both professional and personal lives. Explore the vast collection of Do I Qualify For The Solar Tax Credit to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really free?

- Yes you can! You can download and print these tools for free.

-

Can I use free printables to make commercial products?

- It's dependent on the particular terms of use. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Are there any copyright violations with Do I Qualify For The Solar Tax Credit?

- Certain printables could be restricted regarding their use. Be sure to review the terms and conditions set forth by the designer.

-

How can I print Do I Qualify For The Solar Tax Credit?

- Print them at home with either a printer or go to any local print store for higher quality prints.

-

What program will I need to access printables at no cost?

- The majority are printed in the format of PDF, which can be opened with free software, such as Adobe Reader.

Federal Solar Tax Credit What It Is How To Claim It For 2024

Was The Solar Tax Credit Extended SunPro Solar Congress Acts

Check more sample of Do I Qualify For The Solar Tax Credit below

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

26 Solar Tax Credit Extended Oregon Incentives Green Ridge Solar

Do I Qualify For Solar

Do I Qualify For Bankruptcy Husker Law

Solar Tax Credit Guide And Calculator

When Am I Eligible For Medicare Insurance

https://www.energy.gov/sites/default/files/2023-03/...

Yes Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the credit in 2023

https://www.irs.gov/credits-deductions/residential...

Business use up to 20 full credit Business use more than 20 credit based on share of expenses allocable to nonbusiness use Find more on who can claim the credit Qualified Expenses Qualified expenses include the costs of new clean energy property including Solar electric panels Solar water heaters Wind turbines

Yes Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the credit in 2023

Business use up to 20 full credit Business use more than 20 credit based on share of expenses allocable to nonbusiness use Find more on who can claim the credit Qualified Expenses Qualified expenses include the costs of new clean energy property including Solar electric panels Solar water heaters Wind turbines

Do I Qualify For Bankruptcy Husker Law

26 Solar Tax Credit Extended Oregon Incentives Green Ridge Solar

Solar Tax Credit Guide And Calculator

When Am I Eligible For Medicare Insurance

California Solar Tax Credit LA Solar Group

Everything You Need To Know About The Solar Tax Credit

Everything You Need To Know About The Solar Tax Credit

Federal Solar Tax Credit A Quick Rundown Next Energy Solution